A very positive element of aging is the ability to recall historical corollaries and potentially learn from them; this, coupled with my affinity for markets, history, and the arts, has me thinking about today’s markets. From an arts perspective, Mark Twain and others have pointed out that “history doesn’t repeat itself, but it does rhyme.” In capital markets, I’m drawn to indexes, and the current landscape calls to mind a 2011 analogy.

To be clear, this is meant to be observational, not analytical. In other words, there’s no implication that the potential similarities to a dozen years ago means the future path will resemble that of 2011.

The catalyst in my head was the Nasdaq-100 Index (NDX) requiring a “special rebalance.” Much has been written about the process, and one of the most digestible pieces can be found here. The last time it occurred was Q2 of 2011.

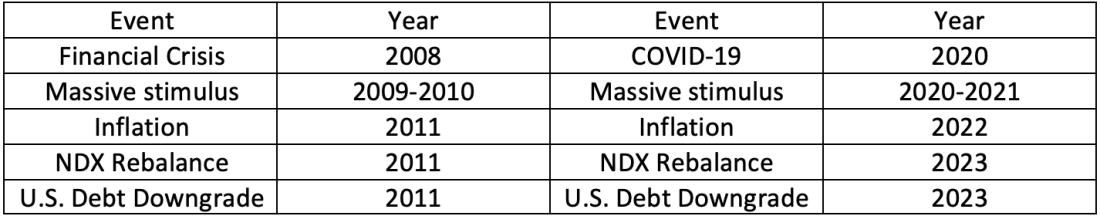

From my perspective, there are a handful of other interesting similarities between 2023 and 2011. There’s nothing prescriptive about this analysis, despite Mark Twain’s missives.

History

The global financial crisis in 2008 precipitated the sharpest decline in the global GDP growth rate since the World Bank started tracking the data in 1960. To combat the wreckage, the Federal Reserve (as well as other central banks) and Congress enacted massive stimulative programs. Equity markets responded positively. Between March 2009 and May 2011, the NDX increased by around 150%.

However, by 2011, inflation was a global concern that spilled over into unrest during the Arab Spring. Global markets declined as the U.S. dollar advanced. The NDX fell by around 20% in 2011. Budget deficits were growing and in August, Standard & Poor’s (S&P) downgraded U.S. credit for the first time ever.

Rhyming?

In 2020, a novel coronavirus brought the global economy to a standstill. The decline in GDP became the worst in history. The response from politicians and central bankers was akin to twelve years prior…only bigger. Between 2020 and early 2022, there was an unprecedented amount of fiscal and monetary stimulus. Equity markets responded in kind. Between March 2020 and November 2021, the NDX added around 155%.

However, by 2022, inflation measures were surging, and the U.S. dollar was at multi-decade highs. Global markets swooned with the NDX declining by around 37%. Presently, budget deficits and interest expenses are growing. In early August, Fitch downgraded U.S. debt from AAA to AA+.

Now What?

Thus far, U.S. equities have been resilient despite the debt downgrade. The reaction in 2011 was markedly different. As of August 10, the NDX is lower by about 3% month-to-date, but that could change significantly. In fairness, the sovereign debt situation in Europe (PIIGS) a dozen years ago compounded the macro uncertainty.

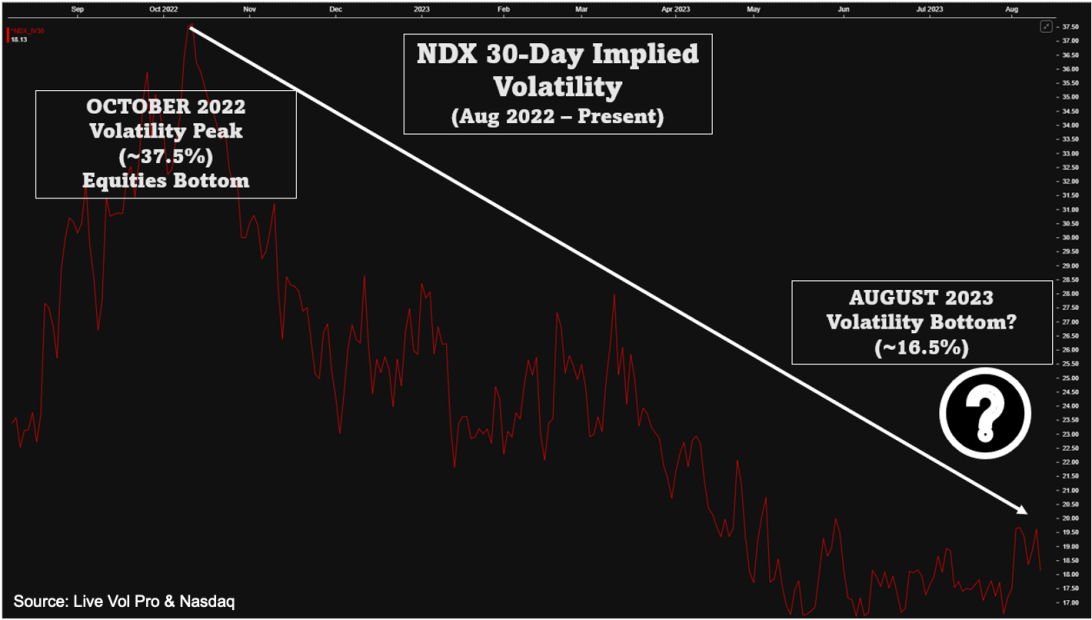

Indexes tend to exhibit greater realized and implied volatility between August and October. There was a slight increase in forward-looking vol measures early in the month, which have since receded.

An awareness of meaningful inflection points from the past can help us place current and future market events in perspective. There are a handful of similarities between the dynamics of this year and the tumult of 2011. There are also several distinctions. We’re reminded that the past is never indicative of future results. Leaning on Mark Twain again, “the only certainties in life are death and taxes.”

Options are flexible tools that allow end users to potentially benefit from uncertainty. If we had to add one more “certainty” – it would be that change is a constant. Learn more about how you can leverage Nasdaq-100 Index Options (NDX) to mitigate risk, generate income and maximize exposure to some of today’s most innovative companies.

Index

Originally Posted August 21, 2023 – Rhyming, Not Repeating

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2022. Nasdaq, Inc. All Rights Reserved.

This interview originally appeared in our Smart Investing newsletter. Sign up here to access your weekly digest of the latest investing news, personal finance tips and educational must-knows – all in one place.

Disclosure: Nasdaq

Index

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

Options

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and education purposes and are not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

© 2023. Nasdaq, Inc. All Rights Reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Nasdaq and is being posted with its permission. The views expressed in this material are solely those of the author and/or Nasdaq and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.