Market participants in the week ahead are set to receive updates on U.S. retail sales and consumer sentiment, as COVID-19 containment measures continue to batter the services sector and the labor market.

The services sector has faced unrelenting pressure in 2020, amid government mandates for social distancing, among other measures, designed to help prevent the spread of the deadly coronavirus. The fallout from these policies has been dramatic, including the bankruptcies of several major retailers, as well as a general deterioration in the leisure and hospitality industry and related employment conditions.

According to the latest ADP National Employment Report, a total 123k nonfarm private payrolls were shed in December from the prior month, with a little more than 85% of those losses stemming from the services sector. Unsurprisingly, leisure and hospitality bore the brunt of the pain, with 58k fewer positions over that one-month period, while another 50k private payrolls were lost in retail trade/transportation/utilities.

The data marked the first decline in the ADP private payrolls report since April 2020, as the impact from the pandemic continued to take a toll on service-providing businesses.

When Will Consumer Spending Return to ‘Normal’?

The ongoing economic devastation doesn’t appear to bode well for consumer spending as 2021 unfolds, despite a general optimism about the rollout of COVID-19 vaccines, and a resurgence of personal consumer expenditure (PCE) in the third quarter of 2020.

Real PCE had spiked 8.9% in Q3’20 from the previous quarter following a half-year of decline.

Analysts at global advisory firm Deloitte recently noted that consumer spending will “continue to feel the weight of COVID-19 and its economic impact for the next two quarters as the job market remains weak.”

While Deloitte anticipates that this pattern is likely to shift by the second half of 2021, as “rising vaccinations thwart the spread of the virus and the public health situation starts returning to normal,” a second trend, where consumers are likely to start spending more on travel, food services, and entertainment, doesn’t seem to be in the cards until 2022.

Many businesses, whose operations rely on in-person foot traffic and crowd gathering such as department stores, restaurants, hotels, and movie theaters, will most likely struggle, or perhaps even fail to survive over that period.

Digital Strategies Gain Even Greater Dominance

Although fiscal stimulus, monetary policy, and local government legislation has helped to buoy short-term economic conditions, operational sustainability in industries that rely on tourism or in-person consumerism will likely continue to face challenges, while internet-based solutions seem to garner even greater importance to business strategies.

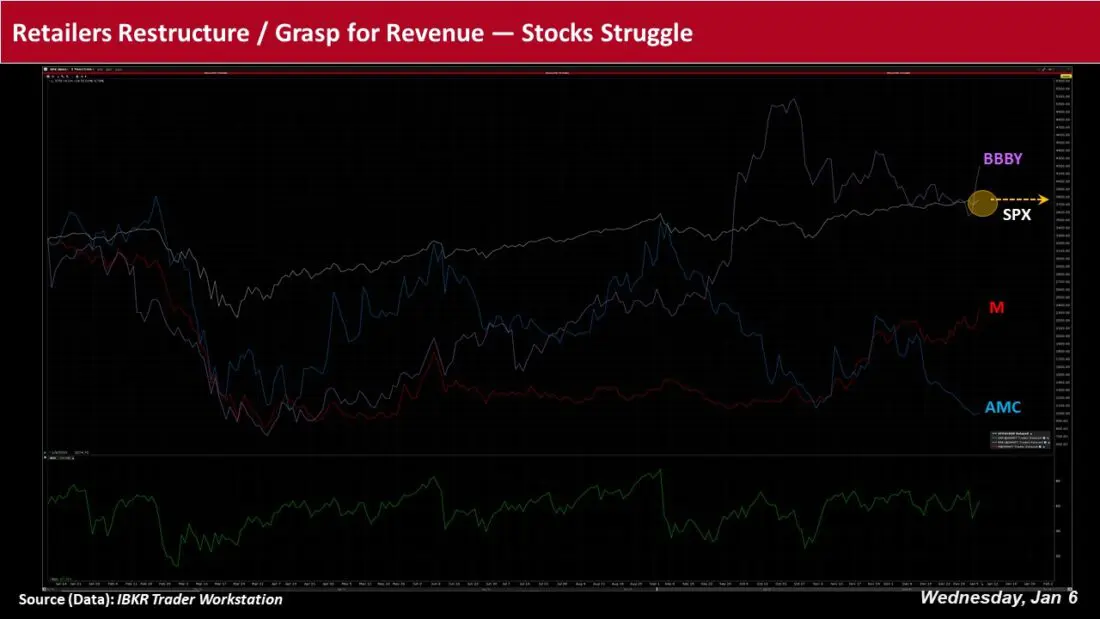

While competition from online shopping had already been spurring retailers such as Macy’s (NYSE: M) and Bed Bath & Beyond (Nasdaq: BBBY) into restructurings, including store closures and asset sales prior to the pandemic, fewer shoppers at their brick-and-mortar locations has generally led to graver conditions for these companies.

At Macy’s, for example, digital sales in the three months to October grew 27% over the third quarter 2019, while comparable sales fell 21.0%, due to continued stores recovery and growth of its digital business.

Also, Bed Bath & Beyond’s net sales fell by around 1% in its fiscal Q2’2020 over the same year-ago period to roughly $2.7 billion, partly due to its divestiture of design marketplace One Kings Lane. However, the company’s net sales from digital channels grew by about 88%, while net sales from stores fell by around 18%, compared to the prior year.

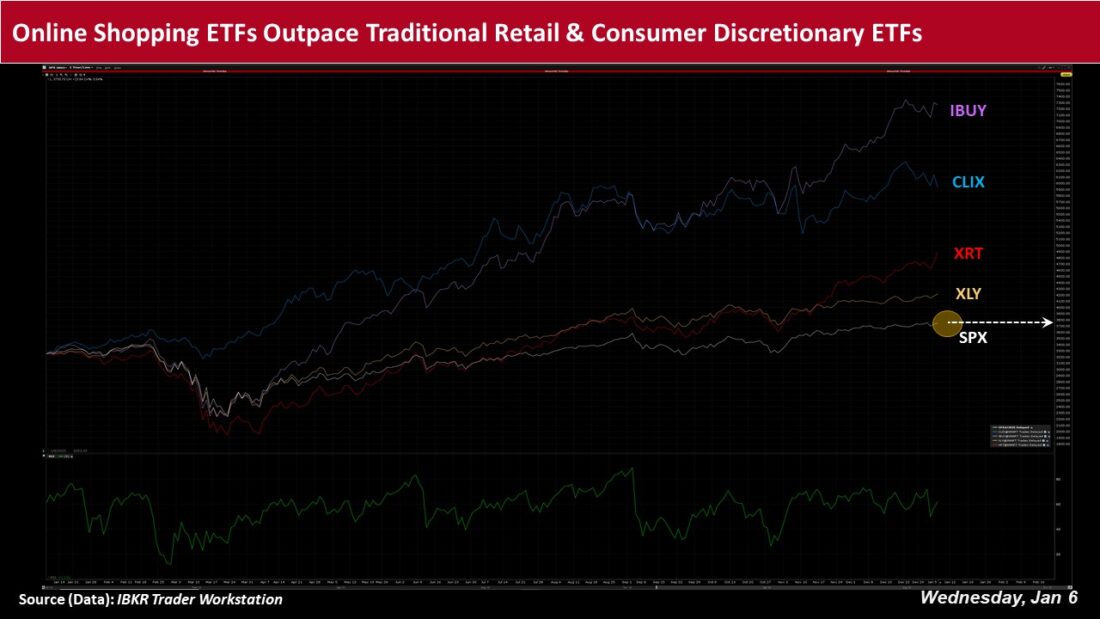

Meanwhile, equity investors in certain non-store-related retail exchange-traded funds (ETFs) have generally seen higher positive returns than those with a focus on non-internet retail.

Over the past year, exchange-traded funds (ETFs) such as industry disruptor ProShares Long Online/Short Stores ETF (NYSEARCA: CLIX), as well as the Amplify Online Retail ETF (NASDAQ: IBUY), have seen positive returns of around 90.7% and 127.2%, respectively, while the SPDR S&P Retail ETF (NYSEARCA: XRT), which is more heavily weighted toward the non-internet retail sector, has seen returns of around +45.6% over the same period.

Other companies, such as giant movie theater chain AMC Entertainment (NYSE: AMC), have taken novel steps and financial risks to keep their operations afloat.

In a bid to drive revenues, AMC in November 2020 launched private theater rentals, and has more recently secured $100 million worth of debt financing from distressed credit lender Mudrick Capital Management to bolster its short-term liquidity, as moviegoers generally ditch the box office for at-home couch-surfing.

Shares of the company have plunged from a high of $7.78 in late February 2020 to just north of $1.90 on January 5.

An Uneven Road for Retail Trade and Spending Appetite

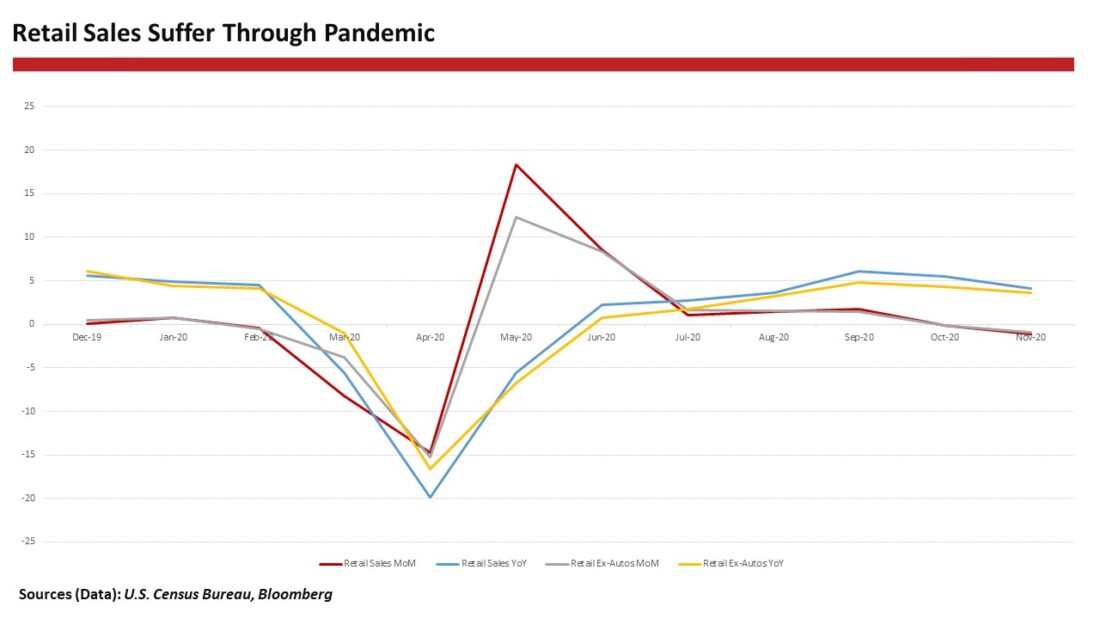

Overall, advance estimates of U.S. retail and food services sales for November 2020 amounted to $546.5 billion, a decrease of 1.1% from the previous month, with marked declines at clothing stores, as well as food services and drinking places.

The U.S. Census Bureau also reported that retail trade sales fell 0.8% in November 2020 from the previous month, but up 7.1% above the prior year – a rise that was dwarfed by non-store retailers, whose sales were up 29.2% year-on-year, and as the leisure and hospitality sector gets hammered by COVID-19-related policies, food services and drinking places plunged 17.2% from last year.

Still, some analysts wax optimistic about the growth of the U.S. economy, despite pandemic-related spending patterns. In the Federal Reserve Bank of New York’s Center for Microeconomic Data most recent Survey of Consumer Expectations, for instance, households’ year-ahead spending growth expectations rose sharply in November 2020 to 3.7%, the highest level recorded in more than 4 years.

The spike occurred despite flat income and earnings growth expectations, as well as a mixed outlook on the labor market, including deteriorating expectations about the unemployment rate and improving expectations about job security.

However, consumer spending is likely to vary by sector.

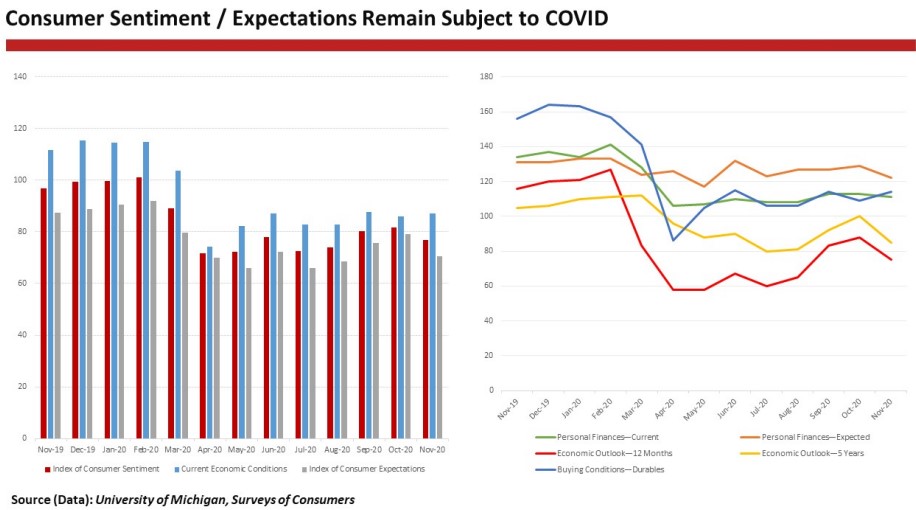

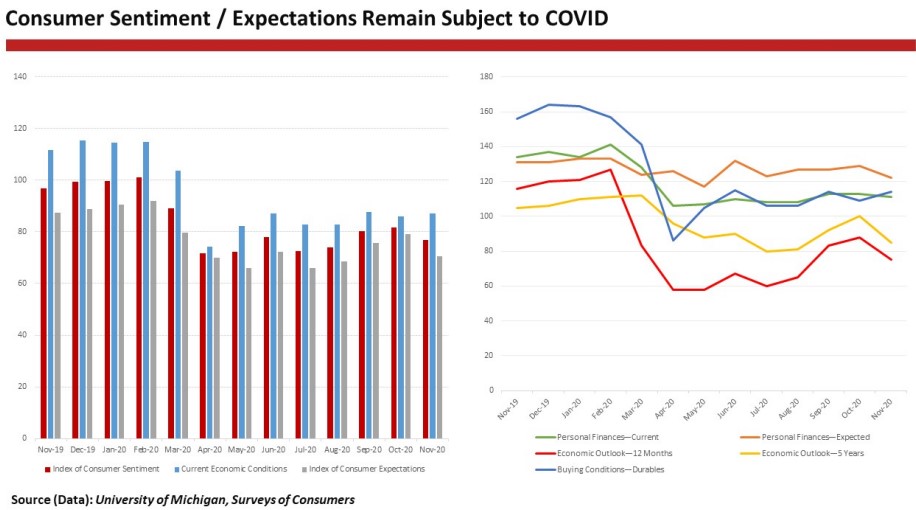

The University of Michigan’s surveys of consumers chief economist Richard Curtin observed that recent trends in prices and interest rates will impact sales differently, with homes benefitting most, followed by vehicles and household durables.

He noted that as a counter to the “favorable impact of interest rates, internet shopping will benefit purchases that can be ordered and delivered, having the most favorable impact on household durables, home furnishing, and recreation goods.”

Although there appears to be a brighter outlook for jobs as 2021 progresses, the labor market seems to face a high hurdle to recovery, amid shifts in consumer behavior and spending patterns, as well as the lingering fallout from the COVID-19 pandemic on business prosperity.

Against this backdrop, with jitters about the employment picture, and rising levels of COVID-19 infections spurring renewed government-led lockdowns, consumer spending is likely to slow, while retailers and other service providers continue to reel under the mounting pressures.

Economists surveyed by Bloomberg generally foresee another monthly decline in the December 2020 Advance Monthly Retail report (-0.1%), while expecting the preliminary January 2021 Index of Consumer Sentiment from the University of Michigan to show a slight increase from the prior month (81.0 vs 80.7).

The December 2020 Advance Monthly Retail report, and the preliminary January 2021 Index of Consumer Sentiment from the University of Michigan, are both scheduled for release on Friday, January 15, 2021.

On the Calendar:

Mon, Jan 11

- Inflation Expectations (Dec)

- U.S. Treasury Auctions

- 3-mo Bill

- 6-mo Bill

- 3-year Note

Tue, Jan 12

- NFIB Business Optimism (Dec)

- Redbook

- JOLTs (Nov)

- American Petroleum Institute (API) Crude Oil Stocks

- U.S. Treasury Auctions

- 10-year Note

Wed, Jan 13

- MBA Mortgage Applications

- U.S. Energy Information Administration (EIA) Crude Oil Stocks

- Inflation Rate (Dec)

- Fed Beige Book

- Monthly Budget Statement (Dec)

- U.S. Treasury Auctions

- 30-year Bond

Thu, Jan 14

- Initial Jobless Claims (Weekly)

- Import/Export Prices (Dec)

- U.S. Treasury Auctions

- 4-week Bill

Fri, Jan 15

- Retail Sales (Dec)

- New York Empire State Manufacturing (Jan)

- PPI (Dec)

- Industrial Production (Dec)

- CapU (Dec)

- U. Michigan Consumer Sentiment (P-Jan)

- Baker Hughes Oil Rig Count

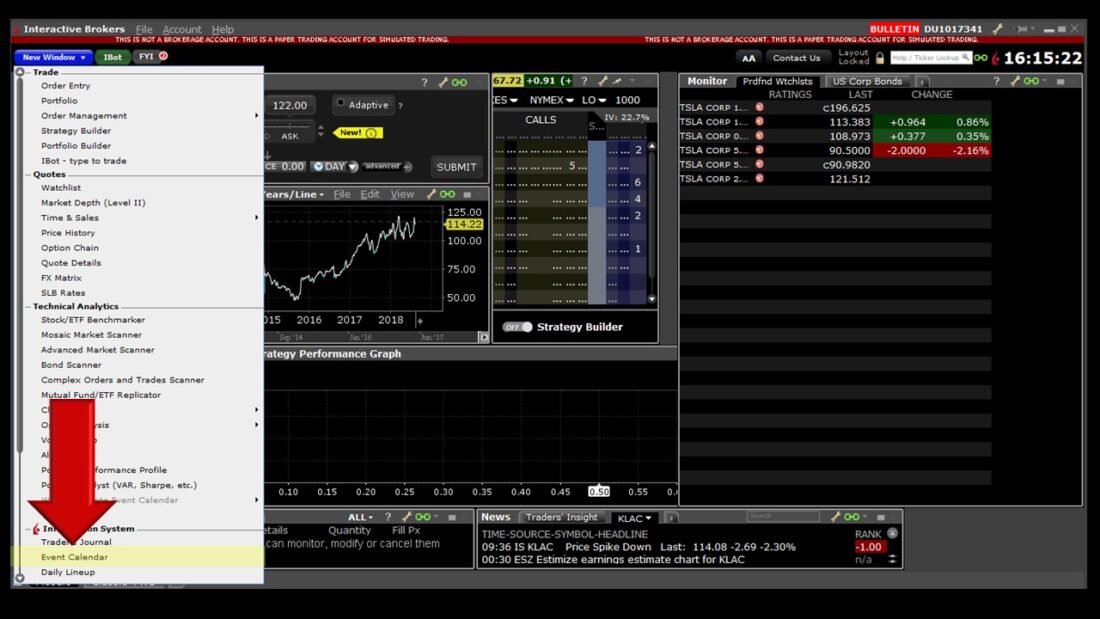

In the meantime, select the Event Calendar option in the IBKR Trader Workstation for a full list of U.S. and global corporate events and earnings, dividend schedules, economic data, IPOs and more.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.