Stock indices are inches away from more all-time highs as the S&P 500 looks to breach the historic 5,000 level. Euphoric sentiment regarding artificial intelligence amidst a bottomless pit appetite for tech stocks continues to push equities higher. Lurking in the background, however, is a myriad of Fed speakers talking about higher-for-longer monetary policy amidst regional bank trouble featuring New York Community Bank front and center. Meanwhile, bond yields are rising against the backdrop of unemployment claims depicting persistent labor market tightness. As equities and yields climb, investors are breathing a sigh of relief after yesterday’s favorable 10-year Treasury auction, but they are cautiously looking ahead to today’s 1 p.m. 30-year bond offering to assess demand for longer duration debt.

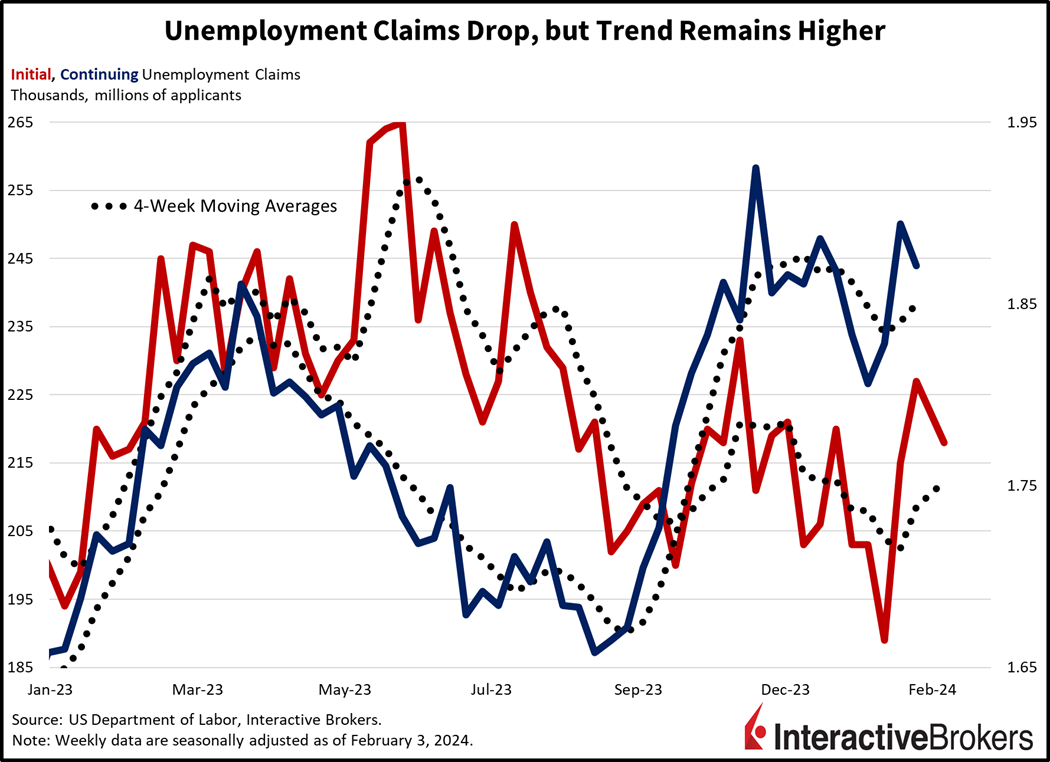

Unemployment Claims Drop, but Trend Remains Higher

Unemployment claims declined for the first week in three as companies refrained from laying off workers in aggregate. Initial unemployment claims declined to 218,000 for the week ended February 3, lighter than the 220,000 estimated and the previous week’s 227,000. Similarly, continuing unemployment claims dropped to 1.871 million for the week ended January 27, lower than the 1.878 million expected and the preceding period’s 1.894 million. The lower figures weren’t enough to buck the trend, however, with the four-week moving averages for initial and continuing claims rising to 212,250 and 1.850 million relative to the earlier weeks’ 208,500 and 1.840 million.

Job Layoffs Drive Earnings Growth

Large-scale layoffs last year helped Disney and PayPal post strong earnings growth. While Disney’s sales climbed modestly, PayPal posted a strong revenue increase driven by a 15% jump in payment processing.

Disney’s aggressive cost cutting last year included slashing thousands of jobs and helped the company’s earnings per share (EPS) exceed the analyst estimate. Its EPS of $1.22 after accounting for irregular expenses surpassed the analyst expectation of $0.99. The EPS climbed from $0.99 in the year-ago quarter despite the company’s revenue of $23.55 billion increasing only marginally from $23.51 billion year over year (y/y). The revenue missed the analyst expectation of $23.7 billion. While the company lost 1.3 million core subscribers from its Disney+ streaming service in the quarter, price increases generated more revenue from individual accounts. Disney said its destinations generated all-time record revenue, with its recently opened World of Frozen at Hong Kong Disneyland Resort and Zootopia at Shanghai Disney Resort being well received by consumers. Additionally, it said it is on target to reach profitability for its streaming services by year-end, and it expects to generate an EPS of $4.60 for 2024, up 20% from 2023. The company also invested $1.5 billion in Fortnite maker Epic Games to create videogames with Disney themes. Shares are up a sharp 12% on the news.

PayPal’s EPS surpassed the analyst expectation, but the company’s disappointing guidance caused its shares to decline approximately 8%. PayPal’s EPS of $1.48, adjusted for irregular expenses, beat the $1.36 expected by analysts. In the year-ago quarter, PayPal posted an EPS of $1.24. Its profit growth was driven, in large part, by the company firing about 2,500 workers, or 9% of its workforce, last year. Additionally, total payment volume of $409.8 billion increased 15% from the prior year and climbed above the $405.51 billion expected by analysts. PayPal’s revenue of $8.03 billion also exceeded the analyst expectation of $7.87 billion and climbed 9% from $7.38 billion y/y. PayPal expects its current quarter EPS to increase in the mid-single digits y/y while analysts anticipated revenue guidance of 8.7%. Shares are down a sharp 11% on the news.

Equities Near Records While 30-year Auction Looms

Markets are mixed with most stock indices lower on the session while bond yields climb across the curve on hawkish remarks by Richmond Fed President Thomas Barkin. Bond players are also anxiously awaiting this afternoon’s 30-year auction of $25 billion worth of Treasurys, which will provide further color on the market’s appetite for duration. So far, this week’s 3 and 10-year note auctions went well, with investors reflecting interest in the instruments.

In equity land, the Dow Jones Industrial, S&P 500 and Nasdaq Composite indices are down between 0.1% and 0.2%. The small-cap Russell 2000 is leading today, as regional banks bounce back slightly from their recent malaise after Treasury Secretary Yellen opined that she doesn’t think recent commercial real estate turbulence will spread and become a systemic issue. Sector breadth is split, with energy, technology, and consumer staples steering the way higher; they’re up 0.7%, 0.5% and 0.3%. Among the laggards, utilities, materials and financials are down the most, with the sectors all losing approximately 0.8% during the session.

Treasurys are being sold heavier at the long-end, with yields on longer-dated maturities up roughly 2 to 3 basis points (bps) more than their short-dated counterparts. The 2- and 10-year durations are trading at 4.45% and 4.16%, 2 and 4 bps higher on the session. Loftier yields are propping up the dollar as well, with the greenback’s index up 20 bps to 104.26. The US currency is gaining against all major peers including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Also propping up yields and the dollar is the jump in oil prices, driven by geopolitical tensions and softer supply conditions, which are pushing up inflation expectations. After ceasefire negotiations between Israel and Hamas failed on Thursday, conflicts intensified along the southern border city of Rafah, 19 miles south-west of Gaza. Additionally, the oil market received support due to a stronger-than-expected drawdown in US gasoline and middle-distillate stocks. WTI crude is up 2.17%, or $1.62, to $75.47 per barrel on the news.

Regional Bank Stress Likely to Build

Continued pressure on interest rates driven by a higher-for-longer Fed, better-than-expected economic growth, continued labor market tightness and sticky inflation will continue to weigh on the health of regional banks. In addition, persistent commercial real estate weakness and the expiration of the Bank Term Funding Program will lead to increasing stress, featuring heavier credit losses and reduced cash levels. The end of the third quarter saw 45 problem banks with total assets of $53.5 billion as of the FDIC’s most recent list, with more banks likely to report declining deposits and rising credit losses in the coming weeks. Similar to the high-profile bank failures of 2023, New York Community Bank is not on the problem bank list, as it has assets over $100 billion. The near future is likely to bring volatility to financial markets, as market players gauge whether this episode of banking weakness will lead to systemic problems. While regulators, bank management teams and political appointees will assure us that everything is fine until it isn’t, we may recall the saying, “If you see one roach, there’s probably more over there somewhere.”

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.