Equities are selling off this morning as today’s construction data showed a fierce uptick in activity on the eve of Federal Reserve Chairman Jerome Powell’s testimony before Congress. The data arrives just a day after homebuilder sentiment reflected seven consecutive months of growth, reinforcing a belief that the housing market has bottomed. Yet concerns are growing that a hawkish Powell tomorrow and Thursday could be the equivalent of ants at a picnic of real estate optimism.

Housing starts spiked 21.7% in May, the fastest month-over-month (m/m) gain since October 2016. May’s 1.631 million seasonally adjusted annualized units (SAAU) blew past expectations calling for 1.4 million and exceeded April’s 1.34 million. Plans for future construction also gained solidly, with building permits rising 5.2% m/m to 1.491 million SAAU, much higher than projections for an unchanged level of 1.42 million.

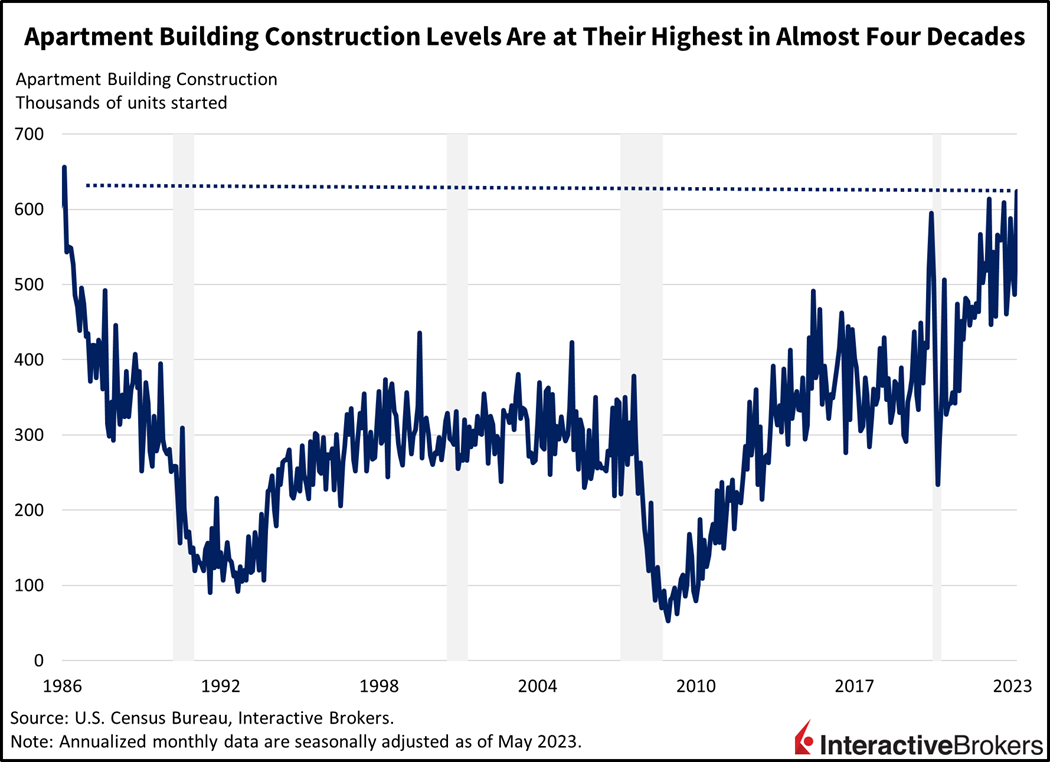

Multifamily apartment buildings boosted the number of starts the most, with a 28.1% m/m increase while single-family rose 18.5%. In fact, apartment unit starts rose to their highest level since 1986. Most regions of the nation experienced gains, with the Midwest leading with a 66.9% increase during the period. The South and West regions also contributed strongly, up 20.3% and 16.4%, respectively, while the Northeast offset some of the progress, declining 18.7%. Apartment buildings also led the charge for permits, rising 7.8% during the period while single-family rose 4.8%.

Optimism is being expressed by more than shovels in the ground and trips to local building departments. After 10-months of home builder pessimism, the National Association of Home Builders NAHB/Wells Fargo Index has jumped into positive territory, climbing from 50 in May to 55 in June. Yesterday’s June reading is also the seventh-consecutive month of increases for the index, which hit a low of 31 last December. Home builder sentiment is being supported by mortgage rates stabilizing in the 6% to 7% range and a shortage of existing homes on the market resulting from the following factors:

- Homeowners with exceptionally low mortgage interest rates are reluctant to sell their properties and then buy new homes at higher financing rates, contributing to the shortage of used homes on the market.

- Existing homeowners are also unwilling to sell because they would likely have to provide concessions to offset costs for buyers who face high monthly mortgage payments due to the combination of real estate prices soaring approximately 40% from pre-pandemic levels and higher interest rates.

The shortage of existing homes for sale has pushed home buyers into the new home market, which in turn has caused home builders to increase their construction activity.

At the same time, current mortgage rates, which are high from historical levels, are low enough to entice individuals and families that currently don’t own homes to consider making the plunge into home ownership. Improving supply chains are also helping to support home builder sentiment. Home builders are also showing restraint in offering buyer incentives. For June, 56% of builders offered incentives, up only slightly from 54% in May but still lower than in December, when 62% of builders offered discounts. On the other hand, it has become harder to secure financing for projects as banks have increased loan requirements.

Stocks are selling off today as risk-off sentiments advance following a thrilling 2023 equity rally year-to-date. All major indices are down roughly 1% with all sectors down excluding homebuilding, which is up 0.2%. Global investors are disappointed that Chinese monetary stimulus measures fell short of expectations, hampering global growth prospects and weighing significantly on the nation’s equity and currency markets while pulling down bond yields in the U.S. The 2- and 10-year Treasury yields are down 5 and 6 basis points (bps) to 4.67% and 3.71%, as lighter demand prospects from China weigh on domestic inflation expectations. The dollar is higher, however, as a weaker Chinese Yuan contributes to a 17 bp increase in the Dollar Index to 102.64. Weakness from China, which is the world’s top oil importer, is weighing on oil prices as well, with WTI crude down 2.8% to $69.76 per barrel.

Stabilizing interest rates and a rising equity market have driven real estate’s recent turnaround. Powell’s remarks during the next two days, however, are likely to move markets. An emphasis on employment and economic growth will embolden the calls of a firm bottom in the real estate market. However, Powell may seek to reinforce comments from Fed Governor Christopher Waller and Richmond Fed President Thomas Barkin, who recently stated that persistent core inflation illustrates the central bank’s need to maintain a hawkish stance against price increases. If Powell concurs with that belief, investors are likely to reset their expectations for real estate and capital markets.

Visit Traders’ Academy to Learn about Building Permits and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.