A hattrick of economic news today is sustaining choppy market conditions as investors become increasingly fearful of potential stagflation, or the painful combination of high inflation and sluggish, or even no, economic growth. This morning’s surprisingly large rate hike from the Bank of England, initial unemployment claims numbers and existing home sales data are three powerful slapshots against investor sentiment that follow Federal Reserve Chairman Jerome Powell ushering in the first day of summer yesterday by reiterating his hawkish stance against inflation.

The Bank of England Launches Surprise

Following a recent uptick in already strong core inflation, the Bank of England escalated its battle against price increases with an unexpectedly large 50-basis point (bp) rate hike this morning. The bank’s 13th consecutive rate increase comes one day after data showed that May’s year-over-year (y/y) core inflation climbed to 7.1%, the highest rate since March 1992. The core inflation rate excludes volatile alcohol, tobacco, energy and food prices and climbed substantially from April’s 6.8% y/y rate. In another troubling development, the y/y headline inflation rate of 8.7% for May was unchanged from April. This morning’s rate hike, which was approved by a 7-2 vote by the bank’s Monetary Policy Committee, brings the key rate to 5%. The scope of the hike surprised investors, with markets having priced in a 60% chance of only a 25-bp hike. Similar to the U.S., the UK is experiencing a tight labor market but also appears to be experiencing strong demand for products and services. Markets are now pricing in a 30% chance that the central bank will boost the key rate to 6.25% by February. Central Bank Governor Andrew Bailey, furthermore, said additional rate hikes may be appropriate if inflation doesn’t show signs of easing.

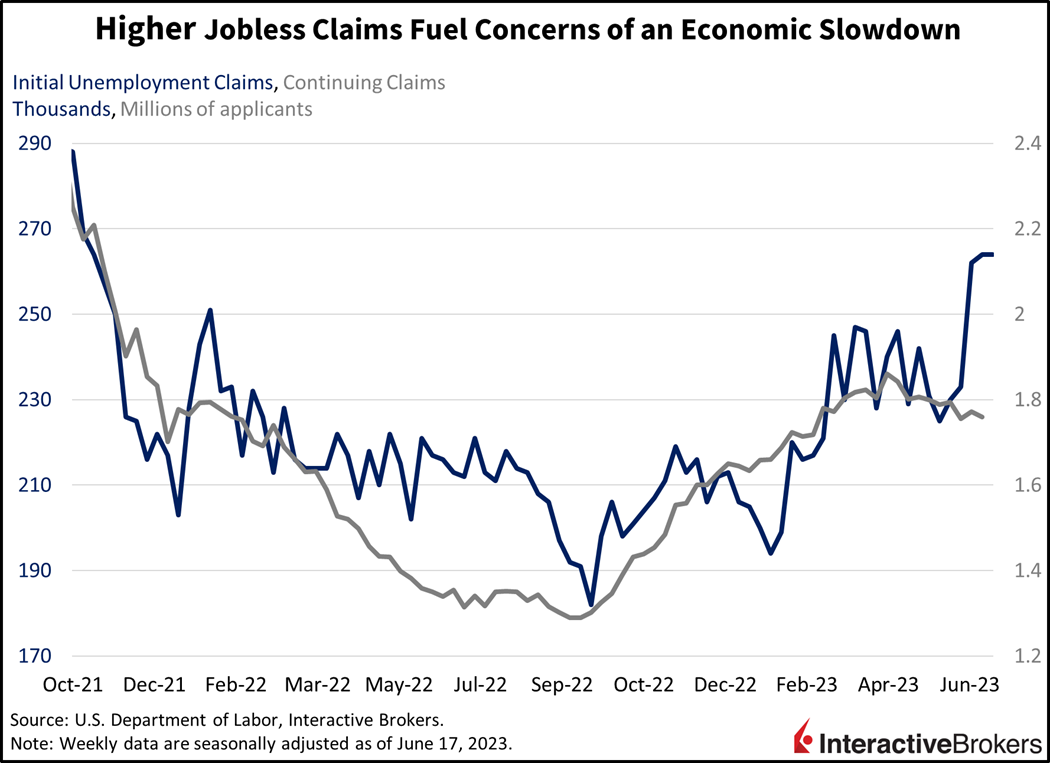

A Tight Labor Market Shows Signs of Weakening

In the U.S., initial unemployment claims remained at the lofty level of the previous week, coming in unchanged at 264,000 for the week ended June 17, surpassing projections calling for 260,000. The 264,000 claims occurring in each of the last two weeks are the highest number of claims since October 2021, strengthening concerns of a material slowdown in the labor market. Offering some relief from fears of a weakening job market, however, are continuing unemployment claims, reflecting that laid off employees aren’t staying unemployed for long. Continuing claims came in at 1.759 million for the week ended June 10, notably below expectations of 1.782 million. Continuing claims also declined from the prior week’s 1.772 million level.

Existing Home Sales Continue to Weaken

Also today, the National Association of Realtors reported that existing-home sales in May were virtually flat month-over-month and down 20.4% y/y, largely due to a lack of inventory and high interest rates. In May, completed transactions of single-family, townhomes, condominiums and co-ops occurred at a seasonally adjusted annualized rate of 4.3 million units, exceeding the consensus’s prediction for 4.25 million but up only 0.2% m/m from April, while down from 5.4 million y/y. NAR notes that new home sales have reached levels experienced prior to the Covid-19 pandemic, due to the real estate category having sufficient inventory. While inventory of existing homes increased from the equivalent of a three-month supply in May from 2.9 months in April, the volume is roughly half of what existed in 2019. Broadly speaking, many homeowners refinanced their mortgages at record-low interest rates in recent years so they are reluctant to relocate because doing so would entail purchasing homes with higher mortgage costs. Despite the tight inventory, the median sales price for existing homes declined y/y from $408,600 to $396,100.

Finesse Over Speed

In a hearing in which he briefly compared notes on the Grateful Dead with a committee member, Powell’s thinking appeared to be influenced by the summer vacation season or perhaps road trips to see the late Rock and Roll Hall of Fame member Jerry Garcia. Like a driver slowing down to avoid missing their highway exit, or search for a side street, the Fed is now using finesse to reach its 2% inflation target.

In his testimony before the House of Representatives Committee on Financial Services yesterday, Powell said the Fed’s decision to pause, or perhaps skip, a rate increase at its last meeting doesn’t indicate that the battle against inflation is done. Rather, the Fed is seeking to finesse its efforts to slow inflation rather than rush to the finish line. In a hearing in which he briefly compared notes on the Grateful Dead with a committee member, Powell’s thinking appeared to be influenced by the summer vacation season or perhaps road trips to see the late Rock and Roll Hall of Fame member Jerry Garcia. Powell said as drivers get closer to their destination, they slow from highway speeds to speed limits on local roads and eventually slow further as they enter parking lots. Having kicked off the inflation battle with a series of rapid and unprecedent 75-bp rate hikes, the Fed has slowed its pace by moving to 50-bp and then 25-bp hikes and its recent pause. Like a driver slowing down to avoid missing their highway exit, or search for a side street, the Fed is now using finesse to reach its 2% inflation target.

Markets Search for Direction

Markets are mixed today, with yields rising notably on the back of hawkish developments from global central banks while equities recover from earlier losses. The Bank of England’s surprise 50-bp hike is concerning investors that the action establishes a precedent for other central banks to follow. Yields are climbing across the curve as a result, with the 2 and 10-year Treasury maturities up 6 bps each to 4.77% and 3.78%. Higher costs of capital in the U.S. are driving up the Dollar Index, which is up 24 bps to 102.32. Equities are mixed, with cyclical sectors underperforming growth. The Nasdaq Composite Index is up 0.1%, outperforming the cyclically tilted Dow Jones Industrials Average as well as the S&P 500 and Russel 2000 indices, which are down 0.2%, 0.7% and 0.1%. Worries of central banks tipping economies into recession are weighing on energy markets even as U.S. inventories fell 1.2 million barrels last week. WTI crude oil is down 2.9% to $70.47 per barrel, remaining above critical support at $70.

As investors evaluate artificial intelligence developments, productivity gains and efficiency improvements across corporate America, hawkish central banks lurk in the background. Market players hope that companies can produce enough liquidity themselves, through rising free cash flow in an environment of monetary policy discipline. Similar to the U.S., England and the European Union suffer from persistent services inflation driven by unyielding labor markets. With prices continuing to rise at a brisk pace, pandemic savings unwinding and student loan repayments ensuing this October, hawkish monetary officials may not be the only threat to this year’s exciting equity rally that has pushed the S&P 500 Index up approximately 18% year to date.

Visit Traders’ Academy to Learn More about Unemployment Claims, Existing Home Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.