Sentiment: (a) An attitude, thought, or judgment prompted by feeling (predilection); (b) A specific view or notion (opinion).

(Definition of “sentiment” from the Merriam-Webster dictionary)

Investors and market “pundits” pay a great deal of attention to “market sentiment” because, regardless of the quantitative facts on the ground, what investors believe also matters a great deal, at least in the short term. As Warren Buffett stated, “In the short run, the market is a voting machine [i.e., sentiment], but in the long run, it is a weighing machine.”

So, what is market sentiment currently telling us, and can we glean useful information from that? Let’s dive in.

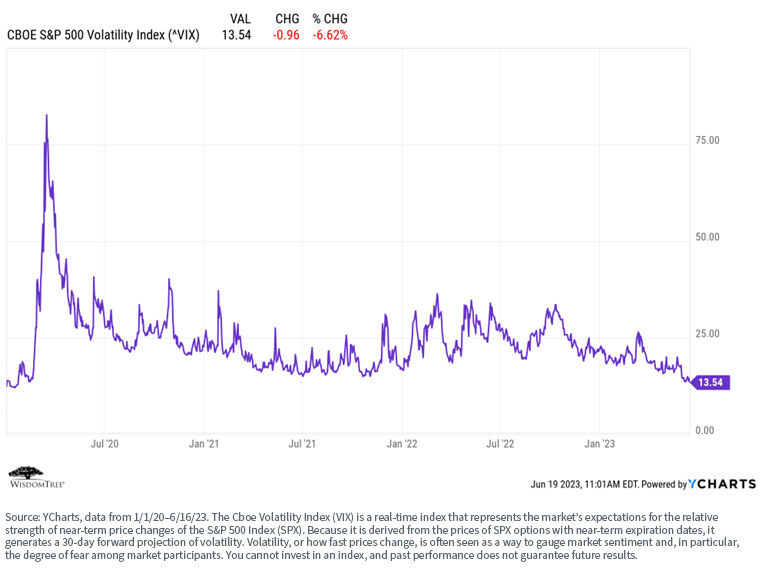

Focusing on the equity market, one measure of market sentiment is the “VIX,” which represents a measure of stock market volatility—the lower the indicator, the more “complacent” or optimistic the market is. By this measure, the market is as complacent as it’s been since pre-COVID-19 in January 2020.

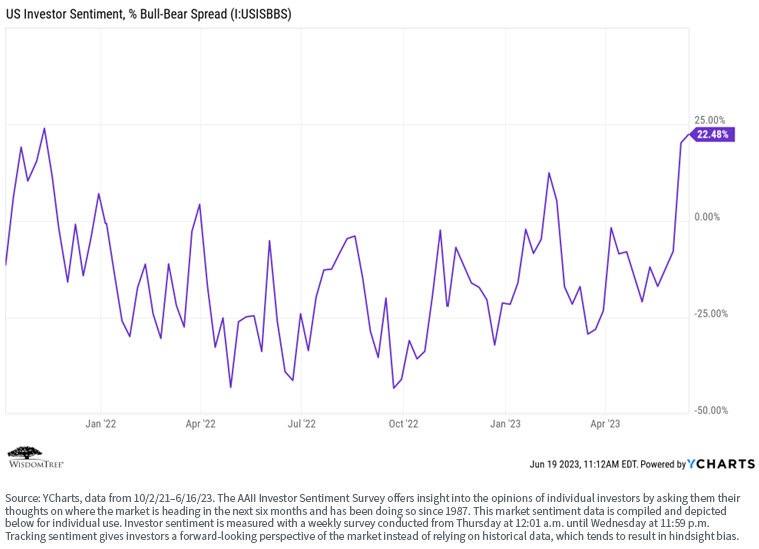

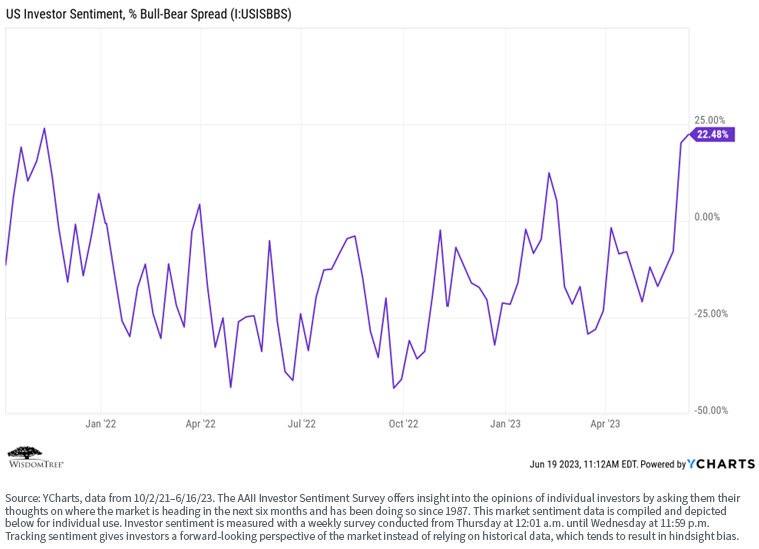

What about actual measures of investor sentiment? One common one is the American Association of Individual Investors (AAII) Investor Sentiment Survey. It seems investors are as optimistic (bullish) as they’ve been since November 2021.

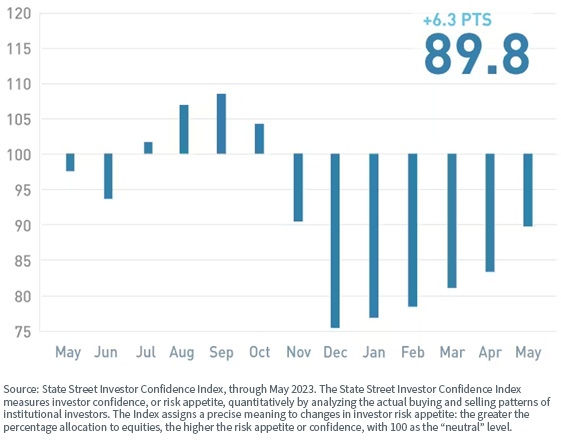

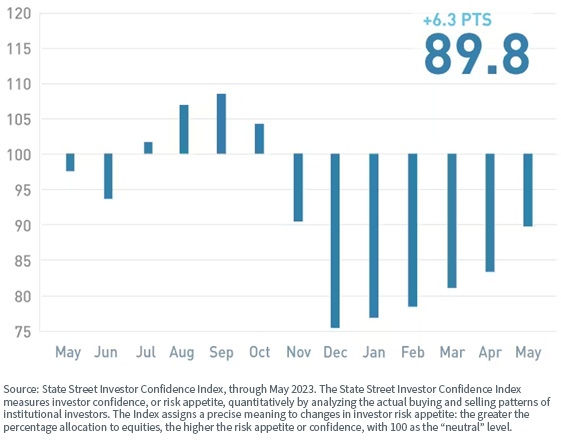

Another sentiment indicator is the State Street Investor Confidence Index, which focuses on institutional versus retail investors. Here we begin to notice some “dissonance” between the two groups—institutional investors are far less sanguine than retail investors, but the trend remains to the upside.

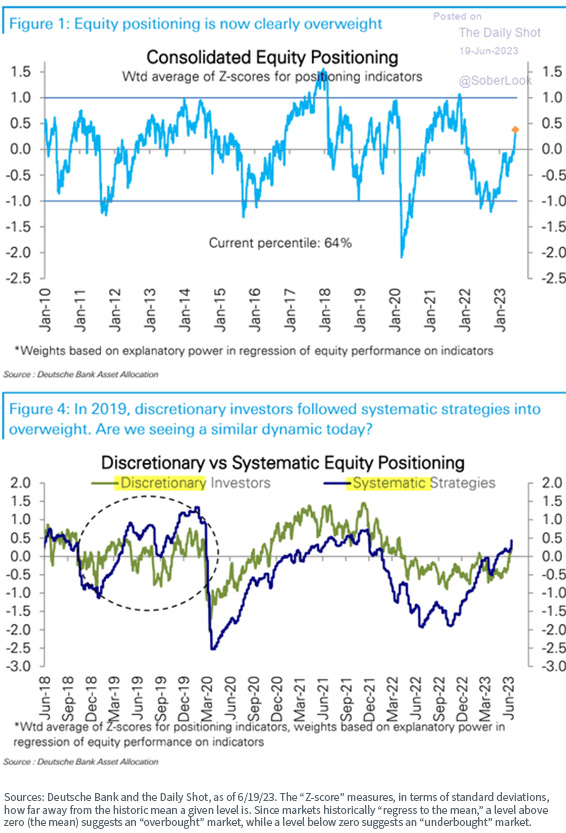

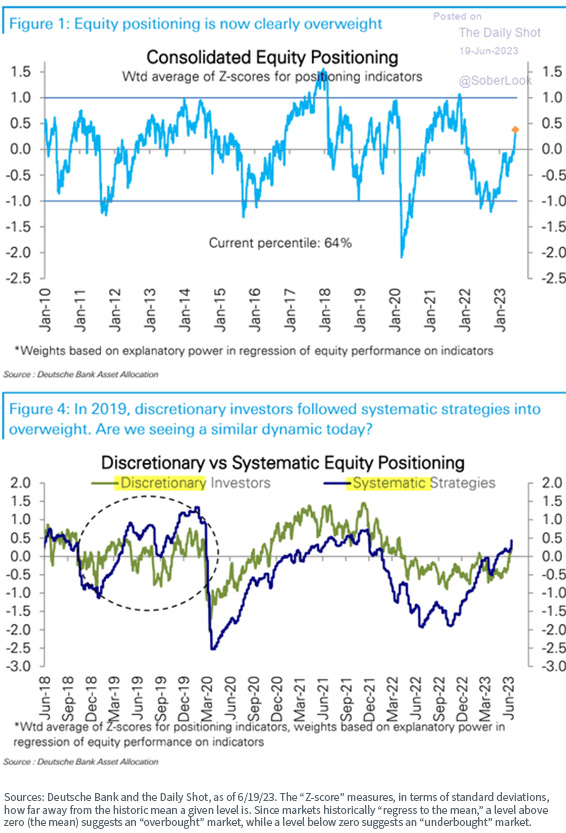

Still another sentiment indicator is the Deutsche Bank “Equity Positioning” indicator, which suggests equities currently are “overbought” by both “discretionary” and “systematic” investors—another signal of (perhaps complacent) optimism.

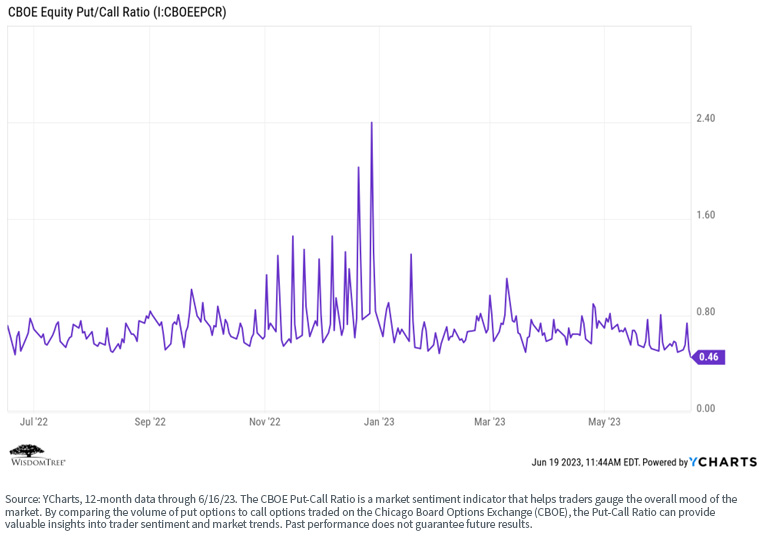

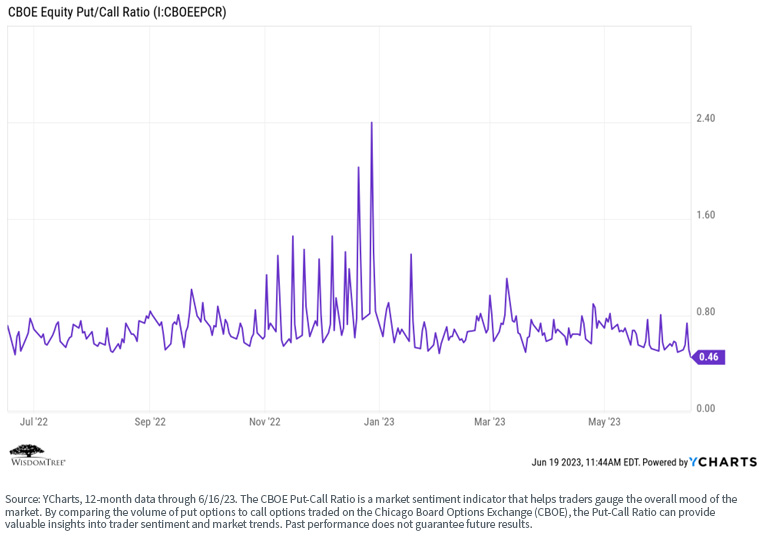

Finally, let’s look at a commonly used measure of market sentiment—the “put/call ratio.” Investors purchasing put options suggests a negative market sentiment, while purchasing call options represents a positive market sentiment. So, the lower the put/call ratio (i.e., the more call options purchased versus put options), the more optimistic the market is behaving. While this is a highly volatile indicator, we can once again see that investor optimism, as measured by this ratio, is as high as it has been over the past 12 months.

So, What Does This All Mean?

Market sentiment, to us, seems elevated and complacent, especially considering elevated valuations (at least in some portions of the market), slowing economic growth, decelerating corporate earnings, uncertain Fed policy, still-too-high inflation and an uncertain geopolitical environment.

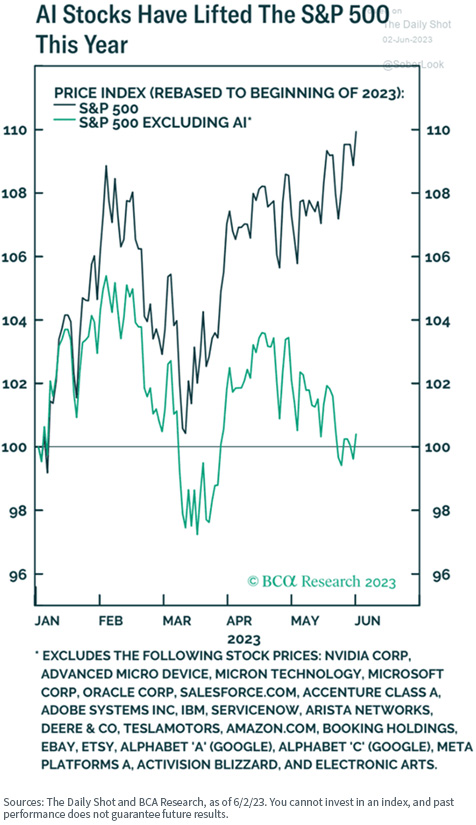

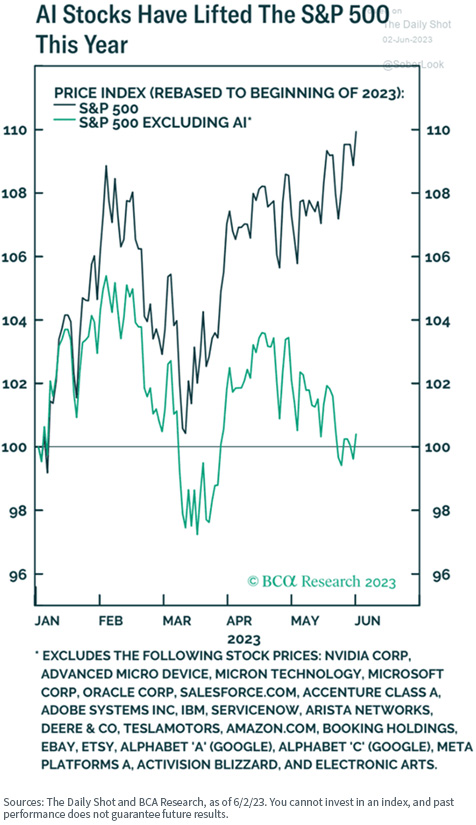

Markets determined to run higher can certainly continue to do so—momentum and sentiment can be powerful catalysts. It is also relevant to recognize that much of the market performance has been driven by this year’s “meme theme”—artificial intelligence (AI).

Historically, however, fundamentals eventually have always mattered again. We are not market timers, nor are we bearish on the longer-term performance of the stock market.

The current complacency among many investors gives us pause because most investors are notoriously poor market timers. We are not “Chicken Little” and are not claiming “the sky is falling.”

But we do suggest paying closer attention to underlying market fundamentals and not just current market momentum.

—

Originally Posted June 29, 2023 – What Is Market Sentiment Telling Us?

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

good advice

Thank you, Bill.