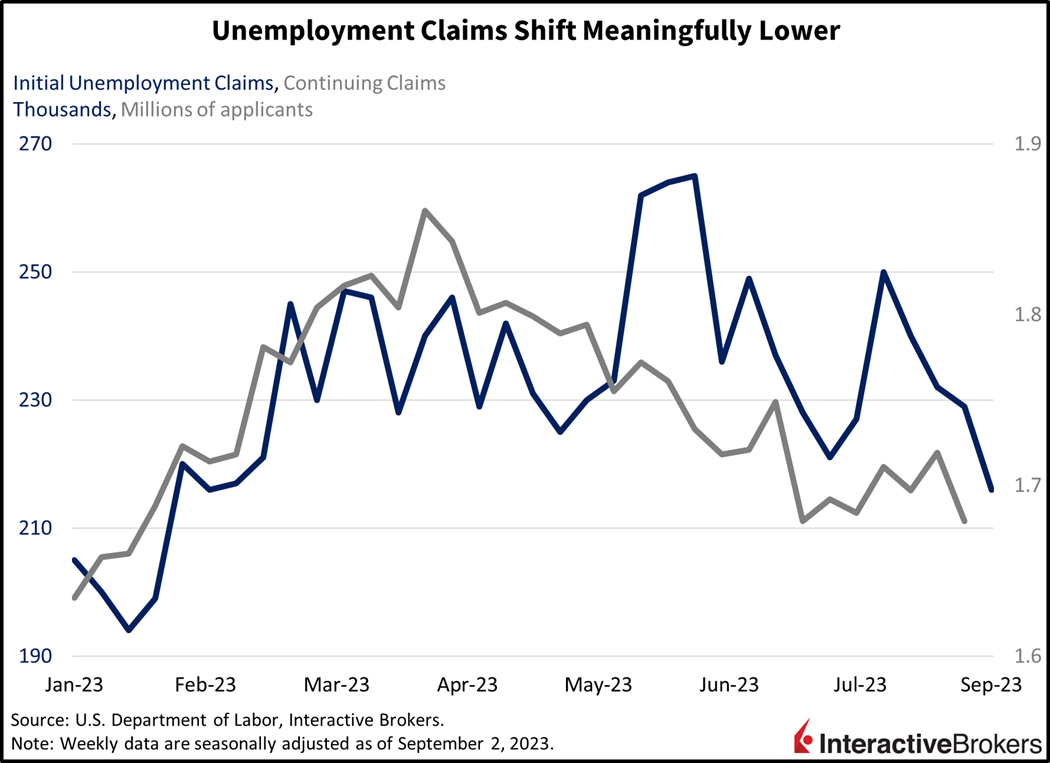

Investors’ hopes that the overheated U.S. job market is cooling received another setback this morning from a significant drop in unemployment claims pointing to an economy that is yet to slow enough to curtail inflation, but in Europe, data is pointing to economic growth that is just barely avoiding negative territory.

In the U.S., lines at unemployment offices were shorter than usual last week, with only 216,000 initial claims filed during the period ended September 2. The figure marks the lowest level since February and is solidly below projections expecting 234,000. Continuing claims, at only 1.679 million for the week ended August 26, tell a similar tale, with laid off employees still able to find jobs elsewhere quite quickly. The number fell significantly below the forecast of 1.715 million. Both initial claims and continuing claims were softer than their previous week’s results that had 229,000 individuals join the ranks of the unemployed and 1.719 million workers continue to seek unemployment benefits. The data is a significant contrast from last week’s report of declines in job openings, slower job growth and moderating wage pressures and is sparking fears that labor market tightness will cause the Fed to remain hawkish for longer than expected.

Europe Continues to Languish from Weak Consumption

In the euro area, however, conditions aren’t as robust with today’s third revision to second-quarter GDP coming in barely positive. The 0.1% growth rate was hampered by weak exports and dismal consumer spending while matching the first-quarter’s pace. The region’s three largest economies offered mixed results. Germany came in unchanged after posting a -0.1% contraction in the first quarter. France grew 0.5% following a quarter of unchanged growth while Italy sunk 0.4% after growing 0.6% in the first quarter. Employment growth also slowed sharply to a quarterly rate of 0.2%, decelerating from the first quarter’s 0.5%.

The third quarter’s data isn’t looking rosy either as yesterday’s euro area retail sales report showed that July consumption dropped 0.2% month-over-month (m/m) as Europeans travelled much less due to higher gasoline prices. Forecasters anticipated a 0.1% consumer spending decline and the July results erased much of June’s 0.2% growth. Weighing on consumption was a 1.2% m/m decline in gasoline station consumption. Offsetting a lot of the contraction was ecommerce and online spending, which rose a whopping 3.8% during the period. Also limiting the blow were the food, drinks and tobacco category with volumes increasing 0.4% and the nonfood products excluding gasoline category, which rose 0.5%.

Different Economic Results Have Similar Results

In Europe, weak GDP growth is driving an equity market selloff while in the U.S. fears that the economy is too strong and supporting inflation is causing investors to flee stocks. The STOXX Europe 600 Index has generated its seventh day of losses, illustrating weak investor sentiment for the euro area while U.S. equities are adding to yesterday’s losses as bond yields and the dollar take a breather. Leading the equity charge lower are small-caps and technology with the Russel 2000 and Nasdaq Composite indices down 1.1% and 1%. Participation is mixed, however, with the defensive utilities, consumer staples and health care sectors higher. On the offensive side, communication services, real estate and energy are offsetting some of the overall downside; they’re all up as well. Bond yields and the dollar are relatively subdued following big moves higher yesterday as the 2-year Treasury maturity is down 3 basis points (bps) to 4.99% while the 10-year is up 1 bp to 4.29%. The Dollar Index is off a recent intraday high from yesterday but has moved up 14 bps to 104.98. Important technical levels that are likely to lead to more upside once conquered are 5.05% for the 2-year, 4.37% for the 10-year and 106 for the dollar. WTI crude oil is also taking a break after a strong run with weak GDP growth numbers out of Europe easing demand fears and resulting in the price declining $0.11 to $87.44 per barrel.

U.S. Consumers Lead the Way

The significant dichotomy in U.S. and Europe economies illustrates that the U.S. is benefiting from strong consumer spending driven by a relatively younger population, record levels of fiscal stimulus during the Covid-19 pandemic, a dynamic, diversified economy and less vulnerability to price volatility associated with foreign-produced gasoline. These factors are helping the U.S. sustain GDP growth even as the Fed aggressively tightens monetary policy. Collectively, they are a double-edge sword. While economic growth is essential, the resulting continued demand for products and services by consumers has created stubborn inflation that is requiring the Fed to remain hawkish, which could push the country into recession. In the meantime, ongoing inflation fears driven by a tight labor market are creating strong equity market volatility and pushing bond yields higher as investors fear that continued monetary policy tightening will weigh on corporate earnings and valuations.

Visit Traders’ Academy to Learn More About Economic Indicators

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Quality content!

Thank you, Greg! We hope you will continue to read Traders’ Insight.