In a change from recent trading sessions, bond yields and equities are simultaneously falling as disappointing guidance from big tech companies, weaker-than-expected ADP jobs data and dismal manufacturing figures out of Beijing weigh on investor sentiment. A continued focus on refunding US debt with short-term Treasury bills rather than longer-term notes and bonds is also placing downward pressure on yields that may reverse following Fed Chair Powell’s comments this afternoon. Meanwhile, investors are mulling over an uptick in layoffs and are bracing for Powell to dish out his outlook for monetary policy.

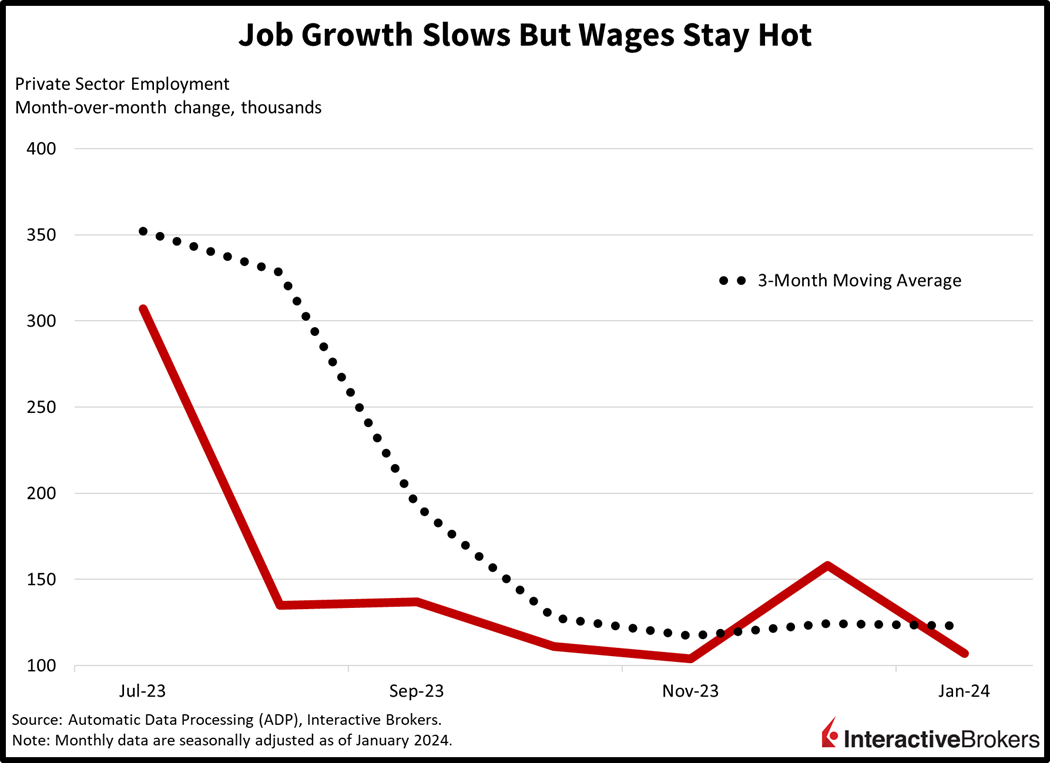

Hiring Slows but Wage Pressures Remain

Payroll processer ADP reported this morning that January private sector job growth slowed but managed to produce broad-based gains. The private sector added 107,000 workers in January, missing projections of 145,000 and arriving below December’s 158,000. All sectors added positions except for information, which shed headcounts by 9,000. The gainers were led by the leisure and hospitality category, which added 28,000 positions. Other categories added the noted number of positions as follows:

- Trade, transportation and utilities, 23,000

- Construction, 22,000

- Education and health services, 17,000

The other positive sectors added between 2,000 and 9,000 workers. Hiring was led by mid-sized establishments (50-499 employees) as they added 61,000 jobs while large firms (500+ employees) and smaller businesses (1-49 employees) grew by 31,000 and 25,000. Wage growth slowed but remained inconsistent with the Fed’s 2% inflation objective. Job stayers and job changers saw their wage growth slow from 5.4% year-over-year (y/y) and 8% y/y in December to 5.2% and 7.2%, respectively.

Layoffs Hurt Investor Sentiment

Paypal disclosed yesterday it will reduce its workforce by 9%, or 2,500 positions by both laying off employees and not filling existing staff vacancies. Paypal isn’t alone: more than 25,000 tech workers have been ushered to office exits year to date, according to Layoffs.fyi and Axios. The flurry of pink slips also involves other industries with Citigroup, UPS, Pixar, Salesforce and American Airlines slashing 20,000, 12,000, 1,300, 700 and 650 positions. Furthermore, Twitch, Hasbro, Spotify, Levi’s, Qualtrics, Wayfair, Duolingo, and the Washington Post are trimming between 10% and 35% of their workforce.

Tech Guidance Disappoints Investors

Big tech earnings season continued last night with Microsoft and Alphabet posting results that beat analysts’ expectations. The companies generated noteworthy increases in advertising revenue and cloud computing with artificial intelligence (AI) supporting results but also provided weaker-than-expected guidance.

Microsoft reported an adjusted earnings per share (EPS) of $2.93 for its fiscal second quarter ended December 31. The EPS exceeded the consensus estimate of $1.60 and climbed from $2.20 in the year-ago quarter. Its revenue of $62 billion surpassed the consensus expectation of $61.03 billion and climbed from $52.7 billion y/y.

Satya Nadella, chairman and chief executive officer of Microsoft, said the company has “moved from talking about AI to applying AI at scale.” AI is infused within each level of its tech stack offering, which is helping the company win new clients while increasing customer productivity. The company reported having 53,000 Azure AI clients. Microsoft’s strongest y/y revenue growth areas included its Xbox content, up 61%, and Azure cloud offering, up 30% y/y. Its search and advertising revenues climbed 8%. However, the mid-range of its current-quarter guidance of $60.50 billion missed the analyst expectation of $60.93 billion. Microsoft shares dropped 1.6% after the company’s earnings release.

Alphabet produced an EPS of $1.64, which climbed 52% y/y and beat the consensus estimate of $1.60. Its revenue of $86.31 billion exceeded the consensus estimate of $85.33 billion and climbed from $76 billion in the year-ago quarter. The company’s Google advertising revenue climbed from $59.0 billion to $65.52 billion y/y, an 11% increase, but missed the analyst expectation of $65.94 billion, causing Alphabet’s share price to decline more than 6% in after-hours trading. The news sparked concerns that even though businesses are increasing their advertising budgets, they are being conservative in their spending due to fears of a slowing economy and geopolitical risks. The company’s cloud revenue, however, grew y/y from $7.31 billion to $9.19 billion and beat the consensus expectation of $8.94 billion. YouTube subscription and advertising revenue also grew, increasing from $7.93 billion to $9.2 billion, roughly in-line with the analyst expectation. Chief Executive Officer Sundar Pichai said the company completed additional layoffs beyond the 12,000 announced earlier in 2023 as part of directing resources to build artificial intelligence services. Pichai has also told employees that additional job cuts will occur this year. In the earnings call, he noted that the company’s search, YouTube and Cloud performance have benefited from the technology. During the quarter, Alphabet took a $1.2 billion charge related to laying off workers and a $62 million accelerated rent charge associated with reducing its real estate. The company also took a $269 million charge for accelerated depreciation.

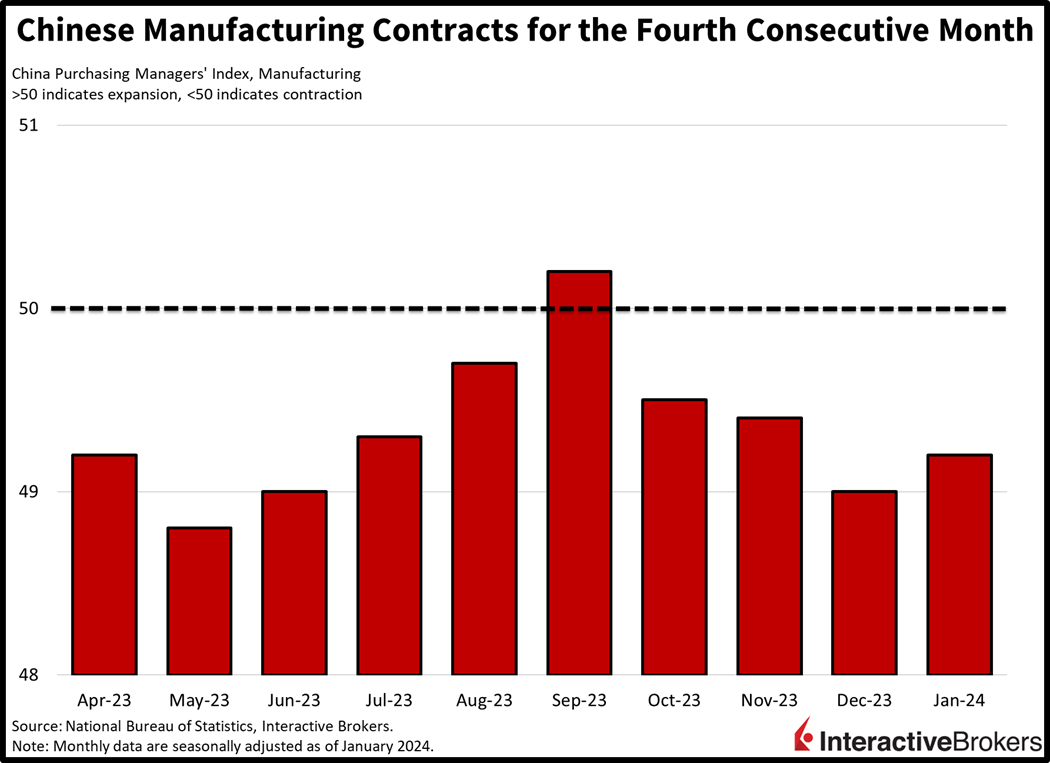

Continued Weakness in China

Across the Pacific in Beijing, Chinese manufacturing activity contracted for the fourth consecutive month, according to the nation’s National Bureau of Statistics. China’s Purchasing Managers’ Index for manufacturing came in at 49.2 for January, missing the expansion threshold of 50 while contracting at a slower rate than December’s 49.0 figure. Services did perform better, however, coming in at 50.7, which beat forecasts of 50.6 and improved from the previous period’s 50.4. The weak manufacturing data for a key global exporter of goods is likely to result in Beijing launching additional fiscal and monetary measures to boost economic activity.

Risk-off Sentiments Dominate Trading

Stocks are selling off following an epic rally off of the October 27 bottom when the S&P 500 hit the 4,100 level. Bond yields are lower though, as risk-off sentiments, softer-than-expected economic data and a continuation in Treasury issuance concentrated among short-term bills caps rates. For stocks, all major US indices are lower with the Nasdaq Composite Index leading the way down; it’s down 1.6%. The S&P 500, Russell 2000 and Dow Jones Industrial indices are down 0.9%, 0.4% and 0.1%, meanwhile. Sector breadth is negative and defensively tilted, with leadership coming from the utilities, real estate and health care sectors, as the segments rise 1.1%, 1% and 0.3%. The other eight sectors are lower though. Communication services, technology and consumer discretionary are the biggest laggards, with declines of 1.8%, 1.7% and 0.6%. Bond yields are tanking with the 2- and 10-year Treasury maturities trading at 4.21% and 3.95%, 13 and 8 basis points (bps) lower on the session. Yields are lower as players dial up rate-cut expectations for March to 61%, a development Chair Powell may very well push back against this afternoon. The dollar is suffering on the back of heavier Fed easing anticipations, with the greenback’s index down 29 bps to 103.12. The US currency is effectively down versus all of its major developed peers, including the Aussie and Canadian dollars, euro, pound sterling, franc, yen and yuan. Oil is on track for a sharp monthly gain on the back of intensifying geopolitical tensions but is down today on weak developments out of China and rising inventories in the US. Beijing, the largest importer of crude, is suffering from struggles that include the liquidation of property developer China Evergrande alongside a manufacturing recession at home and abroad. WTI crude oil is down 1.3%, or $1.05, to $76.67 per barrel on weaker demand prospects amidst stronger supply conditions.

All Eyes on Powell

Investors interpreted Powell’s last batch of tea leaves as having a dovish tilt, which caused financial conditions to loosen, commodity prices to soar and various economic indicators to strengthen. In the weeks following his last presentation, Fed policymakers sought to downplay his comments by emphasizing that the central bank needs more data before it concludes that gains in lowering inflation are durable. It may have been a timely call, with inflation, animal spirits and economic growth all accelerating and risking a renewed uptick in price pressures. After sparking a fresh round of economic momentum with his last presentation, Powell is likely to take a cautious stance today. A hawkish Powell will likely cause stocks to decline further, as investors press the sell button again in the afternoon. While the incentive for morning selling was big tech earnings, the possibility of afternoon selling will almost surely occur because of rates. The Chair is likely to dismiss rate cuts and maintain optionality, pushing back the market’s expectation of the first cut to May from March while dialing down 2024’s path of rate reductions from 6 to 4.

Visit Traders’ Academy to Learn More About PMIs and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.