Stocks are recovering from yesterday’s losses that were driven by a weak 30-year Treasury auction followed by a hawkish Federal Reserve Chairman Powell. Weak investor demand fueled higher-than-expected 30-year yields, concerning market players about the potential for longer-term debt appetites to continue weakening while Washington, D.C. appears unable to curtail deficit spending. Meanwhile, Powell’s tone may have been harshened by a group of climate change protestors that interrupted his presentation, as he resorted to colorful language when directing ballroom ushers to close the door while refusing to close the other one – the door of further possible rate hikes. Today’s market bounce is occurring as the University of Michigan’s Consumer Sentiment Index falls well below expectations, even as inflation expectations picked up.

Consumers Feel the Squeeze

Consumer Sentiment declined for the fourth straight month in November, as younger folks and lower-income cohorts felt the brunt of higher prices, elevated interest rates, tighter credit availability, geopolitical uncertainty and declining bargaining power at job interviews and with their current employers. Consumer sentiment fell to 60.4, well below projections of 63.7 and further below October’s 63.8 reading. The Indexes of Current Conditions and Future Expectations declined to 65.7 and 56.9 from 70.6 and 59.3. Inflation expectations ticked 20 basis points (bps) higher on the 1- and 5-year figures to 4.4% and 3.2% from 4.2% and 3.0%. The main driver of expectations for accelerating price pressures are anticipations of loftier gasoline prices in the short- and long-run.

Bond Auction Raises Fears About Fiscal Policy

Yesterday’s government auction of 30-Year Treasuries was disappointing. The auction ended with a bond yield of 4.769%, approximately five basis points higher than pre-auction trading, which pointed to weak demand for the securities and the need for a premium to entice investors. The bid-to-cover ratio, which is the number of bids compared to the number of successful bids, declined from 2.34 in October to 2.24 and continued to stay below the average ratio of 2.39. The $24 billion auction contributed to the yield increasing from 4.655% on Wednesday to above 4.8% yesterday. Primary dealers, or large banks that must pick up whatever Treasuries weren’t scooped up by other players, bought roughly 25% of the auction total, more than the double the historical average. Also yesterday, Powell sought to dash investors’ interpretations that his November 1 presentation was dovish when he commented that “The process to get inflation sustainably down to 2% has a long way to go.”

Markets Stage Broad Rally

Stocks and bonds are being scooped up today with all major U.S. equity indices higher while yields are lower across the curve. For stocks, the tech-heavy Nasdaq Composite Index is leading with a 1.2% gain while the S&P 500, Dow Jones Industrial and Russell 2000 are up 0.7%, 0.5% and 0.3%. Sectoral breadth is terrific, with all segments higher except for defensive health care, which is down 0.5%. Technology and communication services are leading with 1.7% and 0.7% gains. Yields on the 2- and 10-year Treasury maturities are down 1 and 3 bps to 5.01% and 4.60%. The dollar is gaining against all major currencies, as the greenback’s index rises 6 bps to 105.96. Crude oil is set for its third-consecutive down week even as it gains robustly today, with demand concerns offsetting production cuts from Riyadh and Moscow amidst a declining war-premium from a possible Middle East war escalation. WTI crude is up $1.42 per barrel or 1.9% to $76.96.

Labor Disputes Impact Revenues and Cannabis Companies Cut Costs

Labor disputes have lowered expectations for advertising revenues at Trade Desk, but Lionsgate Entertainment has weathered strikes within its industry relatively unscathed. In Canada, meanwhile, Aurora Cannabis and Canopy Growth are cutting costs as they strive to become profitable.

Last night, Trade Desk provided earnings guidance that reflects the far-reaching consequences of labor turmoil. Its share price, which was up 71% year to date, dropped 30% after the company said businesses in the U.S. auto and media/entertainment industries have become more cautious about advertising in light of high-profile strikes. As a result, the company, which provides technology that automates the placement of targeted advertisements in digital media, said it anticipates generating $580 million in revenue this quarter, which missed the analyst consensus forecast of $610 million. Meanwhile, the company reported third-quarter earnings per share (EPS) of $0.33, which exceeded the analyst expectation of $0.29 as well as the $0.26 earned in the same quarter a year ago. Also, its $493 million in revenue exceeded the analyst expectation of $487 million and increased from $394 million in the year-ago quarter.

Lionsgate Entertainment posted strong results despite the headwind of strikes from actors and writers. During its quarter ended September 30, the company’s $1.02 billion in revenue exceeded the $872 million in revenue from the year-ago quarter. The analyst consensus forecast was $1.01 billion. After adjusting for irregular expenses, Lionsgate’s earnings per share (EPS) of $0.21 increased from $0.05 y/y and exceeded the analyst estimate of a $0.05 loss per share. During the most recent quarter, striking writers and actors caused revenue for the television production division to drop 9% y/y, largely due to a decline in creating various episodes of TV shows. However, the addition of The Continental to Peacock and Amazon Prime Video supported the division’s profit growth. Additionally, revenues for the company’s motion picture division and LIONSGATE + streaming service grew significantly, with the number of streaming subscribers in North America increasing and revenue recognition from bundling partners in Latin America being accelerated. On another positive note, the SAG-AFTRA union that represents actors reached a tentative agreement with movie studios on Wednesday and the writers’ union strikes ended in late September. Lionsgate has reiterated its guidance.

In other earnings news, Canopy Growth’s net revenue declined 21% y/y from approximately $50 million, but its loss declined from $40.5 million to $8.62 million. The company has been moving to an “asset light” business strategy and is cutting jobs, departing from some international markets, closing stores and selling off its retail business in Canada. Its operating expenses dropped nearly 80% during the quarter. Aurora Cannabis generated $45.8 million in net revenue, up 30% y/y and reaffirmed its target of achieving positive cash flow next year. The company said its revenues from its high-margin medical cannabis segment grew strongly. Aurora’s plant propagation business also contributed to revenue growth. During the past three years, the company has trimmed $289 million in costs and anticipates capturing $28.9 million in annualized cost efficiencies next year. For the most recent quarter, revenue growth and cost cutting allowed the company to generate $216,000 in net income compared to the $32.50 million loss in the year-ago quarter.

Understanding a Central Risk for 2024

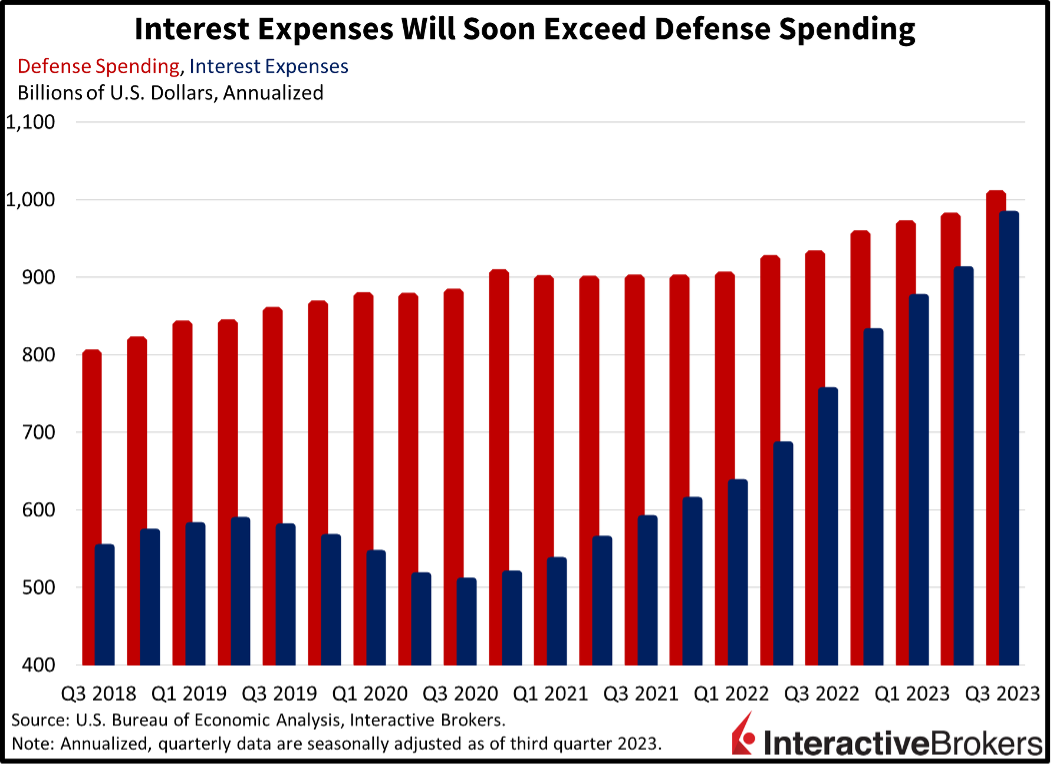

A major risk heading into 2024 remains the long end of the yield curve. With demand declining from traditional buyers that lack price-sensitivity such as the Fed and U.S. banks, the Treasury is looking to borrow more than ever. The Fed is winding down its bond holdings while banks are holding on to cash dearly as they embrace late-cycle risk management amidst uncertainty stemming from commercial real estate and consumer loans. Indeed, commentary is emerging, most recently from Federal Reserve Bank of Dallas President Lorie Logan, that the Fed will continue its quantitative tightening program even after it cuts rates. Furthermore, foreign Treasury buyers such as China and Japan aren’t buying as many Treasuries as they confront problems at home amidst geopolitical uncertainty. With progress in Washington lightyears away on the budget deficit and interest expenses climbing toward the same amount that we spend on defense spending in short order, long-term yields are going higher.

Visit Traders’ Academy to Learn More About Consumer Confidence and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.