CME Group will be launching Options on its Micro E-mini S&P 500 and Nasdaq-100 futures on August 31st*. Having launched Micro E-mini equity index futures on May 6th, 2019, the options will provide another vehicle for market participants to gain exposure to the two benchmark indexes with the precision of a smaller sized option. Combined, the four Micro E-mini futures products have averaged about 1.7 million round turns per day through July in 2020.

The Micro E-mini Options will be similar in many ways to the current options on E-mini futures but, because the underlying is 1/10 the size, the options will also be 1/10 the size in terms of premium, all else equal. For example,

- The Micro E-mini Options (“Micro Options”) will have the same tick size rules but .25 points in the Micro E-mini S&P 500 options will be worth $1.25 versus $12.50 in the E-mini S&P 500 options

- CME Group will list Weekly (Friday), End-of-Month and Quarterly Micro Options expirations.

- The trading hours of the Micro Options will be identical to the E-mini Options

- Active traders can offset Micro and E-mini Options with one another

To provide a practical example of the differences between the E-mini and Micro E-mini Options, let’s take a look at the current E-mini S&P 500 options market.

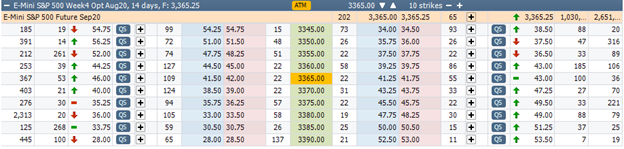

As you can see in the image below, taken from CME Direct (CME Group’s trading front-end), the at the money strike in the August Week 4 option, that has 14 days until expiration, is the 3365 strike (as indicated by the yellow highlight).

The midpoint between the Bid and Ask at the time we took this snapshot in the Calls was 41.75 and in the Puts was 41.50.

Assuming a trader could get filled at these prices, the price of the 14-day straddle would be 83.25 points, which is equivalent to $4,162.5 (at $50 per full point). So, if a trader wanted to assume a speculative position in the at the money straddle, they would have to risk over $4,000.

However, if the Micro Options had similar markets (there is no guarantee that the Micro Options will have identical prices to the E-mini Options but CME Group has solicited market makers for the Micro Options to provide liquidity in the new products), the dollar value, at 1/10 the size, of that same straddle would be reduced to $416.25 per straddle. Of course, a trader could execute 2 straddles for $832.50, 3 straddles for $1,248.75 etc.

Even in this simple example, you can see the notional and risk capital flexibility inherent in the new Micro E-mini Options. More information can be found at https://www.cmegroup.com/activetrader/microemini-options/

* Pending regulatory approval.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.