Equities have surrendered early morning gains following this morning’s stronger-than-expected job market report and data showing that consumer sentiment has improved. Stocks briefly pushed toward a new year-to-date high, with the S&P 500 reaching 4606, just one point below the 4607 level reached in July, but they have since pulled back below the pivotal resistance level of 4600. This morning’s robust data is increasing expectations that the Fed will push its anticipated rate cut from March to May and is pointing to the economy being stronger than many investors had anticipated even as inflation expectations have declined. Investors have assigned a 78.6% likelihood of a rate cut by May, and they have trimmed their 62% odds from yesterday for a cut in March to only 47.4%.

Job Market Expansion Continues

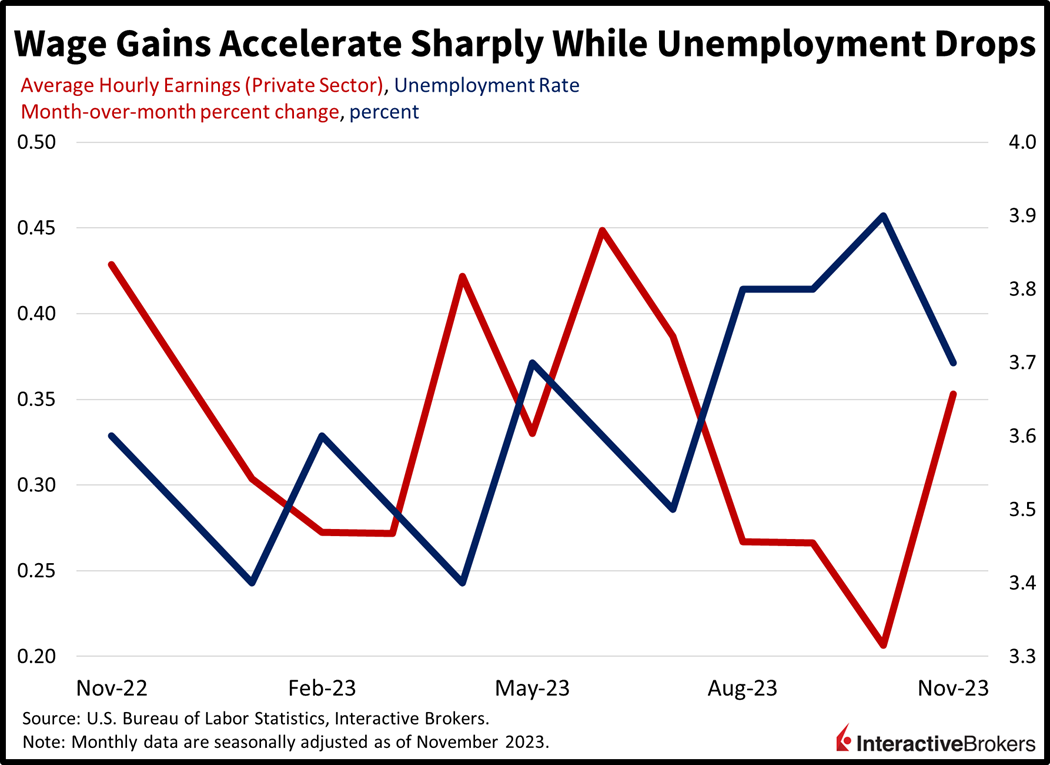

The U.S labor market grew strongly last month despite the historic tightening in monetary policy enacted to defeat inflationary pressures. This morning’s Jobs report came in strongly above expectations across significant metrics like total jobs, wage gains and the level of unemployment. The nation added 199,000 jobs in November, much better than my projection and the consensus estimate of 180,000. Americans are seeing their incomes increase at the fastest rate since July, with average hourly earnings rising a whopping 0.4% month-over-month, exceeding anticipations of 0.3%. The percentage of Americans struggling to find work has also declined, with the unemployment rate dropping to the lowest level since July. Last month’s unemployment rate was 3.7%, better than the expectations of an unchanged reading from October’s 3.9%.

Weakness Under the Hood Though

At the sector level, job growth was dominated by the non-cyclical education and health services and government sectors, which added 99,000 and 49,000 jobs, roughly three-quarters of the total job gain. The leisure and hospitality, manufacturing, other services and information segments added 40,000, 28,000, 12,000 and 10,000, respectively. The wholesale trade, construction, utilities, and finance sectors all added less than 10,000 jobs. Four out of fourteen sectors lost jobs, however, with retail, professional and business services, transportation and warehousing and mining and logging shedding 38,000, 9,000, 5,000 and 1,000 workers.

Consumer Sentiment Strengthens as Gas Prices Decline

On the consumer front, Americans are the most optimistic they’ve been in a while, with the University of Michigan’s Consumer Sentiment figure flying past expectations. December’s figure of 69.4 was the highest since August as households cheered higher stock prices and lower gasoline costs while their short- and long-term expectations for profitable business opportunities rose. Important to note, this survey is notoriously influenced by oil prices. Furthermore, consumer expectations for inflation 1- and 5-years from now fell from 4.5% and 3.2% to 3.1% and 2.8%. The headline figure of 69.4 exceeded projections for 62 and last month’s 61.3. The indices for current conditions and consumer expectations for the future rose from 68.3 and 56.8 to 74 and 66.4. Progress is welcome, but sentiment is still well below its pre-pandemic level of 101.

Bifurcation Between Yields and Stocks

Markets are mixed today with stock players sanguine while bond traders are wary of the implications of this Jobs report against the backdrop of next week’s Fed meeting. Indeed, hot headline growth, reduced unemployment and robust wage pressures could lay the case for rate cuts later rather than sooner, extending the journey across the monetary policy bridge. All major U.S. equity indices are up. The small-cap Russell 2000 Index is leading with a gain of 0.7% while the S&P 500, Nasdaq Composite and Dow Jones Industrial indices are all up 0.3%. All sectors are higher except for real estate, which is down 0.7%, and the defensive utilities, consumer staples and health care sectors, which are lower by 0.2% to 0.5%. Energy and industrials are leading with gains of 1.1% and 0.6%. Yields are higher across the curve, with the 2- and 10-year Treasury maturities trading at 4.72% and 4.25%, increases of 13 and 10 basis points (bps). Higher yields and reduced expectations of Fed easing in March are helping the dollar, with the greenback’s index up 26 bps to 103.90. The U.S. currency is appreciating against the euro, yen, pound sterling, franc, yuan and Aussie dollar while it loses value relative to the Canadian dollar. Crude oil is recovering some of its recent battering on news that the U.S. will begin buying barrels to refill the nation’s Strategic Petroleum Reserve (SPR) facility. It is expected to continue buying oil until at least May. Energy markets are also benefitting from a Moscow-Riyadh campaign engineered to hamper oil production further. WTI crude oil is up 2.53%, or $1.76, to $71.32 per barrel on the news.

Hero of Haarlem or Impending Storm Surge?

Shortly after retailers’ earnings reports included warnings that higher living costs, loftier fuel prices, elevated interest rates, diminished pandemic savings and the resumption of student loan payments could crimp consumer spending, this morning’s robust job data could be the equivalent of the fictional boy in the story the Hero of Haarlem. The youngster saved Holland by plugging a leaking dike with his finger. In a similar manner, the strong employment data may be preventing a flood of reduced earnings expectations resulting from softer consumer spending. The downside, however, is that recent challenges to corporate profits—such as strong wage pressures, high financing costs and decelerating revenue growth—have strengthened, creating additional pressures on the dike that is keeping negative sentiment at bay. Going forward, markets will be heavily influenced by Fed commentary and if the central bank can curb growing flood waters of economic pressure by providing monetary accommodation. Looking forward to next week, the Consumer Price Index is expected to be another doughnut while the Fed’s Summary of Economic Projections (SEP) will reveal how many cuts the committee expects to implement next year. I’m expecting the SEP to be a big market mover, as market participants expect 100 basis points of cuts next year even as Chair Powell has repeatedly stated that it’s premature to think about cuts at this juncture. A projection revealing only two cuts will likely spark volatility, while four cuts wouldn’t guarantee further upside in stocks and bonds due to a large chunk of monetary easing already priced in.

Visit Traders’ Academy to Learn More About Payroll Employment and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.