Equity markets are little changed following the best week since March as the S&P 500 Index reaches its highest level since August of last year. While OPEC + kept production stagnant over the weekend, an independent production cut from Saudi Arabia sent bond yields higher as oil prices jumped in early trading. At 10:00 am eastern time, however, weak economic data from the United States proved increasingly influential amidst Saudi Arabian muscle, reversing bond yields into the red while paring gains for crude oil.

After an OPEC + cartel pledge to cut oil production by approximately 3.6 million barrels a day failed to adequately boost oil prices, Saudi Arabia announced yesterday plans to cut an additional 1 million barrels a day. The country made the unilateral decision after OPEC+ countries that collectively account for half the world’s oil supply failed to approve additional cartel-wide production limits but agreed to continue honoring previously announced cuts. The new Saudi cuts are scheduled to kick in during July, which is the peak of the U.S. summer traveling season. In October, OPEC + announced cutting production by 2 million barrels a day and then in April it added another 1.6 million barrels a day to the production limit. Since October, however, oil prices for WTI crude have dropped approximately 20%.

Meanwhile, U.S. domestic oil producers that are under pressure to return capital to shareholders are also demonstrating production discipline. The U.S. oil and gas rig count plummeted by 44 during May, ending the month at 711, the lowest count since May of last year, according to Baker Hughes. While production cuts express oil executives’ concerns that weakening economic growth will hurt demand for oil, a new survey by the Dallas Federal Reserve Bank conducted from March 15 to March 23 illustrates that the energy industry faces additional headwinds. In the survey, 30% of energy executives said cost inflation is the biggest challenge to profitability while another 30% said the health of the global economy is challenging profits. Executives were also asked to identify prices at which drilling new wells is profitable within regions in which each company is the most active. The price ranged from $56 a barrel in the Eagles Ford basin in Texas to $66 a barrel in the portion of the Texas Permian basin called the Delaware section. On a positive note, only 3% of respondents identified supply chain issues as an impediment to profits.

While OPEC + and domestic U.S. producers are curtailing production, the deployment of alternative energy is growing at a record pace, according to the International Energy Agency. The Europe energy crisis associated with the Russian invasion of Ukraine, the Inflation Reduction Act in the U.S. and the rapid expansion of clean energy in China is expected to result in 440 gigawatts of deployment this year, up from a staggering 333 gigawatts from last year.

Today’s ISM Services data release served to cool WTI crude oil prices, which declined from a daily high of $75 per barrel to $72.06. Data came in well below expectations, with the 50.3 headline reading falling short of the 52.2 consensus expectation. May’s data also came in much cooler than April’s 51.9 and inched close to contraction territory, which lies below 50. May’s expansion, however, was the fifth consecutive month of growth. The greatest headwind to the headline came from employment, which experienced a mixed Jobs Report last week. Friday’s report was characterized by a growth in payroll employment but a contraction in the household survey and an accompanying 30-basis point (bp) increase in the unemployment rate. Employment in ISM services registered a reading of 49.2, while prices paid remained high at 56.2, with both slowing from April’s 50.8 and 59.6 readings. While demand for labor is slowing dramatically in some data sets, inflationary pressures are maintaining their momentum. Also, out at 10:00 am eastern time and pushing yields lower, April Factory Orders grew 0.4%, well below expectations calling for 0.8% and from March’s 0.6% growth.

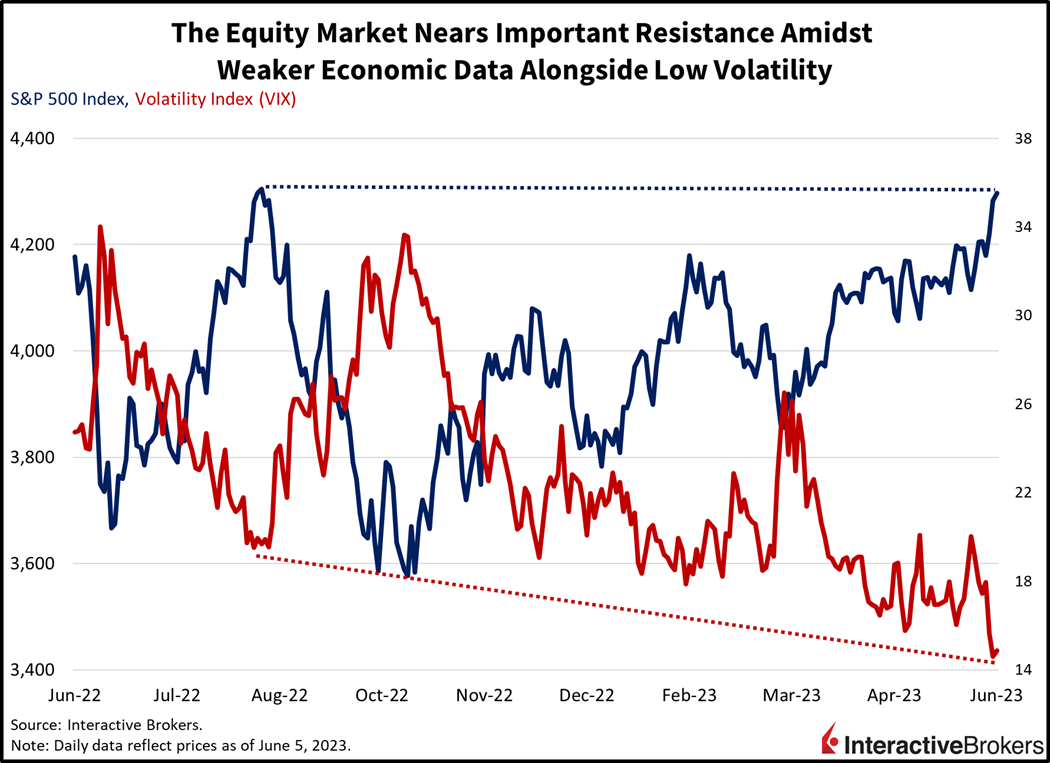

Markets are climbing this morning with stocks up modestly and yields reversing lower following the 10:00 am data releases. The S&P 500 Index is up 0.2% and attempting to conquer the 4300 level, led by tech shares once again with the Nasdaq Composite Index gaining 0.4%. Cyclical indices are suffering worse fortunes, however, with this morning’s data pointing to an economic slowdown amidst contracting services employment. The Dow Jones Industrial Average is down 0.2% while the small-cap Russel 2000 Index is taking a beating, it’s down 1.4%. Bond yields are lower across the board, with the 2- and 10-year Treasury maturities down 3 and 1 bp to 4.48% and 3.68%. The Dollar Index is up 6 bps to 104.07 as investors bet on a pause at next week’s Fed meeting, while pricing in the last 25-bp hike at the July 26 meeting.

Higher prices and lower volatility amidst deteriorating economic data, can point to vulnerable markets. The faster the aircraft goes, the less turbulence it can manage.

This morning’s developments provide more cross currents on the economic front as equities reach new year-to-date highs once again. While momentum and excitement can certainly push equities higher from here, economic realities do catch up. As a reminder, the last time the S&P 500 was at 4300 was immediately prior to Federal Reserve Chairman Jerome Powell throwing a slider pitch at their August event in Jackson Hole, Wyoming. The S&P 500 went on to make a new low at 3491, several weeks later. Higher prices and lower volatility amidst deteriorating economic data, can point to vulnerable markets. The faster the aircraft goes, the less turbulence it can manage.

Visit Traders’ Academy to Learn More about Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.