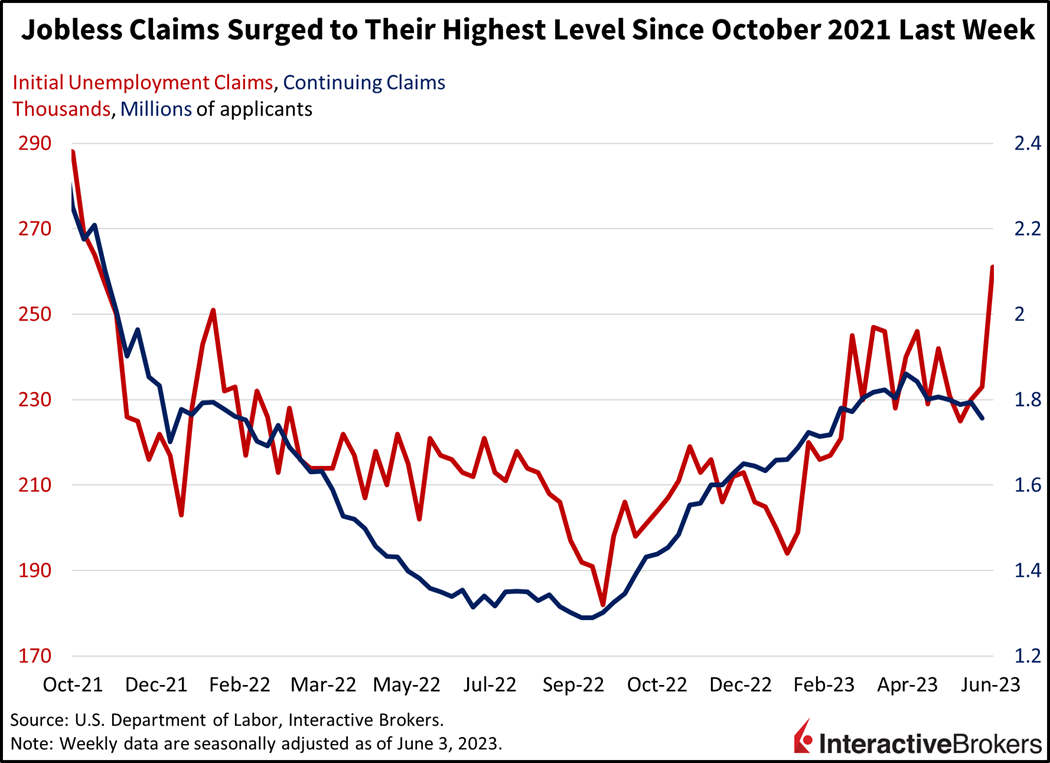

Yields are falling this morning as economic slowdown worries strengthen due to an increase in U.S. unemployment claims and weaker-than-expected eurozone GDP. This morning’s report of the highest level in U.S. unemployment claims in almost two years is leading to concerns that restrictive monetary policy is weakening the tightest labor market in decades. Tighter monetary policy in Europe, on the other hand, is undoubtedly weakening the region’s economy, with this morning’s GDP revisions reflecting the region’s slip into a technical recession, defined as two consecutive quarters of real GDP contraction. However, job growth remains strong in both the U.S. and Europe, as the global slowdown is characterized by affordability pressure and declining investment, not significant unemployment.

Revisions this morning showed the eurozone experiencing negative real GDP in the final quarter of last year and the first quarter of this year. Initial reports pointed to a 0.1% gain in the first quarter and flat growth in the fourth quarter while revised data with more complete information reflects contractions of 0.1% for both quarters. Weighing the most on the headline figures was Germany, Europe’s largest economy, registering declines of 0.3% and 0.5% during the periods. These contractions occurred, however, alongside an acceleration in job growth across the region. Similar to the U.S. where employment deceleration has been elusive, employment growth in the eurozone accelerated to 0.6% in the first quarter on a quarter-over-quarter basis (q/q), double the pace from the fourth quarter’s 0.3%.

Meanwhile in the U.S., initial unemployment claims during the week ended June 3 rose to their highest level since October 2021. The 261,000 claims easily overcame expectations calling for 235,000 while also rising sharply from the previous week’s 233,000. Many of those unemployed workers, however, are finding jobs elsewhere pretty quickly, with continuing unemployment claims trending downward and registered a decline to 1.757 million for the week ended May 27, lower than expectations calling for 1.8 million and down from the previous week’s 1.794 million. Continuing claims reached 1.861 million in April, the highest since November 2021.

Equities are jogging toward the 4300 level on the S&P 500 Index, erasing most of yesterday’s losses. While the tech sector was hardest hit yesterday, it’s making some progress today with the Nasdaq Composite Index up 0.8% while the S&P 500 Index is up 0.4% to 4283. Bond yields are lower on lighter data from the U.S. and the eurozone, with the 2- and 10-year Treasury maturities down 5 basis points (bps) each to 4.5% and 3.73%. Lighter Fed expectations have pulled down the Dollar Index, its down 64 bps to 103.44 against the backdrop of 71% odds of a pause at next week’s Fed meeting. WTI crude oil is down 72 bps to $72.03, as the demand outlook continues to weigh on the commodity.

While Canada and a large portion of the U.S. are struggling under the smoke from wildfires, the economic impact of the record-setting fires remain uncertain. As of yesterday, Canada woodlands comparable to twice the size of New Jersey were scorched and more than 400 wildfires continued to burn. Canada is a major wood exporter and the fires contributed to lumbers’ price rising from $434 in May to $507 today. With U.S. housing highly unaffordable and construction in a slump, it remains to be seen if lumber price increases will persist, but the fires are having other impacts. A handful of gold, lithium, iron, copper and nickel operations have been shut down along with rail service in areas where fires exist. The fires have also weakened production of natural gas and oil. In May, Canada produced an average of 18 billion cubic feet of natural gas a day (BCF/d). That number is estimated to have declined to 17.7 BCF/d as of yesterday, according to S&P Global, while oil operations have also been curtailed. For May alone, the wildfires are estimated to have trimmed 0.1% to 0.3% of the country’s monthly real GDP.

Looking ahead to next week’s Fed meeting, Chairman Jerome Powell may surprise market participants with another 25-bp hike. As 500 bps of hikes have been implemented thus far, job growth and consumer spending continue to move at a brisk pace while labor vacancies remain near record highs. The Consumer Price Index (CPI) is scheduled the day before Powell takes the mound and it’ll be interesting to wonder if it moves the needle for the next day’s press conference. While headline CPI is going to come in low relative to recent memory, the core figures that the Fed cares about most are flatlining, warranting continued monetary policy restraint. A failure to do so will result in a renewed surge in inflationary pressures fueled by a loosening in financial conditions.

Visit Traders’ Academy to Learn More about Initial Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.