Bond traders are reassessing their monetary policy expectations while they digest conflicting messages from members of the Federal Reserve brass. Regarding hot inflation readings in the previous two months, Fed Chair Powell believes they were slight bumps on the rocky road to price stability and he remains committed to several interest rate cuts this year. Fed Governor Waller, on the other hand, just called recent inflation data disappointing and emphasized the need for caution and patience regarding the timing and pace of rate cuts. Meanwhile, this morning’s data releases point to a robust labor market, stronger fourth quarter GDP than previously reported and downward revisions to inflation expectations amidst an upward adjustment to consumer sentiment.

Waller Walks Back Powell Optimism

Investors anticipating that the Fed will start cutting in June received a gut check last night when Fed Governor Christopher Waller said recent inflation data has been disappointing and that there is no rush to lower rates just yet. While speaking at an Economic Club of New York gathering, Waller said he needs to see more data showing that price pressures are sustainably slowing before he becomes comfortable providing accommodation. Waller said that the economy is quite strong and it might take a few more months of encouraging data before he feels comfortable joining the doves on the other side. Still, there are quite a few hawks in the room, with Atlanta Fed Chief Bostic supporting just one 25 basis point (bp) rate cut at this juncture and many others that voted for 2 reductions or less this year.

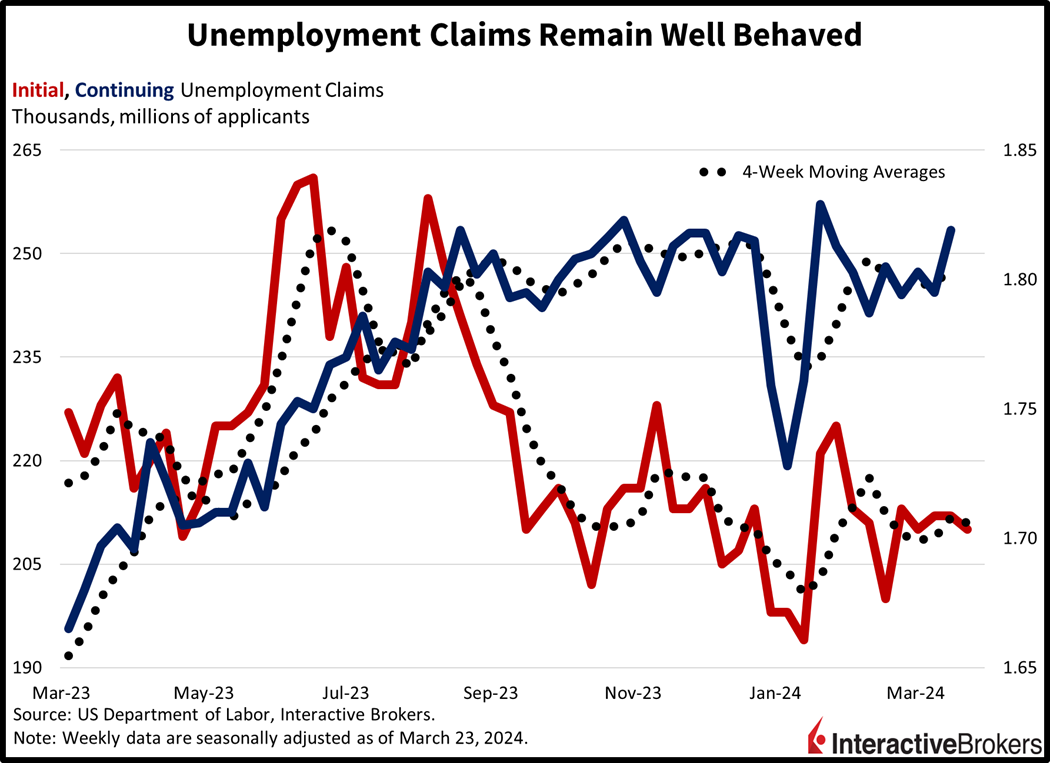

Fewer Pink Slips Issued Last Week

Employers have tempered their pace of layoffs, allowing tight labor conditions to persist. Initial unemployment claims fell to 210,000 for the week ended March 23, down from 212,000 in the prior week while missing expectations of 215,000. Continuing claims for the week ended March 16 totaled 1.819 million, up from 1.795 million and near estimates of 1.82 million. Overall, these figures point to little stress in the labor market, with the four-week moving averages for both figures remaining nearly unchanged week over week. The four-week moving average for initial claims fell to 211,000 from 211,500 while the trend for continuing claims rose slightly from 1.799 million to 1.803 million.

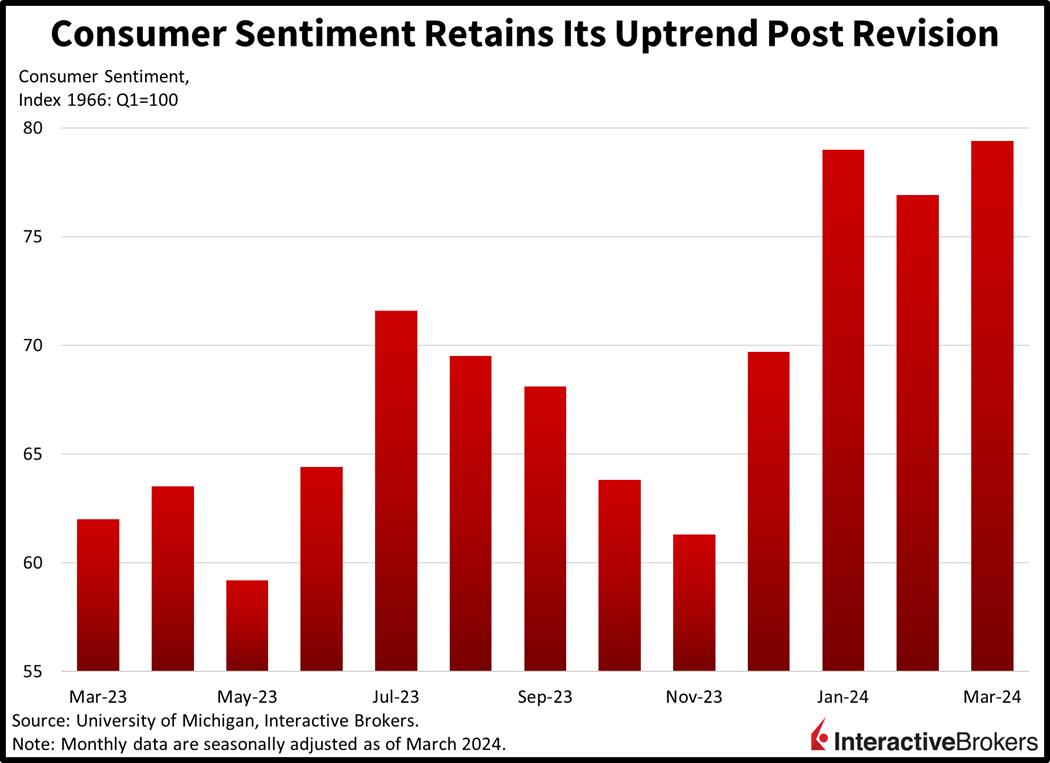

Consumer Sentiment Gets Revised Upward

This month’s University of Michigan Consumer Sentiment headline was revised higher while inflation expectations shifted lower. The headline was increased to 79.4 from the 76.5 preliminary flash reading, even as analysts thought the figure would remain unchanged. In comparison, February’s figure was 76.9. The sub-indices of Current Economic Conditions and Consumer Expectations both rose to 82.5 and 77.4, respectively, from 79.4 and 75.2. Inflation expectations came in softer, with 1- and 5-year projections falling to 2.9% and 2.8%, 10 bps lower month over month (m/m). Survey respondents were pleased with stock market gains, which boosted their optimism regarding their finances.

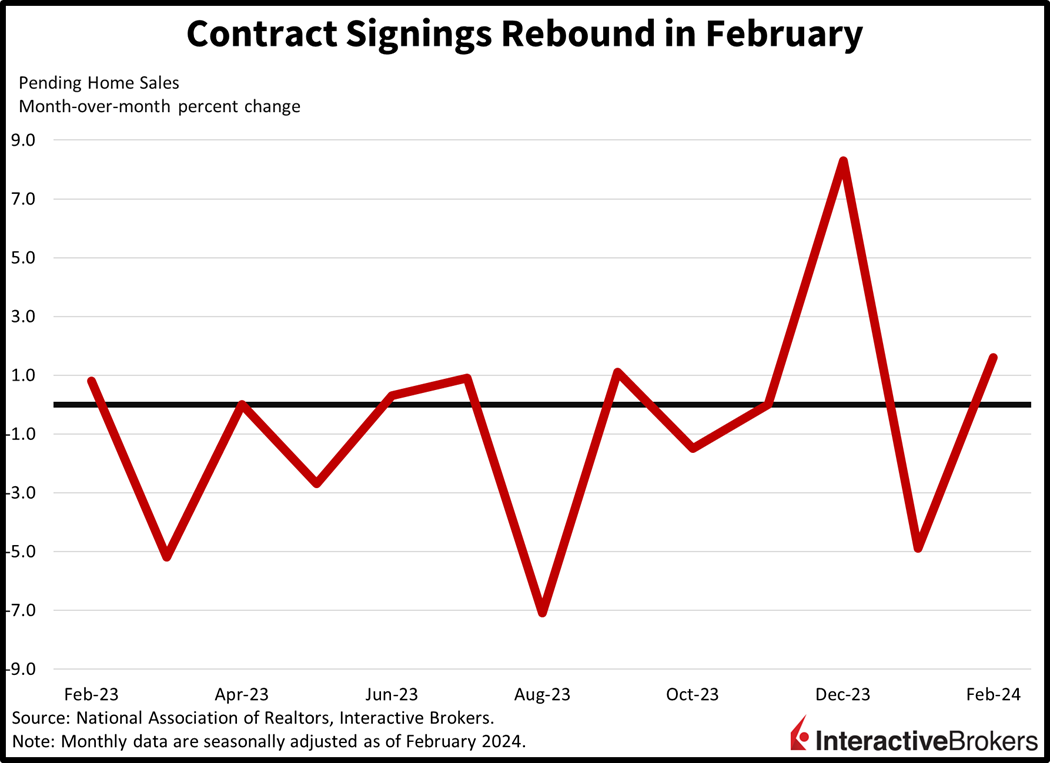

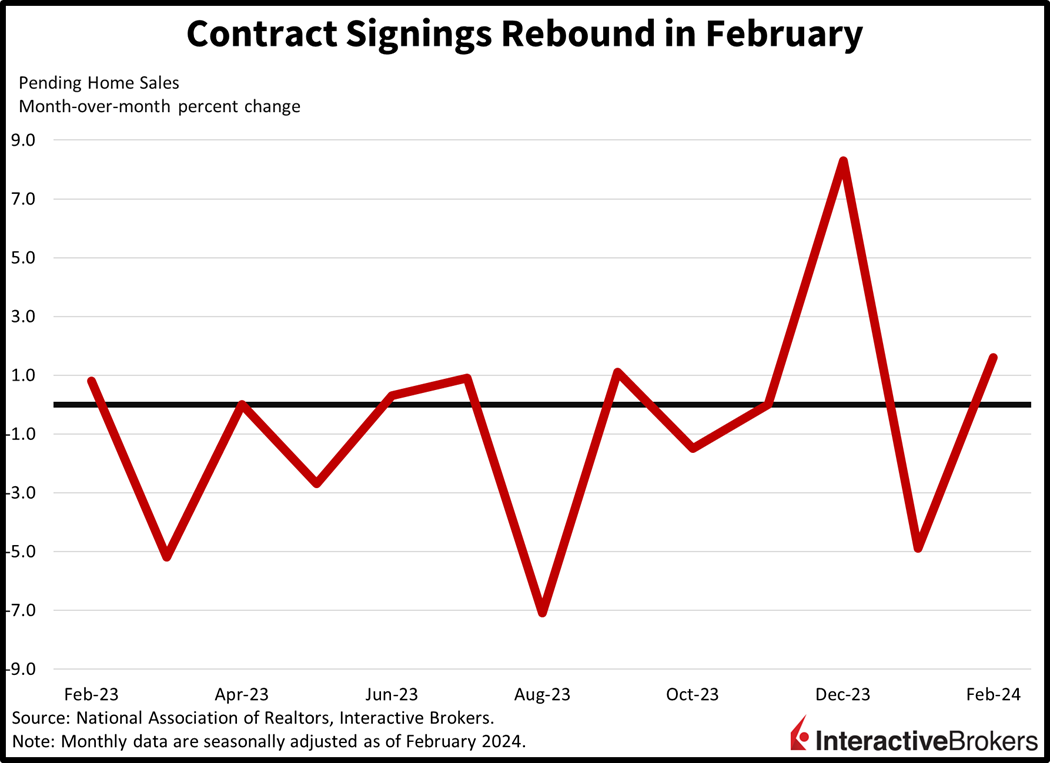

Home Shoppers Step Out of Hibernation

Potential home buyers shrugged off the winter weather and increased their pace of contract signings with pending home sales increasing in February, pointing to gains in completed purchases this month and next. The National Association of Realtors reports that pending home sales grew 1.6% m/m, surpassing projections for a 1.2% increase. On a year-over-year (y/y) basis, though, pending sales declined 7%, a shallower contraction than January’s 8.7% y/y decline.

Markets Seek Direction

Markets are mixed during today’s quarter end as the S&P 500 is on track to close the month up a whopping 10.3% year to date. Most major US equity indices are near the flatline though, but the small-cap Russell 2000 is jumping; it’s up 0.6%. The S&P 500, Dow Jones Industrial and Nasdaq Composite are all roughly unchanged. Sectoral breadth is positive, with 8 out of 11 sectors higher. Energy and real estate are leading with gains of 0.6% and 0.5%, respectively, followed by the utilities sector, which is up 0.5%. Technology, industrials and communication services are lower with values down 0.3%, 0.2% and 0.2%. Treasury yields are higher, though, on the back of Waller’s hawkish comments. The 2- and 10-year maturities are trading at 4.61% and 4.20%, 4 and 1 bps higher on the session. The dollar is gaining on lighter Fed easing expectations as well, with its index higher by 19 bps. It is currently trading at 104.49. The greenback is gaining relative to the euro, pound sterling, yen and the Aussie dollar. It’s losing ground versus the yuan, franc and the Canadian dollar, however. Crude oil is higher on supply concerns, meanwhile, with WTI trading up by 1.1% or $0.90 per barrel, to $82.55.

Certain Risk Assets May Have Upside Potential

As the remarkable first quarter comes to an end, an important consideration that got us here was the dovish shift in monetary policy expectations that began in December. Even as Waller’s comments seemed to contradict Powell’s, the collective messaging of policymakers is that the central bank remains committed to accommodative policy on a relative basis. Even as Waller and Bostic appear more hawkish than other voters on the Committee, they are also both sensitive to the financial stability and funding consequences of an elevated fed funds rate amidst continued quantitative tightening. The Fed, during these times, is committed to stable liquidity and maximum employment while it gives itself a fair amount of wiggle room on its inflation target. Fed cuts and a taper in quantitative tightening will likely occur this year amidst an implicit acceptance of loftier inflation levels. While risk assets have sprinted, many are decent opportunities considering that the Fed has turned from a bull’s foe to a dear friend.

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.