Equities were catching a tailwind today from this morning’s labor report depicting various disinflationary developments, including a big increase in individuals joining the job market, moderating wage pressures, a higher unemployment rate and new hires being concentrated primarily in sectors that are not economically sensitive. The data is helping to dampen concerns of further monetary policy restriction while market players ponder over the sharp rise in the unemployment rate. The confusion has already led to a green to red reversal in equities and bonds.

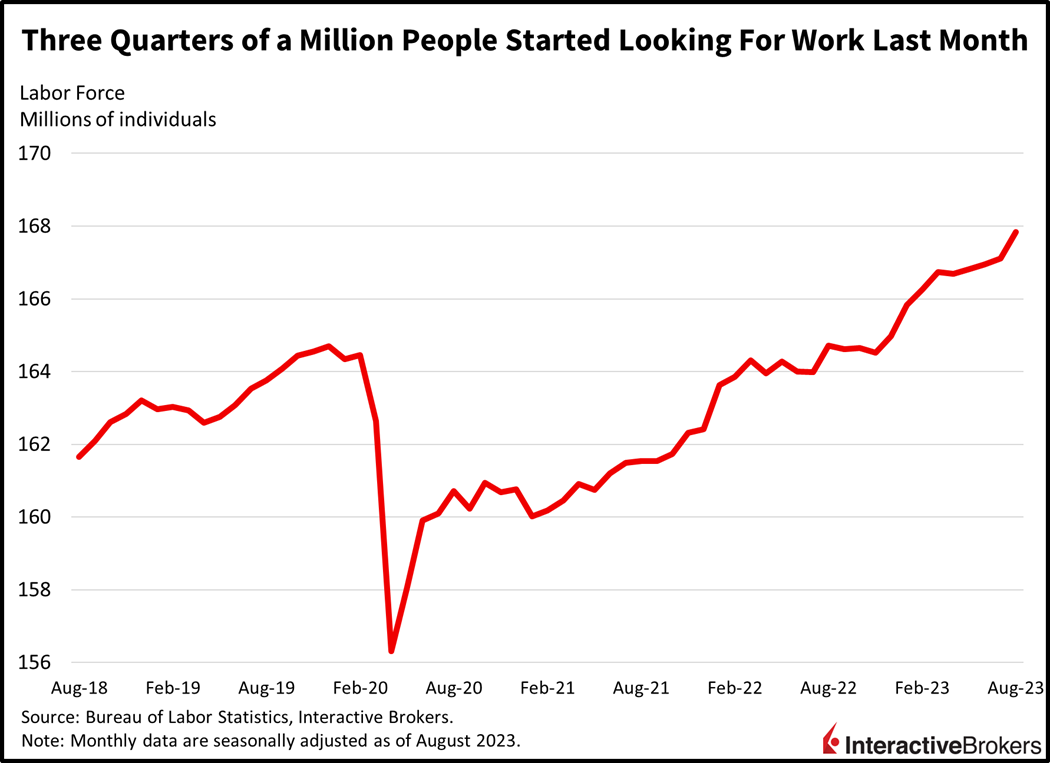

The U.S. economy added 187,000 jobs in August, exceeding the 170,000 consensus estimate and July’s downwardly revised 157,000 filled positions. Despite strong hiring, the unemployment rate rose 30 basis points (bps) to 3.8%, as the labor force welcomed a whopping 738,000 new entrants. Some were fortunate to find work in August while others endured rounds of interviews while transitioning from the status of out of the labor force to the status of unemployed. That shift contributed to the sharp rise in the unemployment rate. Having an increase in individuals rushing out to look for work can help fight inflation because the increase in job candidates can reduce wage pressures. In this case, the rise in available workers softened average hourly earnings during the month, which rose 0.2%, a tenth lower than projections and two tenths lighter than July. On a year over year (y/y) basis, earnings grew 4.3%, both a tenth lighter than estimates and from the previous month.

In a sign of significant economic slowing and similar to the ADP report from two days ago, more than half of job gains were concentrated in the non-cyclical education and health services sector, which added 102,000 jobs. The following sectors contributed the stated numbers of jobs:

- Leisure and hospitality, 40,000

- Construction, 22,000

- Professional and business services, 19,000

- Manufacturing, 16,000

- Other services, 13,000

Government, financial activities, utilities, wholesale trade, and retail trade all added below 10,000 jobs. The transportation and warehousing category was the biggest drag during the period, resulting primarily from the bankruptcy of logistics company Yellow in which 30,000 workers lost their jobs. Transportation and warehousing lost 34,200 jobs while information surrendered 15,000 positions and the mining and logging category lost 2,000.

The normalization in labor market activity characterized by a rush in new labor supply drove the labor force participation up 20 bps in August after the rate was stuck at 62.6% for five consecutive months. August’s rate of 62.8% is the highest level since the pre-pandemic reference point in February 2020 of 63.3%. With the current rate only 50 bps away from that level, the data depicts that it has become easier for businesses to cost effectively fill open positions. President Biden’s friendlier immigration policy relative to the previous administration is also contributing to a flood of new workers. While easing on pay raises, firms boosted average weekly hours from 34.3 to 34.4, matching the pre-pandemic level but lower than the cycle high of 35 reached in January 2021.

Manufacturing Continues to Weaken

ISM’s Purchasing Managers’ Index for manufacturing contracted for the tenth consecutive month. The August figure of 47.6 is an improvement from July’s 46.4 and above the forecasts of 47. Weighing most on the headline were sharp contractions in inventories, order backlogs, and foreign and domestic orders with Index scores of 44, 44.1, 46.5 and 46.8. Manufacturers kept their inventories low due to uncertain future demand while the low level of new orders compelled companies to work down backlogs and cap labor counts. Interestingly enough and adding to the cross currents, the BLS, ADP and S&P Global tallied slow growth in August manufacturing employment while ISM reported a contraction.

While none of the ISM components were above the expansion-contraction threshold of 50, production did recover from 48.3 to a neutral reading of 50, signaling no further deterioration from the prior period. Prices for goods continued to decrease amidst declining demand due to rising interest rates, front loaded pandemic orders and reduced credit availability. Supply chain improvements relative to last year are also relieving firms on the cost side.

July construction spending grew strongly on the back of strong single-family construction with a dearth of existing homes for sale. The figure rose 0.7%, higher than both the 0.6% rate from the previous month and the 0.5% anticipated. The single-family segment grew 2.8% while multi-family served as a drag, growing only 0.2% amidst a challenging commercial real estate landscape plagued by rising costs for insurance, maintenance and financing. Other challenges included higher delinquencies, elevated vacancies, declining rent growth and slim opportunities to work with lenders. Onshoring activity remained strong with construction spending for manufacturing facilities up 1.1% during the period.

Stretched Consumers Splurge on Activewear for Stretching

While many consumers struggling with higher costs of living have turned to off-price retailers for bargains, others have embraced activewear with Lululemon posting second-quarter results that defied concerns about sluggish economic growth, including in China, and exceeded the analyst consensus estimates for both revenues and profits. In the second quarter, the provider of yoga clothing and accessories saw revenue jump 61% y/y in China while sales in North America advanced 11%. Overall, the company generated a diluted earnings per share (EPS) of $2.68 compared to $2.26 for the year-ago quarter and substantially above the $2.54 expected by the analyst consensus. Its revenue of $2.21 billion climbed from $1.86 billion in the year-ago quarter and beat the $2.17 billion expected by analysts. The company also increased its revenue and earnings growth guidance to a range of 17% to 18% for both the current quarter and fiscal year 2023.

Consumers and Businesses Update Technology

Dell Technologies also reported strong profits with a second-quarter EPS of $1.74, which exceeded the consensus expectation of $1.13 and climbed from $1.68 y/y. Its revenue of $22.9 billion, however, declined 13% y/y but was up 10% quarter over quarter. The second-quarter revenue exceeded the consensus expectation by approximately $2 billion and the company’s prior sales guidance range of between $20.2 billion and $21.2 billion. Dell said both personal computer and business infrastructure sales were strong during the quarter.

Early Rally Weakens

Markets were mixed in the middle of the trading session after a bullish response when the labor data first came out. Stocks ripped higher and bond yields plunged but indices have pared gains while trying to avoid a green to red reversal like yesterday. Yields have effectively reversed across the curve except for the very short end at six-months of duration and less. Market players first focused on the higher unemployment rate and the slowdown in wages but then realized that the recent bond rally may be over its skis. For equities, technology is leading the way lower with the Nasdaq Composite Index down 0.5% while the S&P 500 tries to desperately limit losses near the 4500 battlefield. The utilities, consumer discretionary, consumer staples and communication services sectors are also lower on the session while all others are higher. We’re seeing some bear steepening with the 2- and 10-year Treasury yields up 2 and 8 bps to 4.89% and 4.19%. The dollar has also reversed from losses to gains with its index up 50 bps to 104.16 as the greenback gains against the yen, euro, pound sterling, franc and Canadian and Aussie dollars. Crude oil is rocketing higher on news that exports from Riyadh and Kuwait reached multi-year lows on the back of OPEC + supply discipline. Exports from the Kingdom fell to 5.6 million barrels per day while Kuwait’s dropped to 1.5 million, the lowest levels since March 2021 and late 2016, respectively. WTI crude is up 1.9% to $85.12 per barrel.

Employment Data Could Signal Trouble Ahead

In many cases consumers may enjoy a final spending spree before kicking off job searches, driving GDP growth sharply higher the quarter prior to it coming in negative.

Today’s data has an ominous tone when looking beyond the increase in hirings. Past recessions have been preceded by a 50 bp uptick in the unemployment rate’s low, driven in large part by more individuals deciding to enter the workforce after they have spent their savings or have suffered from inflation increasing their costs of living. In many cases consumers may enjoy a final spending spree before kicking off job searches, driving GDP growth sharply higher the quarter prior to it coming in negative. The unemployment rate is calculated by estimating the total workforce, which includes both out-of-work individuals seeking employment and employed individuals. The percentage of unemployed individuals within the workforce then becomes the unemployment rate. As inflation and other factors push people to seek work and the workforce expands, the unemployment rate increases because some of the new workforce entrants won’t find employment. This increase in individuals seeking work signals weakening consumer spending clout and points toward negative GDP growth in future quarters.

Visit Traders’ Academy to Learn More Payroll Employment, ISM Manufacturing, Construction Spending and Other Economic Indicators.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.