As we opined yesterday, the FOMC meeting did indeed prove to be a consequential one. Federal Reserve Chair Powell did little to sugarcoat his message that interest rate hikes and a smaller balance sheet would be among the tools that he would be using to fight inflationary pressures.

We were largely correct about our assessment about how the market would react to the FOMC statement and the Chair’s subsequent press conference, but not 100% correct. We wrote:

“One thing that some equity investors expect is that the Fed will take the recent equity market volatility into account. Sorry, but I don’t see that happening…Furthermore, while I think that Mr. Powell will try to avoid riling investors during his press conference, there is no guarantee that he will succeed.”

While we correctly asserted that Mr. Powell would not take equity market volatility into account, he also made little effort to avoid riling investors. He made little effort to sugarcoat the medicine that he was prescribing. Both bond and stock markets were rattled. The 2-year yield, which was at 1%, which was relatively elevated compared to recent levels, moved another 15 basis points high after the meeting. The 10-year yield shot from 1.77% to about 1.87%, though yields have eased to about 1.80% right now.

Major US equity indices, which were broadly higher before the 2pm announcement, quickly gave back their gains and closed basically unchanged on the day. Today we are seeing something of a recovery, as the graph below shows:

3 Day Intraday Charts, 1 Minute Bars, SPX (red/green), NDX (blue)

Source: Interactive Brokers

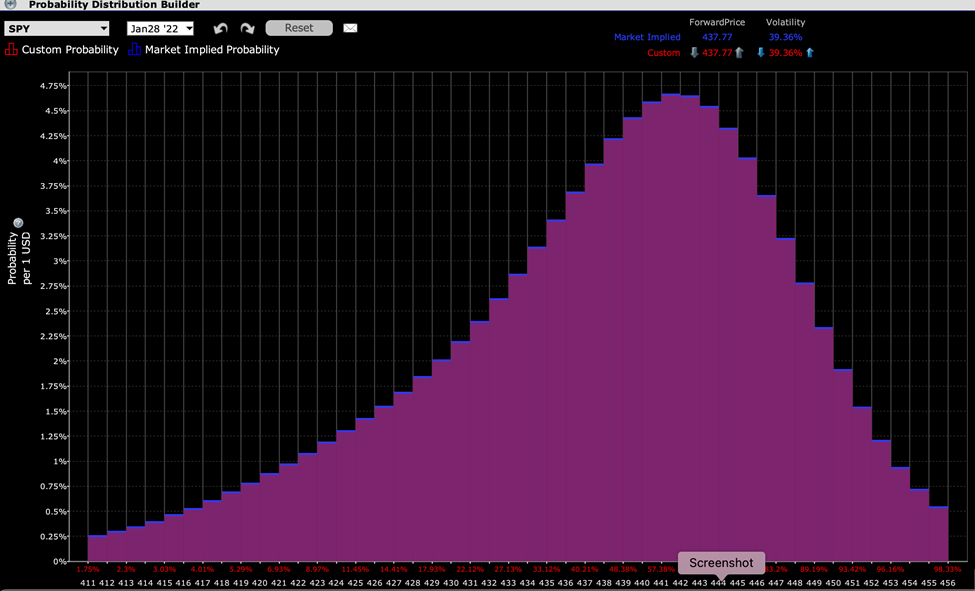

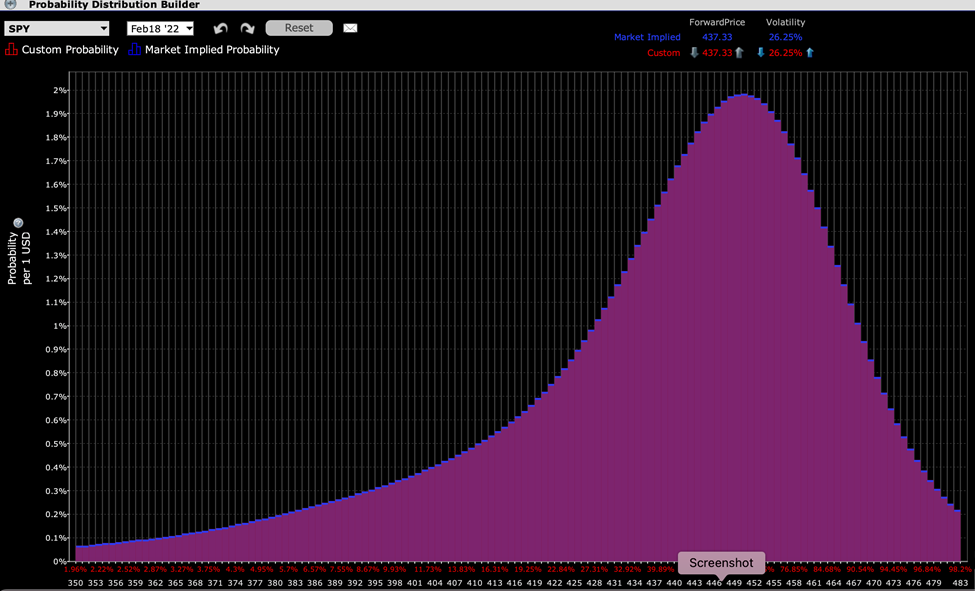

Those of us who follow options markets should not be surprised that stocks are trying to rally yet again. We noted that options traders were assigning their highest probability to a move higher this week, and we still see that enthusiasm baked into pricing. SPY options that expire tomorrow still show a probability peak about 1% above current levels, and those that expire on February 18th (regular monthly expiration) have a peak nearly 3% higher than today:

IBKR Probability Lab for SPY on 1/27/22 for options expiring 1/28/22

Source: Interactive Brokers

IBKR Probability Lab for SPY on 1/27/22 for options expiring 2/18/22

Source: Interactive Brokers

We can see that traders remain sanguine even after the recent drops – or perhaps because of them. The impulse to buy-the-dip remains hardwired into many traders and investors alike, and one can certainly assert that this year’s correction has indeed made many leading stocks, and hence key indices, cheaper on a fundamental basis.

The question for traders now is whether to trust the message of the options market or to take a contrarian view. It is not unreasonable to expect a bounce after a big decline, but speculators who utilize call options should also be aware that a steady rise in markets is usually accompanied by declines in implied volatility – especially when volatility is elevated after a drop in markets. If implied volatility declines, that mitigates the price appreciation of one’s long options positions. My gut is that some skepticism is required. While there are many reasons why stocks could or should rally over the coming days, I think that the options markets are a bit too sanguine. If you believe in being fearful when others are greedy, we are already seeing a solid helping of greed returning to options pricing – even as we have not fully reckoned with all the fear in the marketplace.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ