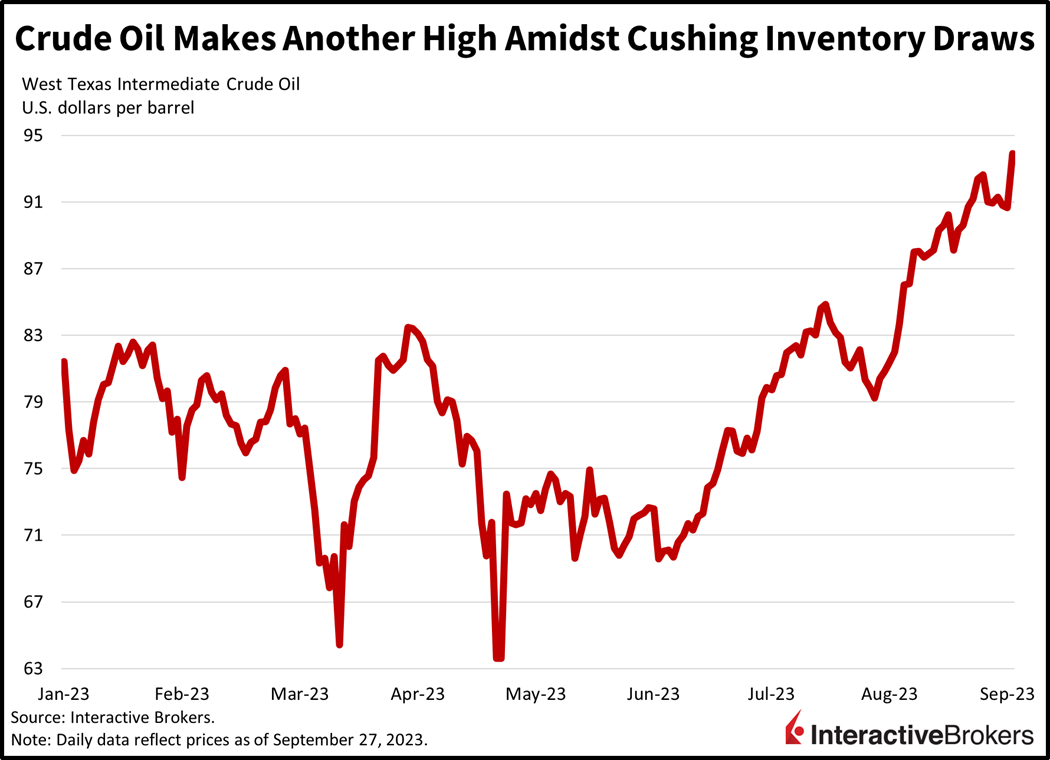

Markets were unable to hold earlier gains amidst continued pressure stemming from interest rates in the nosebleeds, labor disputes and a looming government shutdown. Also this morning, market players are analyzing a renewed momentum push in energy markets, with crude oil prices reaching yet another year-to-date high on the back of supply concerns fueled by inventory draws at the significant Cushing, Oklahoma storage facility. Durable goods orders, meanwhile, reflect a persistent corporate appetite to invest and make money, with business investment rising solidly in August.

Durable Goods Orders Gain in August

Strong business investment spending and robust defense expenditures helped push August durable goods orders up 0.2% on a month-over-month basis. The gain blew past the analyst expectation for a 0.5% decline and partially offset July’s sharp 5.6% contraction. Orders excluding defense and aircraft, an indicator of business investment, grew an impressive 0.9%, better than July’s 0.4% drop and the consensus estimate of 0.1%. Aircraft orders were mixed, with nondefense reporting a sharp decline of 15.9% while defense climbed 19.2%. The broad defense capital goods category rose 18.6% during the period. Other categories that advanced included the following:

- Electric equipment, up 1.1%

- Fabricated metal products, up 0.5%

- Machinery, up 0.5%

- Computers, up 0.3%

- Motor vehicles, up 0.3%

Primary metals and transportation equipment weighed on gains, however, as orders slipped 0.6% and 0.2%, respectively.

Stocks Surrender Gains

Stocks were dead-cat bouncing after yesterday’s bloodbath, but equities are now solidly in the red. The Dow Jones Industrial Average is leading the way lower, it’s down 0.5% while the Nasdaq Composite and S&P 500 indices are both down 0.3%. The small-cap Russel 2000 is bucking the trend, it’s up 0.6%. Sectoral breadth has an offensive, cyclical tilt with the defensive health care, utilities and consumer staples categories down between 0.2% and 0.7%. The financial and consumer discretionary sectors are down 0.1%, while the other six sectors are higher. The energy sector is leading the pack—it’s up 2% on a sharp move higher in crude oil. WTI crude oil has made a new year-to-date high of $93.92 per barrel as it rises $3.42 or 3.7%. The move higher is driven by low inventories, with crude oil supplies falling to a 14-month low at the important Cushing, Oklahoma, delivery location, where U.S. crude future contracts are settled. The dollar is also rallying, with speculators believing that the dynamic U.S. economy will perform better than global competitors in an environment of tight monetary policies and elevated oil prices. Of particular concern is a European recession beginning this quarter and a severe slowdown in Beijing. The Dollar Index is up 40 bps to 106.62 as the greenback appreciates against the euro, pound sterling, franc, yuan, yen and Aussie and Canadian dollars. Bond yields are mixed, however, with investors believing that the market can’t digest more fed hikes even as inflation expectations firm up. The result is a bear steepening on the yield curve, with the Fed-sensitive 2-year maturity down 3 bps to 5.09% while the 10-year maturity is up 5 bps to 4.59%. Indeed, odds of another 25-bp hike in November and December are only at 25% and 35%, even as the Fed’s summary of economic projections has one more hike penciled in this year.

Budget Battle Continues

As fears grow about a potential government shutdown next week if Washington policymakers fail to approve a budget, the Senate has reached a bipartisan stopgap resolution that if approved by the House of Representatives would keep the government operating while a fiscal year spending agreement is forged. It includes $6 billion for disaster relief and another $6 billion for supporting Ukraine’s war against Russia. Yet the conservative segment of republicans in the lower chamber, which is pushing for spending cuts and a reduction in aid to Ukraine, is likely to block the resolution. House Speaker Kevin McCarthy has vowed to have the lower chamber approve a stopgap resolution but if it includes measures that the hard-line members of the Republican party are seeking, it will probably be rejected by the Senate. Kicking the can down the road has become a feature of governance among both parties, with the last budget surplus occurring over 20 years ago.

Big Three Strikes Show No Sign of Easing

The ongoing UAW strike against the Big Three automakers is also adding to investor anxiety about wage pressures, inflation and the health of supply chains. Yesterday, President Joe Biden joined the United Auto Workers picket line and echoed views of the organizers by saying union concessions saved the auto industry during the 2009 crisis and that it’s time for workers to share in the recent success of auto manufacturers. The union lowered its requested 40% pay raise to 36% recently. When asked if workers should be granted the 40% raise, Biden responded that it’s something that they should be able to bargain for.

Earnings and Recession Fears Become Focal Points

September has lived up to its infamous reputation of being the worst month for stock market returns. Headwinds are definitely present, with rising oil prices representing the latest threat to the “inflation is done” narrative. The combination of higher interest rates at the short-end, rallying oil prices, labor disputes demanding raises well above the level of inflation and the potential for a government shutdown could prove to be a nightmare that can totally derail this year’s equity rally, with stocks gains from January 1to July 27 already cut roughly in half. As we enter the fourth quarter while analyzing the long and variable lags of monetary policy alongside the plethora of other headwinds, earnings estimates for next year and the possibility of recession become top of mind.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.