Market dynamics are varied this morning as the January selloff takes a breather. Yields continue to rise, a result of two consecutive days of strong labor market data increasing inflation expectations. Notably, recent reports on Job Openings, Employment Growth, and Unemployment Claims suggest the Federal Reserve is less inclined to ease monetary policy. Just a few weeks ago, the likelihood of a Fed cut in March seemed almost certain, but recent developments have significantly reduced those odds, bringing them much closer to a coin flip.

Hiring Accelerates Sharply

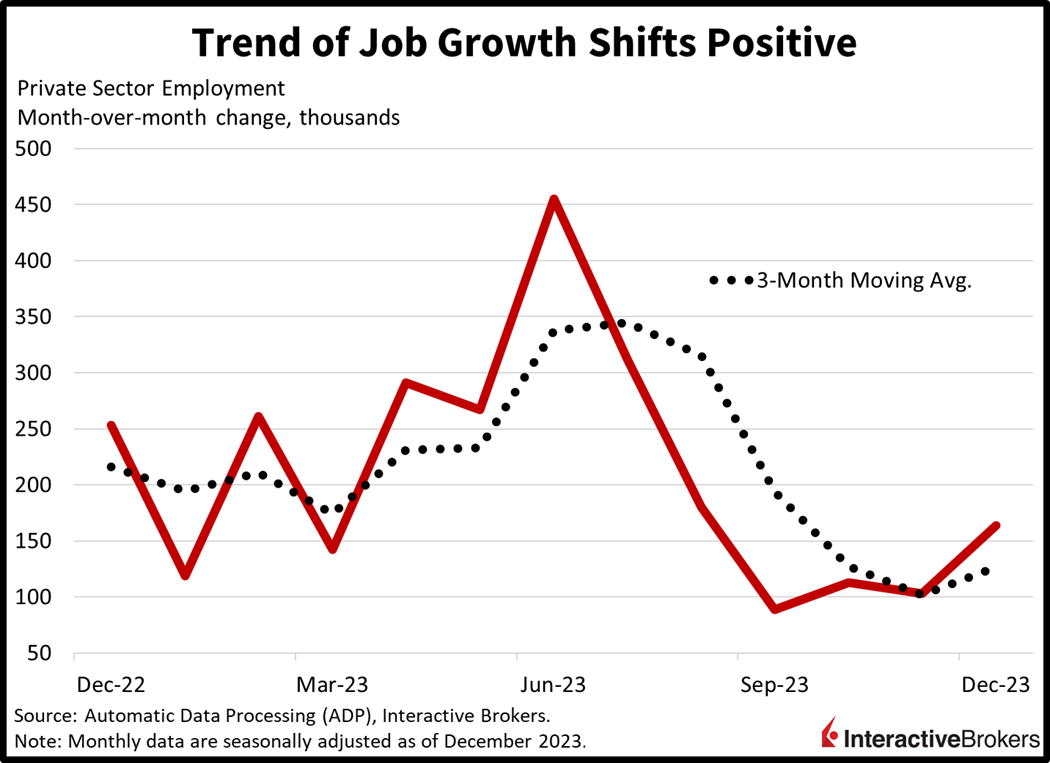

Private sector employers in December hired workers at the fastest pace since August, according to payroll processing company ADP. The 164,000 new additions occurred broadly across sectors while shattering projections calling for a mere 115,000 new positions. In November, just 103,000 net new hires were added, pointing to an economy that’s accelerating. Inflationary risks remain elevated, however, with the labor-intensive, inflation-ridden, leisure and hospitality sector leading the December gains with 59,000 new jobs. Additionally, wage gains slowed slightly but were still strong, exceeding a level that is consistent with the Fed’s 2% inflation target. Year-over-year growth rates for job stayers and job changers slowed to 5.4% and 8% in December from 5.6% and 8.2% in November.

Other sectors that increased headcounts and the number of positions added include the following:

- Education and health services, 42,000

- Construction, 24,000

- Other services, 22,000

- Financial activities, 18,000

- Trade, transportation and utilities sector, 15,000

- Professional and business services, 1,000

Job growth was uniformly positive across firm sizes. Small companies, or those with less than 50 workers, added 74,000 positions. Medium-size companies, or those with 50-499 workers added 53,000 and larger businesses added 40,000 new workers. Conversely, manufacturing lost 18,000 jobs while mining and information each lost 2,000 jobs.

Layoffs Decline

Firms were reluctant to let go of workers recently as well, with unemployment claims coming in well below expectations. Just 202,000 initial unemployment claims were submitted for the week ended December 30, well below the anticipated 216,000 and the 220,000 from the previous period. The downtrend contributed to a sharp decline in the indicator’s four-week moving average, dropping to 207,750 from 212,500 week-over-week (w/w). Continuing unemployment claims depicted a similar phenomenon, with the figure arriving well below estimates and dropping from the previous reading. For the week ended December 23, continuing claims totaled just 1.855 million, missing the anticipated 1.883 million and the previous week’s 1.886 million. The four-week moving average dropped from 1.877 million to 1.867 million.

The Resilient Consumer Shows Signs of Weakness

Walgreens Boots Alliance reported a decrease in retail sales, but highlighted that higher prices for brand name drugs, an expansion into health care services and other positive factors contributed to surpassing earnings and revenue expectations for the fiscal first quarter ending November 30. Excluding irregular expenses, the operator of Walgreens pharmacies achieved an earnings per share (EPS) of $0.66, beating the analyst consensus estimate of $0.61. However, these results represented a 43% decline from the EPS of $1.16 in the year-ago quarter, when the company benefited from a lower effective tax rate due to capital carryforward losses. The recent quarter also saw a decrease in operating income. A 13.1% increase in comparable pharmacy sales partially offset the impact of a 5.0% year-over-year decline in comparable retail sales. Walgreens attributed the decline to “macroeconomic-driven consumer trends,” a weaker flu and respiratory season, and holiday store closures. On a positive note, the company’s international segment’s strength, solid performance in health services such as VillageMD and the acquisition of CityMD parent company Summit Health resulted in revenue climbing 10% year-over-year to $36.71 billion, surpassing the consensus expectation of $34.86 billion.

Conagra faced challenges due to consumer spending weakness, impacting its sales of Slim Jim meat sticks and Healthy Choice frozen meals for the fiscal second quarter ending November 26. Sales on an organic basis dropped 3.4% year-over-year, with overall sales of $3.21 billion contracting 3.2% year-over-year, missing the analyst expectation of $3.23 billion. Despite an EPS of $0.71, excluding one-time expenses, showing a 12.3% year-over-year decrease, it exceeded the consensus forecast of $0.74. Conagra noted that the decline in the unit volume of its sales had slowed since the fiscal first quarter. However, the company revised its annual sales forecast from a 1% increase to a decline of between 1% and 2%.

Stocks Recover but Yields Warn

Stocks and yields are higher this morning with equity bulls seeking to pare some of their recent losses. Fixed-income investors are wary, however, noticing that this recent streak of hot data doesn’t bode well for Fed easing prospects. All major US stock indices have recovered with the Dow Jones Industrial Average leading; it’s up 0.7%. The small-cap Russell 2000, S&P 500 and Nasdaq Composite indices are up 0.4%, 0.4% and 0.3%, meanwhile. Sectoral breadth is impressively positive, with all segments higher except for energy, which is down 0.7%, a result of an inventory spike of gasoline and distillate fuels stateside. Financials and healthcare are leading with gains of 1.2% and 0.9%. Yields are climbing, with interest rates on the 2-and 10-year Treasury maturities up 4 and 5 basis points (bps) to 4.37% and 3.97%. The dollar is weaker, however, with the US currency losing ground relative to the euro, pound sterling, and yuan while it gains relative to the yen, franc and Aussie and Canadian dollars. The greenback’s index is down 13 bps to 102.32. WTI crude oil is down 2.5%, or $1.82, to $71.11 per barrel, as traders turn their focus away from geopolitics and towards buoyant US supplies.

Friday Jobs Could Spark Volatility

Monetary policy hawks may be emboldened by tomorrow’s Jobs Report alongside market bears. I’m expecting payroll growth to come in at 185,000 and hourly earnings to rise 0.4%, developments that will push the 10-year yield above the psychologically important 4% level. The short end of the curve is likely to shift higher as well, with market participants rethinking the likelihood of six interest rate cuts this year against the backdrop of an easing cycle that may be postponed until after March. Against this backdrop, US debt exceeded $34 trillion just this week, with issuance expected to ramp up significantly. The issuance may be tested, however, if Republicans and Democrats can’t shake hands in order to avoid a government shutdown on January 19.

Join Me at The MoneyShow

I look forward to discussing the Federal Reserve’s challenging journey across the monetary bridge—or process of taming inflation while keeping growth positive—when I speak at the MoneyShow Virtual Expo. I will discuss economic and financial market conditions and place an emphasis on consumer spending, labor markets, equities, fixed-income, commodity trends, and monetary and fiscal policies. I will also cover the real estate, banking and manufacturing sectors. Please click below to receive a free pass to the online event, which is scheduled for 11:50 a.m. EST on Thursday, January 18. Register For Free Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.