Investors are getting their popcorn ready for this afternoon’s Fed interest rate decision which will also feature the central bank’s update to its Summary of Economic Projections (SEP), also referred to as the dots, and the bank’s outlook for its balance sheet reduction plans. So far today, markets are quiet with trading likely to accelerate in a binary way into the close. Bulls are looking to stay in charge, hoping that Chair Powell will announce at 2 p.m. that rate cuts are right around the corner and that the dots will remain relatively unchanged from December. Bears, meanwhile, are hoping that fiery January and February inflation data have captured the Fed’s attention, causing committee members to dial back the number of cuts this year from three to two. Inflation hawks are also hoping that Powell refrains from rate cut talk while he points to accelerating price pressures as a threat to the monetary policy outlook.

Fed Is Likely To Scale Back Rate Cut Expectations

When considering accelerating price pressures amidst a robust labor market, adjustments to the dots are certainly warranted. I’m expecting the number of 2024 rate reductions to be dialed back from three to two while also revising estimates of economic growth and core inflation from 1.4% and 2.4%, respectively, to 2% and 2.7% for the year. Also, the longer run neutral fed funds rate will probably be raised from 2.5% to 2.7%, as the post-pandemic economy remains significantly different than the pre-pandemic environment. Indeed, some of the factors that warrant a loftier Fed funds rate over the long haul due to structurally higher inflation include the shift from globalization to regionalization, geopolitical tensions, continued deficit spending, excess retirements, labor shortages, supply chain uncertainties and inefficiencies within commodity markets.

Powell’s Tone Will Be Crucial for Financial Conditions

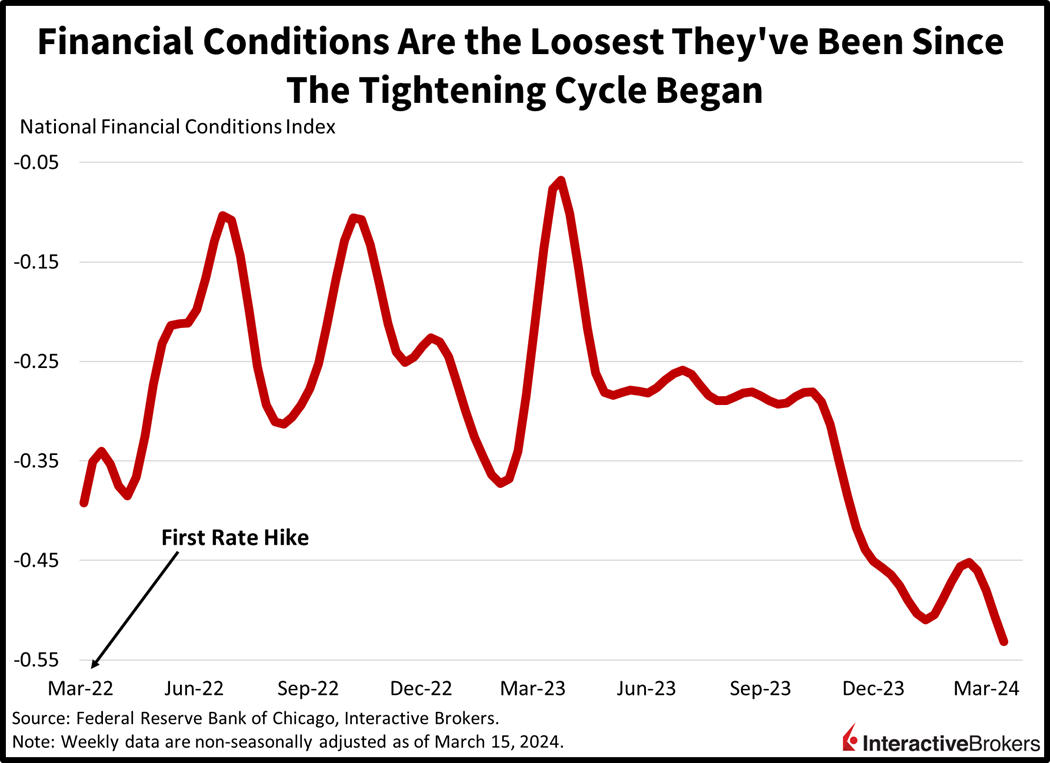

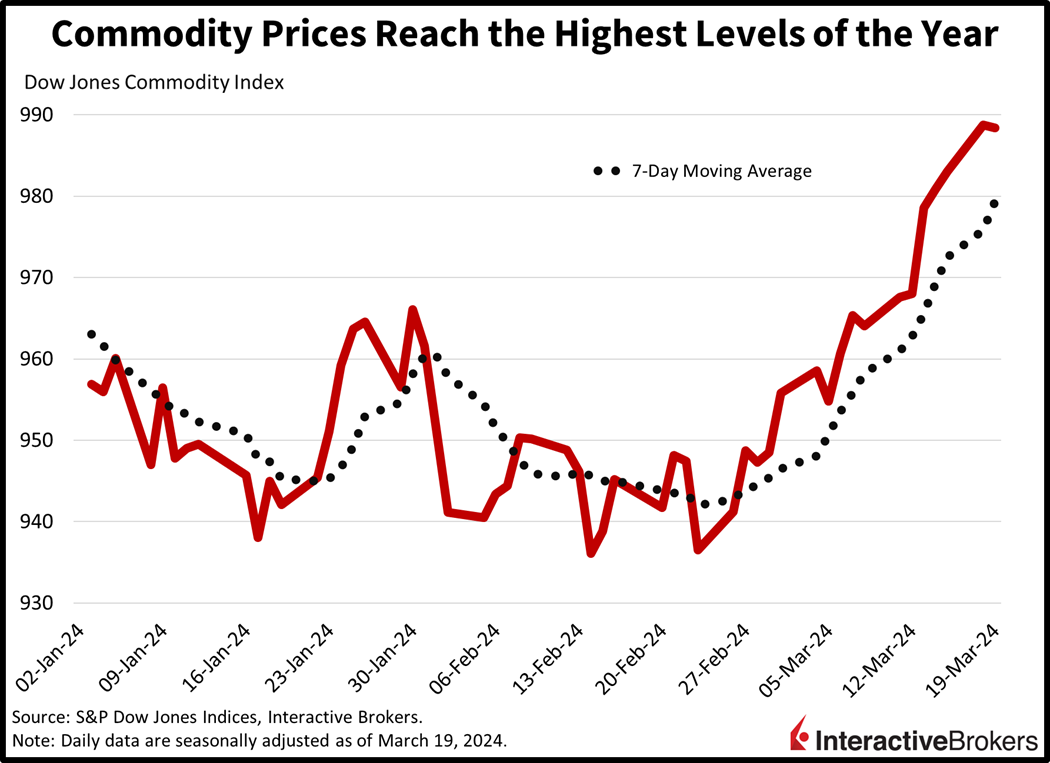

Powell’s tone during the press conference this afternoon will be integral to market participants’ sentiment, with fast-paced investors and reactive algorithms making trading decisions based on his words. In his past statements, comments such as “we need a little more evidence,” “policy is neutral” and “it’ll soon be time to cut rates” significantly loosened financial conditions, which generated more inflationary pressures and setback the central bank in its quest of 2% price pressures. Financial conditions today are significantly looser than when the Fed started hiking in March 2022, while commodity prices are at their highest levels of the year. These conditions point to the need for restrictive monetary policy, not accommodation. The liquidity excesses unleashed post-pandemic are still with us today and will continue to push inflation much higher without the Fed curbing them. A dovish tone will support inflation while a hawkish one will tame it.

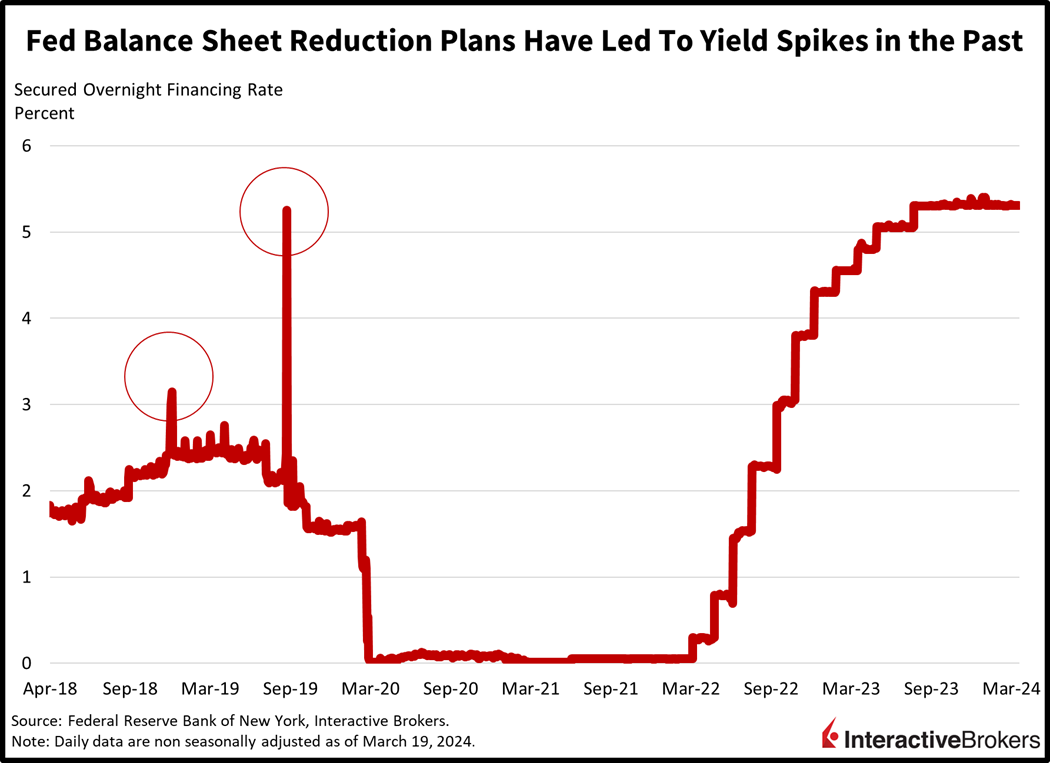

Fed Is Wrestling With Pace of Quantitative Tightening

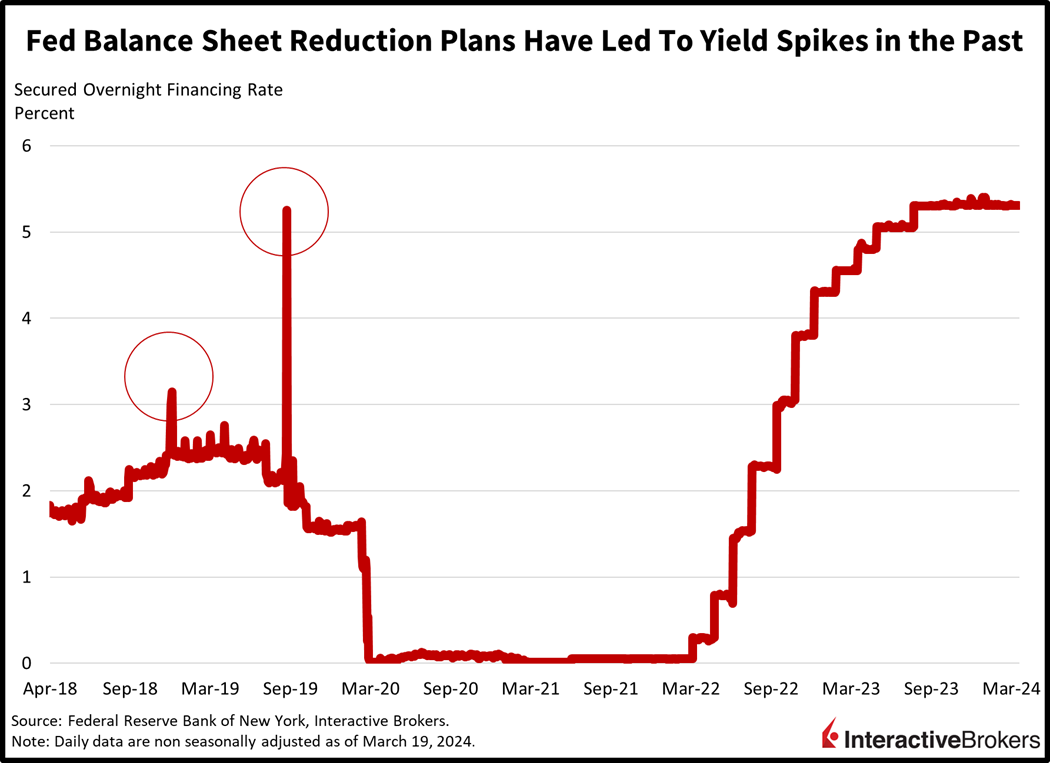

Investors are also looking ahead to Powell’s comments on quantitative tightening (QT), or the process of decreasing the central bank’s balance sheet, which can result in higher yields and less cash in the economy. Fed members had previously agreed to discuss the topic during the FOMC meeting spanning yesterday and today, causing investors to increasingly focus on the matter approximately six years after a similar process sparked funding issues that required the central bank to intervene, and begin to buy bonds again as bank interest rates spiked. More recently, the Fed has been allowing roughly $95 billion in securities consisting of Treasuries and agency-backed mortgage debt to roll off its balance sheet each month as the fixed-income assets mature. Fed members this morning were expected to assess how much longer the current pace of quantitative tightening can continue without sending a jolt into the funding market. I anticipate that the Fed will slow its QT to $50 billion a month. Meanwhile, funding markets have shown no sign of distress this year, but they have yet to face the challenge of the US Treasury issuing significant long-term debt. Rather, the Treasury has relied on issuing shorter term Treasury bills after some sloppy auctions in the second half of last year sent the 10-year yield to 5%.

The Birth of the Inflation Put?

A significant justification for owning stocks in the aftermath of the global financial crisis has been the Fed put. The term refers to investors dismissing meaningful downside equity risks because the Fed will come in, stabilize markets and help fuel capital gains. A failure to quell inflation by the current Fed, particularly today, will lead to another reason for owning equities—the inflation put. If the Fed implicitly moves the goalpost on inflation and price pressures end up running between 3% and 4% longer-term, then earnings will grow an additional 3% to 4% all else equal. Stocks hedge this inflation risk, while the Fed put, earnings growth and dividends will provide substantial long-term support to equities amidst unanchored valuations. The investing landscape as we know it may be on the verge of a significant shift.

Visit Traders’ Academy to Learn More About Existing Home Sales and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

is that buttered popcorn hot or merely medicore as the markets ?