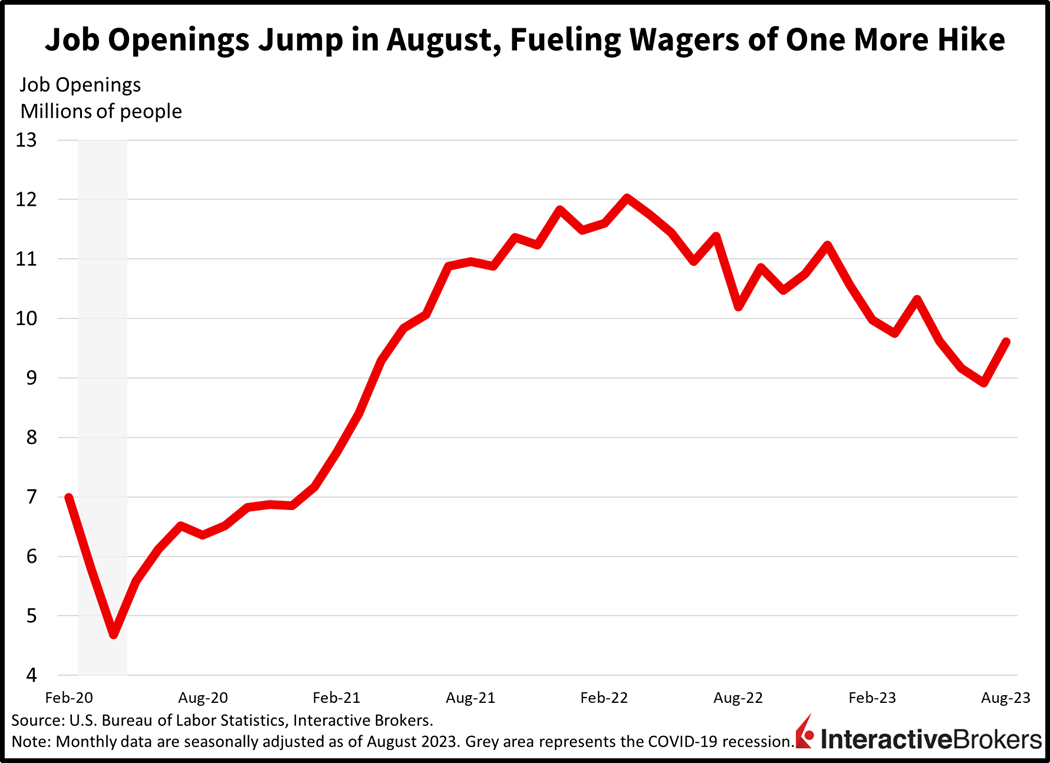

Markets are tumbling this morning as longer-duration bond yields continue their march higher. The market selloff worsened at 10:00 a.m. in response to the Bureau of Labor Statistics reporting a strong 690,000 rise in job openings, intensifying fears of a tight labor market and a resilient economy that may require a prolonged period of higher interest rates to contain inflation. Commentary from Federal Reserve Presidents Bostic and Mester and other policymakers failed to inspire confidence, with members of the central bank beating their drums to the higher-for-longer rhythm.

Businesses Ramp Up Hiring

August’s Job Openings and Labor Turnover Survey (JOLTS) reflected a business community that is determined to flourish and expand. Indeed, the U.S. sported an impressive 9.61 million for hire signs, flying above expectations of 8.8 million and beating the 8.92 million job openings that existed in July. In August, the following sectors added the noted number of job openings:

- Professional and business services, 509,000

- Finance and insurance, 96,000

- State and local government education, 76,000

- Nondurable goods manufacturing, 59,000

- Federal government, 31,000

Job separations or quits were nearly unchanged from July, rising to 3.638 million from 3.549 million.

Markets Tank as Liquidity Deteriorates and Economy Appears Resilient

Stocks and bonds are taking it on the chin yet again with deteriorating liquidity conditions and stronger-than-expected economic data weighing. The 2- and 10-year Treasury maturities are up 4 and 11 basis points (bps) to 5.152% and 4.791%. Yields are also supporting the dollar while fears of the Fed raising the fed funds rate one more time in November on the back of strong labor market data are also bolstering the currency’s strength. The greenback is up against the euro, pound sterling, franc, yuan and Aussie and Canadian dollars while it retreats relative to the yen. The Dollar Index is up 12 bps to 107.15. All major equity indices are lower, as the Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial indices lose between 1.1% and 1.6%. Every sector is lower as the homebuilders, consumer discretionary and real estate segments lead the way down with declines ranging from 1.7% to 2.5%. WTI crude oil is bouncing back as constrained supply offsets concerns that soaring bond yields may slow the economy and dampen demand. The commodity is up $1.61 or 1.84% to $90.19 per barrel.

Fed Policy Makers Support Higher for Longer Strategy

Federal Reserve policymakers have been providing mixed outlooks for its monetary policy while Fed Chairman Jerome Powell and Philadelphia Fed President Patrick Harker recently met with small business owners in York, Pa., to assess additional opinions on the health of the economy.

At a banking conference yesterday, Fed Governor Michelle Bowman said she would support another rate hike if new data doesn’t indicate progress on fighting inflation or if the progress is too slow for the central bank to hit its 2% inflation target in a timely manner. Last night, Cleveland Fed President Loretta Mester echoed Bowman’s opinion. Mester said she suspects another fed funds hike may be appropriate. The higher rate would have to be maintained until the central bank receives more information about economic developments and analyzes the impact of previous rate hikes. Richmond Fed President Thomas Barkin recently maintained that the economy is more resilient than previously believed, and he said there is a divergence in views among Fed policymakers regarding the appropriate fed funds rate, but policymakers have increased their outlook for economic growth, so maintaining a higher rate for longer may be appropriate. Yet, Fed Vice Chair for Supervision Michael Barr, while at a different event, said he believes the fed funds rate is close to or at a sufficiently restrictive level for fighting inflation. He maintained that the most important question is how long the elevated fed funds rate should be maintained. This morning, Atlanta Federal Reserve President Raphael Bostic said he is in no rush to raise the fed funds rate; however, he emphasized that it will be a long time before it’s appropriate for the central bank to cut rates.

A Journey Deep Into Former Peppermint Patties Territory

During a visit to York, Pa., which was the former manufacturing home of York Peppermint Patties, Powell and Harker met with business owners and participated in a roundtable discussion on the economy. Business owners said they are still struggling to find workers and that higher interest rates are discouraging them from expanding their companies. Business owners also said they are having a hard time with acquiring supplies. Kevin Schreiber, CEO of the York County Economic Alliance, during the roundtable discussion, added that businesses and workers are also struggling to find childcare. Prior to the Covid-19 pandemic, the York area had 219 childcare centers. It now has only 170 and many of those aren’t operating at full capacity because of staffing issues.

Costs of UAW Strikes Increase

The economic cost of the UAW strikes against the Big Three automakers is climbing as the union’s efforts to secure a 36% wage increase and improved benefits enters its 19th day. Yesterday, Ford said it was laying off 330 workers at various locations while GM said it would layoff 130 employees as a result of manufacturing disruptions caused by the strike, which currently involves 25,000 out of 150,000 UAW members employed by the Big Three companies. GM has already laid off 2,000 workers in September due to a parts shortage. Yesterday, the UAW submitted a counteroffer to GM’s latest proposal, but GM says significant gaps between the demands of the union and the car manufacturer exist. JP Morgan has estimated that the strike already cost GM $191 million and Ford $145 million, but from a broader perspective, the strikes have been significantly more costly. The Anderson Economic Group, which has done consulting work for the automobile industry, lists the following costs:

- Direct losses to the Big Three totaling $1.2 billion

- Losses to suppliers of $1.29 billion

- Losses to automobile dealers and customers of $1.2 billion

- Lost wages of $325 million

The consulting firm created the estimate prior to the union expanding its strike last Friday.

The Next Two Weeks Could Be Pivotal for Monetary Policy

With the next Fed decision occurring on November 1, this month’s data releases concerning labor markets and inflationary pressures are critical. While today’s JOLTS numbers jolted the market, this Friday’s nonfarm payrolls data and next week’s Consumer and Producer Price indices are likely to shape monetary policy and earnings expectations. While consumer spending is slowing in the short-term, labor demand and commodity prices may lay the groundwork for the Fed to issue one more rate hike. For this Friday, meanwhile, we’re expecting 180,000 job additions, 0.4% wage gains and a 3.8% unemployment rate while tomorrow’s ADP report will offer an imperfect preview of what’s ahead.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.