INTRODUCTION: EXPLORING META’S ROLE IN THE STOCK MARKET

Hey everyone – I’m Scott Bauer, and today we’re zooming into Meta’s current standing in the stock market. As part of the esteemed ‘Magnificent Seven’ tech stocks, which also include heavyweights like Netflix, Amazon, Alphabet, Microsoft, Apple, and Nvidia, Meta has been a significant market influencer. This year, these stocks have led the market’s movements, particularly noticeable after the rally we saw in November. However, Meta has experienced a recent pullback, which is particularly intriguing. This shift demands a detailed analysis to understand what it means for investors, especially considering the broader market trends and the potential implications for Meta’s future performance.

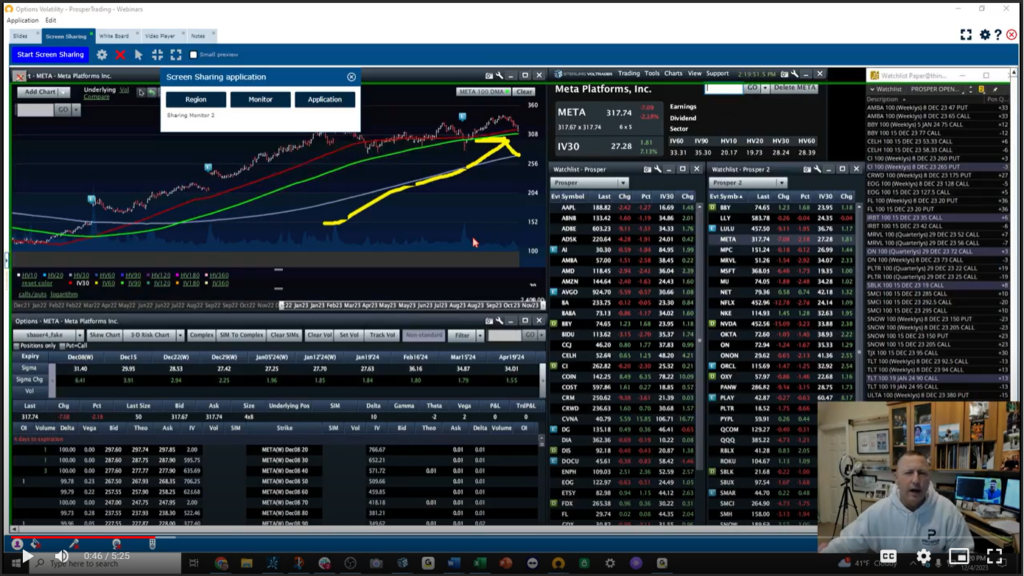

META’S STOCK ANALYSIS: UNDERSTANDING THE TECHNICALS

Meta’s stock has experienced a pullback, bringing us to two key technical levels that are vital for understanding the stock’s behavior:

- The 50-Day Moving Average (Red Line): This line has been a consistent support level for Meta, often indicating where the stock finds stability and possibly rebounds.

- The 100-Day Moving Average (Green Line): Alongside the 200-day moving average (blue line), this line serves as a long-term trend indicator and support level.

The importance of these moving averages cannot be overstated. They provide investors and traders with critical insights into market sentiment and potential future movements of Meta’s stock. This historical perspective, especially over the past 18 months, can be a valuable tool in predicting future trends and making informed investment decisions.

IMPLIED VOLATILITY AND OPTIONS: A MARKET INDICATOR ANALYSIS

In the current Meta stock scenario, two significant factors stand out:

- Implied Volatility: The low level of implied volatility, despite the stock’s decline, is an unusual yet important signal. It often indicates a divergence between market expectations and actual stock performance, suggesting that there may be unexplored opportunities for investors.

- Option Premiums: The unusually low option premiums, the lowest in the last two years, provide a potentially lucrative entry point for savvy traders. This could signal a period of undervaluation, offering a window for strategic investments in options.

These indicators are crucial for understanding the broader market dynamics at play. They can help traders and investors identify unique opportunities that might not be apparent through traditional analysis methods.

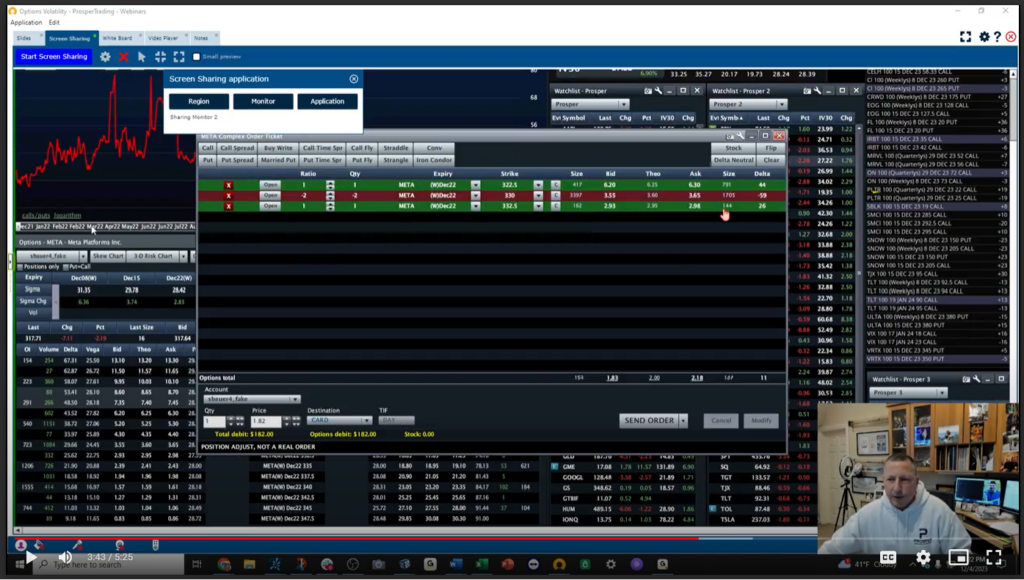

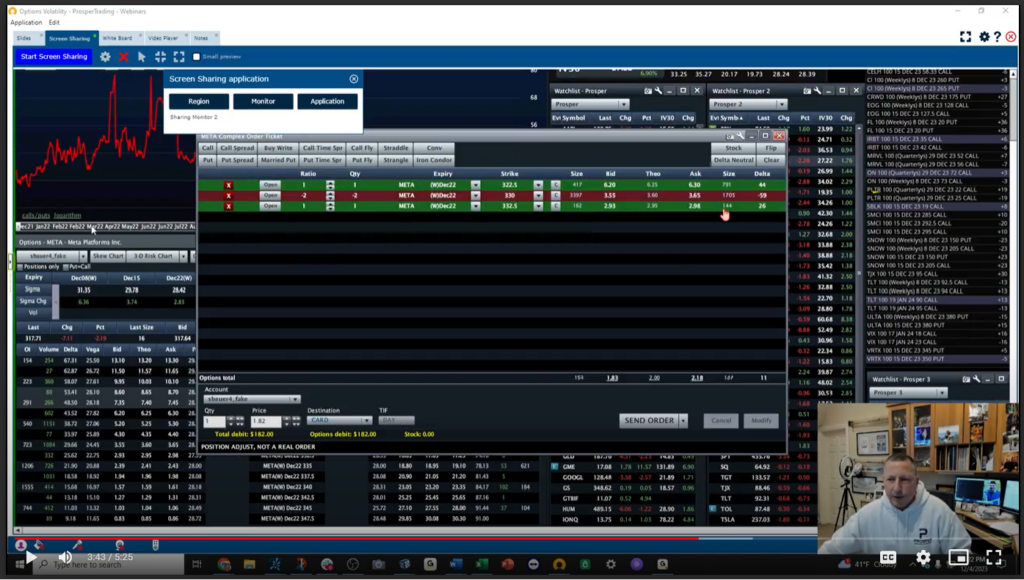

CONSIDER: THE BROKEN WING BUTTERFLY

In light of Meta’s current market position, I’d consider looking at the ‘broken wing butterfly’ spread strategy in call options. This strategy is particularly suited to the present market conditions characterized by low implied volatility and robust support levels:

- Understanding the Strategy: This strategy involves a unique setup of call options, where you buy and sell options at different strike prices, creating an asymmetrical structure that favors upward price movements.

- Advantages of This Strategy:

- It is particularly effective in periods of low volatility, allowing traders to capitalize on small price movements.

- Aligning with Meta’s current support levels, it provides a strategic edge, increasing the likelihood of a successful trade.

Executing the Strategy: A Step-by-Step Guide

Implementing the ‘broken wing butterfly’ strategy involves a few critical steps:

- Adopting a Bullish Stance: Given Meta’s strong historical support levels and the current market dynamics, a bullish position could be advantageous.

- Setting the Target Range: With Meta trading around $317.5, aiming for a target price range of $332.5 to $335 in the next three weeks could be a viable strategy.

- Managing the Spread: This involves buying a call spread that is $75 wide and selling a spread that is $25 wide. This asymmetry is what gives the strategy its name and its unique advantage, allowing for greater flexibility and potential upside.

CONCLUSION: CAPITALIZING ON META’S MARKET POSITION

To conclude, Meta’s current position in the market, characterized by significant support levels and low option premiums, presents a unique opportunity. The ‘broken wing butterfly’ spread strategy is an innovative way to leverage these conditions. It’s important for investors and traders to remain vigilant and responsive to market changes, as these conditions can evolve rapidly. Staying informed and adaptable is key to capitalizing on these opportunities.

—

Originally Posted December 5, 2023 – META Stock: Is Meta A Good Stock To Buy Now?

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Prosper Trading Academy

IMPORTANT NOTICE: Trading Stock, Stock Options, Cryptocurrencies, and their derivatives involves a substantial degree of risk and may not be suitable for all investors. Currently, cryptocurrencies are not specifically regulated by any agency of the U.S. government. Past performance is not necessarily indicative of future results. Prosper Trading Academy LLC provides only training and educational information. By visiting the website and accessing our content, you are agreeing to the terms and conditions.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Prosper Trading Academy and is being posted with its permission. The views expressed in this material are solely those of the author and/or Prosper Trading Academy and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

Recognition, good, valuable

Thanks for engaging!

很好Very good.

Thanks for engaging!

Just trying to study the strategy, I wish if the image could be opened in a bigger or zoomed window so I could see the exact trades and if I could backtest it

Hello Shaz, thank you for reaching out. You can copy the image to Paint and zoom in if necessary. We hope this helps!