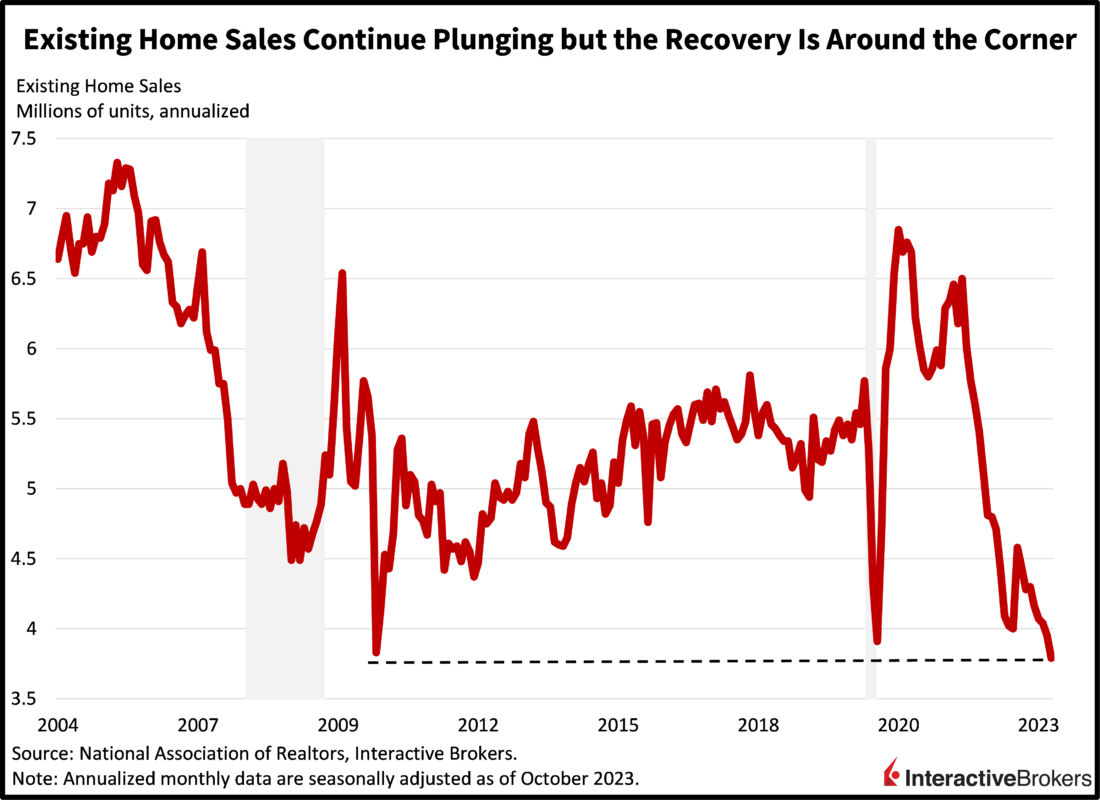

Stocks are taking a break following yesterday’s euphoric bull run as weaker-than-expected retail earnings dampen investor sentiment. Economic data also failed to inspire, with the pace of existing home sales falling to the lowest level in over two decades. Against this softer backdrop, bonds are catching a bid, as market players pull Fed rate cuts forward while trimming inflation expectations.

Existing Home Sales Plunge Further

Existing home sales plunged to their lowest pace in a generation last month, as elevated mortgage rates, lofty prices and low levels of inventory weighed on buying activity. October existing home sales fell 4.1% month-over-month (m/m) to 3.79 million seasonally adjusted annualized units, weaker than expectations of 3.9 million and September’s 3.95 million. Inventory did rise, however, as some sellers grew increasingly anxious about unloading their properties. Inventory rose 1.8% m/m to 1.15 million but still down 5.7% year-over-year (y/y).

Among residence types, single-family homes led the decline, with transactions down 4.2% m/m. Condominiums and co-ops did offset some of the drop, however, with transactions down only 2.4%. Across regions, transactions in the South, Northeast and West decreased 7.1%, 4% and 1.4%, respectively. The Midwest came in unchanged, meanwhile.

I believe the recovery is around the corner for residential real estate, as buyers are determined to own residences in the United States despite sky-high costs. I’m expecting continued relief concerning inventory and mortgage rates as the Fed begins cutting rates in the first half of next year, opening up credit availability and lowering interest expenses. Prices are likely to soften by 4% in 2024, which together with higher inventory and lower mortgage rates will drive transactions much higher.

Retailers Reflect Consumer Stress

Retailers’ earnings reports released this morning depict weakening consumer spending and a potentially disappointing holiday shopping season as illustrated by the following examples:

- Lowe’s cast a downbeat outlook for its full-year results and said revenue of $20.47 billion during its third quarter ended November 3 fell from $23.47 billion y/y. Its results missed the analyst consensus of $20.89 billion. The company’s same-store sales, furthermore, declined 7.4% y/y compared with the analyst consensus estimate of a 5% decline. On a positive note, sales to contractors increased but the company experienced a more significant pullback in discretionary spending and big-ticket sales, according to Chief Executive Officer Marvin Ellison. The company’s third-quarter EPS of $3.06 increased from $0.25 in the year-ago quarter, during which Lowe’s took a $2.1 billion charge associated with leaving the Canada marketplace. For its full year, the company anticipates total sales of $86 billion compared to its previous estimated range of $87 billion to $89 billion. Lowe’s also lowered its full-year EPS guidance to $13.00 from a previous estimate of between $13.20 and $13.60.

- Best Buy’s earnings report also underscored consumer weakness, with the company explaining that holiday shopping will be dominated by consumers making price-conscious decisions. During its earnings call this morning, Best Buy said it expects full-year revenue to fall within a range of $43.1 billion to $43.7 billion, down from $43.8 billion to $44.5 billion that it previously estimated. It reduced its sales guidance in anticipation of holiday shoppers seeking bargains as discounting and sales promotions have become more common in the consumer electronics market. Additionally, Best Buy guided for a 6% to 7.5% same-store sales decline compared to its earlier guidance of a 4.5% to 6% drop. For the third quarter, its revenue of $9.76 billion declined y/y from $10.58 billion and missed the analyst consensus expectation of $9.90 billion. Customers cut back on buying appliances, mobile phones, computers and home theaters, resulting in a 6.9% y/y comparable sales decline. The metric was worse in the U.S., with comparable sales declining 7.3%. The company’s adjusted EPS of $1.29 fell y/y from $1.38 but beat the analyst consensus expectation of $1.18.

- Department store retailer Kohl’s Corp.’s third-quarter net sales were also disappointing. They declined y/y from $4.05 billion to $3.84 billion and missed the consensus estimate of $3.99 billion. While Kohl’s net sales declined 5.2% y/y its same-store sales fell 5.5%. Additionally, its earnings per share (EPS) of $0.53 dropped from $0.82 in the year-ago quarter but exceeded the analyst consensus estimate of $0.36. Kohl’s Chief Executive Officer Tom Kingsbury says the EPS benefited from improved gross margins and expense management with the company reducing its inventory by 13% y/y. In another sign of continued spending weakness, Kohl’s increased its estimated sales decline for the full year to 2.8% y/y. It previously estimated a minimum decline of 2%. Kohl’s kept its maximum decline guidance of 4%. It expects to produce an EPS of $2.30 to $2.70 for the full year compared to the analyst consensus of $2.41.

Markets Players Trade Stocks for Bonds

Stocks are down across the board with tech and smallcaps leading the way lower. Bonds are going the other way, however, with market players scooping up bonds in efforts to lock in the yields of the moment. All U.S. major indices are lower with the tech-heavy Nasdaq Composite and small-cap, cyclically tilted Russell 2000 down 0.9% each. The declines in the S&P 500 and Dow Jones Industrial indices aren’t as bad, with the baskets down 0.4% and 0.3%. Sectoral breadth is negative, with almost all sectors lower led by technology and consumer discretionary, they’re down 1% and 0.7%. Materials and health care are higher, meanwhile, with the groups up 0.6% and 0.4%. In fixed-income land, the 2- and 10-year Treasury maturities are trading at 4.88% and 4.4%, as the instruments are offering lower yields by 3 and 2 basis points (bps) each. Lighter yields and cozier Fed easing expectations are weighing on the dollar, with the greenback’s index down 11 bps to 103.33. Crude oil is down 0.5% or $0.37 per barrel to $77.18, as weak economic data hampers the demand outlook despite Riyadh and Moscow’s extended production cuts into 2024.

Fed Minutes, Nvidia Earnings Ahead

Looking ahead, this afternoon will feature minutes from the latest Fed meeting followed by a huge earnings report from Nvidia. Bulls are looking for dovish tilts in the minutes and blockbuster projections concerning AI and chip demand from Nvidia. Bears, meanwhile, are looking for a higher-for-longer melody from the Fed, with FOMC members possibly concerned that reduced hawkishness will propel a fresh leg higher in inflationary pressures. As for Nvidia, bears are hoping that good news from the earnings call is already priced in, off the back of a breathtaking rally in which the S&P 500 Index rose 11% in roughly three weeks. Indeed, markets have a way of catching both bulls and bears offsides.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.