This morning’s Personal Consumption Expenditure Price Index, Employment Cost Index and other data are making the narrow path to an economic-soft landing envisioned by Federal Reserve Chairman Jerome Powell a tad bit wider. During a press conference on Wednesday, Powell refrained from saying he was optimistic about achieving a soft landing. Rather, he maintained that he sees a path to such an outcome and that the economy has remained highly resilient as the Fed has pursed tighter monetary policy. Today’s data reflect persistent consumer spending, a tight labor market and slowing inflation.

Consumption Increases as Inflation Moderates

Consumer spending rose strongly in June, accelerating from 0.2% in May to 0.5% and exceeding projections of 0.4%. Goods spending performed better than services, growing 0.8% versus 0.4% during the period. Consumers did tap their savings to fuel their spending, however, with personal income growing 0.3% and trailing the increase in spending. This caused the personal savings rate to dip from 4.6% to 4.3%.

Inflation data released within the report also boosted investor sentiment on the heels of a hawkish tilt by the Japanese central bank. The Core Personal Consumption Expenditures Price Index (Core PCE) rose 0.2% on a month-over-month (m/m) basis, exactly as expected and better than May’s 0.3% rate. Year-over-year (y/y) improved as well with the core PCE rising 4.1%, down from 4.6% for May and better than the 4.2% consensus projection. Higher prices were a result of higher costs for energy and services, while goods and food items provided relief to consumers.

Labor Market Remains Tight

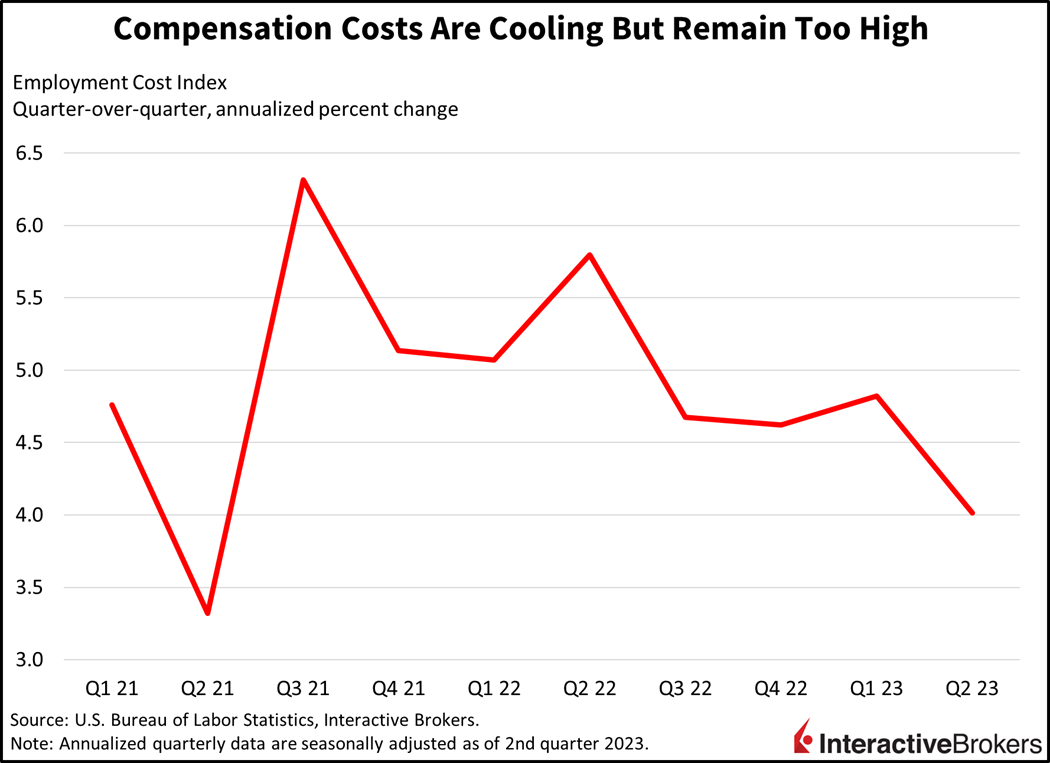

The Employment Cost Index also released this morning pointed to continued momentum on the wage front against the backdrop of some high-profile labor disputes occurring nationally. The cost of providing wages and benefits rose 1% quarter-over-quarter and 4.6% y/y, slightly lighter than estimates of 1.1%. Wages pressures have softened from the first quarter when costs rose 1.2% q/q and 5.1% y/y. Still, labor market tightness and the continued rise in compensation expenses is weighing on the Fed’s ability to quell inflation. On an annualized basis, the second quarter’s increase amounts to 4%, a rate inconsistent with the central bank’s price growth objectives.

Markets Seek to Recoup Recent Losses

Markets are riding high today as the Fed’s preferred inflation gauge shows continued progress. Stocks are striving to hold impressive gains after faltering intraday yesterday on the back of a lackluster Treasury auction that served to boost yields. Yields are cooperating today, however, even as the Bank of Japan adjusts its Yield Curve Control program by now allowing the Japanese 10-year bond to rise as high as 1%, up from a cap of 0.5%. The 2- and 10-year Treasury yields are down 7 and 6 basis points (bps) to 4.87% and 3.96% on hopes of a lighter Fed and softer inflation expectation. Lower yields are weighing on the dollar as well, with its Index down 19 bps to 101.51. WTI crude oil is unchanged at $80.09 per barrel as traders examine the supply-demand outlook.

All major U.S. indices are positive amidst broad participation. All sectors are green today while technology leads as the Nasdaq Composite Index grinds higher by 1.9%. The S&P 500 Index is up 1.08%, meanwhile, and about 20 points from its one-year high reached yesterday at 4607.

Challenges Ahead

The longer-term future for consuming spending, however, is unclear, as Americans have likely spent most of their pandemic savings. Ideally, a moderation of consumer spending could help slowdown inflation, but if Americans’ spending drops dramatically, the employment mandate will likely resurface.

While the circuitous path out of the forest of inflation appears to have widened, Powell and his fellow policymakers clearly aren’t out of the woods yet with the Beyonce Blip and corporate earnings calls illustrating that demand for travel, dinning out and entertainment can potentially support inflation in the services sector while commodity prices are climbing. Google searches for nail salons in cities where Beyonce is performing have soared as fans that have paid hundreds of dollars for concert tickets prepare to get decked out for the events, while Philadelphia recently had its strongest post-pandemic month for hotel room bookings when Taylor Swift announced she would perform there. The longer-term future for consuming spending, however, is unclear, as Americans have likely spent most of their pandemic savings. Ideally, a moderation of consumer spending could help slowdown inflation, but if Americans’ spending drops dramatically, the employment mandate will likely resurface.

Visit Traders’ Academy to Learn about Personal Income and Outlays and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.