Setting the Stage: The Prelude to NVDA’s Earnings

In the intricate world of the stock market, each movement carries significance – a story told through hopes, strategies, and anticipations. A recent example of this intricate interplay occurred on August 24, 2025, when NVIDIA Corporation (NVDA) released its earnings report, triggering a notable ripple effect across the market. However, to truly understand the subsequent day’s dramatic price action, one must rewind to the prior day, August 23, which witnessed a flurry of activity that might hold the key to comprehending the unfolding events.

Exploring Options Activity on August 23

NVDA Option Order Flow Sentiment

Source: Market Chameleon

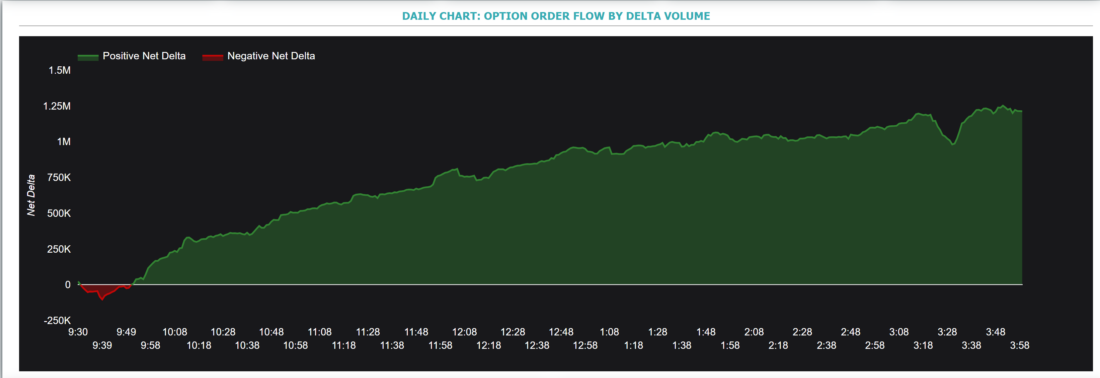

August 23, 2025, marked a pivotal moment as traders held their breath in anticipation of NVDA’s earnings report, while the options market was filled with a tangible sense of anticipation and energy. It was a day marked by a substantial buildup of bullish trading in NVDA’s options, a buildup that continued to climb as the hours ticked by.

Understanding Option Order Flow

At the heart of this analysis is the concept of option order flow sentiment. It’s like reading the collective mood of traders through the lens of options trading. Machine-generated estimates, like the whispers of the trading community, calculated the incoming order flow and the delta pressure it exerted from option trades.

Analyzing Imbalances

Source: Market Chameleon

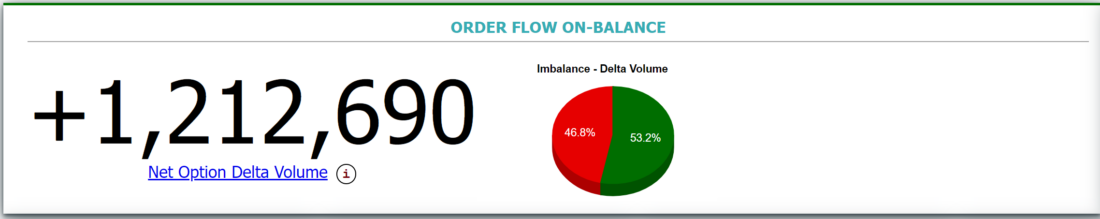

If we break down the sentiment, we find a notable imbalance of 1.2 million positive deltas from options traders by the day’s end on August 23. It’s like a chorus of bullish voices rising above the noise. But where did this imbalance stem from?

Source: Market Chameleon

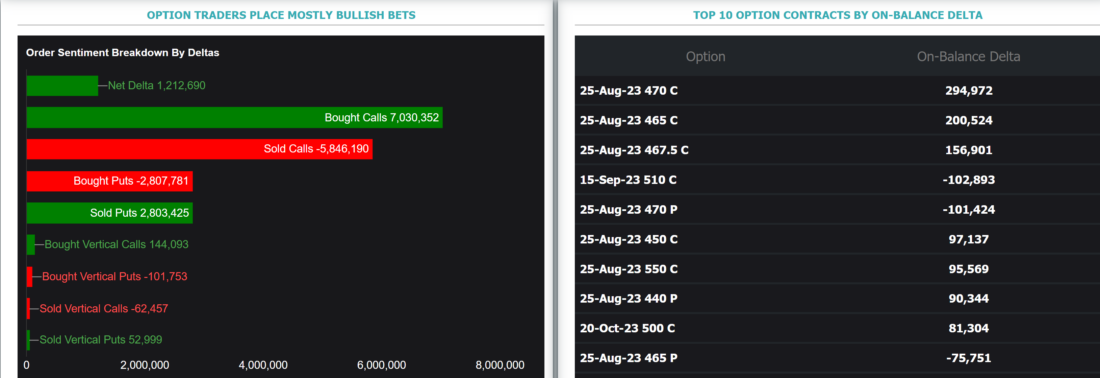

The intriguing part lies in the details. While the positive deltas predominantly stemmed from bullish call trades, the put buys and sells largely cancelled each other out as you can see from the diagram on the left. The top 10 option contracts, shown on the right hand side, are responsible for the highest delta contribution and tell a tale of their own.

The chart-toppers were bullish calls with expirations set for August 25, ranging from strikes 465 to 470. These contracts seemed to whisper optimism, as the traders on balance leaned toward an upward trajectory for NVDA’s price.

The Earnings Day Unfolds

Source: Market Chameleon

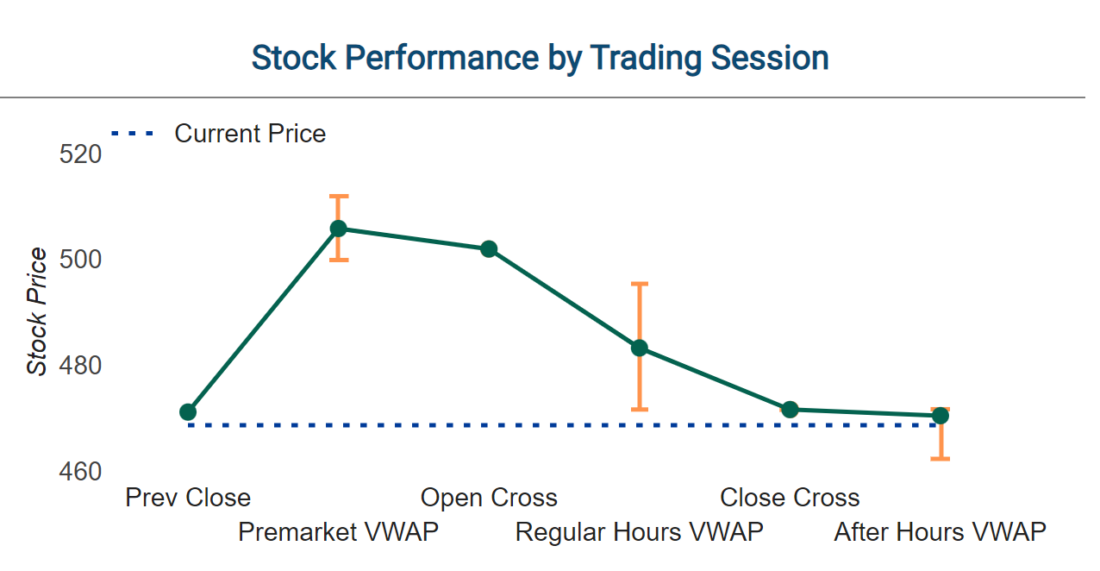

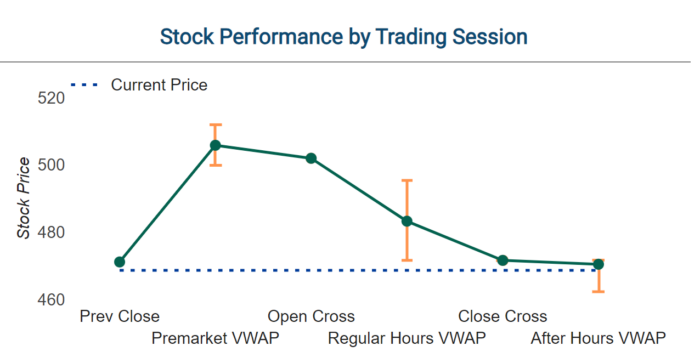

As the earnings day dawned, the stock embraced an upward momentum, even crossing the $510 mark in premarket trading, which was a crucial threshold for several bullish call options. With these calls having a strike range of 465 to 470, the stock needed to surge past $494 to render them profitable based on closing prices. However, an intriguing shift unfolded soon after the opening bell – a retreat that seemed to coincide with profit-taking behavior. The stock’s opening price of $502, well above the mark required for the calls to yield profit, possibly signaled a tactical maneuver by traders to capitalize on the considerable climb.

The Intersection of Options and Price Action

Now, let’s not be mistaken – stock market dynamics are complex, and countless factors influence price action. But in this intricate dance, the role of options traders becomes evident. Their positioning and subsequent actions can cast shadows or illuminate potential price action.

The takeaway from this NVDA saga is that every move, every option trade, every whisper in the market contributes to the grand narrative. While we can’t predict the future with certainty, analyzing the collective wisdom embedded in options order flow can certainly provide valuable insights. It’s a glimpse into the minds of traders, a dance of sentiment that accompanies the numbers on the screen.

So, as you follow stock market news and watch the dance unfold, remember that behind those numbers, charts, and tickers lie the stories of traders shaping the narrative, step by step, option by option.

—

Originally Posted August 25, 2023 – NVDA’s Earnings Impact: Option Order Flow and Price Action

Disclaimer

The information provided on this financial blog is for educational and informational purposes only. It is not intended as financial or investment advice. The content presented here should not be considered as a recommendation to buy, sell, or hold any securities or financial instruments.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.