Last week was a wild one. We sold off sharply on Monday, recovered the entire loss on Tuesday, then rallied the rest of the week, with big gains on Friday. So what do we do for an encore? How about having about a third of the S&P 500 (SPX) and about half of the NASDAQ 100 (NDX) indices report earnings over the coming five days.

Much of the analysis in this piece incorporates pricing from the options market. Options can offer powerful signals about the type of moves that traders are expecting. Remember that markets tend to use consensus analyst expectations as a guide, but options traders then try to anticipate the magnitude of potential post-earnings moves that could result under likely scenarios of a company beating or missing its earnings. Your TWS offers powerful tools to help you analyze these signals, which I’ve previously discussed in this linked article.

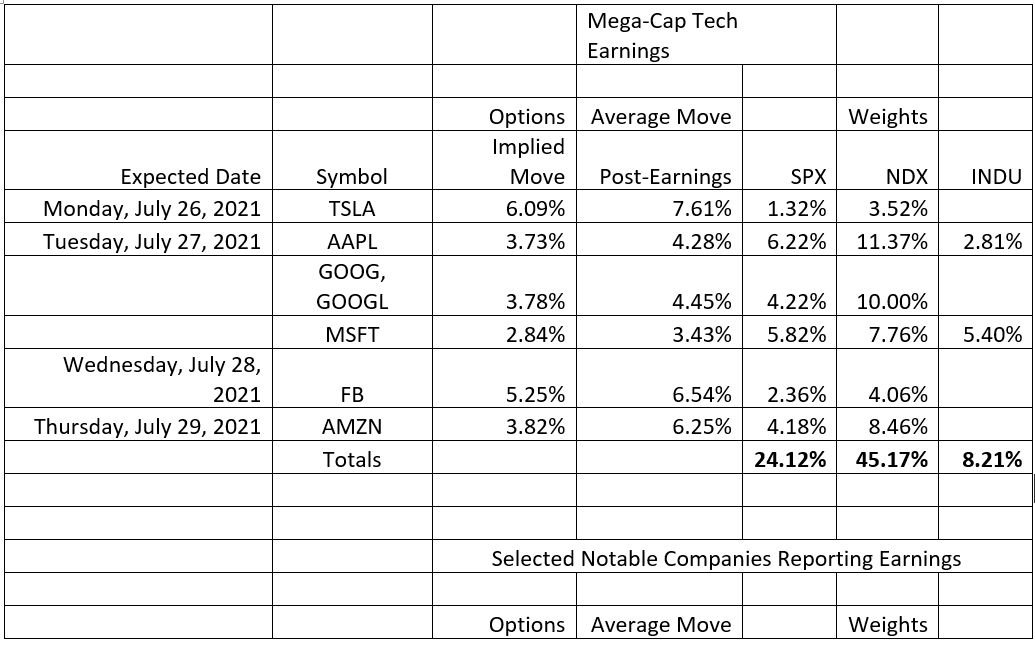

I would like to bring your attention to the following table, which contains a sampling of major companies that are scheduled to report this week, beginning with Tesla (TSLA) after today’s close and culminating with two Dow Jones Industrials (INDU) components on Friday morning:

Sources: Barron’s, Bloomberg, Interactive Brokers

Much of the attention will be focused on the names in the first section of the table. That is both logical and sensible, since we see that those six companies comprise about 25% of SPX and 45% of NDX. If any of them has a substantial move, it can’t avoid influencing the indices in which it is a major component. (That said if one moves up and another moves down simultaneously, they can cancel out each other.) I find it interesting that all the options in that section show that traders are relatively sanguine about earnings. While most of them are sporting fairly high implied volatilities around their earnings dates, all of them are below the companies’ average historical post-earnings moves.

Has the outperformance of the mega-cap tech stocks made investors complacent about their post-earnings prospects? We have seen that they have been essentially impervious to changes in economic outlook, as I wrote on Friday: “So, slower growth is good for tech stocks when it can lead to higher valuations, and faster growth is good for tech stocks because they can earn more. Heads I win, tails I win.” It will be fascinating to see whether they are similarly impervious to earnings, revenues, and expectations.

Among the stocks in the second section of the above table, which I selected somewhat arbitrarily based upon whether the companies are components of major indices and/or widely held, we see that huge sectors of the economy are relatively underweighted by SPX and NDX. This is because so much money has flowed into the leading tech shares that their market capitalizations are often magnitudes greater than key companies in other industries. Is TSLA twice as crucial to the economy as Pfizer (PFE), which holds the key to ending the Covid crisis? I’ll leave you to ponder that, while bearing in mind that TSLA has about twice the weight in SPX as PFE. (Oddly, one could argue that INDU – a measure that I typically detest – does a much better job of measuring the economic relevance of these companies than its market cap weighted cousins.)

We also see that there are far more instances of options markets pricing in potential post-earnings moves that are larger than average. That is partly because both the implied volatilities and post-earnings moves are generally lower than those of the megacap tech shares, but I would also assert that there is far less of a consensus among investors that any potential failures to meet expectations would be as easily overlooked as they might be among the tech leaders. These stocks represent a broad range of industries, not all of which have been granted saintly status by investors.

Over recent weeks we have noted some significant divergences among market subgroups that don’t necessarily bode well for markets, recent highs notwithstanding. Among others, the S&P 500 Value index (SVX) once again failed to confirm a high set by the S&P 500 Growth Index (SGX). Investors have been worshipping at the altar of growth stocks, the bigger the better. We will find out this week if that faith is being rewarded.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ