A gradual transition toward a more ‘normal’ mid-cycle…

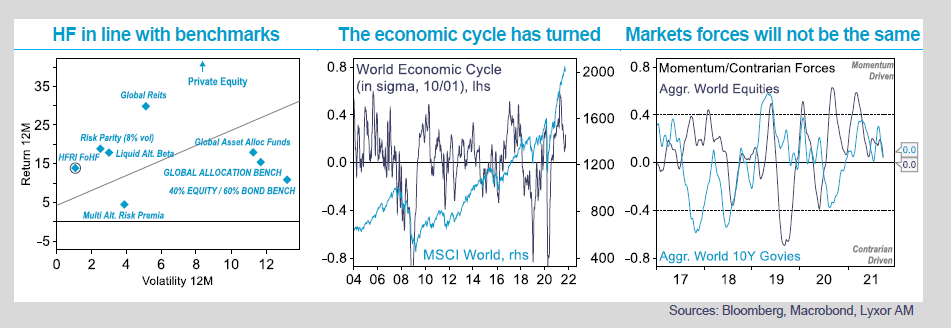

We think global growth has peaked but will remain above average, boosted by broadening consumption and surging capex. A return to more ‘normal’ has already started but will likely take more time than anticipated, complicated by covid variant(s), supply chains disruptions, firming inflation, more hawkish

central banks and multiple political wildcards. The cycle remains modestly supportive for risk assets. In perspective, over the last 30 years, transitions to a mid-cycle usually resulted in a few months of less comfortable phase of wait-and-see, before more bullish market trends could resume.

… has substantial implications for the alpha backdrop.

First, market sensitivity to covid trends would gradually decline,

except for segments most hit by restrictions. Second, markets would be more driven by traditional macro fundamentals. Growth, inflation, productivity, leverage would be stronger market movers and asset prices would better respond to their

fundamentals. Third, we expect central banks to be cautious, which would limit bond market volatility, but their uneven pace would fuel greater regional and asset discrimination. These divergences would provide a pool of relative opportunities. Fourth, as global liquidity moderate, we expect fewer trading and valuation anomalies and better capital allocations, another positive for alpha. However, the biggest wildcard would come from politics, as governments seek to withdraw stimulus, reduce inequalities, and protect strategic segments. Speculative in nature, political choices regarding fiscal spending, tax and labor regimes, regulations and allocation of public investments would be the main challenges for alpha generation.

Click here to read the full report

—

Originally Published on September 29, 2021

The views and opinions expressed in this document are those of the authors and are not given or endorsed by the company. This document is for the exclusive use of investors acting on their own account and categorized either as «eligible counterparties» or «professional clients» within the meaning of Markets in Financial Instruments Directive 2014/65/EU. Not for U.S. investors. See important disclaimer at the end of this document.

Disclosure: Lyxor Asset Management

Lyxor Asset Management S.A.S. (“Lyxor S.A.S.”) is a French investment management company authorized by the Autorité des Marchés Financiers and registered as a commodity trading advisor and commodity pool operator with the CFTC.

The information in this material is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax or legal advice, a recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security. Any decision to invest in a product should be made only after reading the offering document for that product, conducting such investigations as the prospective investor deems necessary after consulting with the prospective investor’s own independent investment, legal, accounting and tax advisors in order to make an informed determination of the suitability and consequences of an investment in such product. Any recommendation or opinion regarding an investment in a product managed by Lyxor S.A.S. or one of its affiliates, as opposed to another product with a similar investment program, is subject to potential conflicts of interest.

The information displayed in this document may change from time to time without notice. Certain information presented herein has been obtained from other sources believed to be reliable. Such information has not been verified for purposes of this material and no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of such information, nor does Lyxor S.A.S. accept any liability arising from its use. Any opinions expressed herein are statements of our judgment on this date and are subject to change without notice. The information contained herein is strictly confidential and may not be reproduced, in whole or in part, nor may its contents be disclosed to any other person (other than the recipient’s confidential advisers) under any circumstances without the prior written consent of Lyxor S.A.S.

Securities in certain funds mentioned herein which are managed by Lyxor S.A.S. are offered and sold to U.S. investors through SG Americas Securities, LLC (“SGAS”), an affiliate of Lyxor S.A.S. and Lyxor Inc. and a member of the U.S. Financial Regulatory Authority, the U.S. Securities Investor Protection Corporation and the New York Stock Exchange. Lyxor S.A.S. may pay a placement fee to, and provide compensation for expenses to SGAS in connection with its services provided in connection with such funds.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Lyxor Asset Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Lyxor Asset Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Hedge Funds

Hedge Funds are highly speculative, and investors may lose their entire investment.