Markets are on tenterhooks as they await Federal Reserve Chairman Powell’s speech at noon Eastern time while digesting data depicting weakness within rate sensitive areas of the economy and a labor market that is shrugging off higher interest rates and restrictive monetary policy.

The Conference Board’s Leading Economic Index and the National Association of Realtors’ Existing Home Sales data this morning depicted economic weakness resulting, in large part, from higher interest rates, while unemployment claims came in below expectations, signaling that businesses are demonstrating monetary policy resilience by continuing to hire and grow.

On the Wrong Side of Higher Interest Rates

The Leading Economic Index declined 0.7% in September, an accelerated drop from August’s 0.4% contraction. The figure missed projections by a wide margin, as the Street anticipated an unchanged pace. Consumer expectations of business conditions, ISM new orders, and the 10-year to fed funds rate differential weighed mostly on the Index, while initial unemployment claims offset some of the weakness. All other components contributed negatively to the headline.

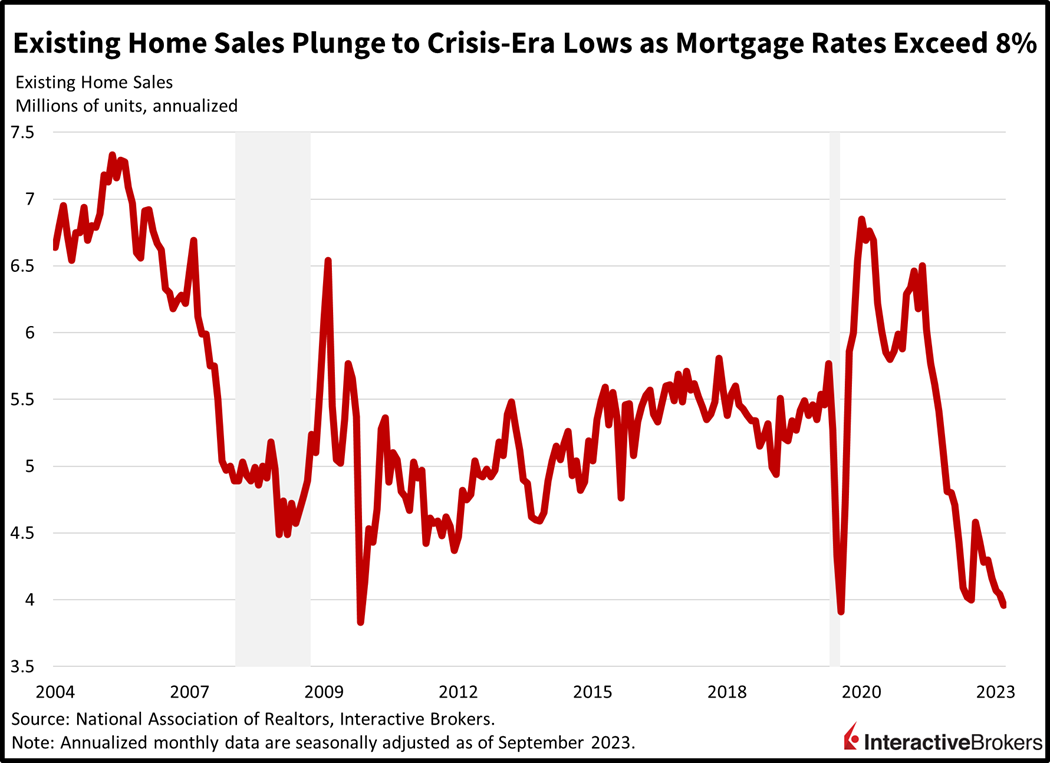

Existing Home Sales Are Few and Far Between

Existing home sales slowed to the lowest point on record when excluding July 2010 and May 2020, periods coinciding with the Great Financial Crisis and the 2020 pandemic recession. Sales slipped 2% month-over-month (m/m) to 3.96 million seasonally adjusted annualized units in September, lighter than the 4.04 million in August but beating expectations of 3.89 million. On a m/m basis, sales contracted 5.3%, 4.1% and 1.1% in the West, Midwest, and Southern regions while growing 4.2% in the Northeast. Mortgage rates sporting an 8 handle are likely to continue constraining the real estate sector.

Unemployment Line Has Fewer New Members

Initial unemployment claims fell to the lowest level since January as employee retention trends strengthened. Laid off workers lining up for unemployment benefits fell to 198,000 for the week ended October 14, substantially below estimates projecting 212,000, which would’ve been near the previous week’s 211,000. Continuing claims, however, climbed for the fourth consecutive week as the duration of hopping from job to job elongates. Continuing claims rose to 1.734 million for the week ended October 7, exceeding estimates of 1.710 million and the previous week’s 1.705 million.

Lunch with Powell

Markets are tanking ahead of Powell’s speech, which may lead to an uptick in sentiment intraday. All major U.S. equity indices are lower thus far, led by the small-cap Russell 2000 Index’s 0.7% decline. The S&P 500, Dow Jones Industrial and Nasdaq Composite indices are down 0.4%, 0.3% and 0.3%. Sectoral breadth is in the tombs, with all sectors lower minus communication services and energy, which are up 0.6% and 0.3%. Bond yields are generally higher across the curve with a few exceptions at the shorter end. The 2-year maturity is up a basis point (bp) to 5.23% while the 10-year is up 2 bps to 4.936%. Earlier in the session, both maturities reached fresh yearly highs of 5.259% and 4.983%. The dollar is lower, however, as it depreciates relative to the yuan, yen, pound sterling, franc and euro while it’s up against the Aussie and Canadian dollars. Crude oil prices are down as Washington relieves Caracas from a plethora of sanctions in efforts to bring more energy supplies online. Concerns that the Middle Eastern conflict could escalate to more regional participants lured in dip buyers, dampening the WTI crude decline to 0.7% as prices hover at $87.55 per barrel.

Businesses Face Pricing Pressures

Earnings reports released last night and this morning are peppered with comments about pricing pressures driven by competition and perhaps more significantly, consumers pushing back on higher prices as they struggle with increased cost of living expenses, higher financing costs and constrained credit availability. The following examples illustrate this trend:

- Tesla CEO Elon Musk last night emphasized that pricing is becoming increasingly important as car buyers are focusing on monthly auto loan payments in a higher interest rate environment. If the existing level of interest rates persist or increase it will make it more difficult for individuals to buy cars. Tesla has cut prices as it faces stiff competition from Chinese manufacturers and U.S. companies that are aggressively pushing into the EV market. Tesla’s adjusted earnings per share (EPS) of $0.66 missed the consensus expectation of $0.73 and dropped 37% year-over-year (y/y). Its revenue of $23.4 billion climbed 9% y/y but missed the analyst consensus expectation of $24.1 billion.

- American Airlines said last night that higher fuel costs and lower ticker prices hurt its third-quarter profits, but the company’s adjusted EPS of $0.38 flew past the analyst consensus expectation of $0.25. Additionally, its revenue of $13.48 billion missed the analyst expectation of $13.52 billion. Reduced fares, furthermore, caused the company to estimate that its unit revenue, or revenue generated for each ticket it sells, to decline in the fourth quarter between 5.5% and 7.5% y/y.

- Proctor & Gamble, which makes Tide laundry detergent, Charmin toilet paper and other household products, said its sales volume declined for the sixth-consecutive quarter because some customers are turning to less-expensive private-labeled products. In doing so, they are pushing back against price increases that the company has implemented during the past two years. The company could face challenges such as potentially higher energy costs, weaker Chinese demand and declining household savings rates. Proctor & Gamble’s EPS of $1.83 exceeded the analyst consensus estimate of $1.72. For the quarter, higher prices offset the impact of customers switching to lower cost alternatives with the company’s revenues of $21.87 billion exceeding the analyst expectation of $21.58 billion and increasing 6% y/y. The company lowered the bottom range of its previous 3% to 4% fiscal-year 2024 revenue growth guidance by one percentage point.

In other product pricing comments, Netflix reported that subscriptions to its lower-cost advertising-supported option grew 70% during the third quarter while Nestle said its price increases caused consumers to tighten their purse strings, resulting in the company’s nine-month sales growth missing expectations.

Ford Lays Off More Workers

The United Auto Workers union and the nation’s three largest car manufacturers continue to be at loggerheads and Ford Motor Company has just laid off an additional 150 employees at its axle plant in Sterling Heights, Michigan. Ford, which has now laid off 418 workers at the location, says the axles are currently not needed because of union workers striking at the company’s Kentucky Truck plant.

Congress Remains Leaderless

Representative Jim Jordan from Ohio’s 4th district lost his second bid for the House speakership yesterday with 22 members of his Republican party voting against. It appears Jordan will continue efforts to secure those members votes today rather than seek another vote. Jordan is also believed to be ready to support extending the existing interim House Speaker Patrick McHenry’s stint until January.

Powell Stays on Target

Chairman Powell appeared unsatisfied with the current level of inflation according to his pre-speech notes for the Economic Club of New York. Powell remarked that lower economic growth is needed to bring down price pressures. He also mentioned that a softer labor market is required to achieve the central bank’s inflation target while acknowledging that the long and variable lags of monetary policy have not been fully felt yet. Finally, recent data support continued restrictive policies as the risks of doing too little outweigh the risks of doing too much. Enjoy the presentation.

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.