To shed some light on the potential of artificial intelligence (AI), and discuss the role of the supporting infrastructure enabling this boom, we were delighted to leverage the expertise of Eric Rothman, Portfolio Manager, Real Estate Securities with CenterSquare. CenterSquare is a dedicated real estate investment manager, with around $14 billion under management, and Eric has been with the company for 17 years.

Before we explore the Nvidia story and the relationship between AI, data centres, and ‘new economy real estate’, let’s define what that latter phrase means.

New economy real estate is supporting technological advancements, like AI

What is ‘new economy real estate’? Eric noted that there is so much beyond the traditional ‘4 foodgroups’ of real estate:

1) retail

2) office

3) residential

4) industrial

When CenterSquare defines the ‘new economy real estate’ space, Eric noted that the larger components include data centres, cell phone towers, and warehouses dedicated to new economy logistics—things like ecommerce fulfillment. This is far from traditional, industrial real estate.

Some of the smaller segments include life sciences, cold storage, and office space that is uniquely tailored to technology tenants, typically located in specific cities with focused pools of technology talent. Such cities might be Seattle, San Francisco or New York. These types of ‘real estate’, most notably data centres, are vital to support growing technologies like AI.

The Nvidia story—$1 trillion to be spent?

There has been a huge amount of excitement and discussion around Nvidia as the stock has enjoyed overnight success on the coattails of the AI boom. ‘$1 trillion’ is a big number (and a nice headline), but it’s very difficult to forecast where generative AI will take us. Some people say it is like inventing the wheel or the personal computer. This is a big claim, and only time will tell.

If people are thinking about ‘data centre REITs’ as an investment, they have to understand that data centres just fulfil the provision of power, cooling, and connectivity. The data centre REITs do not actually own the computers. The tenants invest in the computers. One thing that is absolutely true, however, is that as an owner, you love to see the tenants putting money into the space that they are renting. Why? This makes it less likely they are going to leave. Therefore, a greater investment in AI technology and computing power may be a positive signal for the supporting real estate (like data centres).

Eric’s conclusion, whether thinking about the impact of generative AI on data centre REITs or cell phone tower REITs, was that the move in share prices hasn’t reflected where we could be going yet. Connectivity and data centres will be vital components for artificial intelligence, but it’s not yet clear how or when investors are going to reflect that in the real estate prices. Eric noted that investors frequently forget about the buildings until later in a cycle or a trend.

Greater computing power = greater energy consumption?

Another aspect that we discussed was energy usage. Eric estimated that newer AI-focused semiconductors draw more power, not just a little bit more power but a step change in power consumption.

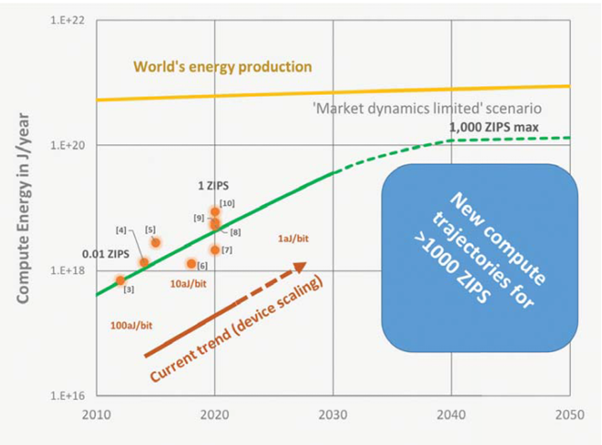

In Figure 1, we show a chart from the ‘Decadal Plan for Semiconductors’, a research report by Semiconductor Research Corporation. A critical point to keep in mind is that ‘something has to give’; simply continuing to add computational capacity without thinking of efficiency or energy resources will eventually hit a wall. However, if history is any guide, we should expect that, as demand and investment in computational resources increases, there will be the potential for gains in efficiency, improved model design, and even different energy resources that may not yet exist today.

Figure 1: Comparing compute energy to the world’s energy production

Source: “Decadal Plan for Semiconductors: Full Report.” Semiconductor Research Corporation. Published January 2021. ZIPS is a measure of compute intensity, referring to 10^21 compute instructions per second. Compute energy measured in J/Year, refers to Joules-per-year.

Historical performance is not an indication of future performance and any investments may go down in value.

Since many investors may be less familiar with cell phone towers, Eric made sure to mention just how strong of a business model he believes this to be. Now, it’s true that these REITs have not performed well in the past 18-months, but we are right in the middle of the current 5G rollout. Tenants have long leases, there is lots of demand, and there are even consumer price index (CPI) escalators that increase the rent to be collected.

Conclusion: a different way to think about real estate

It was great to be able to spend some time speaking with Eric and to learn about what’s happening both in the broader real estate market as well as in the more specific, new economy, ‘tech-focused’ market. The full discussion is accessible here: https://podcasts.apple.com/us/podcast/behind-the-markets-podcast-eric-rothman/id1194707802?i=1000615506518

—

Originally Posted June 28, 2023 – What does real estate have to do with AI?

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.