Yesterday we discussed the options market’s expectations for the earnings announcements that were due for 4 mega-capitalized stocks that make up about 1/3 of the weight in the NASDAQ 100 Index (NDX). This morning we find 3 of the 4 trading lower amidst a broader market selloff. Let’s see whether the options market expectations were correct.

I’ll leave the specific explanations for each stock’s moves to fundamental analysts who understand the mechanics of each individual business far better than I. My goal is to get investors to understand the market dynamics that are on display to investors who can decipher the message of the markets.

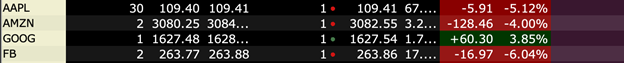

Here is a current snapshot of the 4 stocks current performance:

Going into earnings, I noted “…large tech stocks have tended to fare poorly – even after releasing earnings that beat expectations.”, so this type of reaction should not come as a huge surprise to investors. The broad message of the markets had already become clear – the deck was stacked against large companies. We then dug a bit deeper to see if that sentiment was conveyed in weekly options pricing.

For each of the following examples, I will show the probability distribution and analysis that we used yesterday and annotate where appropriate:

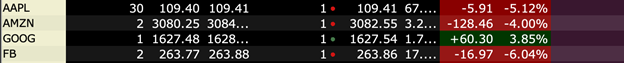

For AAPL, we see a flattish skew with a slight depression in the 118 area. That leads to a fairly symmetrical probability distribution centered around today’s trading price.

Yesterday’s market was fairly agnostic about Apple earnings yesterday. Today’s market reflects disappointment. That said, the implied volatility for at-money options was 83.8%. Using the Rule of 16, that converts to a 5.3% daily volatility. The stock is lower by almost that amount. The market didn’t’ necessarily get the direction right, but it got the magnitude of the move almost perfectly.

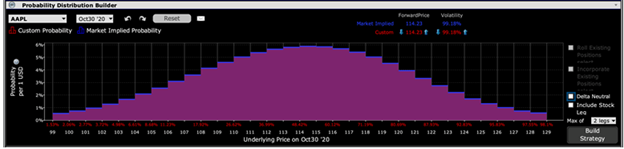

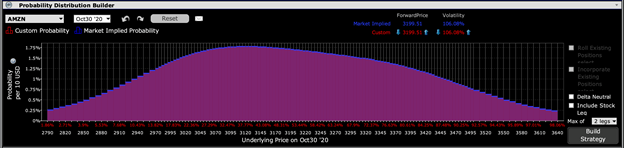

For AMZN, both the skew and the cumulative probability show the highest likelihood outcome is a dip to about 3100, erasing today’s gain but not much more. This is a change, because AMZN had been showing a fairly sanguine view, as evidenced by the upward slope in the lowest line on the chart above

AMZN is trading at $3080 in the snapshot above. That’s close enough to 3100 to say the options market called this one correctly.

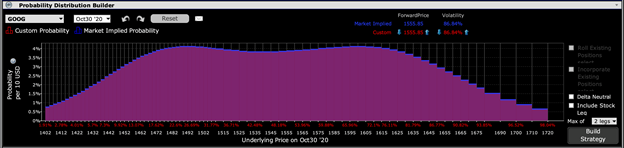

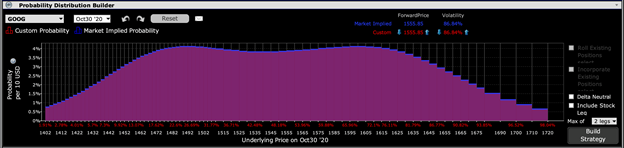

The probability graph for GOOG is rather unusual. Markets are implying a that the stock could rise or fall about 2% as more likely than if it stayed unchanged. In fact, there is about a $100 range of outcomes around the current price that appear to be likely. This could be because Alphabet is notoriously close-mouthed about earnings guidance, meaning that there is even less consensus as usual around their quarterly results.

GOOG options showed the widest dispersion of likely results, so any predictive value was murky. That said, one of the highest probability outcomes was about $1615, close to the current trading price.

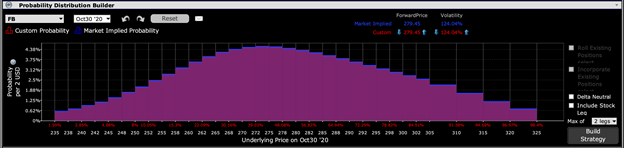

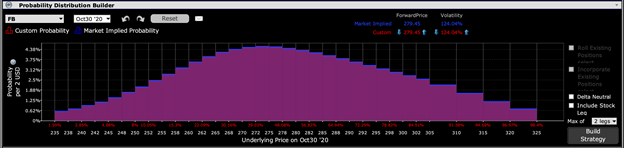

Finally, FB options appear to imply that the most likely outcome is for the stock to give back today’s 5% bounce. Though the skew is roughly flattish, it is clearly sloped toward downside options. It makes me wonder what today’s buyers see in the stock that the options market doesn’t.

With FB down about 6% I would say that the options market did indeed see something that the stock market didn’t.

Bottom line, the options market did a very good job predicting post-earnings outcomes for these 4 mega-cap stocks. Trust me, it doesn’t always work that well. But this time, the expectations were there for all to see. Hopefully you trusted the message of the markets, or at least learned how to better divine that message in the future.

Chart Sources: Trader Workstation

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ