On the eve of a pivotal Jackson Hole presentation by Federal Reserve Chairman Jerome Powell, unemployment claims continue to point to a business community that wants to continue expanding despite tighter monetary policy. Equities were higher following stellar earnings from Nvidia, but they have violently reversed as market players recall last year’s Jackson Hole nightmare. Yields are inching up meanwhile as investors elevate the probabilities of another Fed interest rate hike.

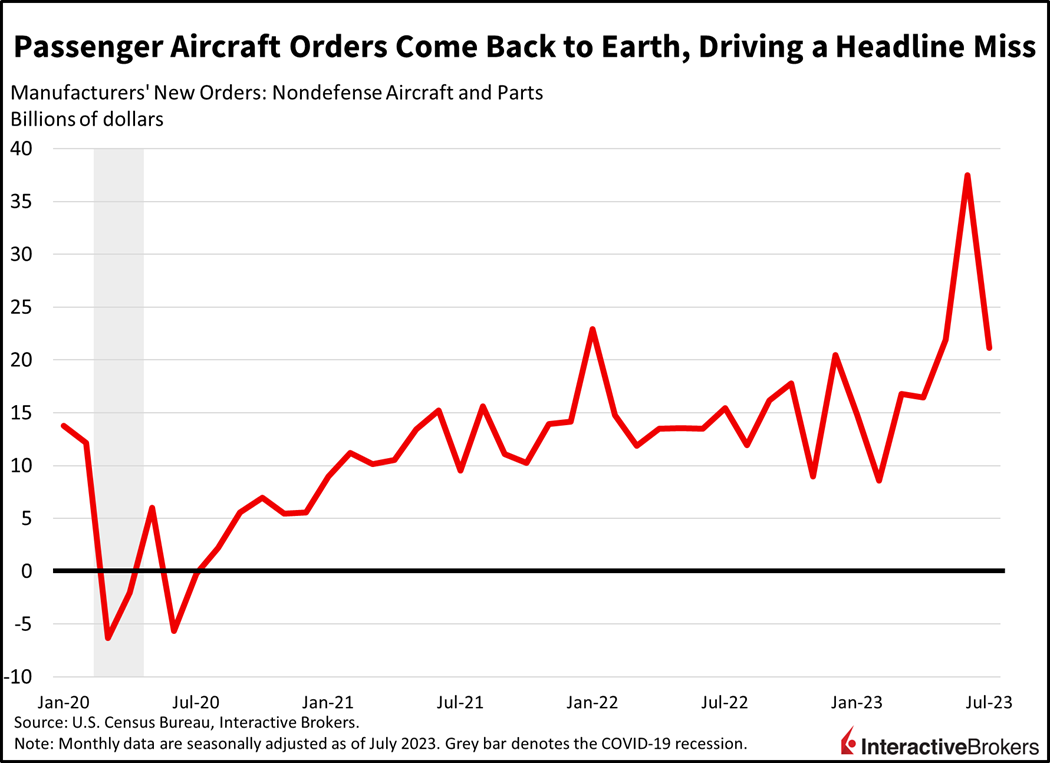

This morning’s Durable Goods Orders report and Unemployment Claims data depict persistent labor market tightness even as demand for goods weakens. July Durable Goods orders declined 5.2% month-over-month (m/m), the sharpest decline since the pandemic era’s 19.3% fall in April 2020. July’s headline figure fell below projections of a 4% decline and erased slightly more than all of June’s 4.4% gain. The weakness was concentrated in passenger aircraft, however, with overall durable goods orders rising 0.5% when excluding transportation. Following strong growth of 71.1% in June and 33.4% in May, aircraft order volumes came back to Earth in July.

Some of the aspects of the durable goods report weren’t as dismal as the headline number implies with the following categories expanding:

- Defense capital goods, up 2.5%

- Communication equipment, up 1.2%

- Machinery, up 1.1%

- Electrical equipment and appliances, up 1.0%

- Motor vehicles, up 0.8%

- Fabricated metal products, up 0.7%

Help Wanted

In a sign of labor market tightness that may embolden Powell’s Fed, unemployment claims totaled 230,000 during the week ended August 19, much softer than estimates calling for an unchanged 240,000 from the previous week. The four-week moving average of 236,750 did tick higher, however, but it remains well below the yearly high of 256,750 from the week ended June 24. Continuing claims came in at 1.702 million for the week ended August 12, below expectations of 1.708 and softer than the previous week’s 1.711.

Artificial Intelligence Generates Optimism

The labor market isn’t the only portion of the economy to shrug off the Fed’s aggressive monetary policy tightening with Nvidia this morning providing a strong forecast for artificial intelligence semiconductors that is fueling optimism about the potential for the technology to grow rapidly and support the overall computing industry. The retail sector, however, is continuing to illustrate that consumers are focused on finding bargains as inflation increases their living expenses. The following points illustrate these themes:

- Nvidia yesterday said it anticipates sales in its quarter ending in October to reach $16 billion, while analysts had forecasted $12.5 billion. Nvidia Chief Executive Officer Jensen Huang believes a new era in computing has started as the growing use of chatbots and other AI services is creating strong demand for powerful semiconductors. Revenue during for Nvidia’s quarter ended July 30 doubled to $13.5 billion, supporting an earnings per share (EPS) of $2.70 while the analyst consensus prediction was for $11 billion in revenues and an EPS of $2.07.

- Dollar Tree and Burlington Stores said they have benefited from inflation-weary consumers seeking bargains at off-price retailers. While Dollar Tree’s guidance disappointed investors, its Dollar Tree branded same-store sales climbed 7.8% and its Family Dollar store sales climbed 5.8%. The company said it is capturing market share as consumers stung by higher living expenses turn to off-price retailers. Burlington Stores reported same-store sales growth of 4% while its total sales climbed 9% for the second quarter. It forecasted total sales to increase between 13% and 15% year-over-year during the third quarter while comparable same store sales will climb between 5% and 7%.

Meanwhile, weak orders for aircraft in today’s Durable Goods data were accompanied by another glitch with Boeing’s 737 airliner that will delay deliveries of the aircraft. Fastener holes in aft pressure bulkheads on certain planes were drilled incorrectly, an issue which Boeing maintains does not impact aircraft airworthiness. Inspections and reworking of planes that have the issue will delay final deliveries. The 737 Max has a turbulent history with the aircraft’s Maneuvering Characteristics Augmentation System causing two crashes by automatically sending aircraft into nosedives. In response to the 737 Max design issue, the Federal Aviation Administration had previously grounded the aircraft for 20 months.

Investors Hope to Avoid Repeat of Jackson Hole 2022

Market players are cautiously awaiting tomorrow’s Jackson Hole presentation while praying that the event doesn’t serve as a déjà vu by sparking volatility.

Market players are cautiously awaiting tomorrow’s Jackson Hole presentation while praying that the event doesn’t serve as a déjà vu by sparking volatility. During last year’s Jackson Hole meeting, Powell increased his emphasis on fighting inflation and opined that below trend economic growth is needed to curtail price gains. The presentation is clearly on everyone’s mind, with equities pulling a green to red reversal this morning. Excitement about Nvidia’s earnings quickly tilted to a focus on the potential of a hawkish Powell with the Nasdaq Composite Index going from up 1% to down 1%. Tech and semiconductors more specifically are leading the decline amidst a broad move lower. Meanwhile, materials, financials, utilities and real estate are the only sectors higher. Bond yields and the dollar are higher, with this morning’s labor data supporting a firm Fed. The 2- and 10-year Treasury maturities are up 2 basis points (bps) each to 5.0% and 4.22% while the Dollar Index is up 32 bps to 103.69. Energy markets are softer this morning on reports that the U.S. is approaching a softening of Venezuelan sanctions which would bring more supply online. WTI crude is down 0.1% or $0.8 cents a barrel to $78.40.

Fed is Likely to Send Hawkish Message

Powell and his fellow policymakers are unlikely to be satisfied with the underlying price and labor pressures in the current economy. Powell has previously emphasized that reaching the Fed’s 2% inflation target will likely require the resilient and tight job market to soften via the job opening channel. The Fed, however, is facing a business community that is willing to accept lower margins in exchange for continuing to generate revenues, which means companies are fighting the central bank by holding on to employees, which is supporting tight labor conditions. As we have seen throughout the Fed’s battle against price increases, inflation’s strength has frequently alternated between strong, moderate and weak while even modestly dovish commentary by Powell have caused the central bank to lose ground. Additionally, services inflation is strong and commodities prices are volatile on a month-to-month basis. With those points in mind, Powell is likely to warn of additional rate hikes or a long pause even as goods experience deflation.

Visit Traders’ Academy to Learn More about Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.