Following a trip to Santiago, the Antofagasta region of northern Chile, and Buenos Aires, where we met with 13 companies, government officials, mining consultants and visited SQM’s Salar de Atacama lithium mine and processing plant, we walked away cautiously optimistic for three major reasons: 1) The region’s exposure to the electrification trend 2) The political pendulum swinging from the left towards the center and 3) Monetary policy easing in Chile.

Key Takeaways

- The Southern Cone is home to abundant natural resources, including vast lithium deposits, which appear poised to benefit from likely long-term tailwinds such as greater electric vehicle adoption and technological advancements in lithium extraction.

- Market-friendly political reforms could gain traction in the region, as some recent developments have suggested that the political landscape is shifting toward the center from the left. Argentina has a presidential election scheduled for later this year, which could be a pivotal moment for the country.

- Near term, Chile may benefit from declining interest rates, while ample low-hanging fruit in the form of fiscal adjustments and labor reforms could unlock significant domestic growth in Argentina.

“Green” Metal Opportunity

The global push towards electrification remains a powerful tailwind for green metals, specifically lithium, with demand having the potential to grow over 6x by 2030.1 This is expected to be mainly driven by increasing electric vehicle (EV) adoption, as EV’s share of new passenger vehicle sales is anticipated to grow from roughly 20% in 2022 to over 60% by 2030.2 The Southern Cone’s vast natural resource base may well position the region to be an outsized beneficiary. Chile, Argentina, and Bolivia are home to the lithium triangle, the world’s largest lithium deposit, which holds over 50% of the world’s reserves.3 Most of the region’s reserves also consist of lithium-dense brines, which have historically been more cost efficient than hard rock. Chile could also stand to benefit from an acceleration in copper demand from the electrification trend, with the average battery electric vehicle containing nearly 4x more of the metal than a traditional internal combustion engine vehicle.4 Although we recognize this demand boost will likely be less of a driver for copper than lithium, due to the metal’s more diverse set of end uses, the energy transition could help support prices for the commodity, which amounted to over 14% of the Chile’s exports in 2022.5

Regional Lithium Market Share to Increase?

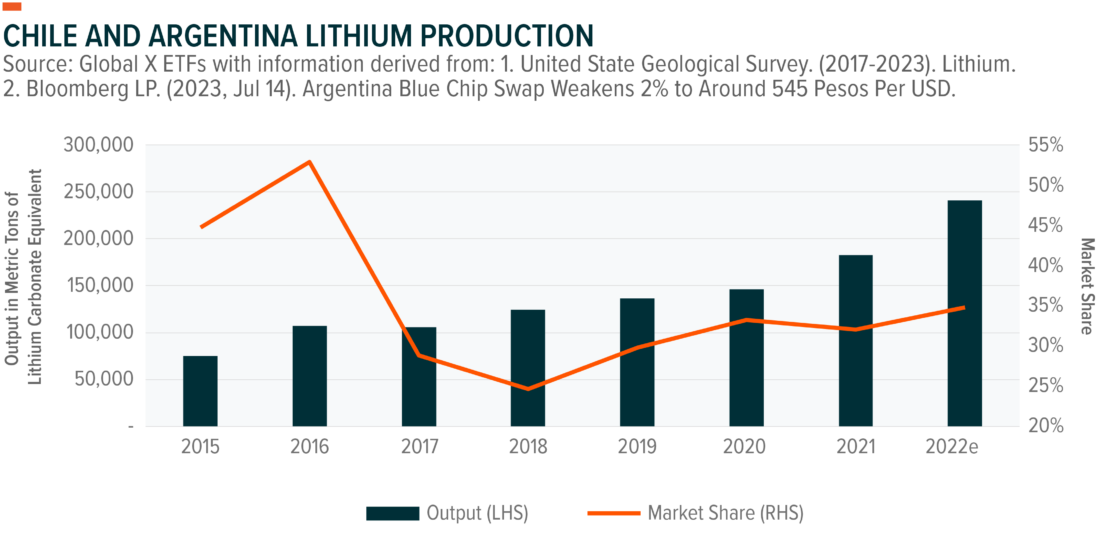

After talking with industry experts and local operators in Chile, we came away with a more positive view on President Boric’s new lithium strategy, seeing it mischaracterized by many as a “nationalization.” Chile’s lithium reserves were designated as a “strategic resource” in 1979, significantly restricting the country’s ability to ramp up production in recent years. This regulation and red tape contributed to the country’s significant market-share loss in the global lithium market, which fell from 45% in 2015 to 32% in 2021.6 We see the new strategy providing a path to a mutually beneficial outcome, potentially leading to Chile increasing its output quicker, while the government remained adamant it will respect existing contracts. In Argentina, regulation has been less of an impediment on the industry, with 38 lithium projects currently under development.7 However, we do see a market-friendly election outcome being a likely catalyst to drive further foreign direct investment (FDI) and provide potential upside to the country’s longer-term output. We see the timing of these developments as keys for the region to capitalize on the energy transition, as the current elevated lithium price environment will probably help further drive capital to the region. The Southern Cone is also set to move up the value chain, with Chile recently announcing an agreement with Chinese EV maker BYD to build a lithium battery cathode factory in the country.8

Other Lithium Market Factors

Beyond electric vehicle penetration, we see technological innovation and operational expertise playing major roles in the future of the lithium market. In terms of new technology, direct lithium extraction (DLE) appears to present a large opportunity but will likely take time to implement at scale. Battery recycling could accelerate towards the later part of this decade, but we don’t expect this to materially alter the supply/demand balance in the short term. Sodium-ion batteries could marginally cannibalize lithium demand on the stationary storage side, but this is expected to eventually accelerate the infrastructure buildout, likely unlocking increased demand for EVs. We also came away from the trip with a greater appreciation of the difficulty in lithium extraction, as well as the importance of experience and expertise in the development of new projects, differentiating high-quality operators such as Chile’s SQM.

Political Risk Improving?

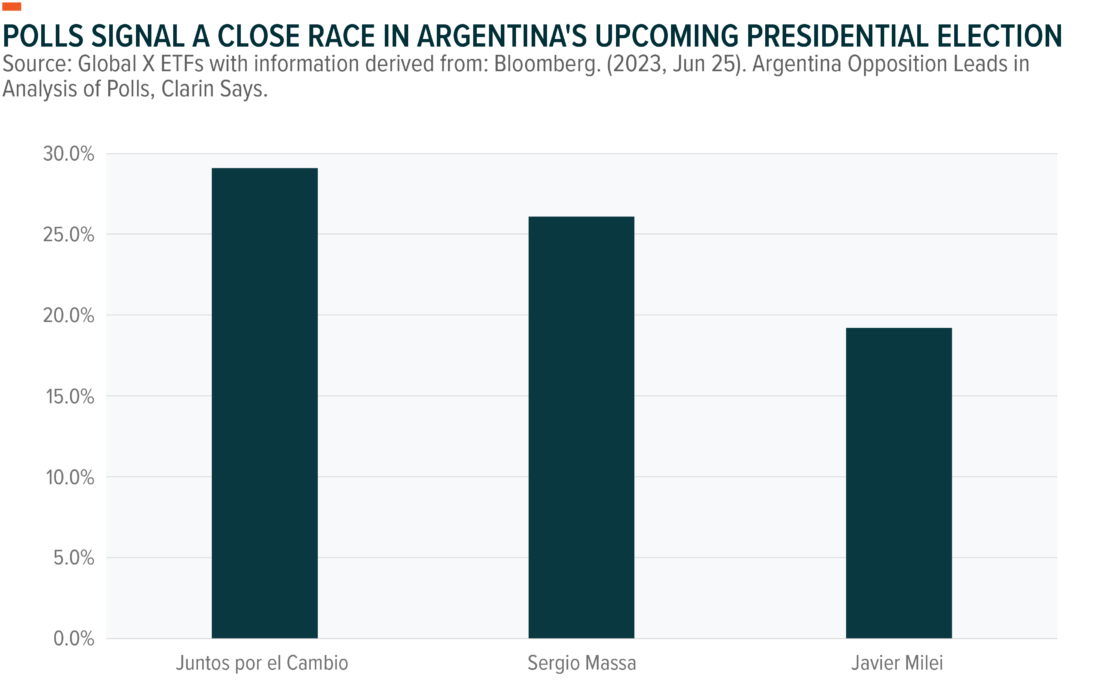

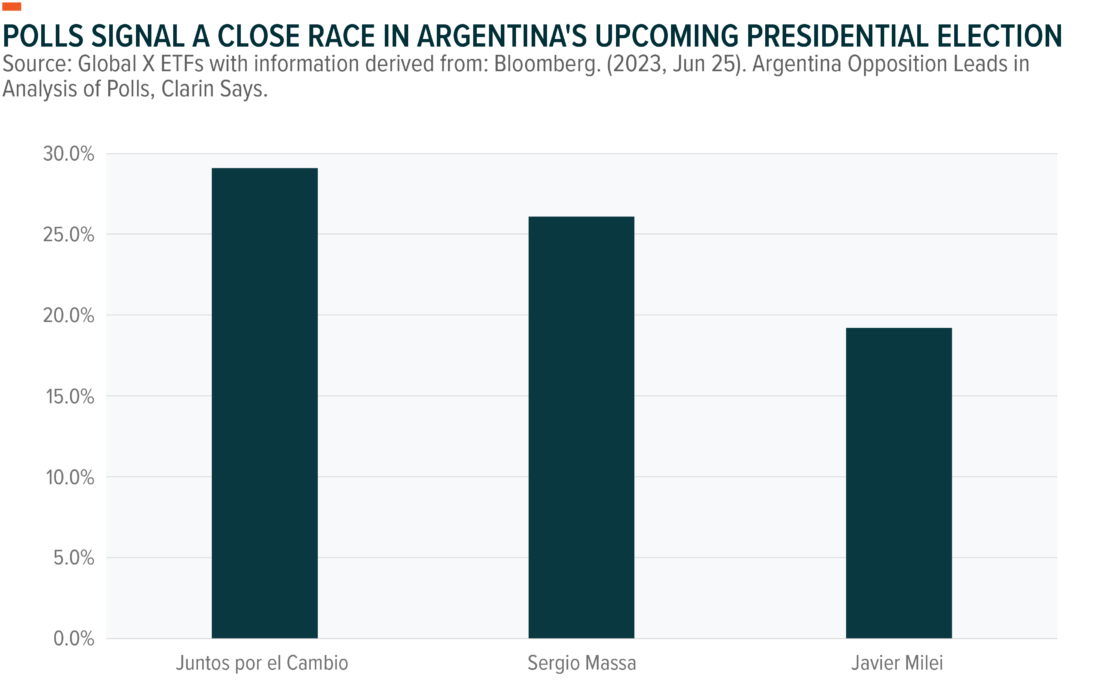

Argentina’s upcoming Presidential election represents a potential turning point for the country. The market-friendly and center-right Juntos por el Cambio coalition is currently seen as the favorite despite not yet naming a single candidate.9 The two candidates running are Patricia Bullrich, the former Minister of Security, and Horacio Larreta, the current mayor of Buenos Aires. They both are considered market-friendly, with expectations that they would implement reforms and return to economic orthodoxy. Current Finance Minister Sergio Massa was recently named as the candidate for the incumbent Union por la Patria (formerly Frente de Todos) coalition. Massa is considered more market-friendly than alternative “Kirchnerist” candidates, de-risking the downside outcome. The final candidate is Javier Milei, the leader and founder of the La Libertad Avanza coalition. His ideas are characterized as Libertarian, campaigning on the promise to dollarize the economy and abolish the Central Bank.10 Talking to individuals on the ground, we got a sense of frustration with the nation’s politics. This has led to a growing disengagement with the electoral process, made evident by growing voter absenteeism. The most recent election polls continue to signal a close race, with the primaries taking place in August.11 Given Argentina’s long-standing rule under Peronist leaders, we see a potential change in political ideology as transformational for the country’s outlook. This could include reining in spending, allowing for a free-floating currency, reducing or eliminating import controls, allowing for increased International Monetary Fund (IMF) cooperation, and/or generally boosting investor confidence, which could in turn attract capital and potentially result in the country regaining its Emerging Market designation.

Chilean politics have been surprisingly returning to the center since the election of leftist President Boric in late 2021. This was made clear by the population emphatically rejecting the radical proposed constitution in 2022 and after Boric’s Frente Amplio coalition lost control of the congress in the most recent elections.12 These events offered clarity over the future of policy, likely placing Chilean politics in a state of gridlock until the 2025 Presidential election and in turn reducing the country risk premium. From our conversations, most Chileans don’t support Boric’s more extreme policies and prefer the status-quo of previous administrations. Looking ahead, the main political headlines are expected to revolve around the new watered-down constitutional proposal, as well as the Boric Administration’s new “Lithium Strategy” and subsequent Salar de Atacama contract negotiations.

Diverging Short-Term Economic Outlooks, Long-Term Potential

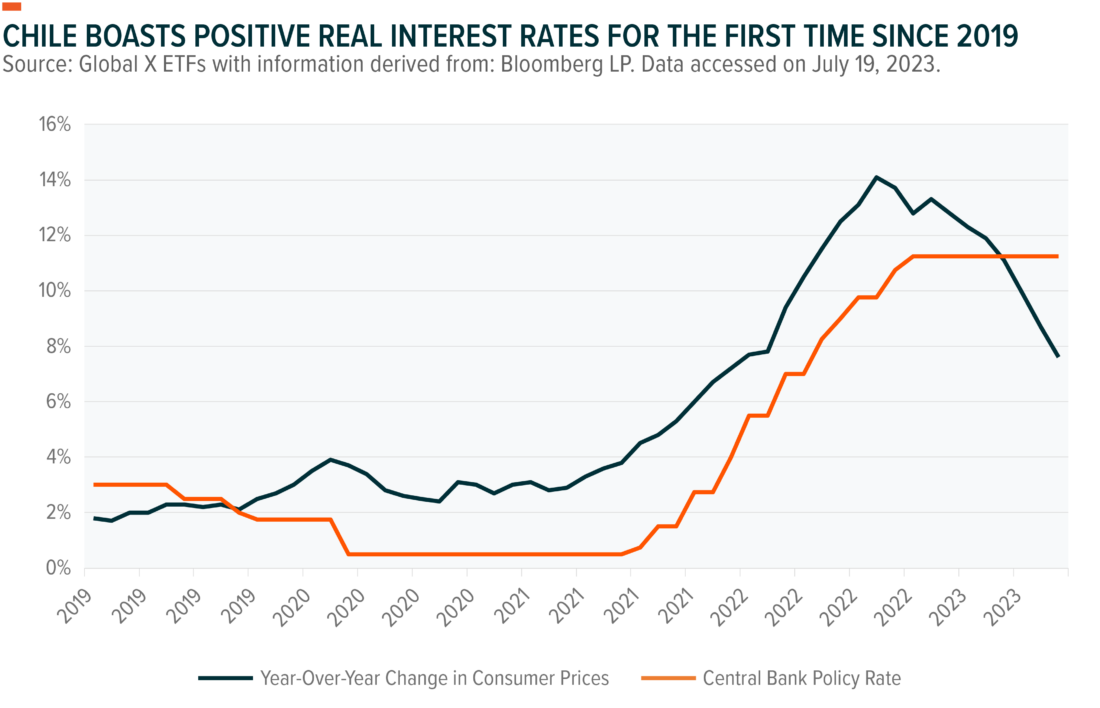

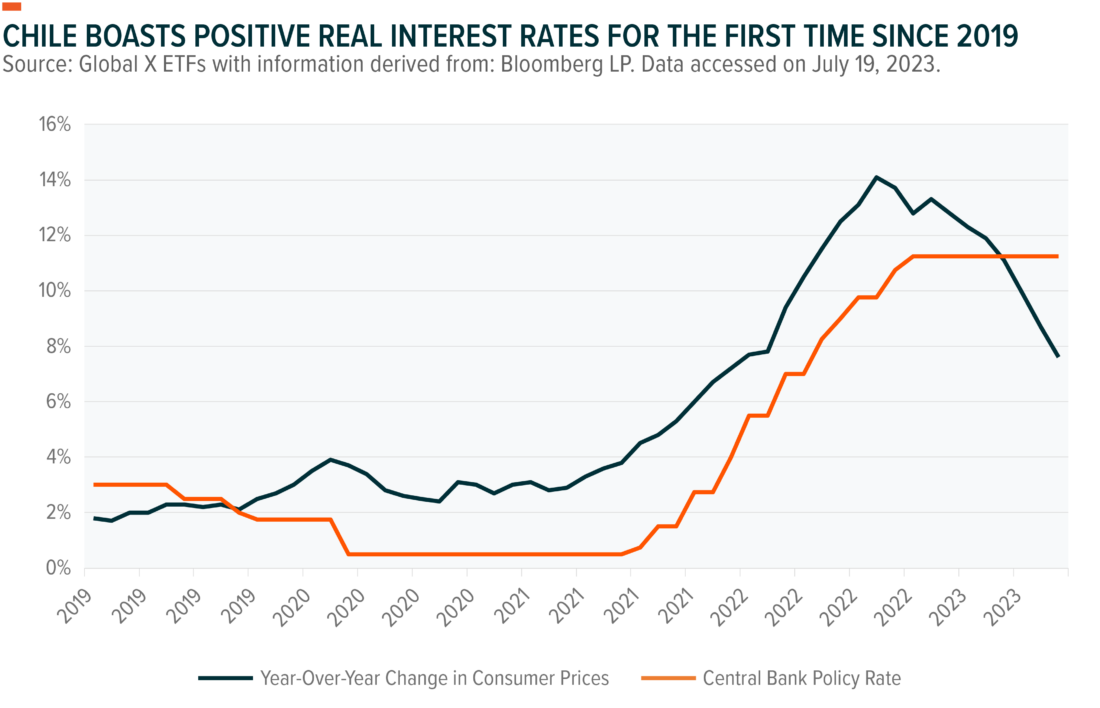

Undergoing a tumultuous 2022, Chile’s economy appears to be nearing an inflection point. After entering a technical recession during the first quarter of 2023, GDP growth is forecast to return to positive levels in the second half of the year and further accelerate in 2024.13 Consumer prices should also remain on their disinflationary trend, with the consumer price index (CPI) already falling from the peak of +14.1% year over year in August 2022 to the +7.6% level this June.14 The central bank’s aggressive monetary policy tightening cycle in 2021 left it with positive real interest rates, opening the door for potential significant monetary policy easing in the second half of this year. Economic growth will likely also remain tied to copper prices. In our view, copper’s risk/reward improved following the -22% decline since the March 2022 cycle peak, while the metal also appears positioned to be a beneficiary of any stimulus from China.15

The short-term economic outlook for Argentina remains muddled, with the main determining factor likely to be the looming Presidential election. However, a potential change in political leadership could translate into a sharp decrease in government spending, a new IMF deal, and increased investor confidence, potentially lowering the risk premium and lifting the market. However, even in the scenario of a favorable election outcome, the next administration will probably be dealt a difficult hand, with the economy expected to contract by over 2% this year and consumer price inflation accelerating above the 100% level, while structural issues like a large fiscal deficit and negative reserves remain.16 In our view, the currency will also have to be addressed by the next government regardless of the election outcome, with the unofficial “blue chip swap” rate now more than 100% higher than the official exchange rate.17 This pending devaluation will probably not help ease inflationary pressures, with many locals we spoke with citing retail prices changing on a weekly or even daily basis.

Despite this short-term uncertainty, we feel the country’s vast natural resource base presents a compelling longer-term opportunity. Beyond its structural advantages in lithium and agriculture, Argentina is home to Vaca Muerta, a premier shale oil and gas field. This large reserve base, along with the presence of capable operators and newly added midstream capacity, could drive investment into the country and possibly push Argentina to become a net exporter of oil once again. In our view, these transformational opportunities, along with the favorable demographics of its well-educated population, present a compelling long-term backdrop for the economy if politics successfully move towards the center.

Conclusion

We remain cautiously optimistic on the Southern Cone, with the improving short-term outlooks complementing the longer-term potential of the region. Chile and Argentina’s vast natural resource bases position them to be outsized beneficiaries of the energy transition, while Argentina also stands to benefit from increased domestic oil production. The region could also benefit from declining country risk premiums, with Chilean politics likely to be gridlocked while Argentina approaches a pivotal election. Finally, the Chilean economy appears to be approaching an inflection point with the domestic economy set to benefit from declining interest rates, while ample low-hanging fruit in the form of fiscal adjustments and labor reforms could unlock significant domestic growth in Argentina.

FOOTNOTES

1. Bloomberg NEF. (2022, Jul 21). Race to Net Zero: The Pressures of the Battery Boom in Five Charts.

2. United State Geological Survey. (2017-2023). Lithium.

3. Reuters. (2023, Apr 21). Chile Plans to Nationalize its Vast Lithium Industry.

4. Copper Alliance. (2022, Oct 17). Copper: The Material of Choice for Vehicle Manufacturers.

5. Trading Economics. (2023, Jul). Chile Exports of Copper.

6. United State Geological Survey. (2017-2023). Lithium.

7. Ministerio de Desarrollo Productivo Argentina. (2023). Proyectos de Litio en Argentina.

8. Reuters. (2023, Apr 20). China EV Maker BYD to Build $290 Million Battery Component Plant in Chile.

9. Bloomberg News. (2023, Jun 25). Argentina Opposition Leads in Analysis of Polls, Clarin Says.

10. Forbes. (2023, Jul 15). Ultra-Libertarian Economist Javier Milei Proposes Dollarization in Argentina.

11. Bloomberg News. (2023, Jun 25). Argentina Opposition Leads in Analysis of Polls, Clarin Says.

12. Reuters. (2022, Sep 5). Chile Overwhelmingly Rejects Progressive New Constitution.

13. Bloomberg LP. Data accessed on July 19, 2023.

14. Ibid.

15. Ibid.

16. Bloomberg News. (2023, Mar 14). Argentina Inflation Surpasses 100% as Economic Recession Looms.

17. Bloomberg LP. (2023, Jul 14). Argentina Blue Chip Swap Weakens 2% to Around 545 Pesos Per USD.

GLOSSARY

Foreign Direct Investment (FDI): Foreign direct investment is an ownership stake in a company or project made by an investor from another, outside country.

Direct Lithium Extraction (DLE): Rather than extracting lithium by evaporating brine in large pools, DLE puts brine through a series of chemical processes to separate the lithium. This process is faster, uses less land, and can be used on lower-quality brine compared to evaporating.

Consumer Price Index (CPI): A consumer price index is a measure of aggregate price levels in a given economy. It is designed to measure inflation by examining the price level of a basket of commonly purchased consumer goods and services.

—

Originally Posted July 27, 2023 – Views from the Ground: Southern Cone (Chile and Argentina)

Information provided by Global X Management Company LLC.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.