Markets are lower on the first day of the fourth quarter, as yields reach fresh highs while stocks fumbled between gains and losses. Stronger-than-expected economic data from the Institute for Supply Management (ISM) during intraday trading failed to bring in the bond bulls, with long-end yields climbing to new highs. Equity investors were increasingly motivated by the last-minute surprise stopgap spending deal in Washington, D.C., delaying the prospect of a government shutdown until mid-November. The move in yields served to be too much of a burden, however, sparking an intraday reversal.

Manufacturing Doldrums Persist

On a sobering note, the manufacturing sector contracted for its eleventh-consecutive month in September, according to the ISM Manufacturing Purchasing Managers’ Index, but its score of 49 exceeded the consensus expectation of 47.8. September’s reading, however, fell short of the expansion-contraction threshold of 50, as declining new orders, shorter backlogs, falling prices and dwindling customer inventories weighed upon results. Still, September’s read was the best month since November and a much more modest contraction than August’s 47.6 result. An uptick in employment and production provided relief last month with employers adding workers at a strong pace, driving the employment result to 51.2, up from 48.5.

Construction Spending Grows, but Pace Moderates

While investors are fretting over the sorry state of manufacturing, they are assessing good news from the U.S. Census Bureau, which reported this morning that construction spending continued to increase in August, but at a slower pace than in July. For August, growth was supported by the residential, lodging and manufacturing segments. The 0.5% month-over-month (m/m) growth met expectations but decelerated sharply from July’s 0.9% m/m pace as higher financing costs took a bite from activity. Still, homebuilders increased their outlays on new single- and multi-family projects to the tune of 1.7% and 0.6%. The overall residential sector, which includes renovation spending, rose 0.6%, while lodging and manufacturing supported gains as well, rising 1.3% and 1.2%. Manufacturing construction continues to benefit from onshoring amidst the tailwinds from fiscal programs providing industrial subsidies. While the ISM reported continued contraction in manufacturing, construction trends point to the sector eventually returning to growth.

It’s the Season for Striking

The UAW strike is continuing and while the action is highly visible, it is only part of a larger trend of unions seeking better pay, benefits and working arrangements for members. This trend is creating concerns about the potential for increased wage pressures that could crimp corporate earnings or accelerate inflation if businesses pass higher labor costs onto customers by raising prices at a time when the labor market is already tight. The UAW currently has 25,000 Big Three automobile company workers striking, which is a considerable number that could increase if negotiations don’t progress favorably, but it pales in comparison to another potential strike: This Wednesday, 75,000 union workers at Kaiser Permanente could walk off the job in a strike that is expected to last three days. Kaiser Permanente has been on a hiring spree during the past two years, but the union maintains that the health care organization is significantly understaffed. The Culinary Workers Union Local 226 and Bartenders Union Local 165, furthermore, secured a 95% vote in favor of striking. The union represents 40,000 hospitality workers in Las Vegas. The UAW strike is noteworthy because it is simultaneously targeting all Big Three companies, but perhaps even more significant, it’s seeking a 36% pay increase. If granted, it won’t be the only big salary increase this year with United Airlines approving a 40% pay hike over four years for union pilots earlier this year.

Shutdown Averted

Investors are feeling relieved after Congress and President Joe Biden approved a 45-day stopgap funding measure this weekend to avert, at least temporarily, a government shutdown. In order to win Democrat’s support, House of Representatives Speaker Kevin McCarthy dropped numerous provisions that certain hardline Republicans sought, such as various spending cuts, but he appeased the faction by dropping a Democrat-supported provision for funding for Ukraine’s efforts to turnback Russia’s invasion of the country. In the aftermath of the stopgap approval, political infighting between hardliners and McCarthy is escalating, but perhaps even more significant, Washington observers are opining on how strong polarization within Congress will make it difficult to pass a full-year budget in just over 40 days.

Liquidity Concerns Pump Bond Yields Higher

Yields are jumping today on the back of challenging liquidity conditions while stocks are experiencing bifurcated action. Yields on the 2- and 10-year maturities are up 7 and 12 basis points (bps) to 5.12% and 4.701%. Indeed the 10-year just reached a fresh year-to-date high, the loftiest level in sixteen years. Higher yields are benefitting the dollar, which is also rising due to stronger-than-anticipated economic data and Federal Reserve Governor Bowman’s comments supporting another interest rate hike by year-end. The Dollar Index is up 64 bps to 107.31 as the greenback appreciates against the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. For stocks, economically sensitive sectors are underperforming technology, with the Russell 2000, Dow Jones Industrial and S&P 500 indices down 1.5%, 0.6%, and 0.4% while the Nasdaq Composite Index is up 0.3%. The technology, communication services and consumer discretionary sectors are up between 0.1% and 0.6%. Meanwhile, the other eight sectors are lower, as the utilities, energy and real estate sectors shed between 5% and 1.9%. Crude oil prices are sharply lower this morning, with Asian imports declining for the second-consecutive month in September as high prices dampened activity. A stronger dollar alongside higher interest rates is also offsetting the bullish supply story, with WTI down $1.64 to $89.07 per barrel.

Bonds Fall Out of Favor with Investors

Amidst the headwinds, continued political polarization, sticky inflation, record issuance, eye-watering budget deficits and uncertain commodity prices may push the 10-year above 5%.

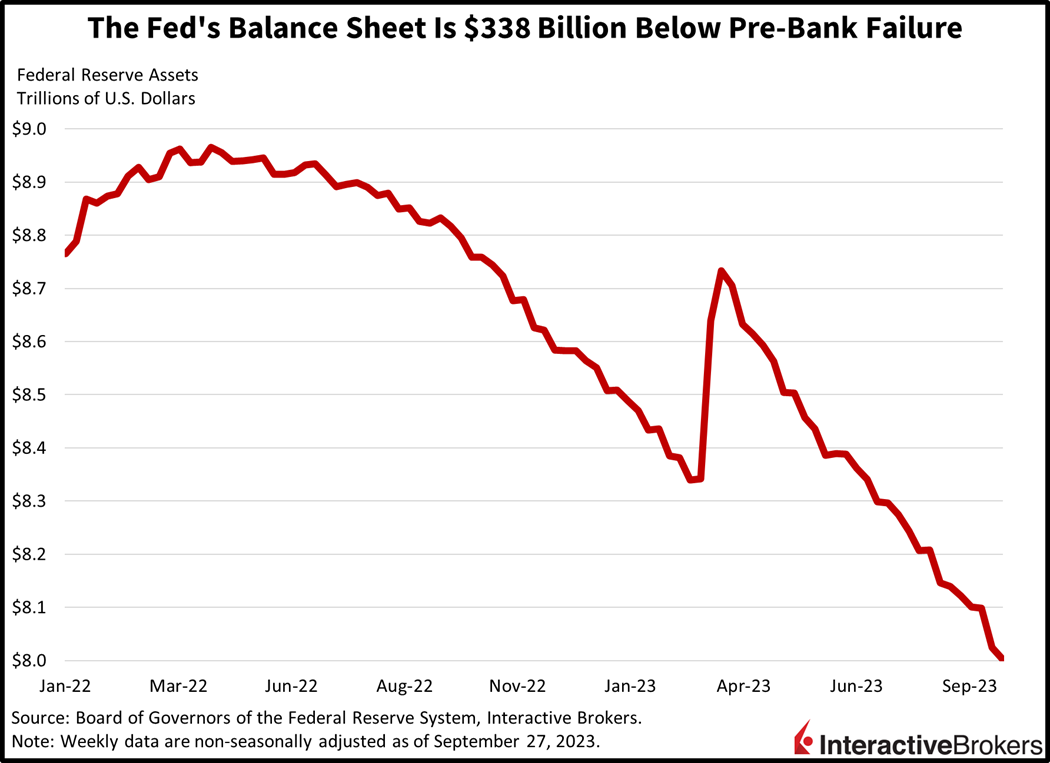

As we witness the 10-year reach a fresh year-to-date high at 4.701%, market players are wondering what role quantitative tightening is having. Indeed, $963 billion of balance sheet runoff with more on the way is a significant drag, as the Treasury’s largest price-insensitive buyer slowly leaves the table. International players are also buying less, with Beijing experiencing deep domestic troubles while Tokyo focuses on buying bonds at home in an effort to suppress yields. Amidst the headwinds, continued political polarization, sticky inflation, record issuance, eye-watering budget deficits and uncertain commodity prices may push the 10-year above 5%.

Visit Traders’ Academy to Learn More About ISM-Manufacturing and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.