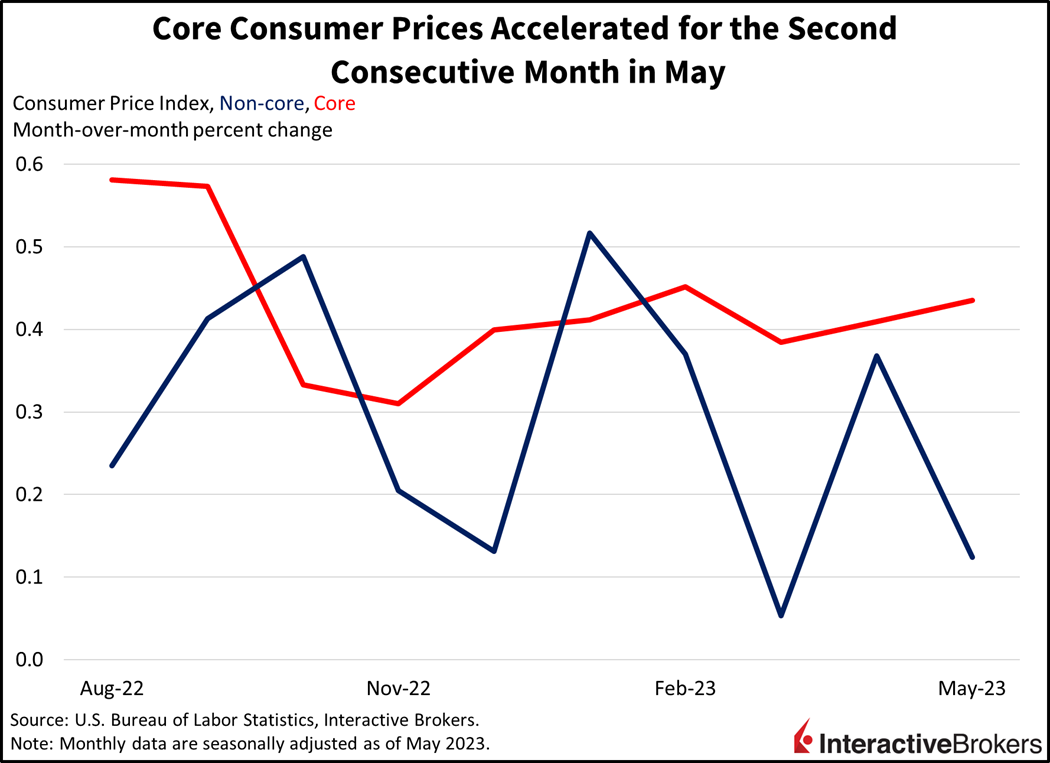

Equities are gaining ground and investors’ expectations that the Federal Reserve will announce a rate hike pause tomorrow are being reinforced after this morning’s Consumer Price Index report showed that inflation is continuing to moderate. While the progress is encouraging, inflation still exceeds the Fed’s 2% target rate by a long shot, implying that Fed Chairman Jerome Powell is likely to maintain hawkish comments in his statements tomorrow. In addition, core inflation has accelerated for two consecutive months, concerning market participants of a challenging road ahead. Meanwhile, a July rate hike is currently priced as the most likely outcome, with June representing a skip rather than a pause.

Consumer prices rose 0.1% during the month of May, an improvement from April’s 0.4% while meeting expectations. Core consumer prices, which exclude food and energy, however, rose 0.4% month-over-month (m/m), gaining a few basis points (bps) on a rate of change basis relative to the previous month and arriving in-line with the consensus. On a year-over-year (y/y) basis, overall consumer prices rose 4%, the lowest growth rate in over two years. Core, meanwhile, rose 5.3% y/y; its lowest growth rate in 18 months.

May’s inflation read was helped almost exclusively and immensely by the steep decline in energy prices. Gasoline prices declined 5.6% m/m while energy services, comprised mainly of electricity and heating, fell 1.4%. New automobiles and medical care services each dropped 0.1%, weighing on inflationary pressures at the margin. Food at supermarkets, which rose 0.1%, also served to lessen the cost burden on households. Progress was hard to come by in other areas of the economy however, with used automobiles and transportation costs increasing at staggering rates of 4.4% and 0.8%. Shelter, medical care commodities and food at dining establishments also propelled prices higher, with gains of 0.6%, 0.6% and 0.5%, respectively. Apparel drove prices higher at a more modest pace however, with prices gaining 0.3% during the period.

Equities are higher today, building on this year’s blistering rally as investors cheer progress on artificial intelligence and a Fed that is nearing the end. All sectors are higher today with the exception of the utilities safe haven as the S&P 500 gains 0.5%, cooling to 4363 after reaching another fresh year-to-date and 52-week high of 4373. Bond yields are lower at the short-end, driven by a firm expectation of a pause at tomorrow’s Fed decision. The 1-month Treasury maturity is down 5 bps while the 2- and 10-year maturities are close to unchanged. The Dollar Index is also down, declining 38 bps to 103.23 in response to investors pricing in a 94% chance of a pause at tomorrow’s Fed event.

Oil prices are recovering from yesterday’s battering with WTI crude up 4% to $69.80 per barrel. Yesterday’s downturn to $66.80 occurred on news that the Pakistani government paid for discounted barrels from Moscow in Chinese currency. Prices have trended downward all year even after Saudi Arabia’s recently announced plan for a unilateral production cut of 1 million barrels a day on top of existing OPEC + plans for eliminating 3.6 million barrels a day from new supplies. Oil is down 16.4% from its year-to-date high of $83.53, even as wildfires in Canada’s Alberta province threaten locations where the country extracts light oil.

Earlier this year, oil bulls expected the commodity to reach new highs in response to the OPEC + cuts. Optimists also pointed to expectations of growing demand from China as the country reopens its economy after the Covid-19 pandemic, which has been a disappointment so far. Furthermore, Western sanctions restricting the purchase of oil from Russia to punish the country for its invasion of Ukraine were expected to also push up prices.

Fears of a global recession, however, have had a multiprong assault on prices. Recession fears have driven many foreign investors to the stability of the U.S. dollar, causing the greenback’s value to increase. Since oil is denominated in U.S. currency, the strong dollar increases the cost of the commodity in other countries, which could cause oil consumption to weaken. Regardless of the dollar, a global recession would also crimp oil consumption, thereby easing price pressures. Meanwhile, China’s economic recovery following the pandemic has been weaker than expected and the country has turned to Russia for oil. Pakistan and India have also inked deals to buy oil from Russia, which is believed to be exporting the commodity at the same level as before the country invaded Ukraine, albeit at discounted prices.

In fact, a rate hike surprise, similar to what occurred in Australia and Canada last week, is more likely than the market thinks on the back of accelerating core inflation, persistent wage growth and a May Jobs report reflecting 339,000 new jobs.

Progress on inflation after 15 months of rate increases is encouraging with the headline inflation number roughly half of the rate of last summer, but the persistence of the monthly core rate poses a challenge, reflecting loosening financial conditions as the failures within the regional banking sector appears to be limited to only a handful of banks. Meanwhile, bonds yields have declined and spreads of asset backed bonds relative to Treasuries have also tightened, reflecting improved credit terms and access. After the last Fed meeting, Chair Powell commented that the Fed’s past efforts to improve liquidity during the current economic cycle have resulted in a resurgence of inflation. With those points in mind, the Fed will likely need to maintain its hawkish stance despite the growing likelihood of it pausing its rate increases tomorrow. In fact, a rate hike surprise, similar to what occurred in Australia and Canada last week, is more likely than the market thinks on the back of accelerating core inflation, persistent wage growth and a May Jobs report reflecting 339,000 new jobs.

Visit Traders’ Academy to Learn More about the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.