Stocks are having trouble accumulating more gains this month as softening economic data paint a mixed picture. On the one hand, slowing economic performance points to weaker earnings prospects but it does raise odds of rate cuts from the Fed. This morning’s news that OPEC + will cut oil production further failed to aid sentiment, with oil prices higher for the third day in a row which is propping up inflation expectations, bond yields and the dollar as a result.

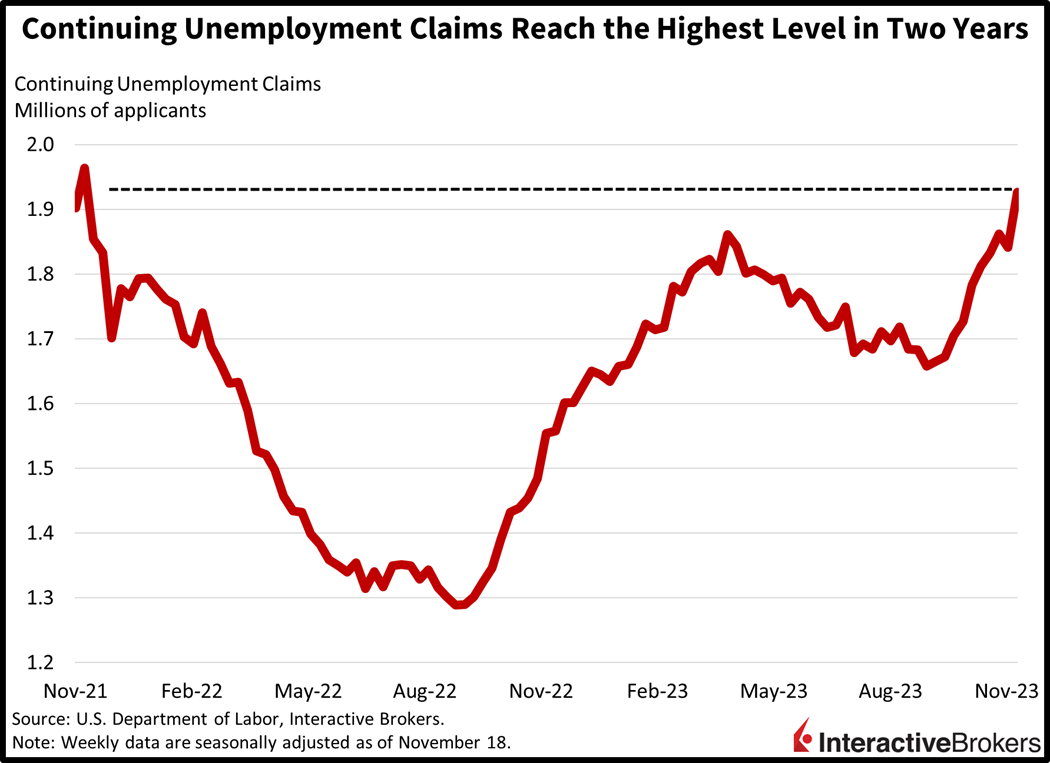

Continuing Claims Hit Highest Level in Two Years

This morning’s Labor Department data depicted a sharp rise in continuing unemployment claims amidst a modest rise in initial unemployment claims, pointing to slower wage pressures and reduced demand for labor from the business community. Unemployment numbers can vary significantly from week to week, but this morning’s report is nevertheless an encouraging sign for businesses that have faced challenges with compensation expenses and staff level maintenance. Indeed, continuing unemployment claims rose to the highest level in two years. The data also illustrates how the Federal Reserve’s restrictive monetary policy is decelerating economic activity.

For the week ended November 18, continuing unemployment claims jumped by 86,000 to 1.927 million while shattering estimates expecting 1.872 million. Initial unemployment claims for the week ended November 25 also climbed but at a more tempered degree. Initial claims rose to 218,000 from the previous week’s 211,000 while coming in narrowly below projections of 220,000. Overall, the data is telling us that laid off workers are taking much longer to replace their jobs, while overall layoffs remain modest.

Consumer Spending, Inflation Decelerated Last Month

Consumer spending decelerated sharply last month as the resumption of student loan payments ensued. Consumer spending rose just 0.2% month-over-month (m/m) in October, in line with estimates but much slower than September’s 0.7% growth rate. Spending on services rose 0.2% while goods outlays increased by just 0.1%. Similar to spending, personal income also dropped to 0.2%, but from 0.4% during the previous period.

On the inflationary front, the overall and core PCE price indices both showed improvement from September. Overall prices were unchanged m/m, less than projections of 0.1% and from the previous month’s 0.4%. Meanwhile, core prices increased 0.2% m/m, exactly as anticipated and cooler than September’s 0.3% growth rate. On a year-over-year basis, overall and core prices rose 3% and 3.5%, in line with the Street and better than the previous month’s 3.4% and 3.7%. Driving the reduction in m/m price pressures were energy and goods, whose prices declined 2.6% and 0.3% during the month. Offsetting some of the progress were services and food, which both rose 0.2% m/m. When annualizing inflation data from the last three and six months, the core PCE, which is the Federal Reserve’s preferred inflation gauge, rose just 2.46% and 2.34%. Victory is near, but energy prices are back on the upswing, which could complicate things going forward.

Yields and Oil Jump Higher

Markets are tilted bearishly today with technology down while cyclicals and defensives are higher. Inflation expectations are jumping against the backdrop of more production cuts from OPEC +. Bond yields and the dollar are also rising in response, as higher oil prices may incrementally delay the Fed’s rate cuts while investors demand a higher premium for lending over the long-term. Major U.S. equity indices are mixed, with the Nasdaq Composite and S&P 500 indices down 0.9% and 0.1% while the Dow Jones Industrial and Russell 2000 indices are higher by 0.9% and 0.5%. Sectoral breadth is positive with all sectors higher except for communication services, consumer discretionary and technology, which have declined 1.1%, 0.6% and 0.5%. Health care and financials are leading: they’re up 0.9% and 0.8%. In fixed-income land, the 2- and 10-year Treasury maturities are trading at 4.69% and 4.32%, with the instruments’ yields rising 5 and 7 basis points (bps). The Dollar Index is higher by 49 bps and is trading at 103.34 as the greenback gains against the euro, pound sterling, yen, yuan and Aussie Dollar while it loses value versus the franc and Canadian dollar. WTI crude oil is up 0.8%, or $0.83, to $78.49 per barrel as OPEC + agrees to curtail an additional 1 million barrels per day of production.

Will Powell Keep Michelin Tire Man Alive?

Today’s economic data doesn’t appear to have significantly impacted investor sentiment with equity markets struggling to achieve direction in aggregate. The soft data, however, may have set markets up for a rally if Fed Chairman Jerome Powell provides dovish comments when speaking tomorrow. Recent progress only provides a medium-sized window of optimism though, as Powell has emphasized that the Fed wants to see evidence that inflation is slowing for the long haul before the central bank cuts rates. If he maintains his hawkish stance and dashes hopes of rate cuts early next year, then today’s data may be similar to the teasing nature of an unseasonably warm day in February. While it’s easy to assume such a day is a sign of spring’s arrival, it’s often just a temporary reprieve from shoveling snow and winter clothing that resembles the Michelin tire man. Likewise, if Powell maintains his hawkish stance, the deep chill of pessimism regarding potential rate cuts early next year could spark volatility.

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.