Markets are uneventful today on light holiday volume. Economic data detailing unemployment claims, pending home sales, retail inventories and international goods trade failed to influence investor sentiment. Stocks are up slightly while bonds are selling off marginally as interest rates bounce.

Unemployment Lines Extend

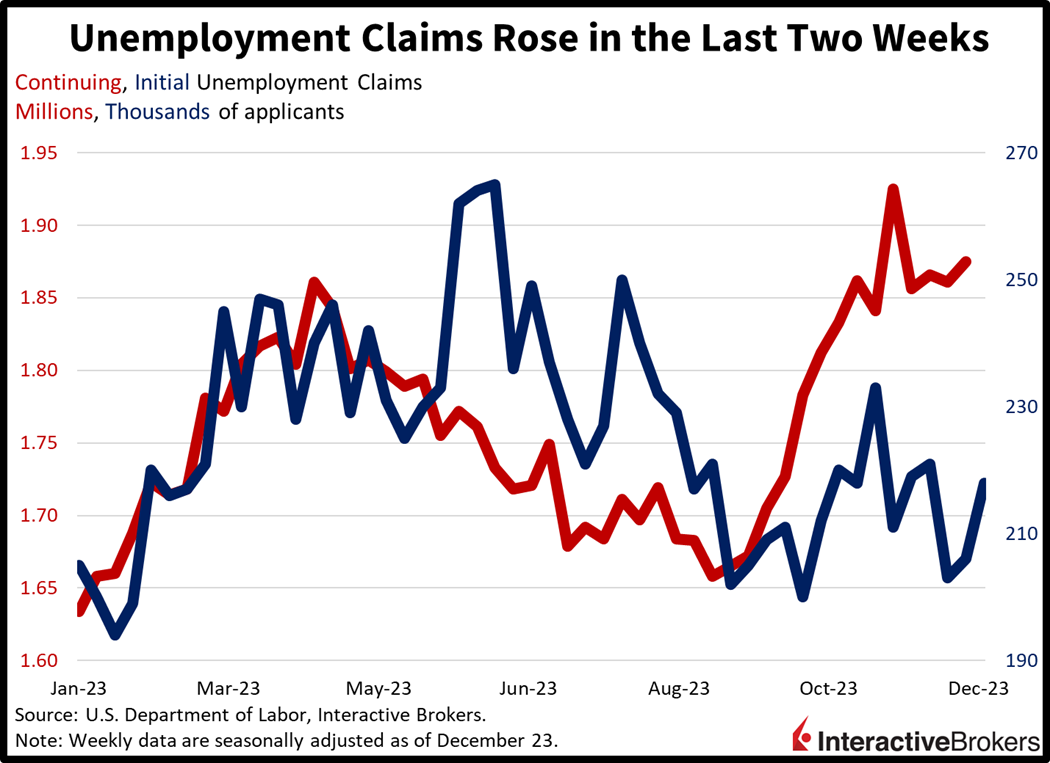

The labor market loosened in the last two weeks, as unemployment offices experienced higher traffic volumes. Initial unemployment claims totaled 218,000 during the week ended December 23, above the previous week’s 206,000 and exceeding the 210,000 projected. The four-week moving average did slip slightly, however, from 212,250 to 212,000. Continuing unemployment claims rose to 1.875 million during the period ended December 16, meanwhile, exactly as expected. The previous week’s figure came in at 1.861 million. Similar to initial claims, the four-week moving average for continuing claims dipped despite the increase in the weekly figure. The moving average declined from 1.877 million to 1.865 during the period.

Light Inventory Hampering Pending Home Sales

Softer mortgage rates couldn’t offset the tight supply story for the residential real estate sector last month, according to one data point. Pending home sales came in unchanged during November, despite economists anticipating a 1% month-over-month (m/m) pace of growth. November’s figure did arrive better than October’s 1.2% decline, however. Across regions, the West, Midwest and Northeast offered gains of 4.2%, 0.8% and 0.5% m/m. Unfortunately, a 2.3% decline in the South hampered progress.

Goods Sellers Trim Inventories

Persistent weakness in manufacturing led to both wholesalers and retailers decreasing their inventories last month. The retail inventory segment excluding automobiles declined 0.8% m/m, slipping at a slower rate than October’s 1.1%. Wholesalers saw their inventories drop 0.2% m/m, also a lighter rate of decline from October’s 0.4% fall.

From a trade deficit angle, the US’s goods trade balance dropped to $90.27 billion in November from $89.56 billion in October.

Markets Trade on Light Volumes

Markets are sluggish on light volume with most stock indices modestly higher, rates up and the dollar lower. For stocks, the Dow Jones, Nasdaq Composite and S&P 500 indices are up 0.1% each. The small-cap Russell 2000 Index is lagging, however: it’s down 0.3%. Sector breadth is mixed, as health care, communication services, utilities, financials and consumer staples trade higher while the other 6 segments are lower. Energy stocks are leading the downside, as the price of oil buckles on improving conditions near the Suez Canal; they’re down 0.9% as a group. Maersk, France’s CMA CGM and other large shipping companies are comfortable transporting products through the Red Sea at the moment. WTI crude oil is down 0.3%, or $0.22, to $73.56 on the news. The 2- and 10-year Treasury maturities are trading at 4.27% and 3.82%, 3 and 2 basis points (bps) higher on the session. The Dollar Index is down 2 bps to 100.94, as the US currency loses ground relative to the franc, yuan, yen and Aussie and Canadian dollars. The greenback is gaining against the euro and pound sterling though.

Valuation is Dangerous Here

As we shift into 2024, the main risk to this market is valuation. I believe inflation (CPI) has troughed at 3% alongside bond yields at the long-end, which make the current valuation proposition unattractive and outright risky. A forward earnings yield of 5% (Forward P/E of 20) is too much to pay, considering that earnings estimates will be tough to achieve amidst a 10-year that is going back above 4%. Indeed, to meet earnings expectations, companies will have to trim labor, scale down operations and focus on margins due to revenue headwinds, activities that don’t promote longer-term growth. Next year is a down year, with the S&P 500 finishing at 4,100, on slower consumer demand, excessive optimism concerning Fed rate cuts and deficit fueled, higher-for-ever long-term interest rates.

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

You cannot continue to pump up the economy with more debt. Tough times ahead.

thank you for speaking the truth and for pointing out that the SPX could go lower…

Hope for a big drop, we haven’t gotten on the train yet.

EPS survived this year, especially in the second half, because of the cost-cutting approach by companies, and not due to revenue expansion or margins. This cannot continue for long, especially since the Fed is adamant about keeping rates higher for longer. Although the stock market is not the economy, it doesn’t mean it will not fluctuate between highs and lows, and sideways. At the current moment, it’s pricing in rate cuts in the second half of next year, 75 basis points. But the elephant in the room is corporate debt maturity. Therefore, the corporate debt issuance coming up in the year ahead and the year after will surely increase financing costs further, like the interest expenses from debt.

Do you mean VALUE is in danger?

Tell me, what time and when does the terminal open?

Hello, thank you for reaching out. You can view this website for more information about Trading Hours: https://www.interactivebrokers.com/en/?f=%2Fen%2Ftrading%2Ftrading-hours.php#:~:text=Regular%20Trading%20Hours,-Regular%20Trading%20Hours&text=For%20example%2C%20the%20Regular%20Trading,EST%20%E2%80%93%2020%3A00%20EST. Please reach back out if you have any more questions. We are here to help!

Ok someone was tampering with my computer and messed up my password to my account so I will give you a new user name and could you send me a new password for this the user name is. As follows. Nottettingthrough could you send me a new password for this account please

Hello, thank you for reaching out. For account security reasons, we require clients who are experiencing login issues to call Client Services. You can find the hours of operation for phone support in your area here: http://spr.ly/IBKR_ClientServicesCampus Please note, IBKR does not reset passwords, provide usernames or unlock accounts via e-mail or chat for account security reasons. Thank you for understanding.