The BRICS nations are coming of age.

At its annual summit in Johannesburg last week, the bloc of five emerging countries—Brazil, Russia, India, China and South Africa—announced plans to expand for the first time since 2010. On January 1, 2024, the BRICS will welcome six new members: Saudi Arabia, Argentina, Egypt, Ethiopia, Iran and the United Arab Emirates (UAE).

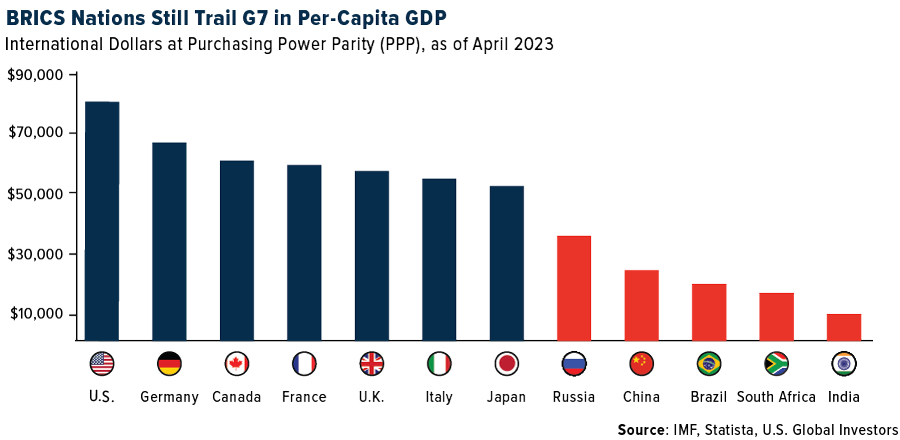

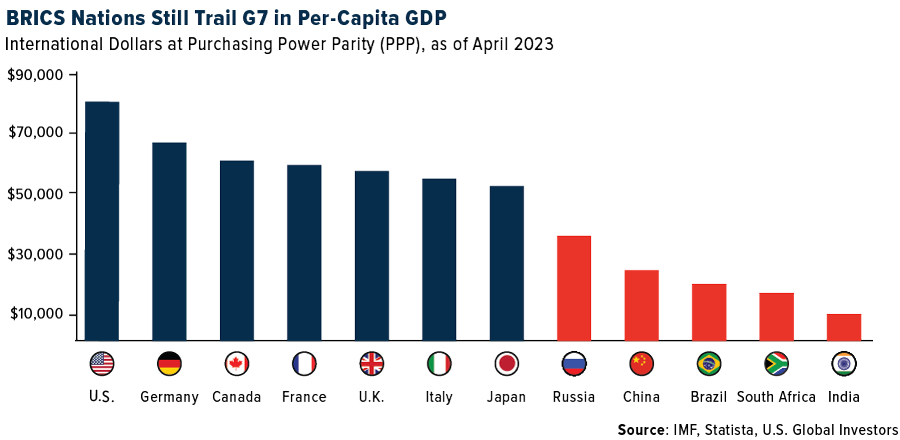

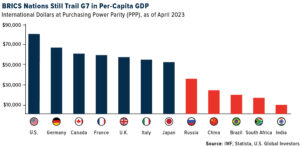

The expansion will further establish the group as a counterbalance to the G7’s global influence, catapulting BRICS’ share of global GDP to 36% as well as covering nearly half of the world’s population. With dozens more nations expressing interest in joining the bloc, the BRICS are clearly positioning themselves for a multipolar world, one that is not dominated by the U.S. and other members of the West.

I expect the BRICS’ rise to create both opportunities and challenges for investors. Understanding the geopolitical, economic and regulatory landscape will be critical for navigating this environment successfully.

The Dollar’s Dominance Challenged

Perhaps most notably, Russian President Vladimir Putin—speaking remotely due to an International Criminal Court (ICC) arrest warrant for alleged war crimes—discussed the BRICS’ push to conduct trade in local currencies instead of the U.S. dollar, a move that would significantly reconfigure global trade dynamics.

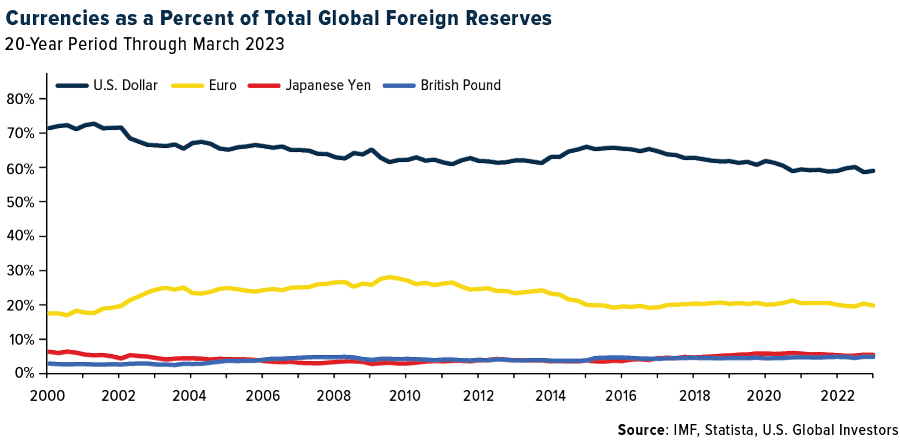

Since the Bretton Woods Conference in 1944, the dollar’s status as the world’s primary reserve currency has offered the U.S. tremendous benefits such as cheaper financing and unparalleled leverage in the form of financial sanctions. But now, with BRICS nations seeking an alternative to the greenback (and growing their ranks from five members to 11), the currency landscape may see a new major tectonic shift, contributing to greater volatility in the Treasury market, exchange rates, inflation and more.

At the heart of this strategy lies the New Development Bank (NDB).

Established in 2015 as an alternative to Western lenders such as the World Bank and International Monetary Fund (IMF), the NDB has been making waves. Its recent decision to release an Indian rupee bond and to consider local currency bonds in other countries reflects its intent to diversify away from the dollar.

Former Brazilian leader and NDB’s current president, Dilma Rousseff, shared the bank’s ambitious plans to lend between $8 billion and $10 billion this year, with approximately 30% of the lending in local currencies. The U.S.-based financial system is “going to be substituted by a more multipolar system,” Rousseff told the Financial Times.

My own opinion is that the U.S. dollar will not be completely dethroned as a reserve currency, though we may end up seeing it share the stage more prominently with the euro, Chinese yuan, Bitcoin or some other currency. In their current roster, the BRICS represent over 32% of the world’s GDP, which is slightly more than the G7’s 30%; however, GDP per capita, an indicator of economic prosperity, remains a gap that the BRICS must bridge.

As the BRICS nations evolve and expand their influence, a more diversified global governance is inevitable. The current trajectory promises a world where traditional powerhouses, including the U.S. and European Union (EU), must adapt to new realities.

As an investor and an observer, staying nimble will be paramount.

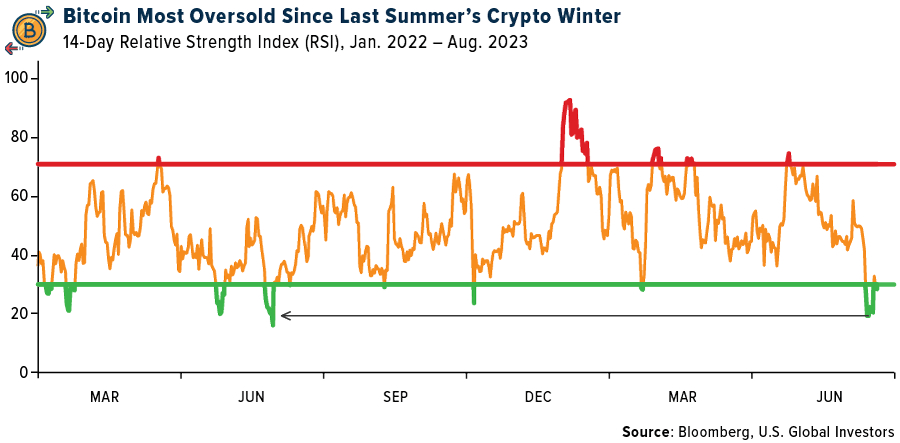

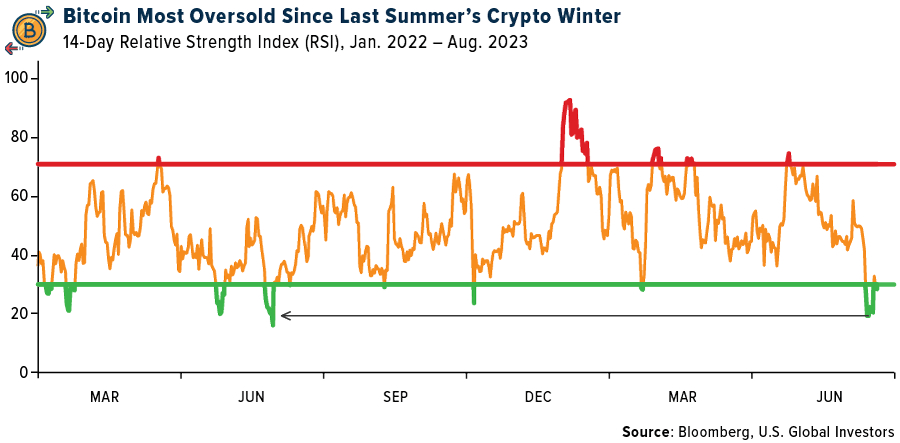

The Impact Of Rising U.S. Treasury Yields

Also shaping the market right now are rising U.S. Treasury yields. As these yields surge due to stronger-than-expected economic growth and the Federal Reserve’s tightening policies, risk-on assets, from stocks to Bitcoin, are feeling the heat. Over the past 30 days, the 10-year Treasury yield has risen some 9.4% while the S&P 500 and Bitcoin have lost 3.5% and 10.8%, respectively. Bitcoin, in fact, has fallen into the most extreme oversold territory since last summer’s crypto winter, triggered by the failures of crypto firms Celsius, Three Arrows Capital and Voyager.

With Jerome Powell asserting at Friday’s Jackson Hole summit that it may be appropriate to hike rates further to combat inflation, investor focus could be shifting toward sectors less reliant on borrowing, like utilities and consumer staples. Still, many remain optimistic about the resilience of equities, especially in the context of a robust U.S. economy.

The standout exception to struggling equities, of course, has been artificial intelligence (AI) stocks in general and NVIDIA specifically. For the 12-month, year-to-date, three-month and five-day periods, the Santa Clara-based graphics processing unit (GPU) maker remains the top-performing S&P 500 stock by far as investors scramble to get exposure to companies involved in AI.

Gold’s Enduring Luster

In the midst of all this, gold continues its role as a stable store of value. Despite challenges like rising yields, my sentiment around gold remains bullish. Its current trading levels, though down from their peak, still indicate strong investor interest.

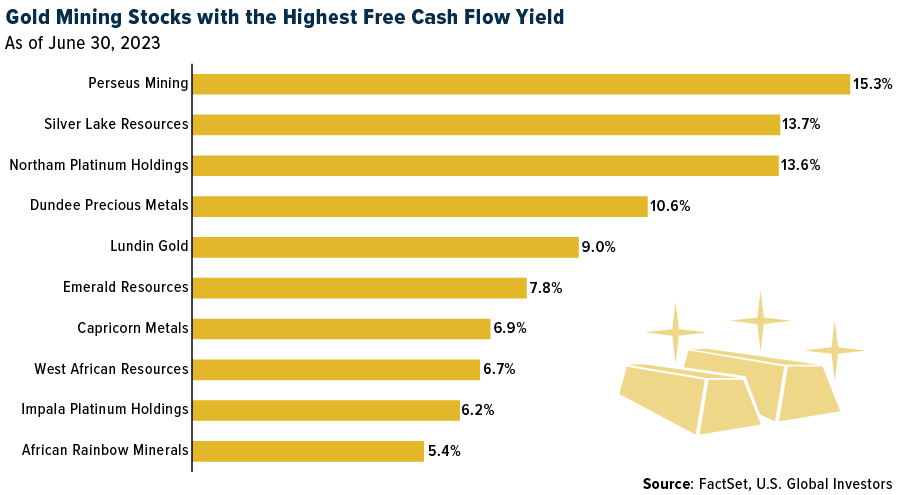

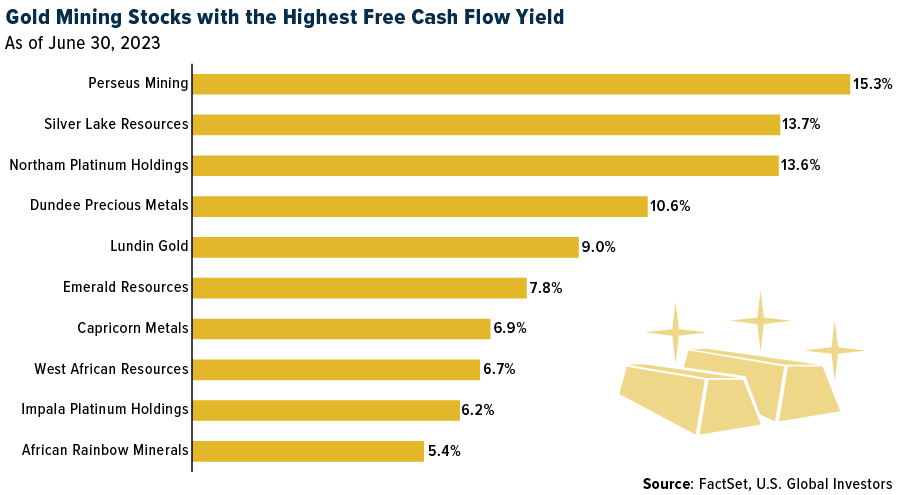

I’m also bullish on gold mining stocks, though I must urge investors to focus on high-quality, well-managed companies with strong balance sheets.

One of our favorite metrics when picking gold mining stocks is free cash flow (FCF) yield, which tells you how much free cash flow a company has relative to its market capitalization. Because explorers and producers have high operational costs and capital-intensive requirements, it’s important that they maintain healthy balance sheets.

Last month, I shared with you the top 10 gold mining stocks ranked by FCF yield, using data from the March quarter. In the chart below, I’ve updated the list for the quarter ended June 30.

Leading the pack with a FCF yield of 15.3% is Australia-based Perseus Mining, which operates three gold mines in Africa. The company reported a strong June quarter in terms of cash generation, with a net increase of $51 million in its overall cash position, taking into account cash, bullion and interest-bearing debt. At quarter-end, Perseus held $484 million in cash and physical gold, against a market cap of approximately $1.5 billion.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. Purchasing power parity is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries’ currencies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2023): Perseus Mining Ltd., Northam Platinum Holdings Ltd., Dundee Precious Metals Inc., Lundin Gold Inc., Emerald Resources NL, West African Resources Ltd., Impala Platinum Holdings Ltd., African Rainbow Minerals Ltd.

—

Originally Posted August 28, 2023 – The Growing Role Of BRICS On The World Stage

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.