Over recent weeks, much has been made of the rise in listed equity options volumes, particularly those of call options. One can easily assert that we have been in a speculative market environment, and many of those speculators realized that call options could be a way to speculate on a rising market with a minimal cash outlay and defined risk. That speculative fervor reached a head during the GameStop (GME) frenzy of late January, but it had been building for several weeks prior. Yet something has been occurring much more quietly over recent sessions – call volumes have been dropping. What does this mean for volatility and markets in general?

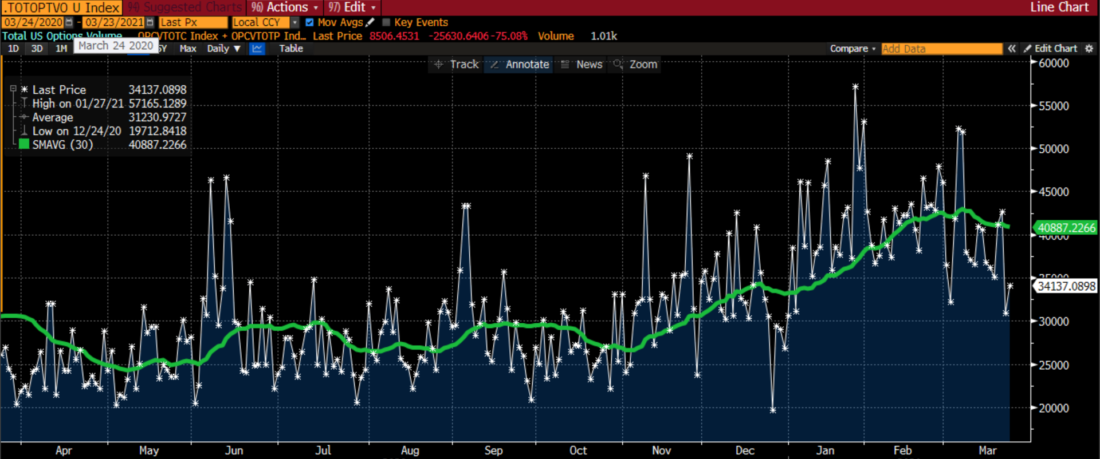

Let’s take a quick look at the volume trends for options. Here is a graph of daily total US options volumes over the past year through yesterday:

Total US Options Daily Volume (Calls + Puts)

Source: Bloomberg

We can see that the daily volume is somewhat erratic, so it is much more useful to focus on the 30 day moving average of the volume as displayed by the green line. We see that average peaking around the beginning of this month. The moving average has since trended lower, and if daily readings remain consistently below that average it will continue to decline.

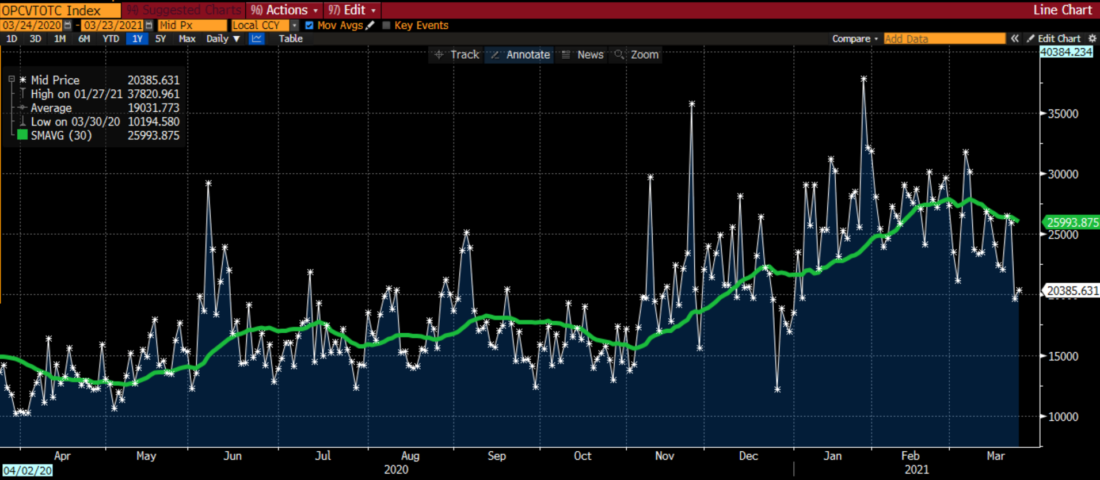

When we compare the graph above to a similar graph of just call options volume, we can plainly see how the changes in volume have been largely the result of changes in call volumes:

US Call Option Daily Volume

Source: Bloomberg

Looking at the two graphs together, the message is quite clear. Call options have been driving the bus over the past few months.

In early February, we explained how speculative call activity was pushing up the CBOE Volatility Index (VIX). The index construction utilizes all options within a band around 30 days to expiration with a non-zero bid. That means that a wide range of out of the money options have an effect on the pricing of VIX. Steeper skews have a positive effect on VIX. In other words, the more value that traders place upon protective puts and speculative calls, the higher the index reading (all things otherwise being equal). Over the past 30 days, despite some spikes late last month and early this month, we can see that VIX has trended marginally lower:

Intraday VIX, Past 30 Days

Source: Bloomberg

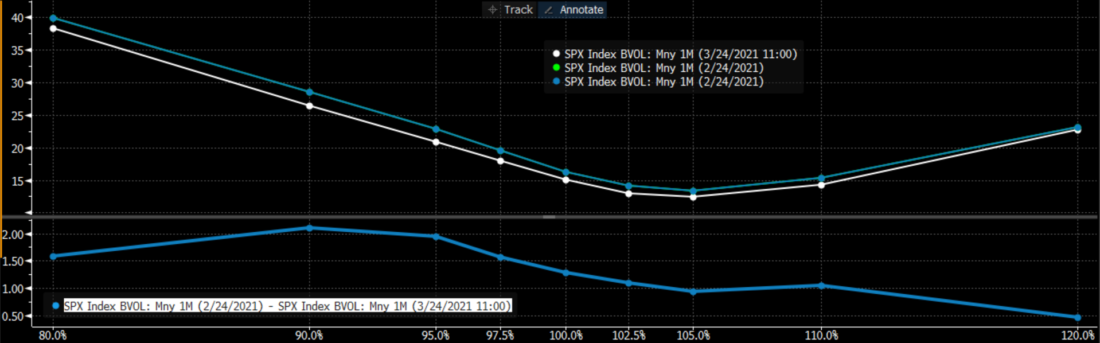

If we compare changes in at-money SPX options to VIX, we can somewhat isolate the effects of skew on VIX. In the graph above, we see VIX falling from 21.64 to 19.51, a decline of 2.13 points. During that same period, the graph below shows at-money SPX options (100% moneyness) declining from 16.33 to 15.38, or -0.95. The rest of the decline can be largely explained by changes in skew, as shown below:

VIX Skew, Today (white) vs. One Month Ago (blue), with Change (bottom)

Source: Bloomberg

At first glance, it appears that there was a generally parallel shift lower in the curve. But upon closer examination of the changes in values displayed in the bottom section, we see that the decline in below market options is greater than that in above market options. That fits with the general idea that VIX declines when fear abates (though I would like to reiterate that VIX is not now, nor has it ever been, the market’s fear gauge). The skew in above market options, those favored by speculative call buyers, has remained relatively firm, even despite the diminution in call volume.

We can debate whether the more sanguine nature of put hedgers is appropriate at present, but for now, one of our key assertions is being borne out. We have asserted that options market makers had systemically boosted implied volatilities of out of the money call options after being burnt multiple times during speculative waves, leading to more symmetrical skews on a lasting basis. One month does not make a trend, nor is it a sound historical precedent, but the early data shows that despite a reduction in overall call volumes, the volatility effects caused by the earlier fervor are persisting.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ