Markets are tanking today with the decline accelerated by triple witching Friday, a day when a large number of options expire. The decline is proving yesterday’s rally to have been a head fake amidst the burden of continued inflation. On the heels of sizzling data this week reflecting hot consumer and producer price growth alongside stronger-than-expected retail sales, today’s University of Michigan Consumer Sentiment data show that households are feeling the pain of inflation. The strong economic data this week, furthermore, is not isolated to the U.S. with Beijing reporting much stronger-than-expected data on industrial production and retail sales.

Reality Dings Consumer Sentiment

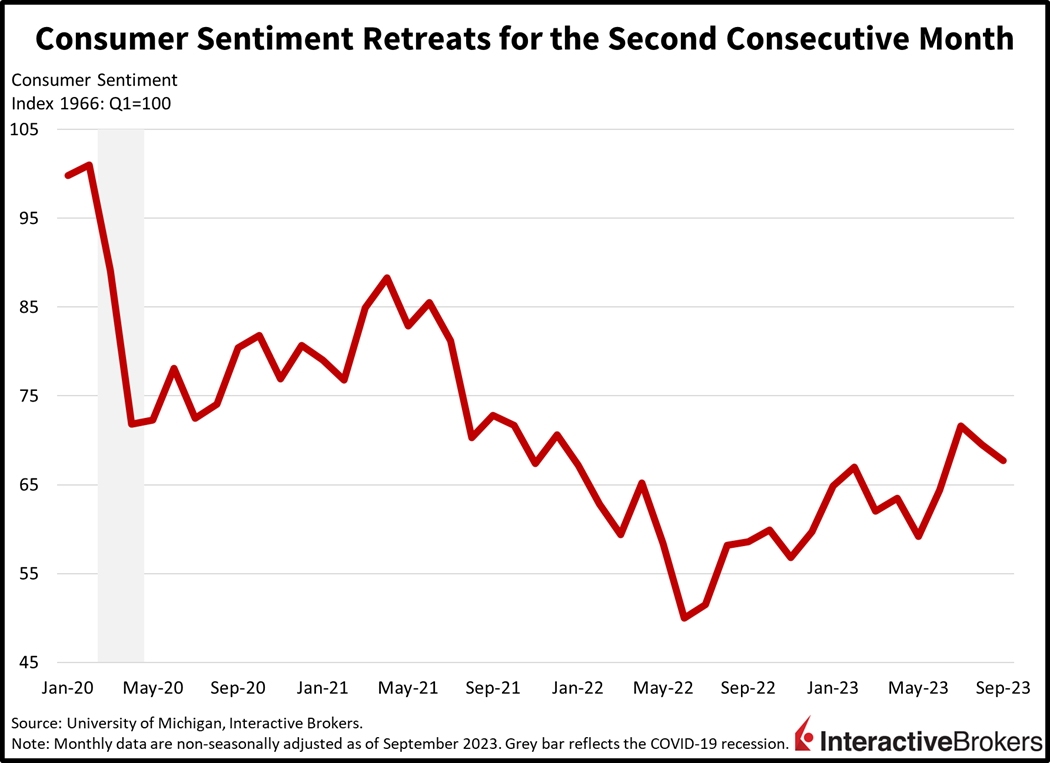

Consumer sentiment declined this month, as moods concerning current economic conditions deteriorated. This morning’s 67.7 figure is both lighter than forecasts calling for 69.1 and August’s 69.5 number. Current conditions declined from 75.7 to 69.8 on the back of soaring gasoline prices, dwindling pandemic savings and reduced bargaining power at job interviews. Expectations for the future improved marginally, however, but are still near the tombs, rising from 65.5 to 66.3 as continued inflation, higher interest rates, declining credit availability, rising debt-payment delinquencies and lofty credit card balances take their toll. On the bright side, inflation expectations dropped markedly, with one-year and five-year figures declining to 3.1% and 2.7% from 3.5% and 3.0%.

Markets are getting hammered today on concerns that next week’s Federal Reserve meeting may offer market players more reality and fewer fairy tales. Chairman Jerome Powell will likely remind everyone to forget their notebook calculations on how quickly inflation is coming down and point to the central bank’s preferred inflation gauge rising 4.2% year over year (y/y) as of July. Yes, you heard that right, more than double the 2% target.

A Rough Day for Equity Investors

Nothing is working for equity traders today with every sector down including defensives. Leading the way lower is interest-rate sensitive technology, with the Nasdaq Composite Index losing 1.5% while the Russel 2000, S&P 500, and Dow Jones Industrial indices are down 1.1%, 0.9% and 0.6%. Treasury yields are looking to take out recent highs and break technical resistance areas. The 2- and 10-year maturities are up 3 and 4 basis points each to 5.05% and 4.33%. The dollar meanwhile is taking a break, with its Index marginally down 7 bps to 105.27 as it depreciates relative to the euro and yuan while appreciating versus the Canadian and Aussie dollars, pound sterling, franc and yen. Crude oil is roughly unchanged, holding strong gains on the back of continued supply constraints, low inventories in the U.S. and hot data out of Beijing. WTI crude oil is up 2 pennies to $90.68 per barrel.

Labor Market Appears to Ease

In recent months, the bruising impact of inflation on consumer sentiment has been partially offset by a tight labor market allowing workers to negotiate wage increases that for the most part have exceeded the rate of inflation. The Teamsters, for example, negotiated an immediate $2.75 hourly increase for some 340,000 UPS workers with a contract that will eventually raise hourly wages by $7.50. Meanwhile, workers for Blue Cross Blue Shield of Michigan who are United Auto Workers members are striking and the union is also striking against GM, Ford and Stellantis after failing to reach renewed contracts with the car manufacturers last night.

Home Shoppers Focus on Lower Price Properties

The tight labor market, however, appears to be easing, at least within the construction industry, according to Lennar Homes. The homebuilder reported that its cycle of building homes during the third quarter shortened due to increased labor availability and supply chain improvements. However, with higher mortgage interest rates and a change in sales within the company’s product mix, the average unit selling price declined y/y from $491,000 to $448,00, a 9% drop, but lower building materials costs partially offset the impact of the lower sales price. Lennar’s EPS dropped 23% y/y to $3.87 and revenue dropped nearly 3% to $8.73 billion. Analysts expected Lennar’s EPS to drop to $3.52, or 30%, and revenue to decline to $8.49 billion, or down 5%. With existing homeowners keeping their houses rather than selling their properties and buying new residences with substantially higher mortgage rates, real estate inventory is tight, which helped Lennar’s unit sales increase y/y from 17,248 units to 18,559.

AI Supports Earnings

As the economy struggles with the burden of higher interest rates and tight credit conditions, many investors are anticipating that the adoption of artificial intelligence will help companies grow their revenues and earnings, which was the case for Adobe during the third quarter. The company reported its strongest third quarter in its history with increasing sales for its artificial intelligence services that assist with generating and editing images, videos and documents. Adobe revenues of $4.89 billion climbed 13% y/y and beat the consensus expectation of $4.87 billion. Its adjusted EPS of $4.09 jumped 20% y/y and exceeded the consensus expectation of $3.98. With increasing customer adoption of the company’s AI products, Adobe believes its fourth-quarter revenue will range from $4.98 billion to $5.03 billion while analysts expect $5 billion. The company also expects a fourth-quarter adjusted EPS of between $4.10 and $4.15, exceeding the average analyst estimate of $4.06 per share.

Summary of Economic Projections

As we look forward to this Wednesday’s Fed decision, market players don’t expect a hike. Of critical importance, however, will be the outlook for future hikes, the length of a possible pause and the expectations for cuts. Much of this significant information will lie within the central bank’s summary of economic projections, which I expect will have upward adjustments to inflation, GDP and rates. Those adjustments are likely to drive yields even higher at a time when the Fed, banks and international players aren’t showing up to the auctions relative to the past. This occurs while the federal government is running elevated deficits and needs lenders to show up to the table. With volatility at low levels and investor sentiment riding high, the possibilities for disappointment are elevated during a weak seasonal period for stocks.

Visit Traders’ Academy to Learn More About Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

72784 I was not able to find the stock I was & still am looking for. QQQ options. I found the internet difficult to travel.

Hello, thank you for commenting. We do have QQQ options available on our platforms. You can review all our available products on our website: https://ndcdyn.interactivebrokers.com/en/trading/products-exchanges.php#/

If you do not have an IBKR account and would like to open one, please visit http://spr.ly/OpenAccountfromIBKRCampus