Let’s be real. Every meeting of the FOMC and subsequent press conference by the Federal Reserve Chair is important, but some are more important than others. Today’s meeting is potentially one of the most consequential FOMC announcements in some time.

Chair Powell has been masterful at telegraphing his intentions prior to FOMC meetings. It has become clear that he is not in the business of surprising investors. When he allows markets to discount likely Fed policies before they are publicly announced, traders can take the FOMC announcement relatively in stride, and Mr. Powell can then address reporters in a more nuanced fashion. I first termed him “Goldilocks in a Suit” in a piece last summer, and extended the analogy two weeks ago when I questioned whether he was trying to find a happy medium for investors or trying to land an airplane amidst a crisis.

Despite Mr. Powell’s rhetorical talents, it appears that investors are far more confused than normal. One way to put this is “this meeting is in play.” The Fed must toe a careful line, and it is not clear exactly what is priced into volatile markets. The Fed’s dual mandate considers stable prices and full employment. One can argue that if we’re not currently at full employment, we seem close to it; on the other hand, it is impossible to argue that we are in a stable price environment. It appears incumbent on the FOMC that they must do something to fight inflation, but there is little consensus about whether that means ending their bond purchases more abruptly than previously announced, raising rates, or a combination of both.

If they do signal a rate hike, will it be now or later, and how large and how many? According to Bloomberg, Fed Funds futures are pricing in about a 5% chance of a hike today, but near-certainty about a 25-basis point boost in March. Looking out to December, those futures are anticipating Fed Funds to rise from near-zero to 1%, or 4 hikes of 25 bp. Today’s announcement could certainly influence those expectations, along with the inflationary expectations that influence longer-term rates.

One thing that some equity investors expect is that the Fed will take the recent equity market volatility into account. Sorry, but I don’t see that happening. I know that equity investors have become accustomed to the idea of Fed accommodation in response to stock market concerns, but that is by coincidence, not design. Stock prices don’t enter into the dual mandate, and credit market conditions are the primary market concern of the Federal Reserve. It is entirely possible that the FOMC statement could be taken positively by the market, however. Furthermore, while I think that Mr. Powell will try to avoid riling investors during his press conference, there is no guarantee that he will succeed.

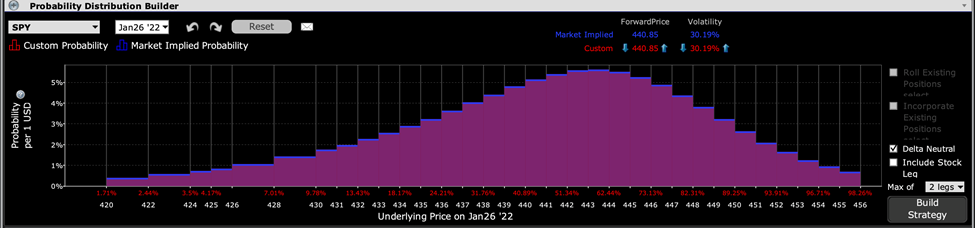

That said, options markets are pricing in a high probability of success, as evidenced by the IBKR Probability Lab:

IBKR Probability Lab for SPY on 1/26/22 for options expiring 1/26/22

Source: Interactive Brokers

IBKR Probability Lab for SPY on 1/26/22 for options expiring 1/28/22

Source: Interactive Brokers

We see that the peak probability assessments for SPY options expiring both tonight (top) and on Friday (bottom) are above the current level for that ETF – about 1% higher for this afternoon and about 2% for the end of the week. It is quite clear that the “buy the dip” mentality is firmly in place, even if a more balanced approach might be more appropriate.

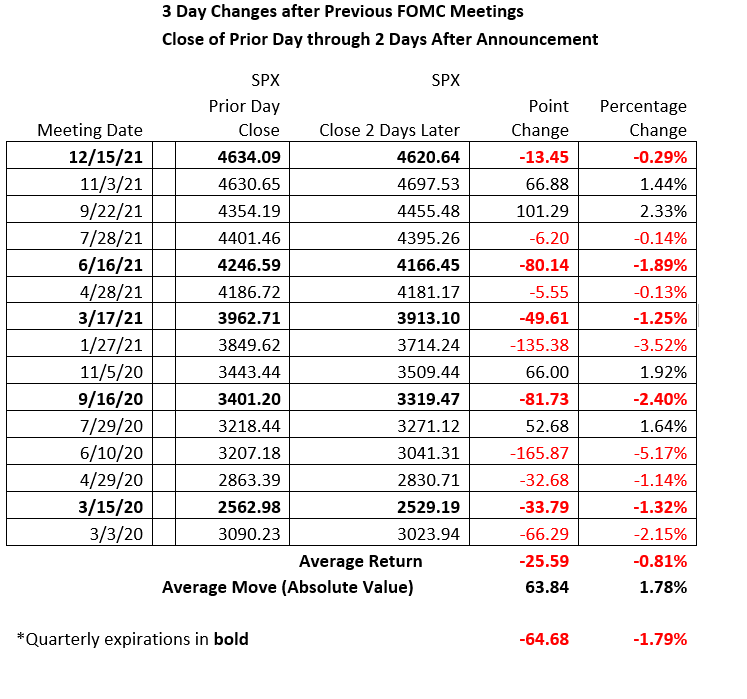

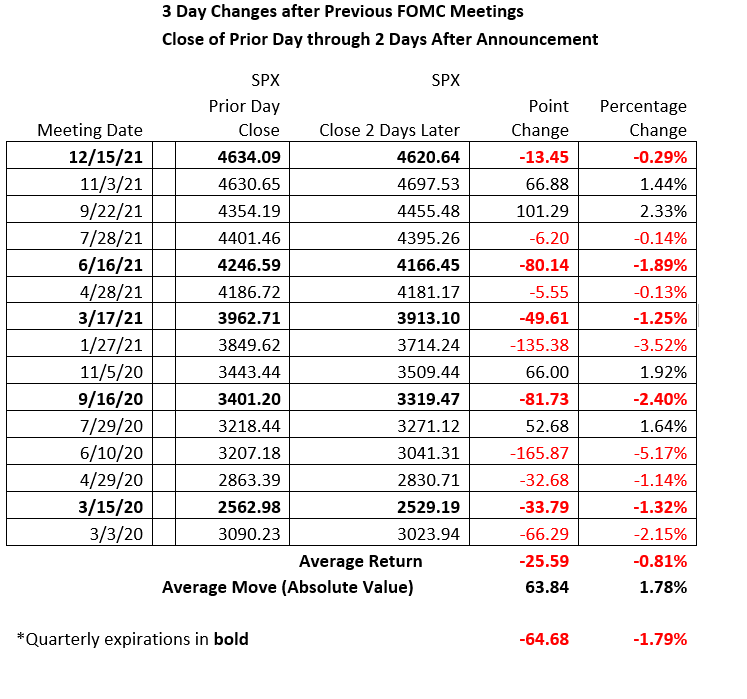

Recent history is not on the side of these options bulls, by the way. We update our customary table that shows the 3-day move from the close on the day prior to an FOMC meeting to the close 2 days later (usually Tuesday to Friday). It shows that since March 2020, when the post-Covid stimulus began in earnest, this period has been generally negative, though quarterly expirations have weighed more heavily upon the data. We will know soon enough whether the options market’s optimism is indeed warranted.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.