Central banks packed quite a punch last week. Unlike the Federal Reserve and the European Central Bank that raised policy rates by 25Bps, as was widely anticipated, the Bank of Japan (BOJ) on July 28 unexpectedly decided to tweak the Yield Curve Control (YCC) band.

The BOJ begins its withdrawal from YCC

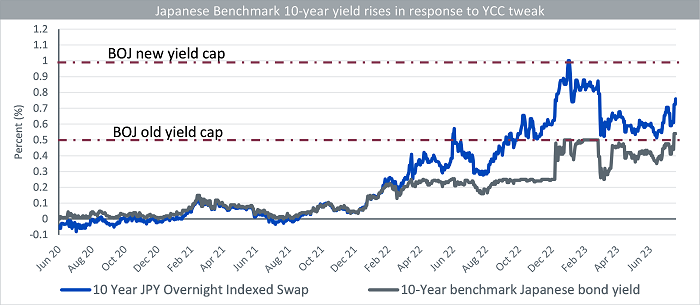

It will now allow some deviation above the long-term rate cap of 0.5% and has raised the rate for its 10yr Japanese Government Bond (JGB) fixed-rate purchase operations to 1%. They are effectively doubling their YCC band as it has outlived its purpose over the last seven years. This is despite Governor Kazuo Ueda stressing the BOJs patience a week prior to the meeting leading to 82% of the economists surveyed by Bloomberg expecting no change. There is a strong likelihood the decision was made because the market was least expecting it, similar to the last YCC policy tweak made in December 2022. As it helps avoid the inevitable speculation about the impact of the change on the JGB curve thereby forcing the BOJ to step up its interventions.

Source: Bloomberg, WisdomTree as of 31 July 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

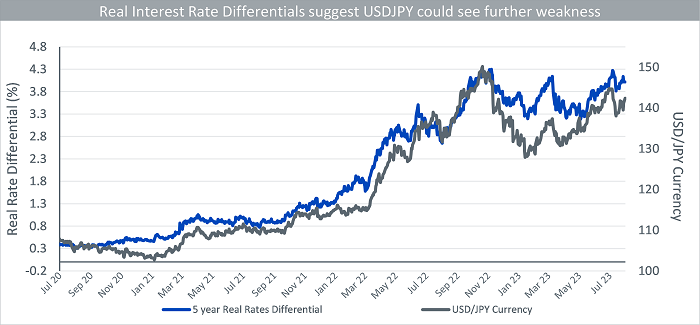

It’s hard to determine whether the new YCC with greater flexibility and nimble responses in its purchase schedule will achieve the BOJs goal of sustainable and stable achievement of the 2% inflation target. Longer dated JGB yields are likely to stay under upward pressure until clearer signs emerge that Japanese inflation and wage pressure are easing again.

Core inflation at highest level since 1982

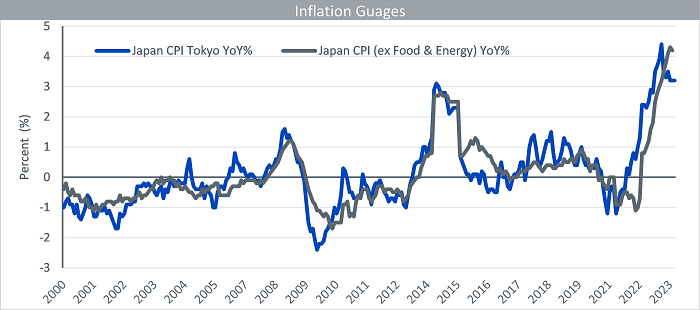

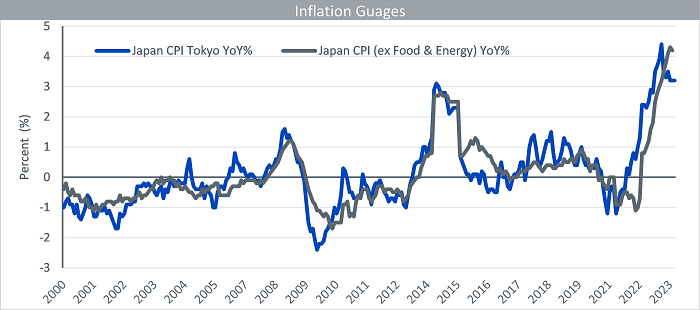

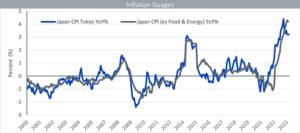

The deflationary headwinds confronting Japan have been around for decades. Signs of change have been seen in firms’ wage- and price-setting behaviour, and inflation expectations have shown some upward movements again (as seen in the chart above).

Spring in Japan is the season for shunto, the annual wage negotiations between company management and unions. This year some firms have already announced significant wage hikes in response to a tightening labour market and rising inflation. May wages rose by 2.9%1. However, a large part of the increase was tied to bonuses. Real wages fell by less but continued to decline by 0.9%2. Japanese headline inflation stayed at 3.2% year on year in July for three consecutive months3. However, core inflation excluding fresh food and energy, reaccelerated to 4.2%, marking the highest level since April 1982.

Looking ahead, headline inflation will likely slow owing to falling global commodity prices and base effects but core inflation will likely remain higher owing to structural change in the labour market.

Source: Ministry of Internal Affairs and Communications, WisdomTree as of 28 July 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

BOJ struck a dovish tone with below target inflation forecasts

The BOJ’s inflation forecasts for the fiscal years ahead are expected to slow further. The BoJ lowered its (median) forecast for FY2024 to +1.9%4 and left its FY2025 projection unchanged at +1.6%3, in effect justifying ongoing easing from the Bank of Japan. BoJ Governor Ueda mentioned at the press conference that there is still some distance to foresee 2% price stability target in a stable and sustainable manner given our inflation outlook for FY2024 and FY2025. This echoes a dovish narrative on the new YCC regime and a continued communication that the BOJ intends to in effect ease policy by still increasing the monetary base via fixed operations.

More volatility beckons for risk assets

The initial response to the BOJs surprise decision was a sharp rise in Japanese bond yields. Japan’s benchmark bond yields surged, extending gains above the central bank’s previous 0.5% cap. The yen whipsawed, falling more than 1% before reversing course and rallying to trade about the same amount higher.

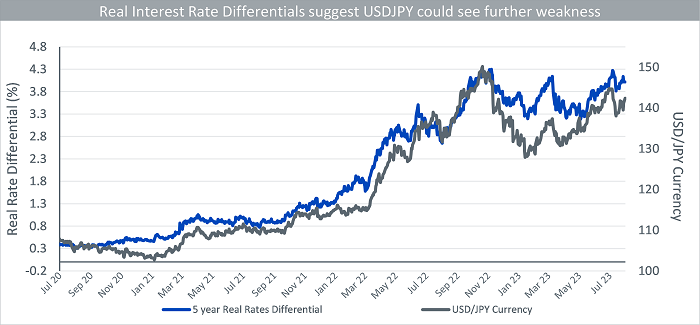

On Monday 31st July, the BOJ sprung another surprise announcement (2 days post the BOJ meeting) of an unscheduled bond-purchase operation to stem the rise in yields5. The BOJ intends to purchase ¥300Bn of five-to-10-year notes at market yields. This serves as an important reminder that the flexibility is intertwined with opaqueness, as the BOJ can intervene at any time (between 0.5% to 1%) which will continue to stoke volatility across risk assets. The BOJ has positioned the YCC as enhancing sustainability of its current accommodative policy. With Japan’s monetary environment likely to be kept relatively loose, the yen is likely to trade in a volatile range for the remainder of 2023.

Source: Bloomberg, WisdomTree as of 31 July 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 Bloomberg as of 31 May 2023

2 Bloomberg 31 May 2023

3 Ministry of Internal Affairs and Communication as of 20 July 2023

4 Bank of Japan as of 28 July 2023

5 Bloomberg as of 31 July 2023

—

Originally Posted August 1, 2023 – What’s Hot: Bank of Japan sitting on the fence on easy policy exit

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.