The Federal Reserve’s journey across the perilous monetary policy bridge toward price stability benefited last year from an unobstructed economic passing lane, or commodity and goods prices declining significantly while the global supply chain fully recovered from Covid-19 driven disruptions. But a handful of risks could quickly clog up the passing lane and unlike Texas feeder freaks, Fed policymakers may not have an appealing alternative road. The Lone Star state has the dubious distinction of using access roads alongside highways for motorists to visit businesses. When traffic swells, certain drivers use these access roads, or feeders, to aggressively end-run highway congestion.

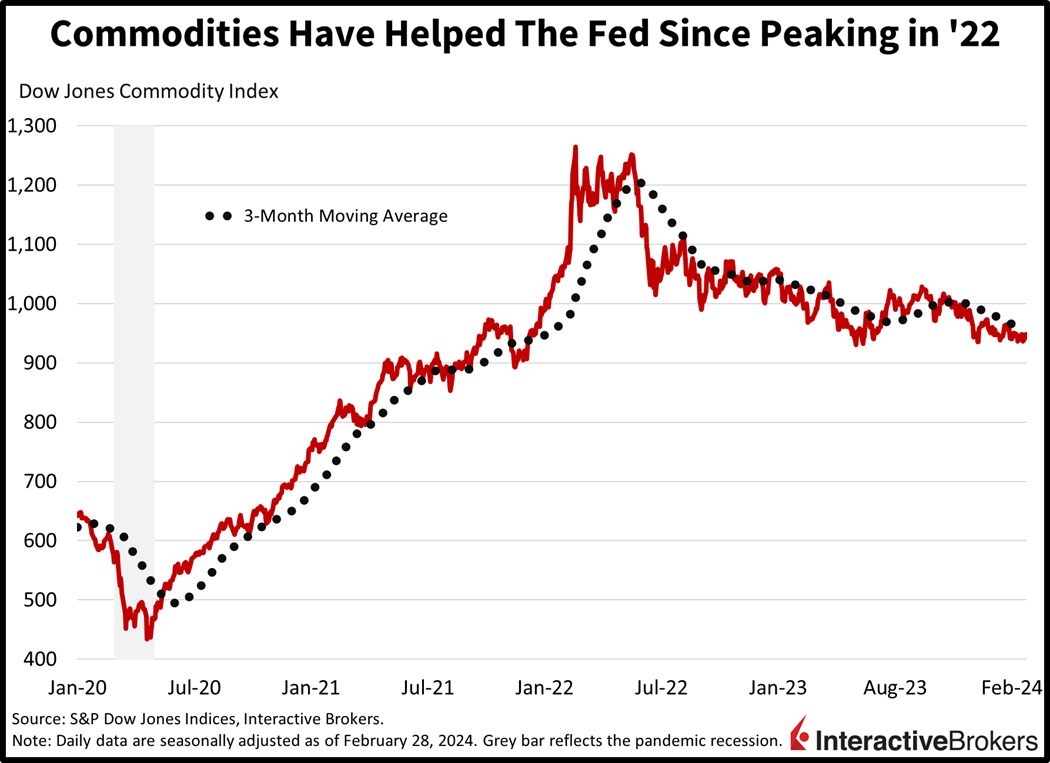

For the Fed, the passing lane opened last year when commodity and goods prices dropped significantly. After climbing at sharp rates of 20.6% and 30.8% in 2021 and 2022, the Dow Jones Commodity Index dropped 4.1% in 2023, providing consumers with relief as electricity, heating and gasoline costs dropped. Meanwhile, businesses benefited from lower input costs. These savings and an ongoing trend of consumer spending favoring entertainment, travel and other services rather than physical products resulted in goods prices dropping last year. The costs of goods and commodities also benefited from higher interest rates and reduced credit availability that hampered demand for big-ticket items like used cars, furniture, appliances, etc.

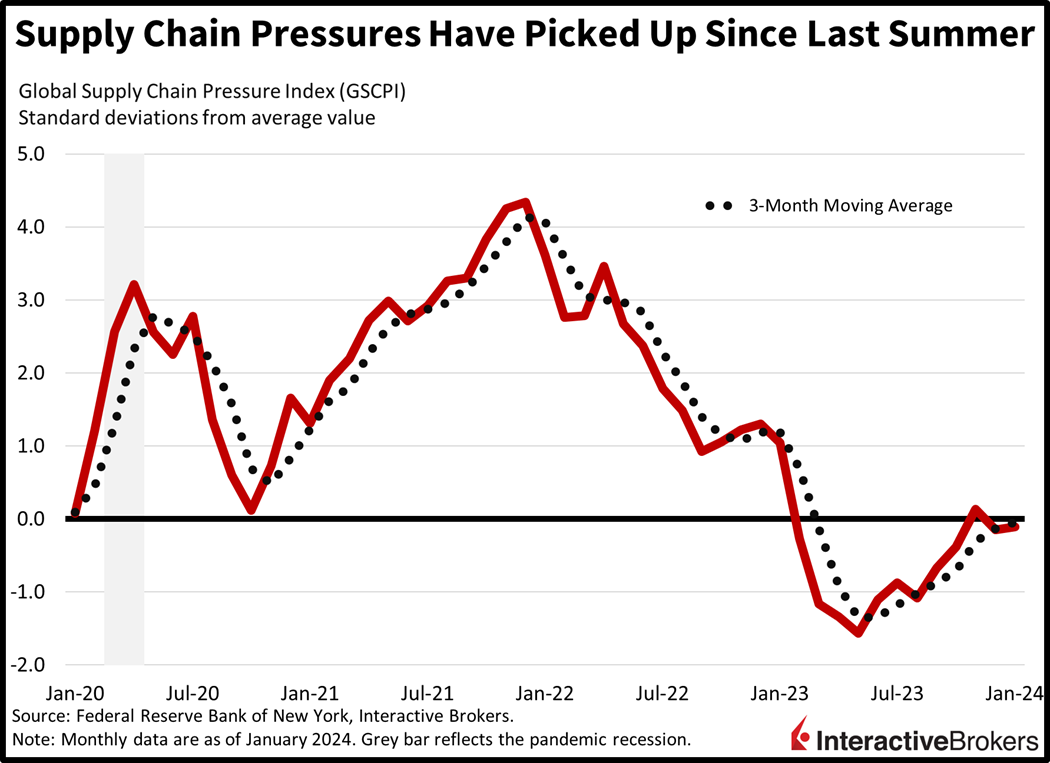

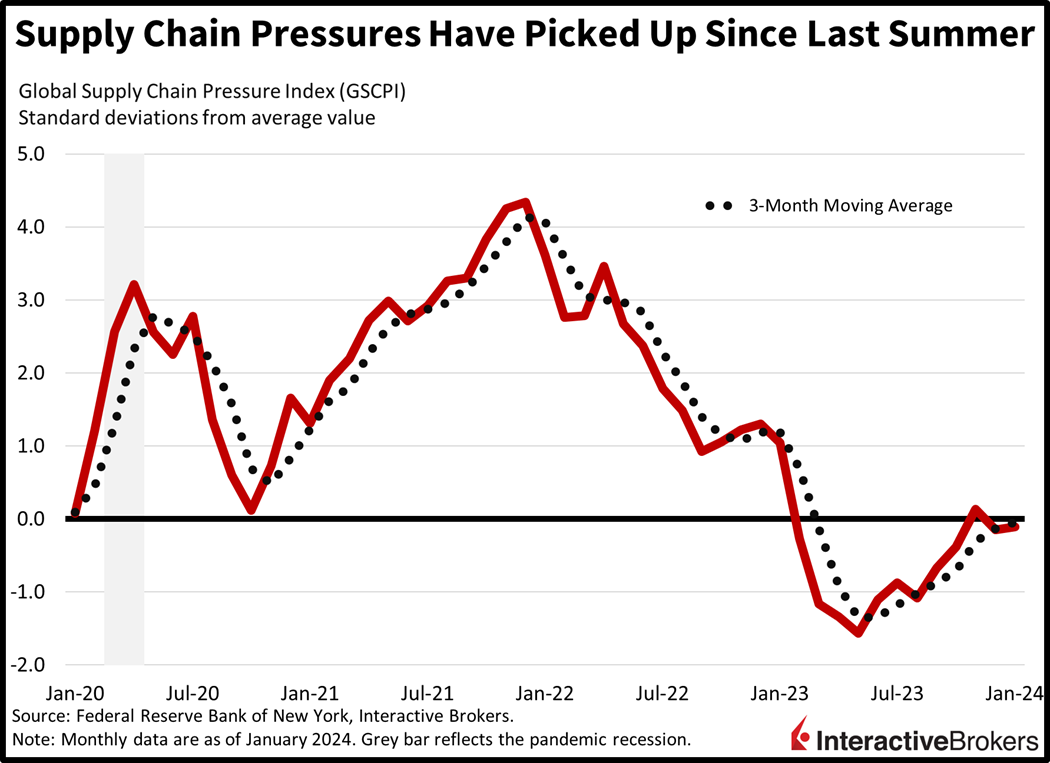

Price stability also benefited from considerable improvements in the global supply chain. After hitting a Covid-19 era high of 4.34 in December of 2021, the Global Supply Chain Pressure Index gradually improved and last year it dropped from 1.05 in January of 2023 to -0.11 as of January. Global conditions are changing, however, and commodities, goods and the global supply chain face escalating geopolitical risks and other challenges that could clog the Fed’s passing lane. Meanwhile, services never really cooled off, as rising housing costs, tight labor conditions and accelerating wages underpinned prices. In the following commentary, we delve into these challenges at a time when expectations for the timing of the central bank shifting towards an accommodative posture are being pushed into the second half of this year while some analysts believe another rate hike may be possible.

Geopolitics, Weather and Labor Market Threaten Supply Chains

As the Covid-19 pandemic eased and economies began to reopen, the global supply chain improved considerably. This helped businesses lower input and logistics costs. More recently, rising challenges contributed to increasing supply chain stress.

The following challenges account for growing concerns about the global supply chain once again contributing to sticky inflation:

- The Israel and Hamas conflict is having global ramifications with various countries in the region supporting rebels that are attacking Israel and western interests. Perhaps most significant, Yemen-backed Houthi rebels are attacking ships in the Red Sea, a route that accounts for approximately 30% of container shipping. Many logistics companies have opted to sail cargo ships—including those carrying energy commodities—around South Africa, which is a longer and more costly route than the Red Sea-Suez Canal option. The long shipping times have also contributed to a shortage of cargo capacity and Fitch reports that shipping costs have increased by 150% since this past December.

This issue could intensify. Militant groups, such as Houthi and Hezbollah that support Palestinians, have been attacking US interests. In response, the US and UK have launched military strikes against rebel locations in Yemen, Syria and Iraq, which could potentially escalate the Israel-Hamas conflict beyond Gaza.

- A severe drought in Central America, furthermore, has restricted shipping through the Panama Canal. In November, the Panama Canal’s reservoir, the Gatun Lake, reached historic low levels, causing the Panama Canal Authority to reduce the number of daily canal transits to 24, down from as many as 40 on a typical day. The organization also restricted the size of ships that use the facility. Rather than a typical 31-day trip from the Pacific Rim to the Gulf Coast, shippers now face as much as an additional 29 days to access the canal or they must sail through the Strait of Malacca, across the Indian Ocean and then pass south of the Cape of Good Hope, a 49-day journey. Trips from the Gulf Coast to the west coast of South America, furthermore, must sail through the Strait of Magellan, which is a 27-day voyage rather than a 14-day trip involving the canal.

- A tight labor market also threatens the supply chain. Last October, Canadian labor union Unifor called for workers at the St. Lawrence Seaway to strike, causing a shutdown of the 2,300-mile route that connects the Great Lakes to the Atlantic Ocean and is used to ship about $12 billion in cargo annually. Tight labor isn’t limited to the logistics industry with 458,900 US workers last year striking, a 280% year-over-year (y/y) increase that led to major work stoppages.

Oil and Gasoline Prices

Various government agencies have painted an optimistic outlook for energy production, but US oil extraction could stay flat or even contract this year. Meanwhile, OPEC + is forecasting increasing demand for hydrocarbon products, and it has extended its production cuts through the second quarter of this year. The Middle East crisis, furthermore, is likely to mandate a risk premium on oil.

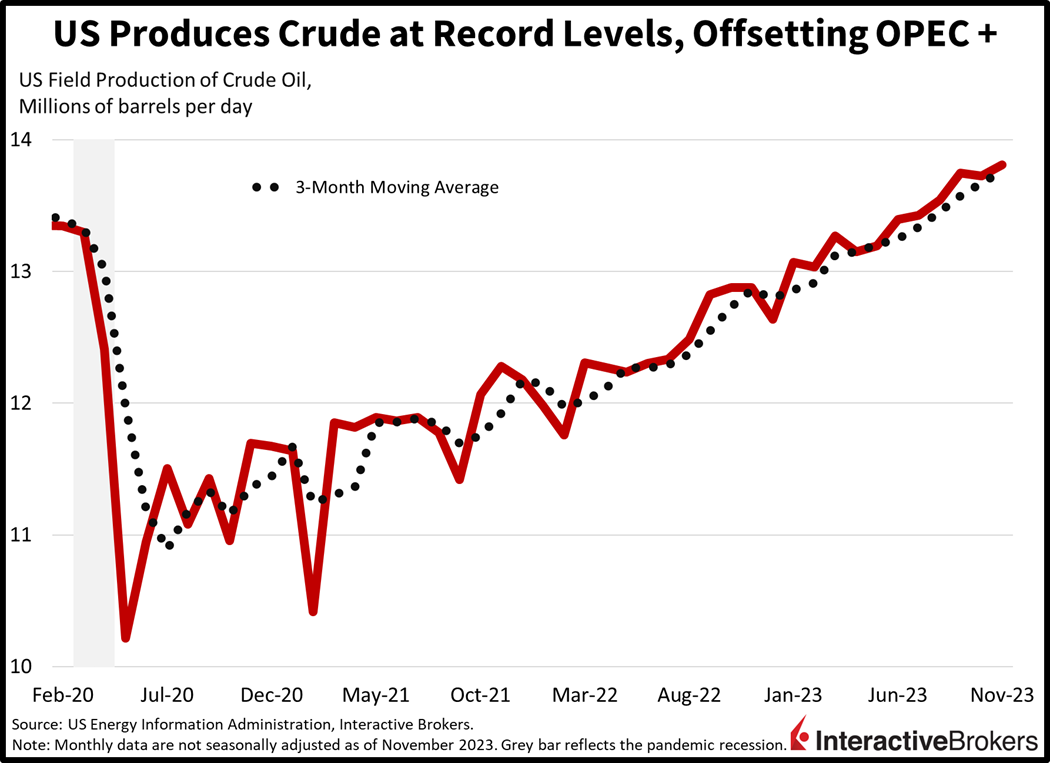

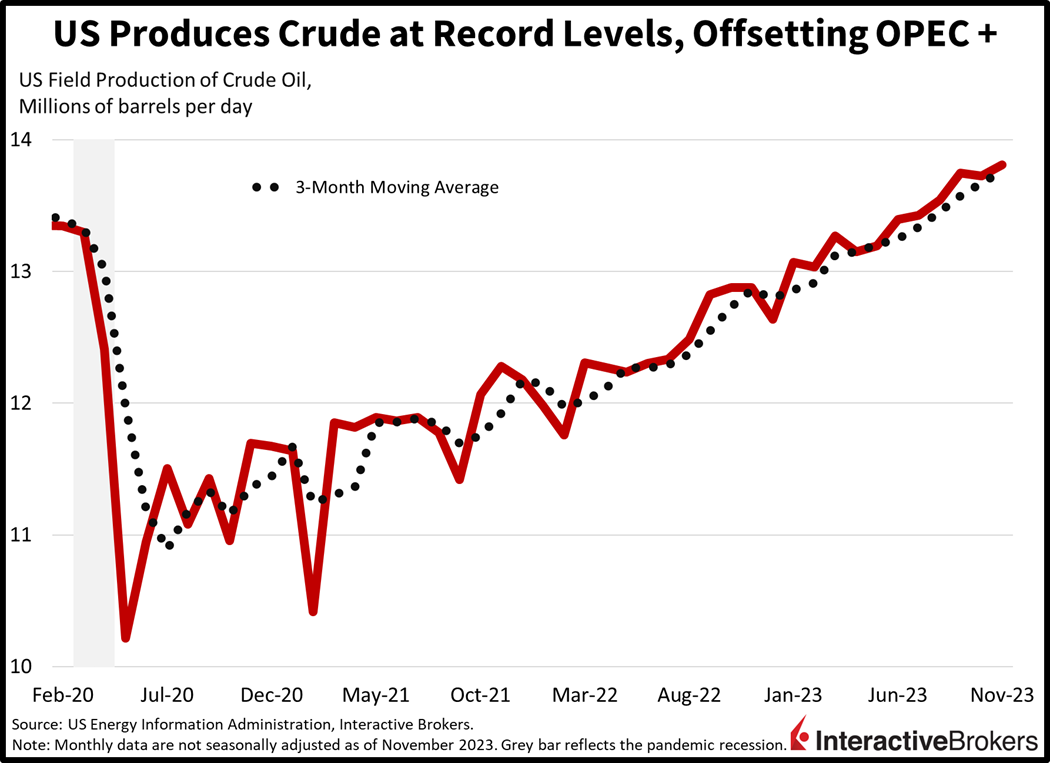

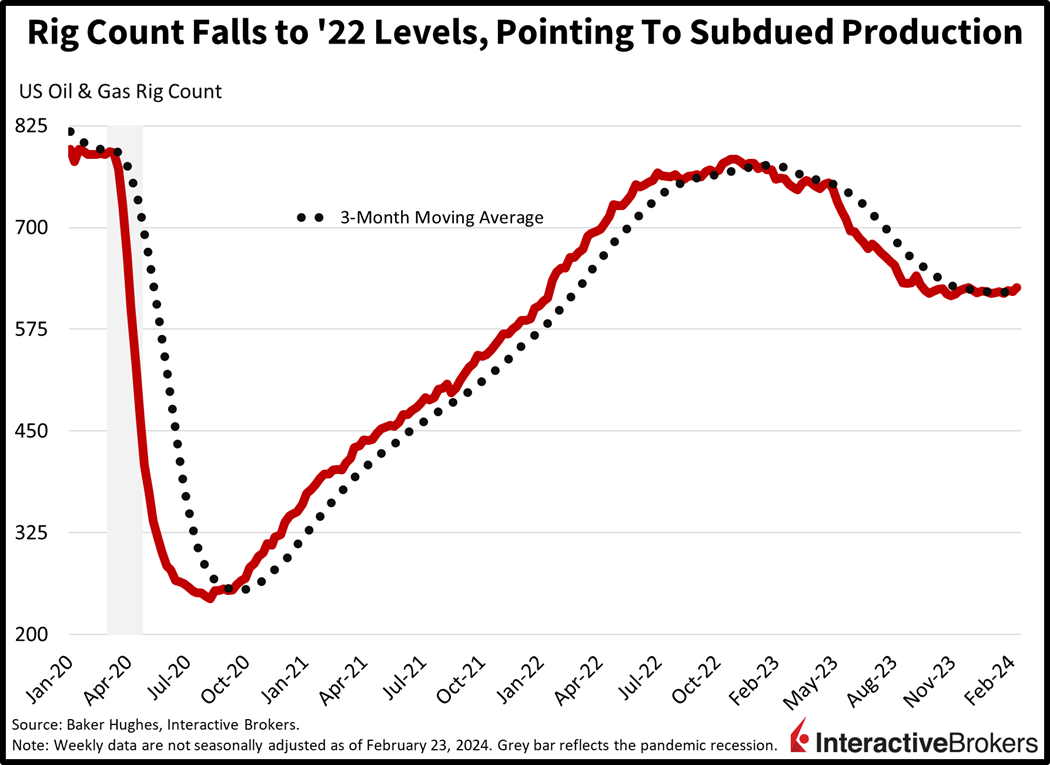

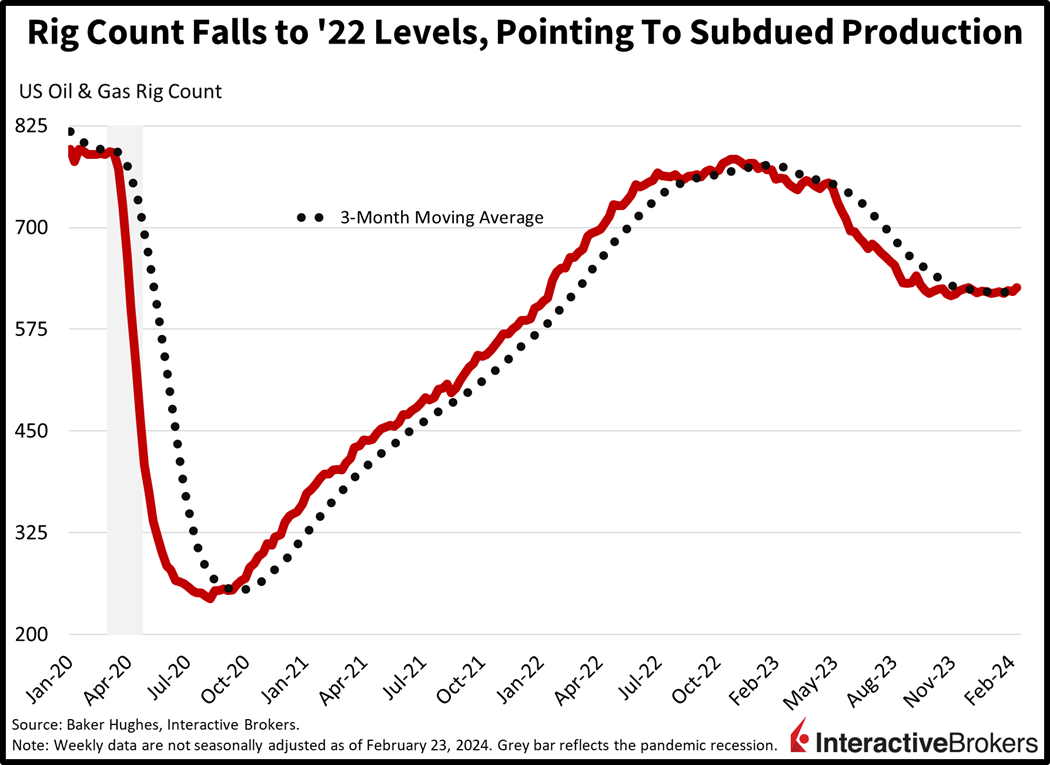

The US set an all-time record last year and became the world’s largest producer of crude oil by boosting production to an average of 12.9 million barrels per day (bpd). This surge was motivated, in part, by oil prices soaring to approximately $120 a barrel as the economy reopened following the Covid-19 pandemic. The combination of higher prices and low financing costs allowed companies to profitably extract energy commodities and satisfy investors’ increasing demands for return on capital. This resulting supply helped offset the impact of OPEC + curtailing production. During the past 12 months, however, the US oil rig count has declined from 753 to 626 as of February 23, according to Baker Hughes. This decline has accompanied a sharp drop in oil prices that have made it more difficult to drill profitably in the US. Additionally, large oil companies that are under pressure from shareholders to generate returns on investment by maintaining capital discipline have been acquiring small energy producers that have been less likely to face such pressures. As smaller companies are integrated with larger companies, they become less likely to aggressively increase production. The decline in rig counts, lower oil prices, higher financing costs and the wave of acquisitions point to US oil production being flat or even contracting this year.

OPEC +, meanwhile, has extended its current 2.2 million bpd production cut through the second quarter to shore up oil prices. Without increasing US production, the OPEC + cuts could contribute to rising gasoline prices as demand picks up during the summer vacation season. OPEC +, furthermore, anticipates that global oil demand will increase by 2.25 million bpd as the Chinese economy recovers and central banks move away from restrictive monetary policy, stimulating GDP. Even if economies fall short of expectations, the US and other countries have low levels of strategic oil reserves after releasing the commodity to reduce prices following the Russian invasion of Ukraine. Efforts to refill reserves could support higher oil prices.

Finally, the Red Sea-Suez Canal route and other assets in the Middle East region, such as pipelines, account for transporting 27% of the global seaborne oil trade, according to Fitch Ratings. With the continuation of Houthi attacks on ships in the Red Sea, oil providers are pricing oil with an elevated risk premium. Additionally, the potential for the Israel-Hamas conflict to escalate and threaten significant oil resources in the area is adding uncertainty.

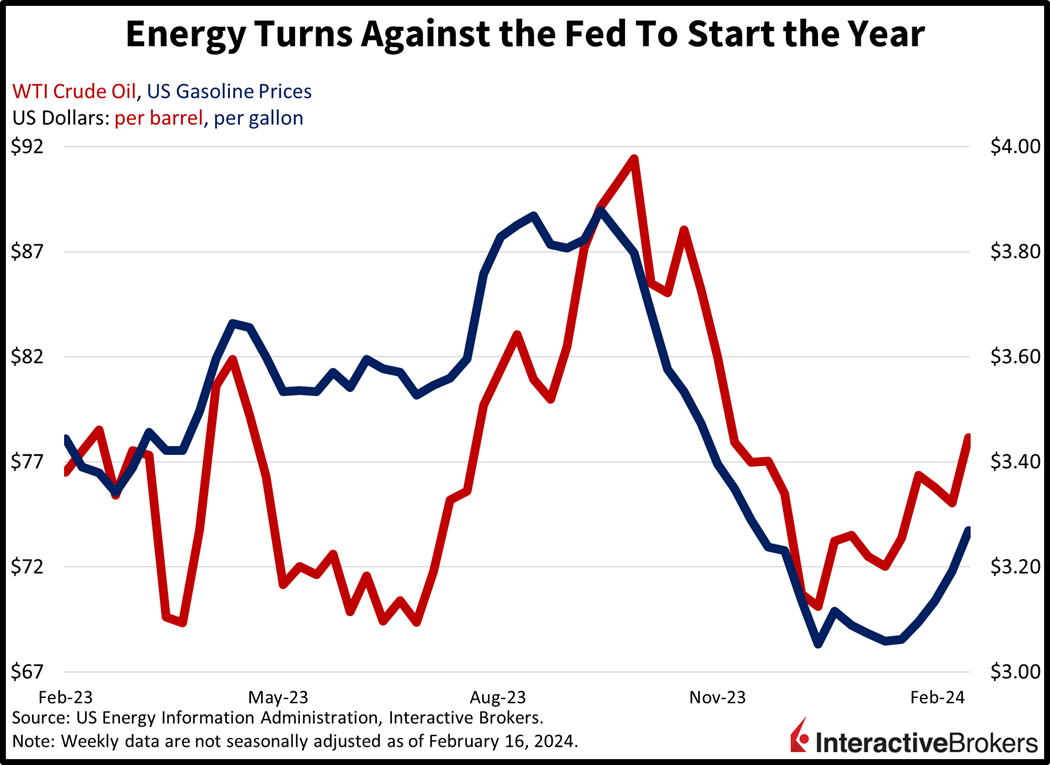

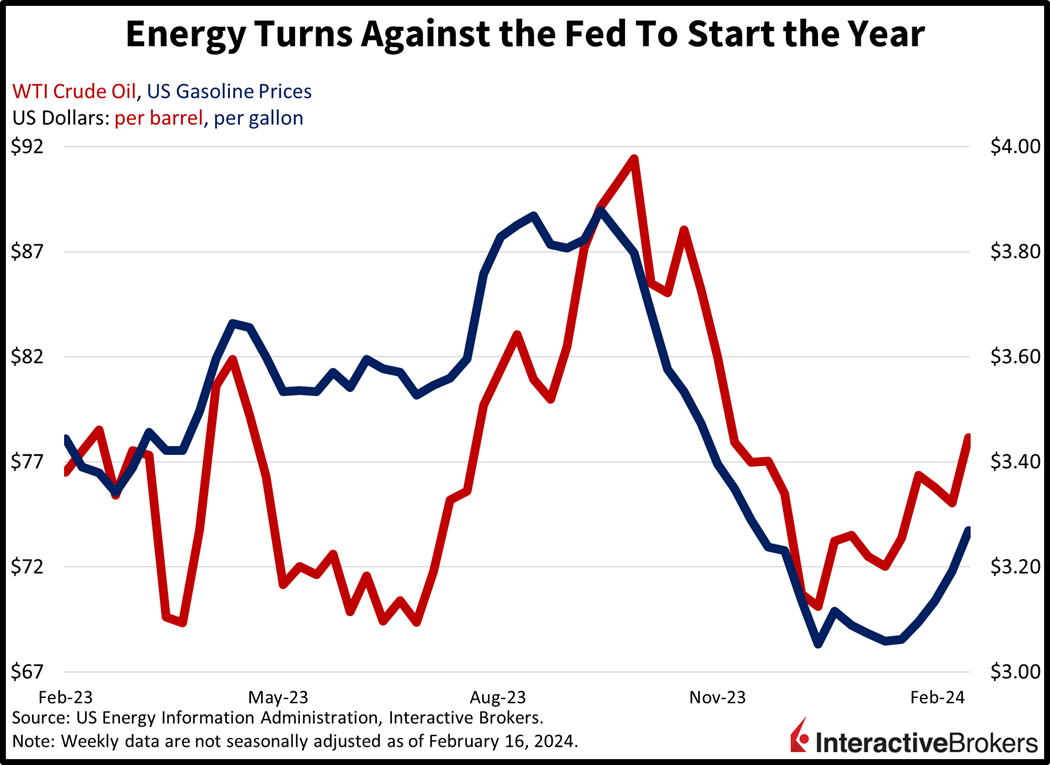

These factors are likely to cause oil and gasoline prices to continue climbing unlike in 2023, when WTI oil declined from $76.87 a barrel to $71.89 and regular gasoline, which started 2023 at $3.09, finished the year virtually flat at $3.08. So far this year, gasoline has climbed nearly $0.25 while oil has gained slightly more than $8 a barrel.

Labor Costs and Supply Chain Push Prices Up

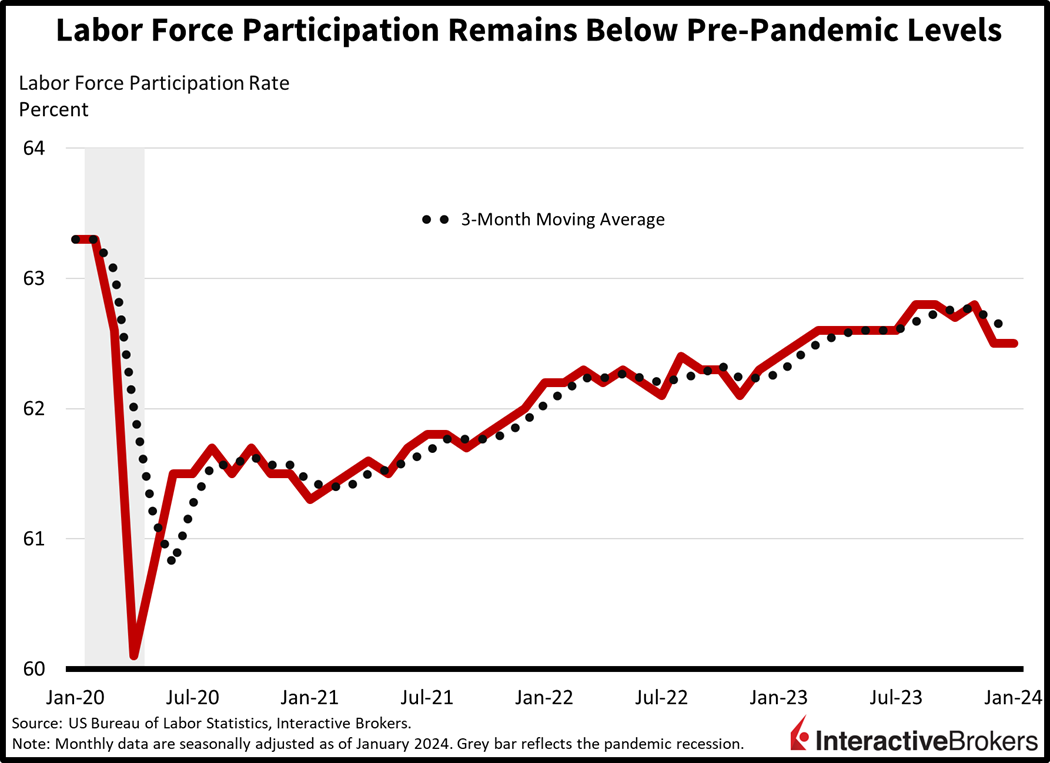

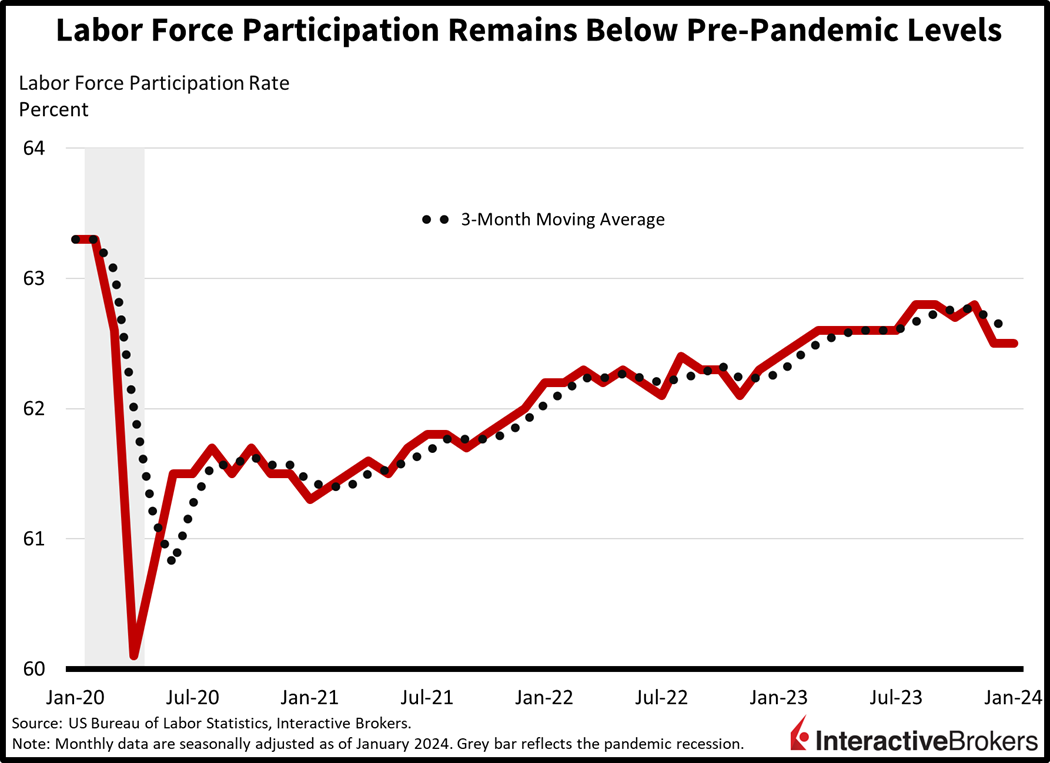

As mentioned above, labor conflicts can threaten the supply chain, but separately, a shortage of workers is creating wage pressures in services sectors, which are labor-intensive. In the aftermath of the Covid-19 pandemic, the US has created jobs at an impressive clip, resulting in the non-farm payroll report posting a total of 157.7 million filled positions in January, up from a prior peak of 152.3 million in early 2020. The labor pool, however, is tight due to low labor force participation, or the portion of working age individuals that are either employed or actively seeking work. At 62.5% in January, it’s down from the pre-pandemic rate of 63.3% in early 2020. From a longer-term perspective, the rate has been declining in recent years from 66.4% in early 2007.

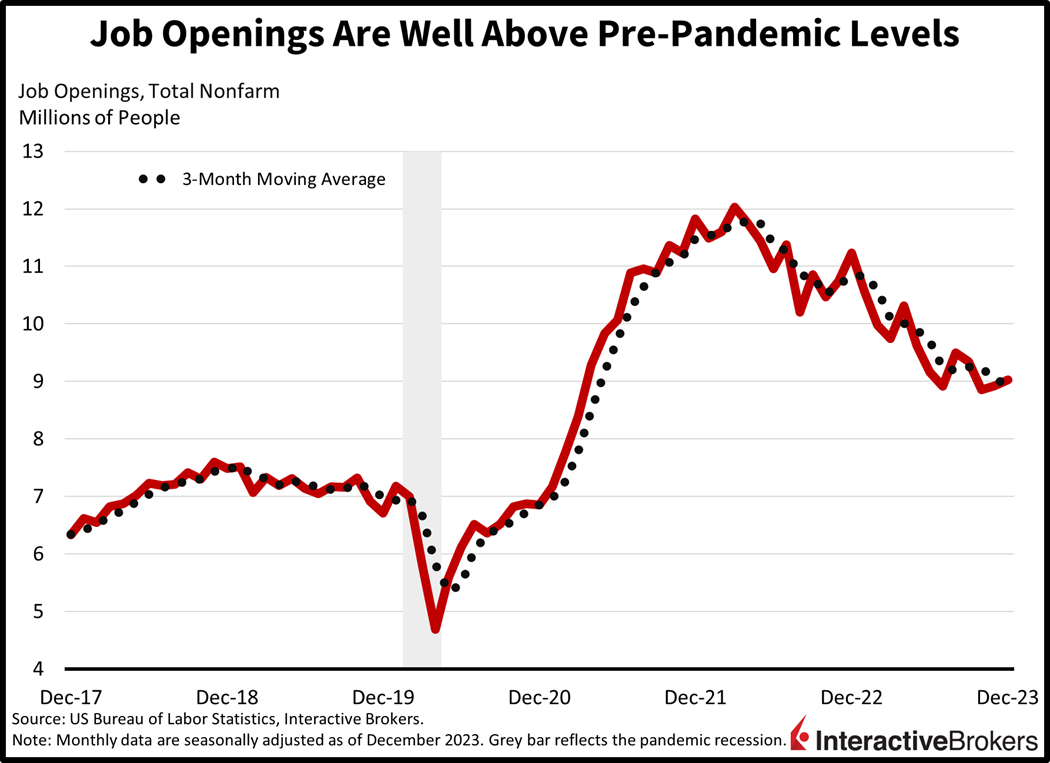

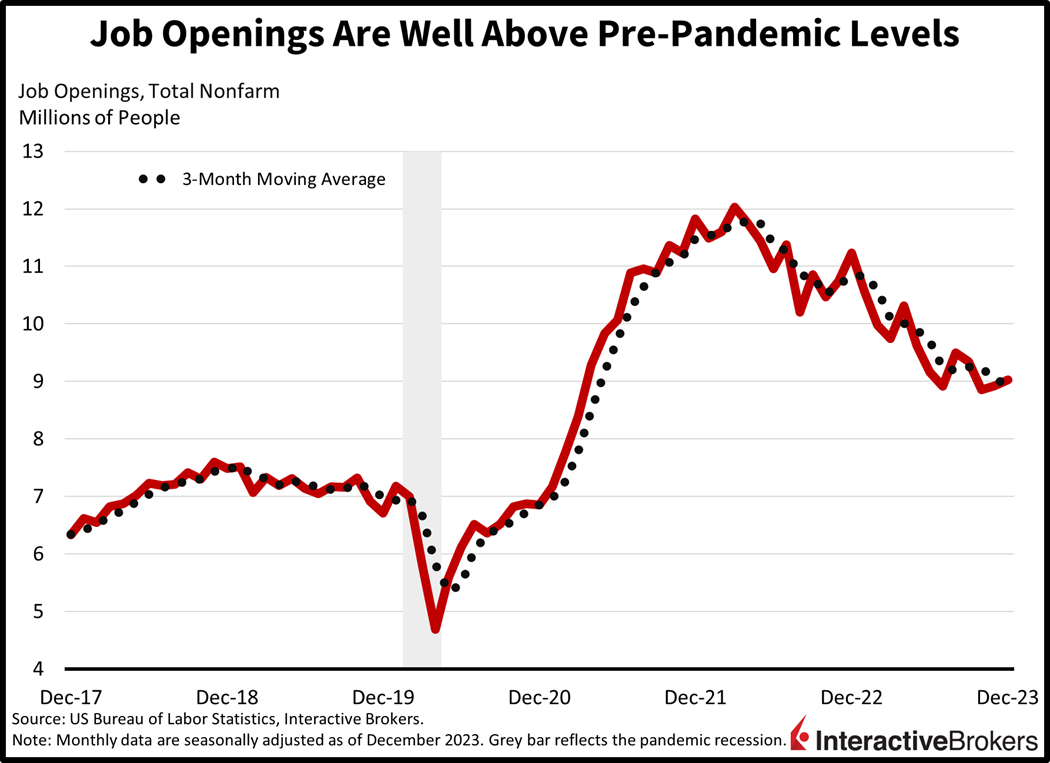

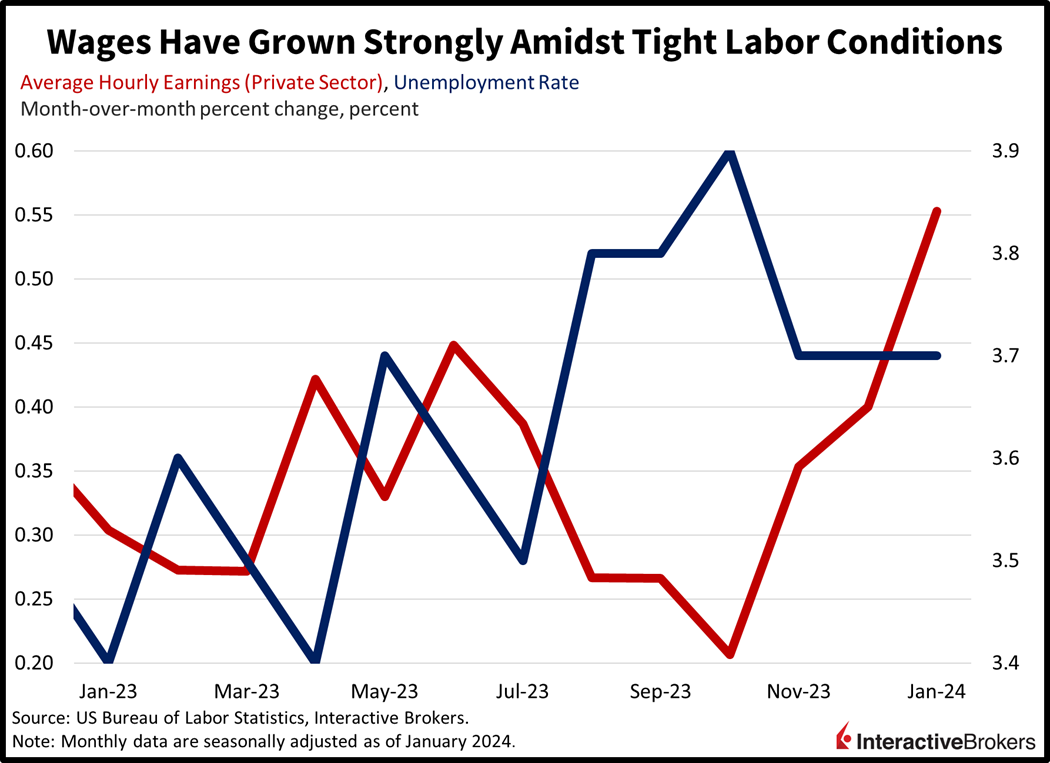

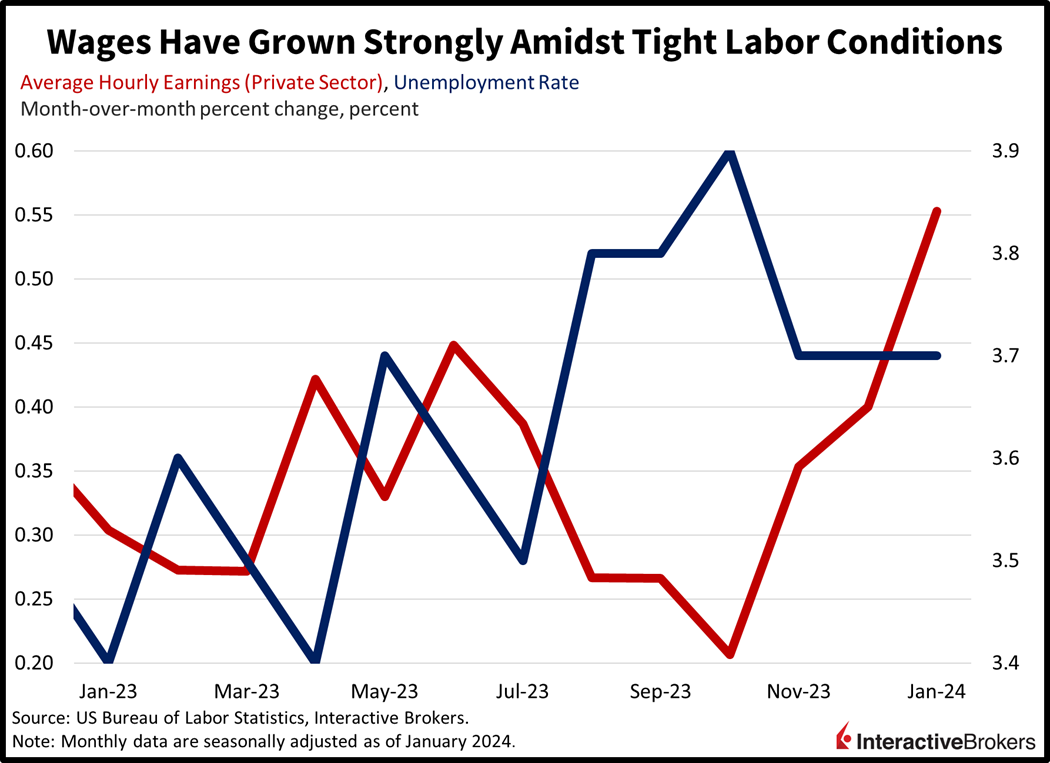

With a tight labor market, many businesses are reluctant to lay off workers and some are even hoarding employees in anticipation of pursuing future growth opportunities. Against this challenging backdrop, there are more than 9 million job openings, which is considerably higher than the pre-pandemic level, and the unemployment rate is only 3.7%.

These factors provide workers with many job options, so they can bargain for higher wages. Additionally, the nation faces a mismatch in the skills within the workforce and the skills that employers are seeking. This has resulted in employers having to compete for a limited number of qualified workers by offering bigger paychecks, which has driven strong wage pressures.

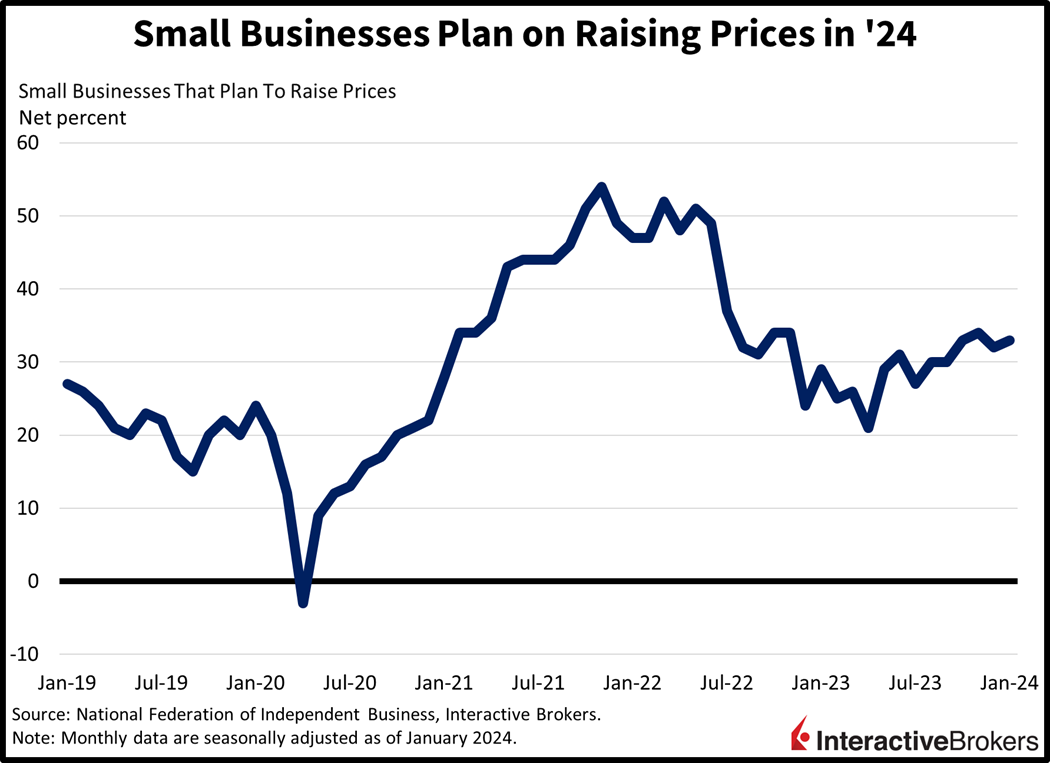

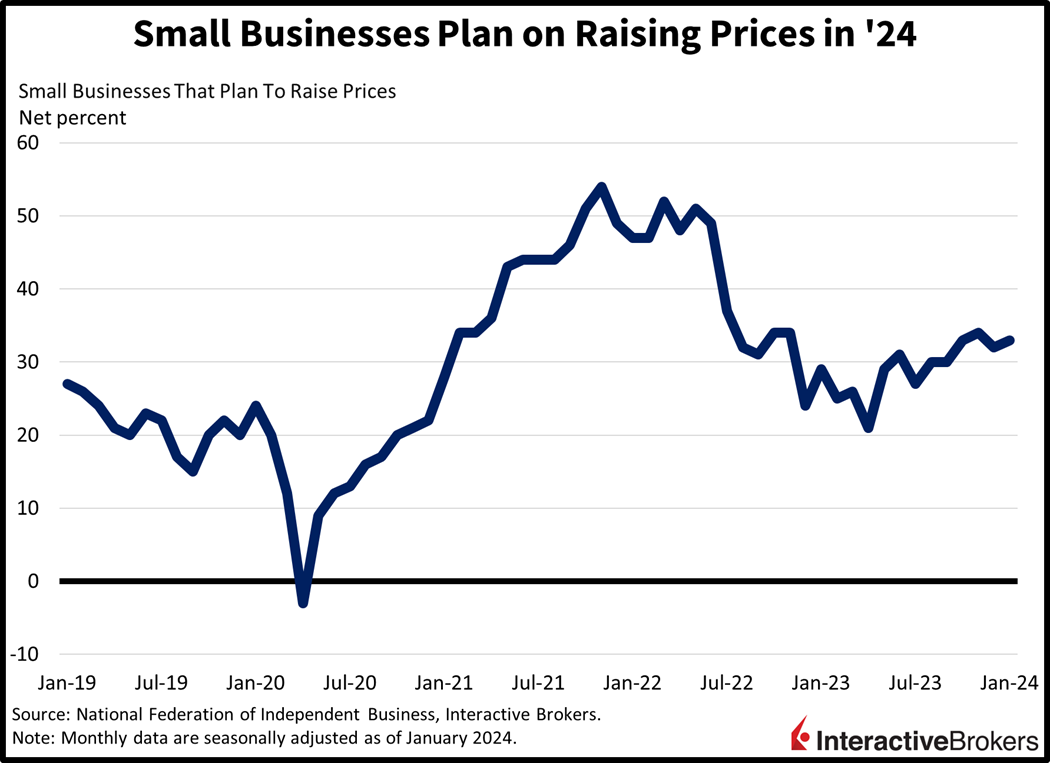

In January, average hourly earnings were 4.5% higher than during the year-ago period, a pace hardly consistent with a 2% inflation target. These labor expenses along with increased input costs and higher logistics costs resulting from shipping disruptions and other supply chain issues are being passed to consumers as higher prices and smaller portions within packaged goods. Indeed, the percentage of small businesses planning to raise prices has been trending higher, a development that in the past has led to rising inflation in future months.

Entertainment Costs Skyrocket

The average ticket price for live concerts climbed from approximately $90 prior to the Covid-19 pandemic to more than $120, according to the Apollo Academy. While labor is a significant factor, concert venues have also experienced large increases in insurance premiums. Other forms of entertainment are experiencing similar cost pressures and have become more expensive. Disney is an example as represented by the company’s Disneyland Resort in Anaheim, California. Disney has kept the price for its basic day pass at $104, but its most expensive tier now costs $194, up from $179. Food prices at restaurants have also increased, climbing 5.1% y/y as of January, according to the Consumer Price Index (CPI).

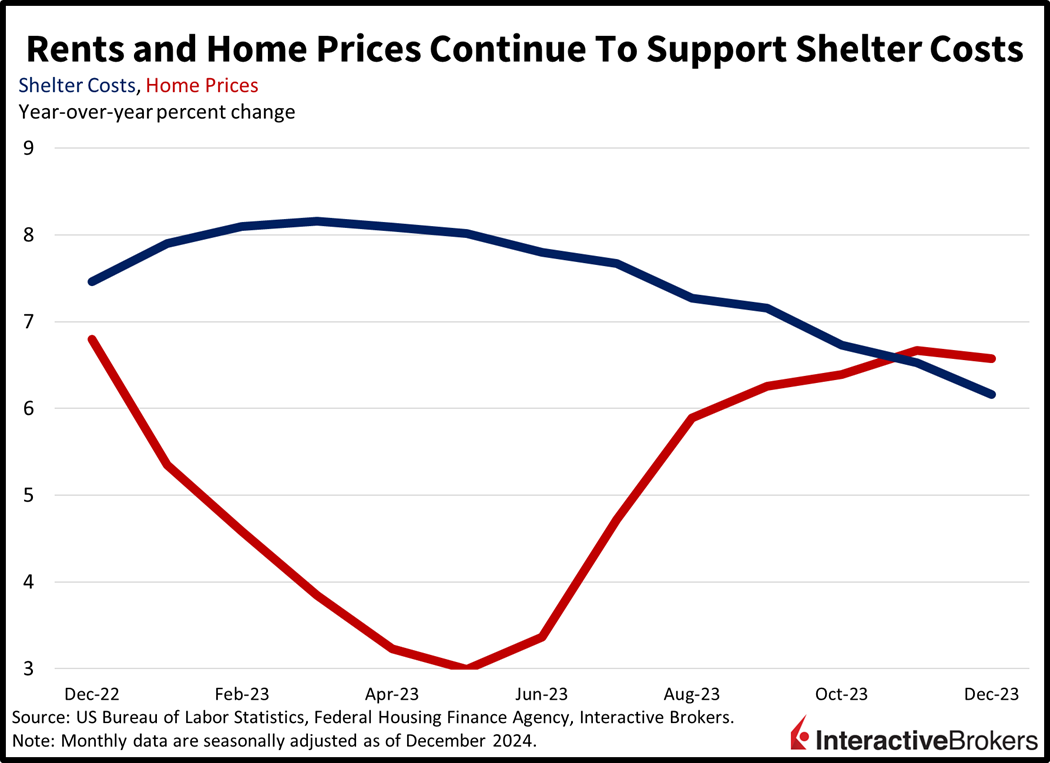

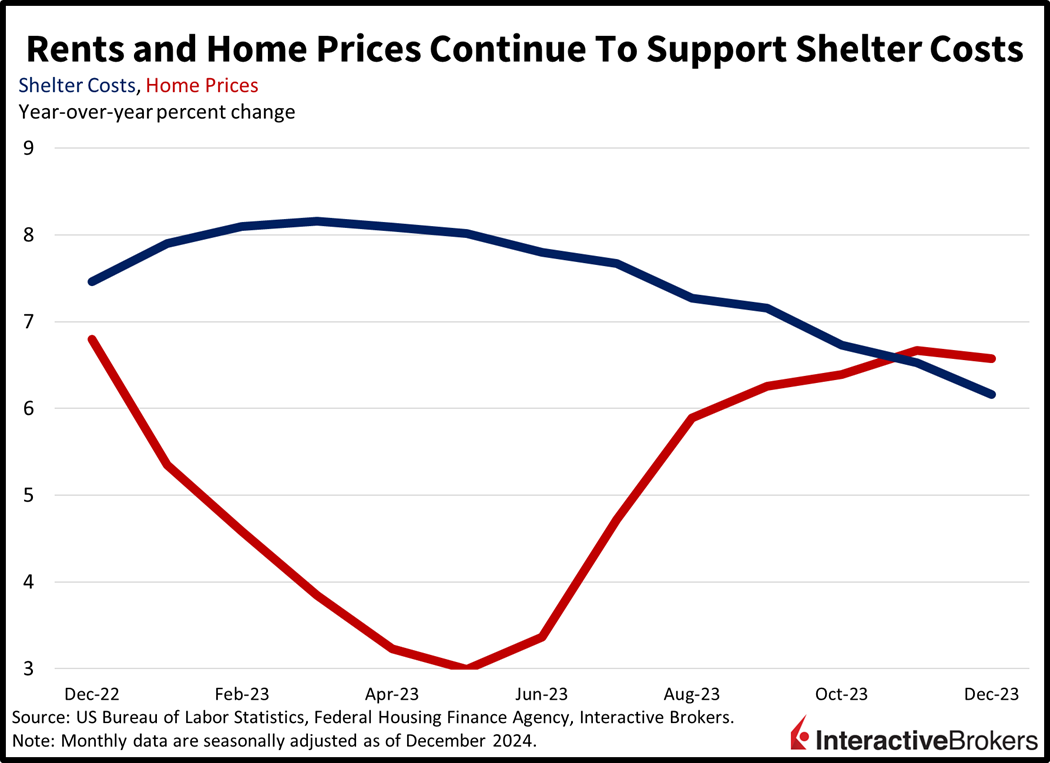

Airline tickets have been an exception, with prices declining last year, however, new pilot contracts, labor union actions to increase pay for flight attendants and potentially higher fuel prices are likely to reverse that trend. In the meantime, airlines have been increasing fees for luggage rather than raising airfares to better compete for passengers. Also among services, shelter costs are continuing to increase and climbed 6% last year, according to the CPI. The increase is driven by higher rent renewals and loftier home prices, although new rents have provided marginal relief.

Shelter Dings Consumers’ Spending Clout

Shelter costs climbed 6.1% y/y, according to the CPI. The increase is significant because housing typically represents roughly 40% of individuals’ living costs. The following factors have contributed to this increase and are likely to support additional price pressures in the coming months.

- Elevated mortgage rates, low inventories and all-time high real estate values have resulted in record low levels of affordability for potential homebuyers

- Many individuals are instead leasing homes and apartments, which has increased demand for rental units

- Landlords are passing higher costs for interest, insurance, labor, materials, maintenance and other expenses to renters

- A surge in multifamily construction in recent years has led to declining new rents, but most people don’t move every year, so the new figures take a while to affect overall benchmarks

- Slowing apartment building development will be supportive of rising rents in the future, as landlord margins are poised to recover

Importantly, factors that have contributed to services inflation, such as labor, higher insurance premiums and in the case of dining out, higher food costs, aren’t likely to abate and could even intensify in the coming months.

Goods Prices Are Likely to Reverse Higher

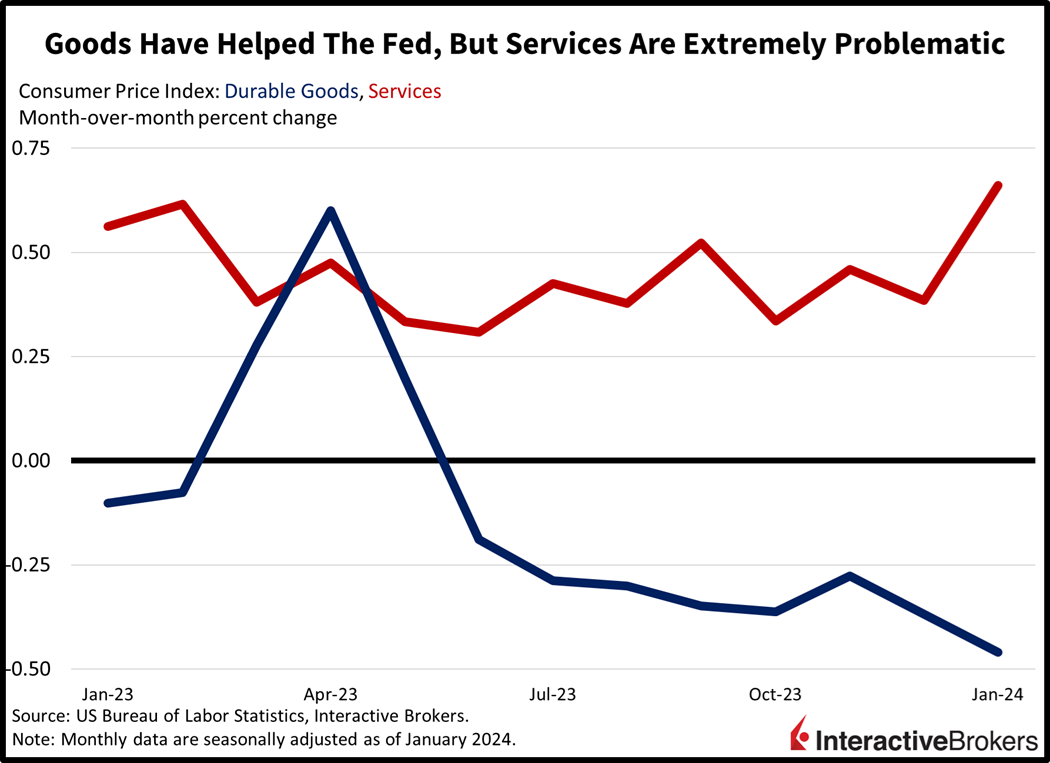

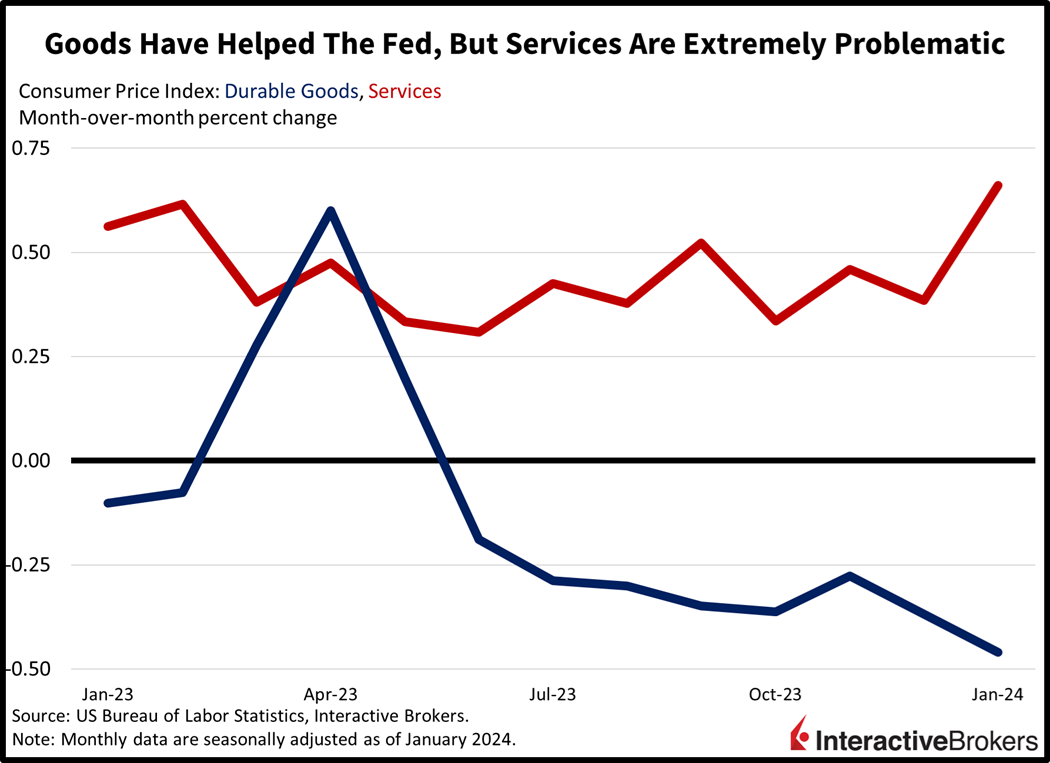

Last year, the CPI for Durable Goods fell 1% as global supply chains improved and weakness in demand persisted due to consumers focusing on services spending.

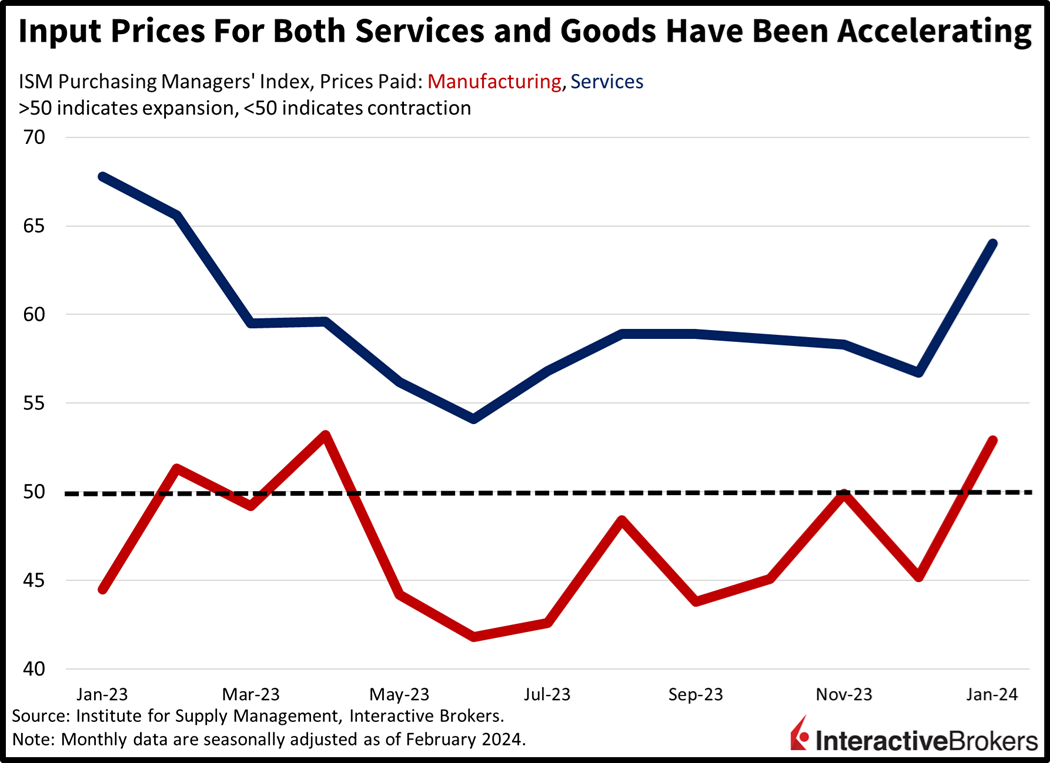

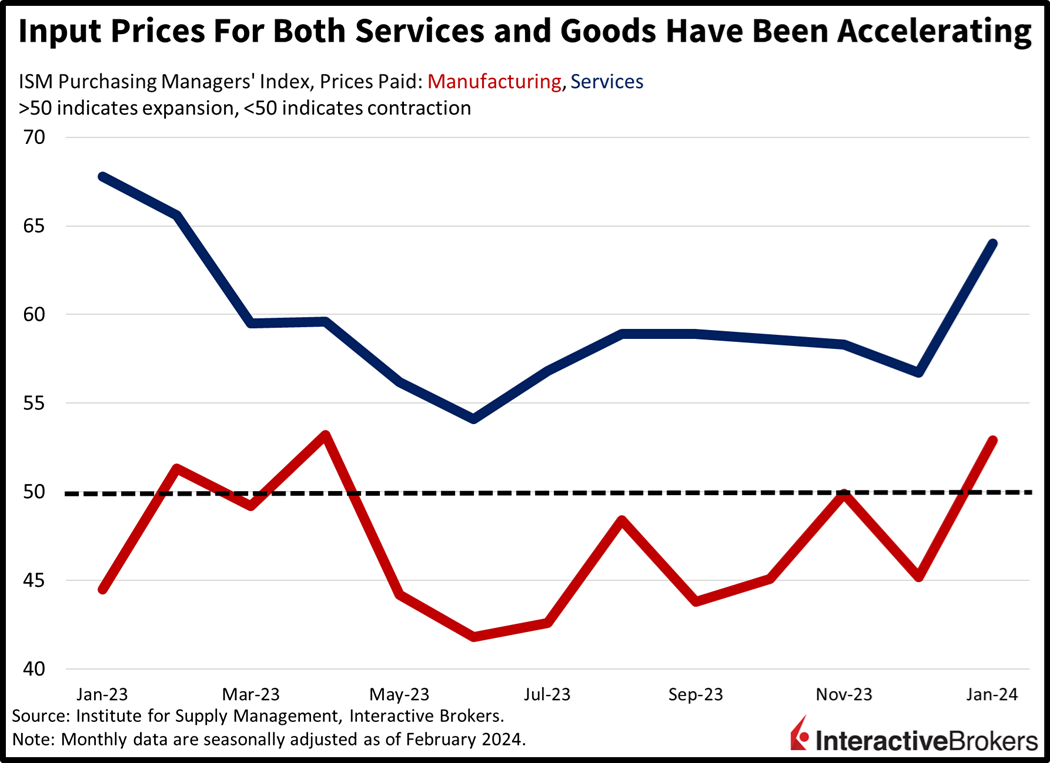

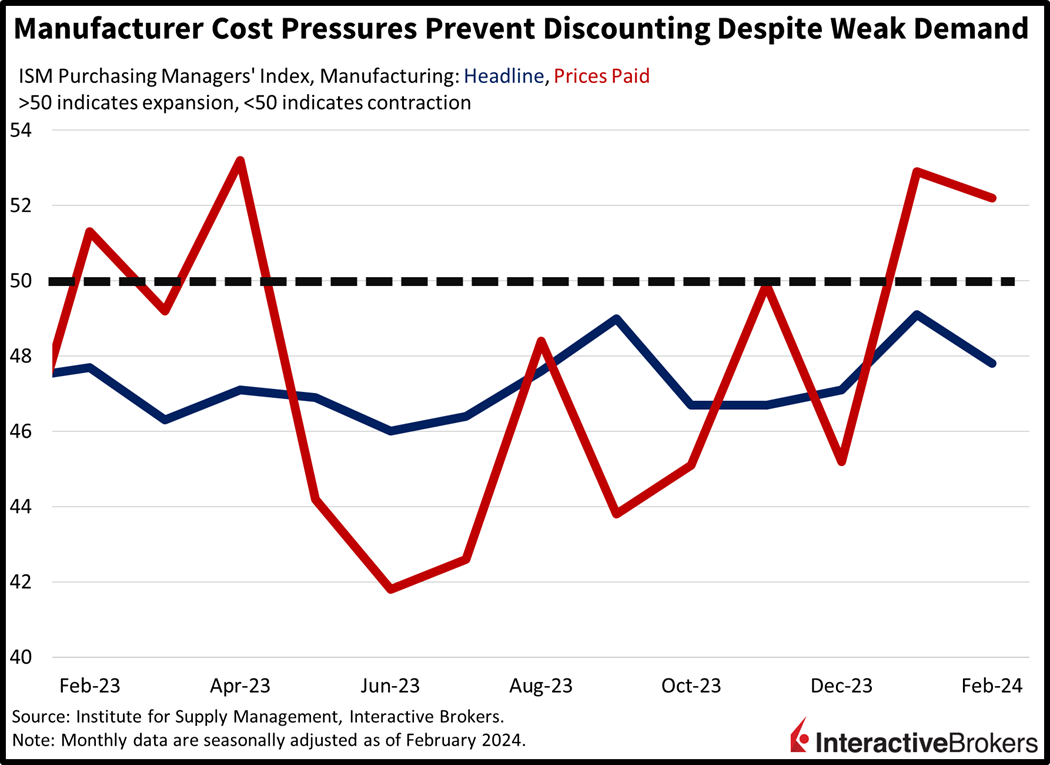

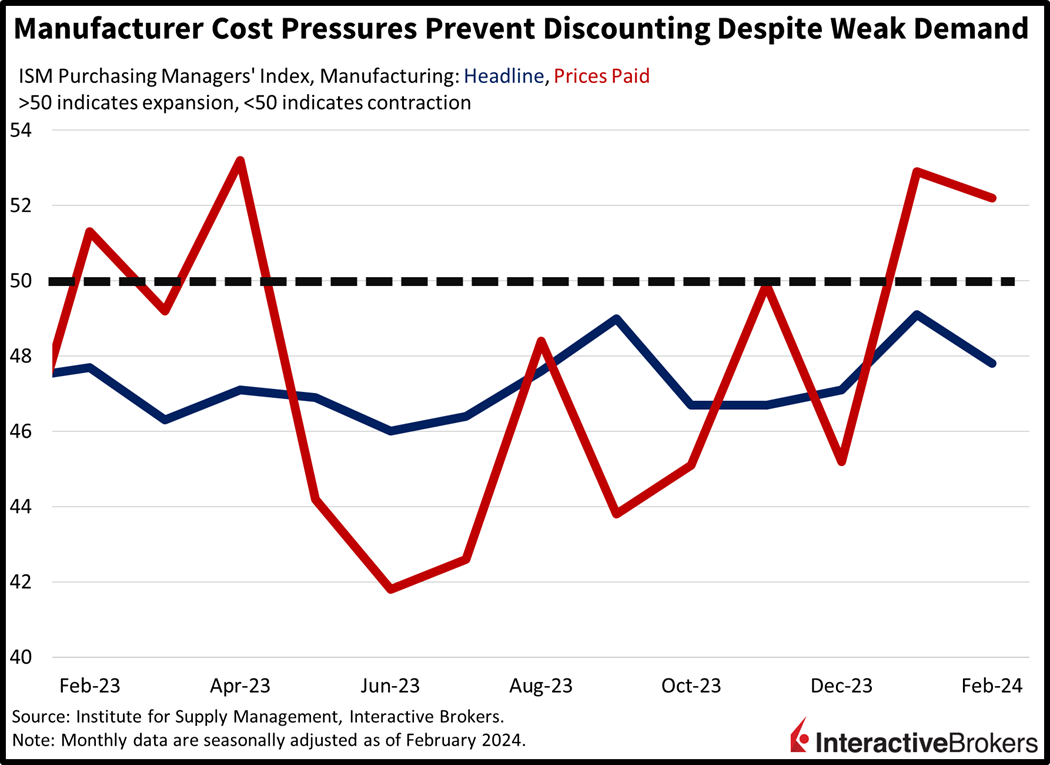

Much like services providers, manufacturers of goods also face higher labor costs and more recently, increased supply chain issues. Goods providers have benefited from lower materials and energy costs with the energy category within the CPI declining 4.6% in January y/y. As discussed previously, energy costs are likely to increase while separately, challenges with the supply chain will likely increase input costs. These factors are likely to cause goods prices to increase this year even though demand is likely to be weak. So far, the Manufacturing Purchasing Managers’ Index from ISM reflects two consecutive months of rising input costs for goods despite weak demand. Recently, manufacturers were positioned to provide discounts to offload their inventories, but conditions changed this year, as supply chain disruptions and rising energy costs have prevented sellers from lowering their prices despite a lack of orders.

Financial Conditions Fight Fed’s Tightening Efforts

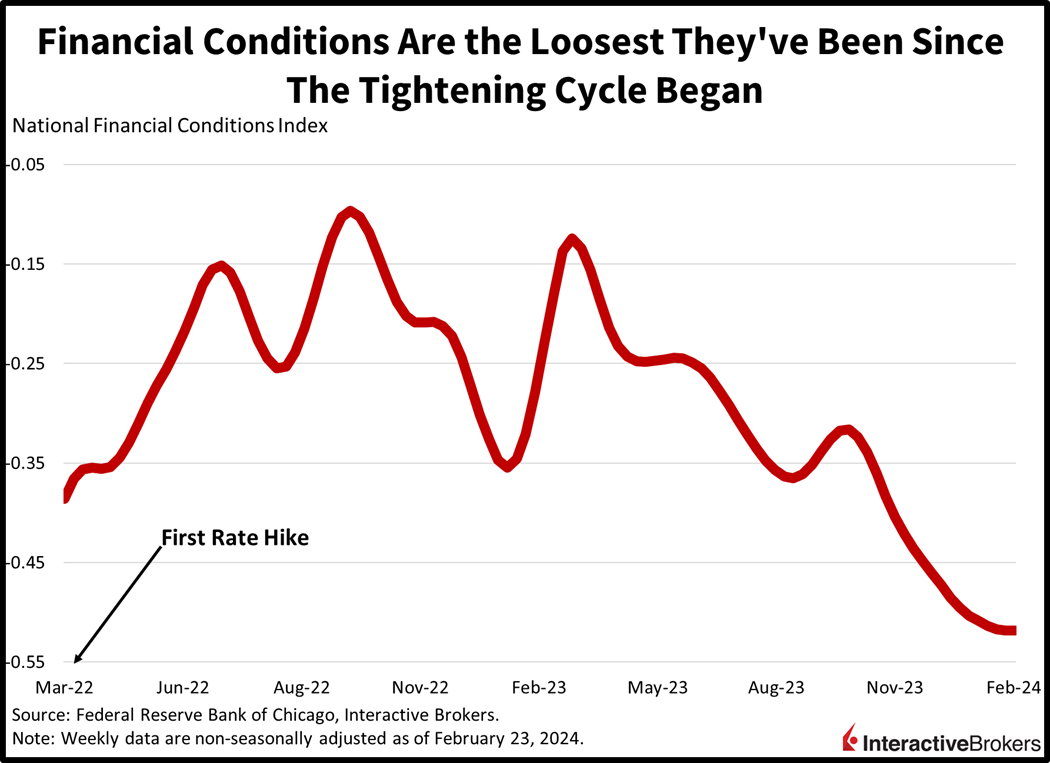

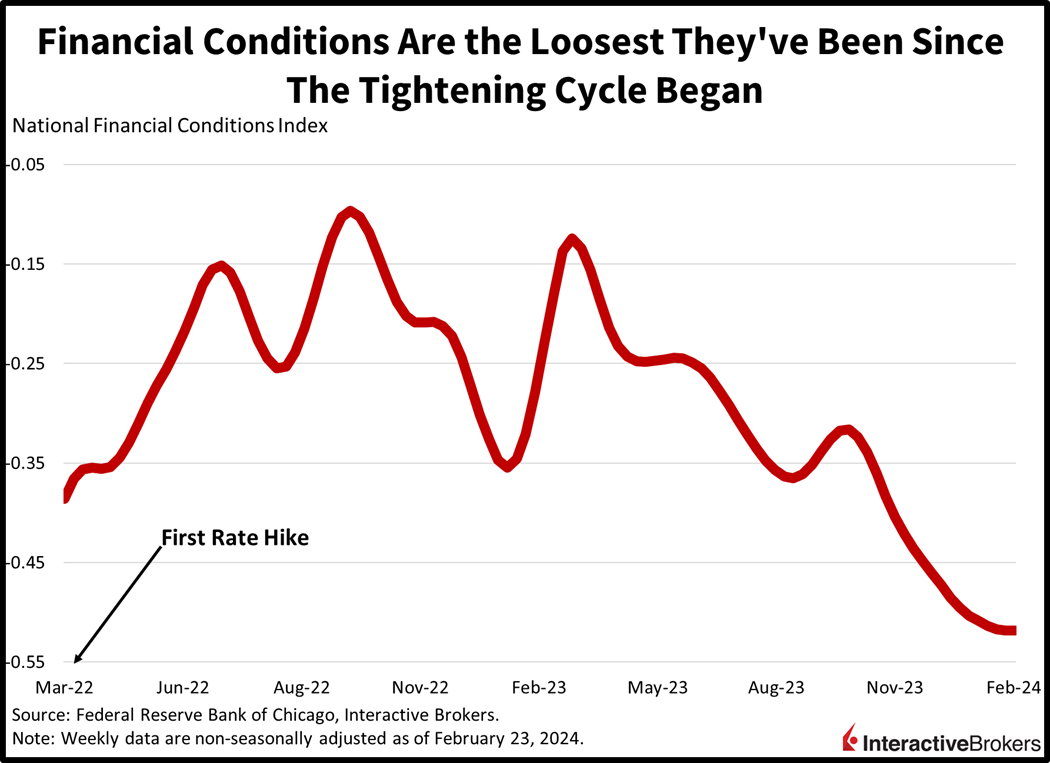

Despite the Fed maintaining an elevated fed funds rate and allowing its balance sheet to decline, financial conditions have been surprisingly loose, in part due to accommodative fiscal spending from the US Treasury. Also, elevated levels of liquidity injections following the pandemic are still sloshing around the economy, with the Fed’s reverse repo facility sporting more than $400 billion. There were also interruptions in the Fed’s balance sheet reduction plans as financial stability issues forced the central bank to add to it in certain periods, providing stimulus in what otherwise would be a restrictive regime. Some of that liquidity has supported a strong equity market with major indices including the S&P 500, Dow Jones and Nasdaq Composite hitting all-time highs. As Americans’ wealth has swelled from equity gains, they have become more confident in the finances and have increased their spending. The end result, however, is that financial conditions are looser now than they were when the Fed started hiking rates.

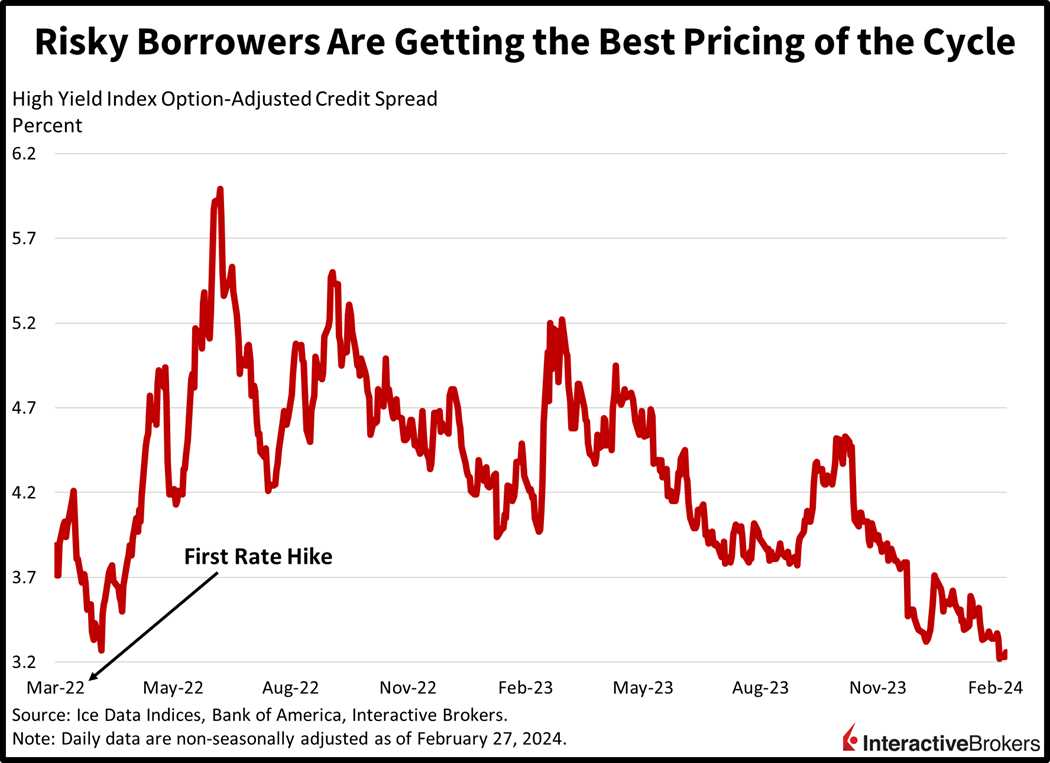

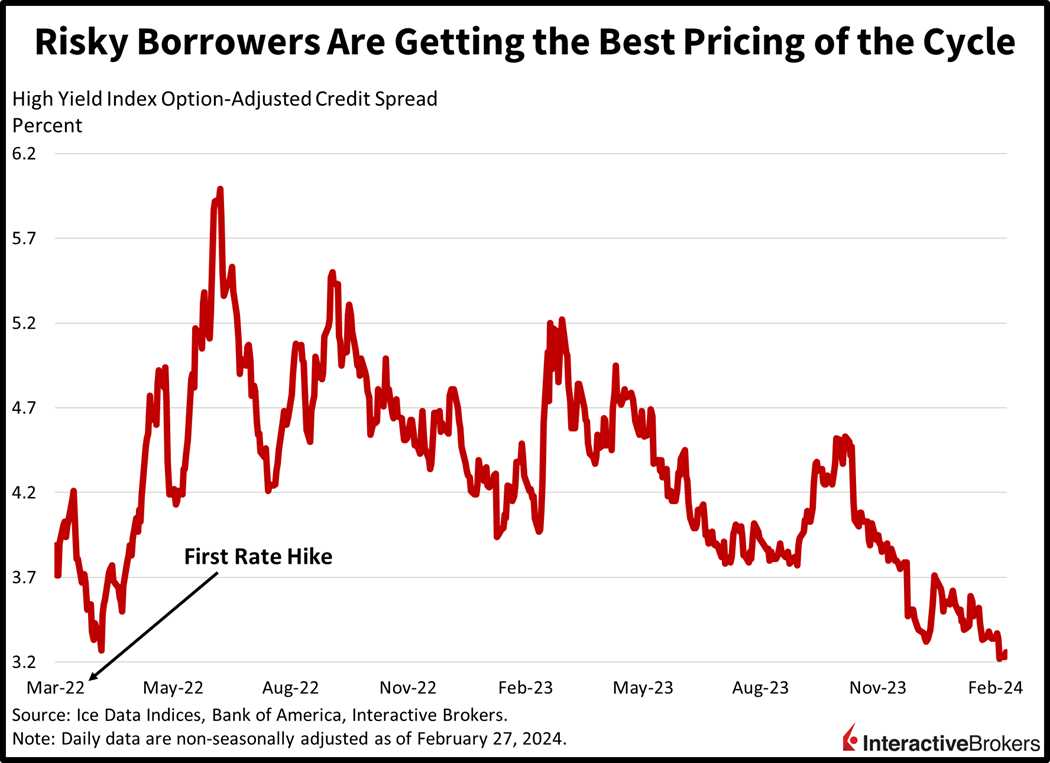

The loose financial conditions have contributed to price gains in commodities and overall inflation by making it easier for businesses to acquire new equipment or undertake new growth initiatives. The backdrop has allowed both businesses to deploy capital and consumers to splurge. Despite the central bank looking to slow economic activity in efforts to subdue price pressures, animal spirits are flying high as even the riskiest corporate borrowers are benefiting from cheap financing costs. Even cryptocurrencies are joining the party, with Bitcoin roughly $4,000 away from its 2021 all-time high.

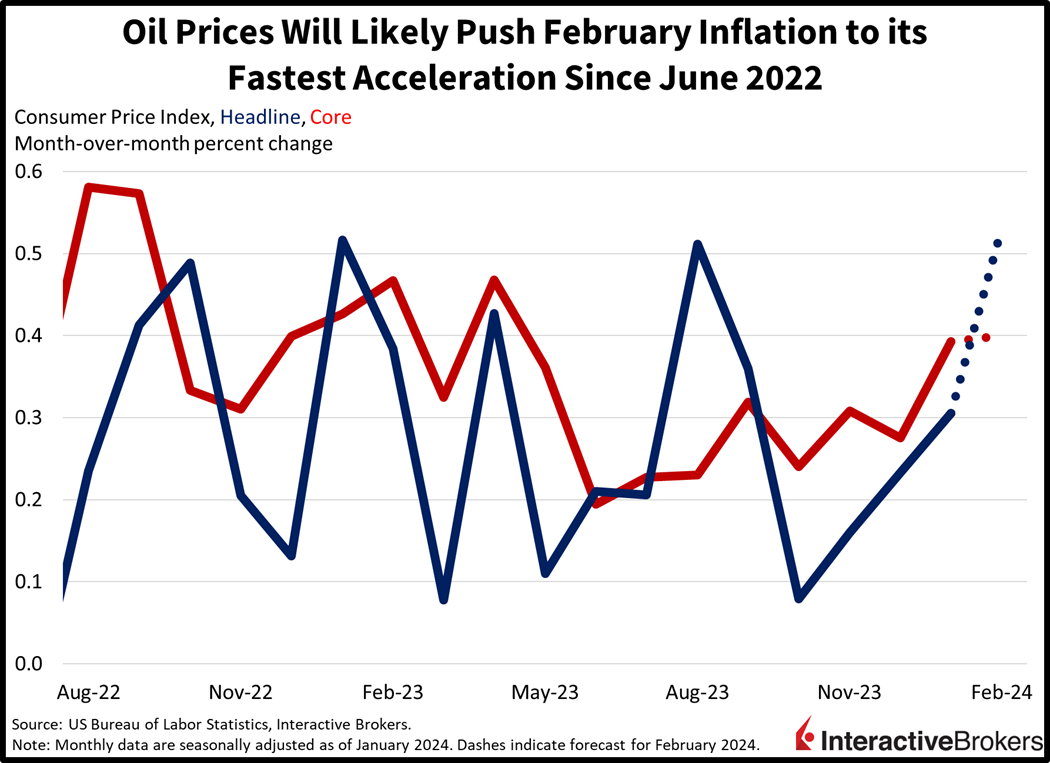

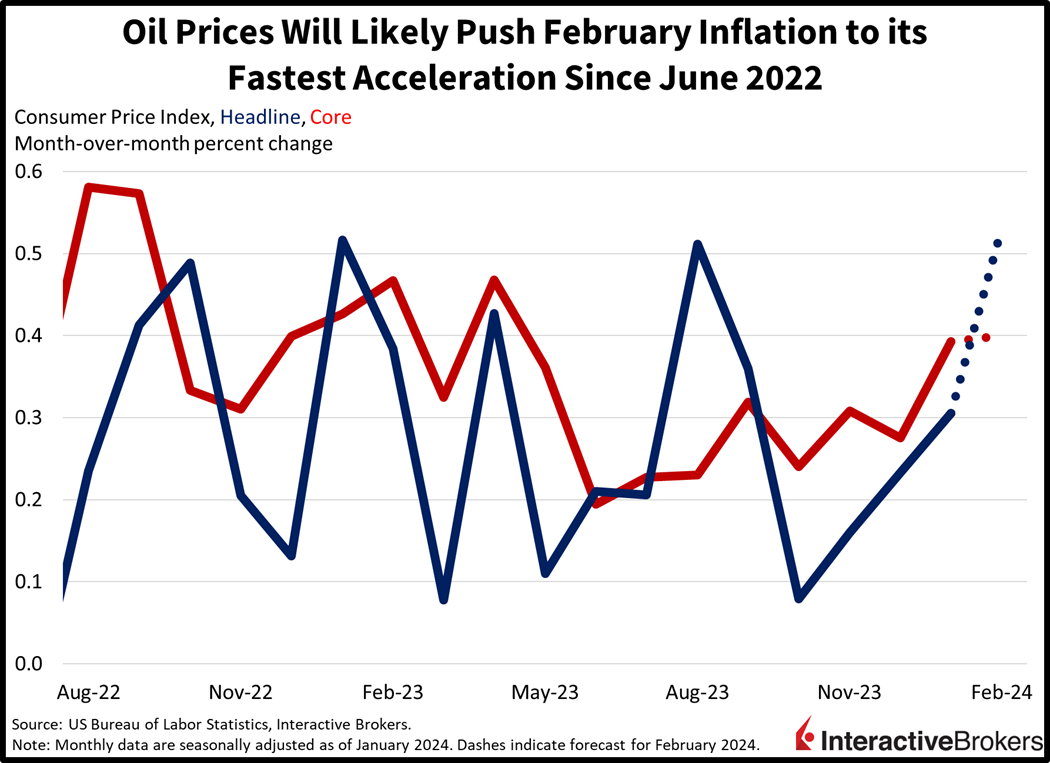

Entrenched Inflation and Monetary Policy

Over the past few months, higher-than-expected inflation and jobs data have caused investors to reluctantly push the expected timing of an initial rate cut to the central bank’s June meeting. When assessing the entrenched nature of inflation, including high wages, fierce services spending, increased input costs and supply chain issues, expectations for rate cuts are likely to fade as the potential for another Fed rate increase becomes more likely. Next week’s CPI, specifically, is likely to feature the fastest monthly gain since the summer of ’22, as gasoline and goods prices mount a mean comeback. Next week’s CPI is likely to reflect monthly price pressures of 0.5% for headline and 0.4% for core. Before then, however, we’ll have a buffet of labor data to analyze as well as Chairman Powell’s semiannual update to Congress.

Visit Traders’ Academy to Learn More About the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.