This afternoon we have the most highly anticipated FOMC meeting since, well, the last one six weeks ago. Expectations for a rate cut are essentially nil, even if the probability of a June cut has crept back up to about 70%. Today’s activity will be driven primarily by traders’ interpretation of Chair Powell’s demeanor, and the newest “dot plot”.

As of now, a few hours ahead of the meeting, equity investors and options traders seem relatively unconcerned. If they were nervous, we wouldn’t have seen two prior days of rallies and a current reading of VIX below 14. They appear to believe that the Summary of Economic Projections (aka SEP, or “dot plot”) will be benign and that Powell will once again be “Goldilocks in a Suit” at the press conference.

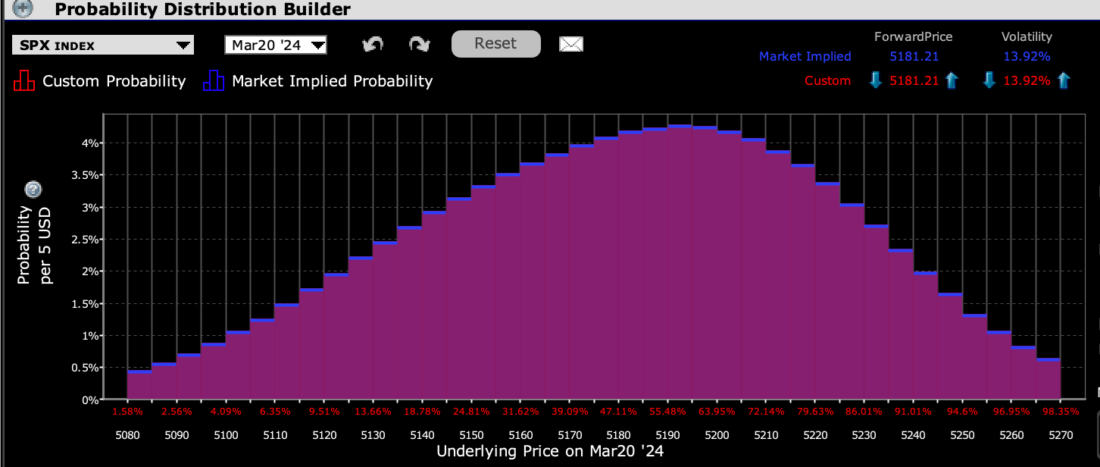

Using the prices of S&P 500 (SPX) index options as a guide for broad market sentiment, we see that a sanguine attitude, if not the continuing demand for “FOMO insurance”, prevails. The IBKR Probability Lab shows that SPX options are assigning peak probabilities to options in the 5200 range, about 0.35% above current levels:

IBKR Probability Lab for SPX Options Expiring March 20, 2024

Source: Interactive Brokers

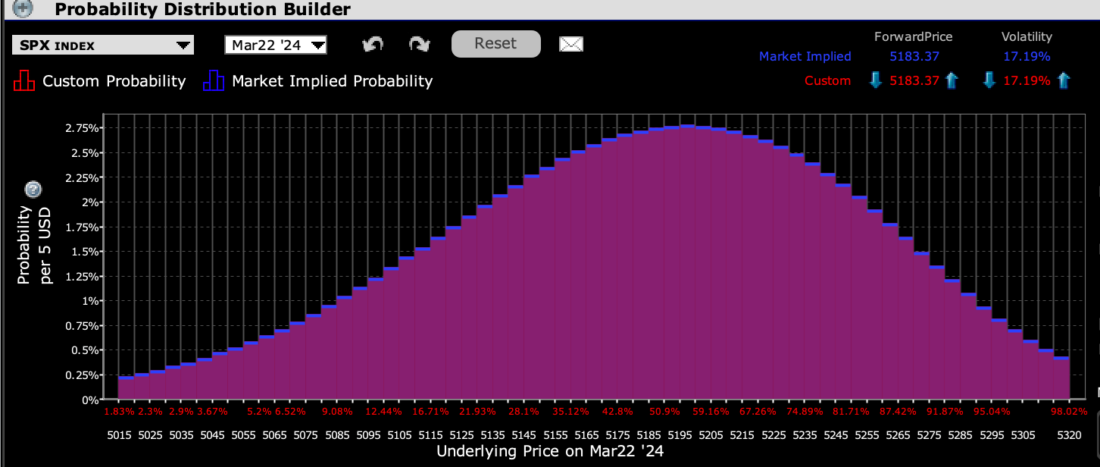

IBKR Probability Lab for SPX Options Expiring March 22, 2024

Source: Interactive Brokers

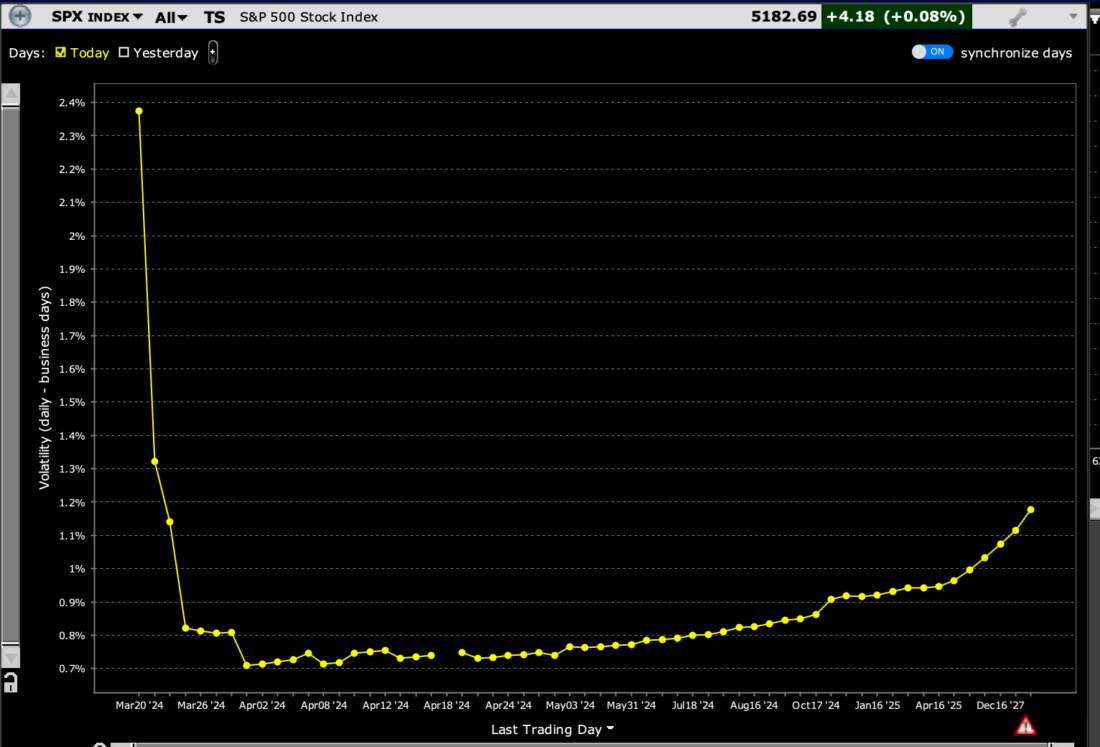

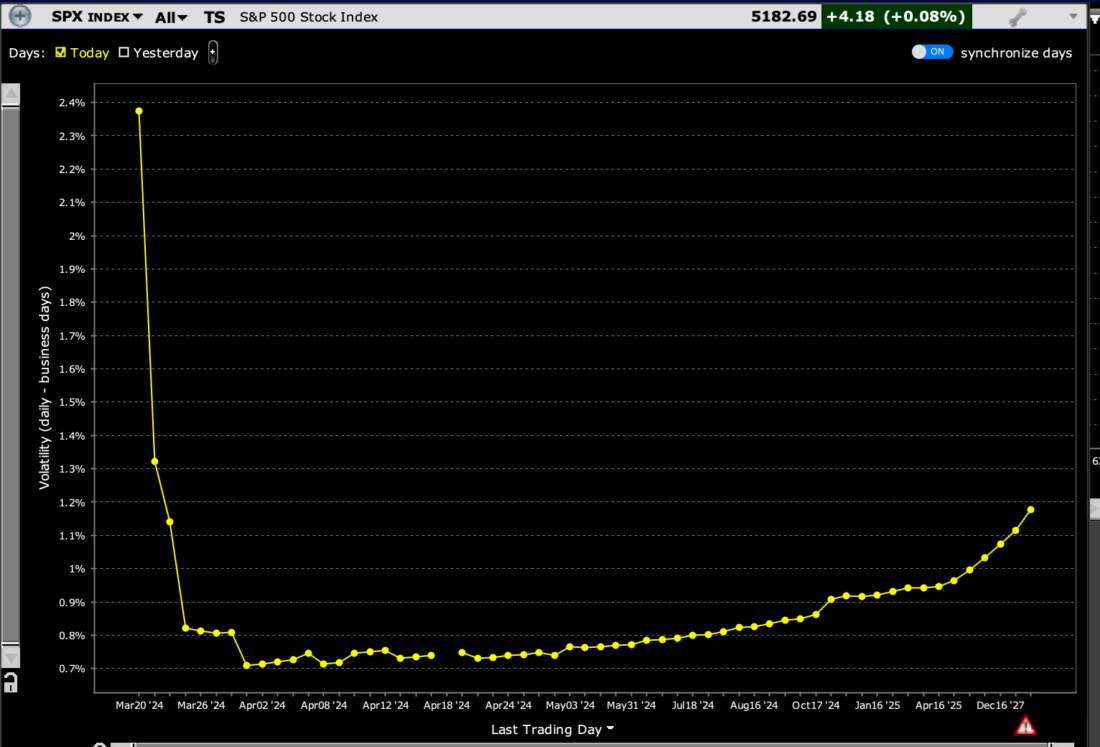

It has become fairly typical for major indices and stocks to be more heavily weighted to upside reactions than downside. An extended period of “weaponized FOMO” will do that. That said, at-money volatilities do indeed show a regard for the potential that volatility can result from today’s activities. The implied volatility for options expiring today is pricing in a move of just under 2.4%, with options expiring tomorrow and Friday pricing in average daily moves of about 1.3% and 1.1% respectively. The latter two readings imply that the bulk of any post-FOMC move will be felt today and ebb during the rest of the week.

SPX Volatility Term Structure

Source: Interactive Brokers

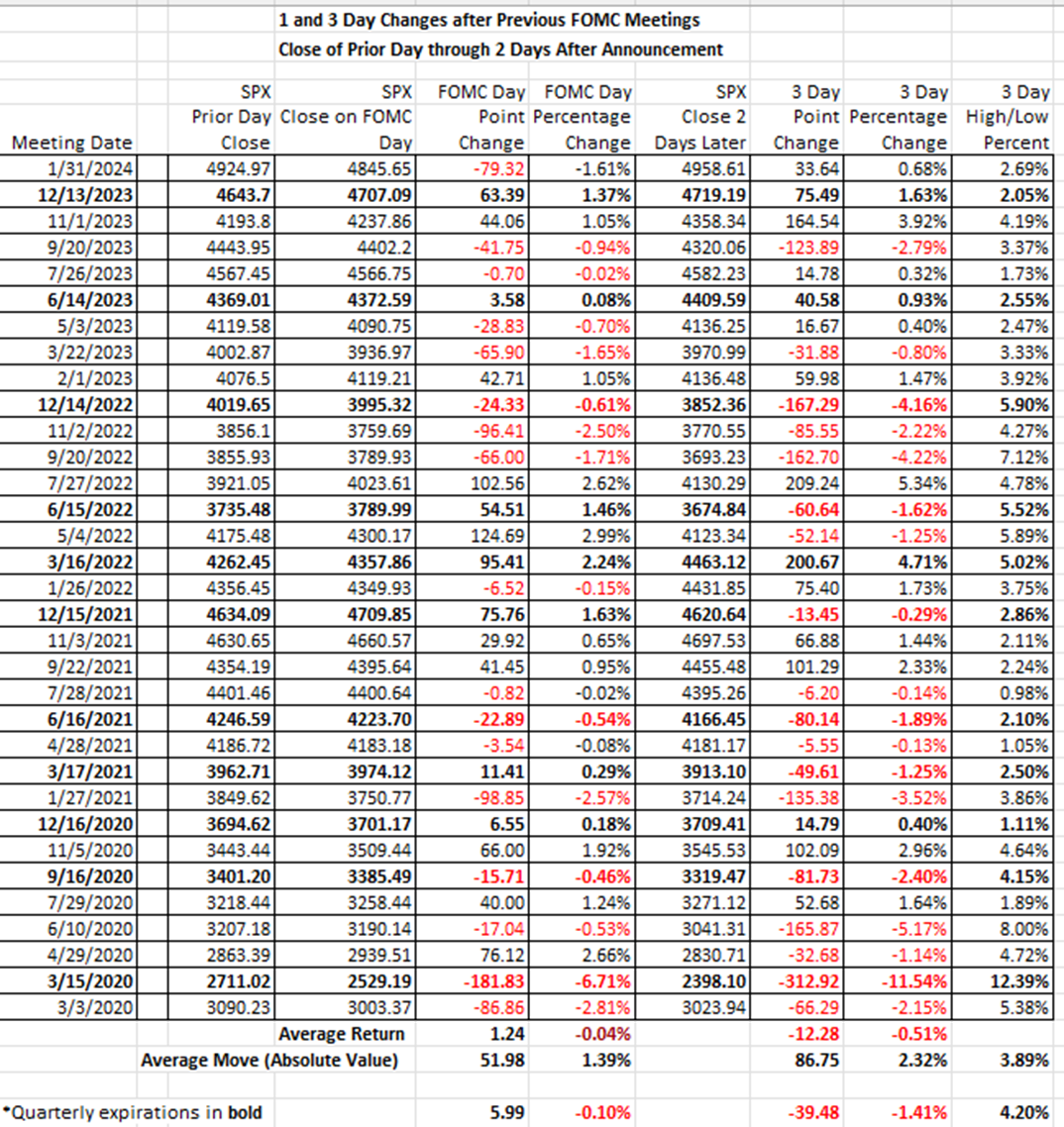

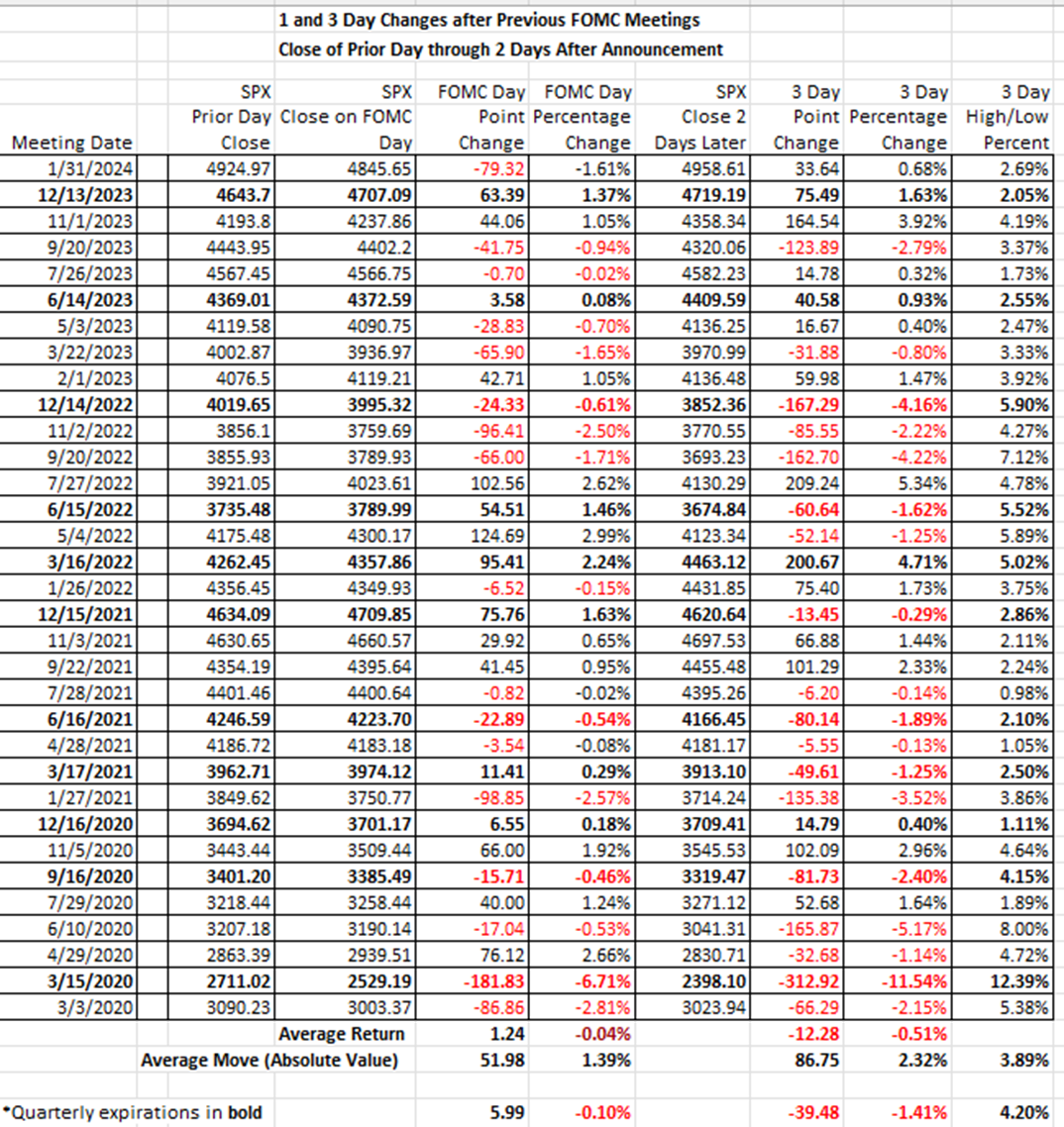

Today’s anticipated move is well above the 1.39% average move (in absolute value terms) that we see on FOMC days, while the following days’ pricing may be underestimating the reaction that could occur over the rest of the week:

Source: Interactive Brokers

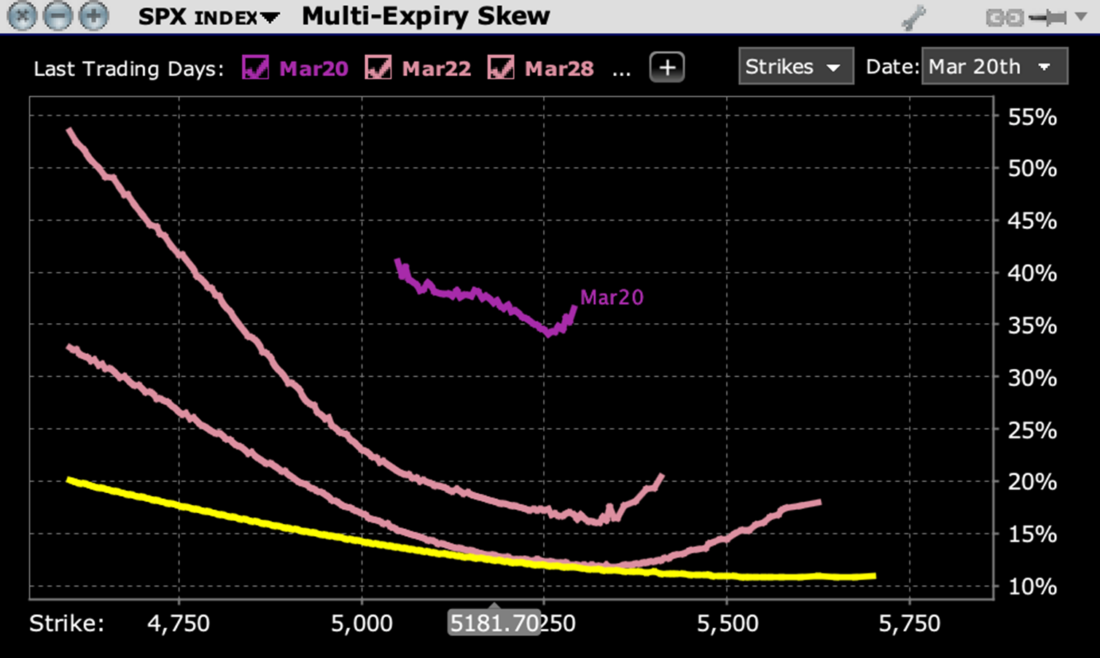

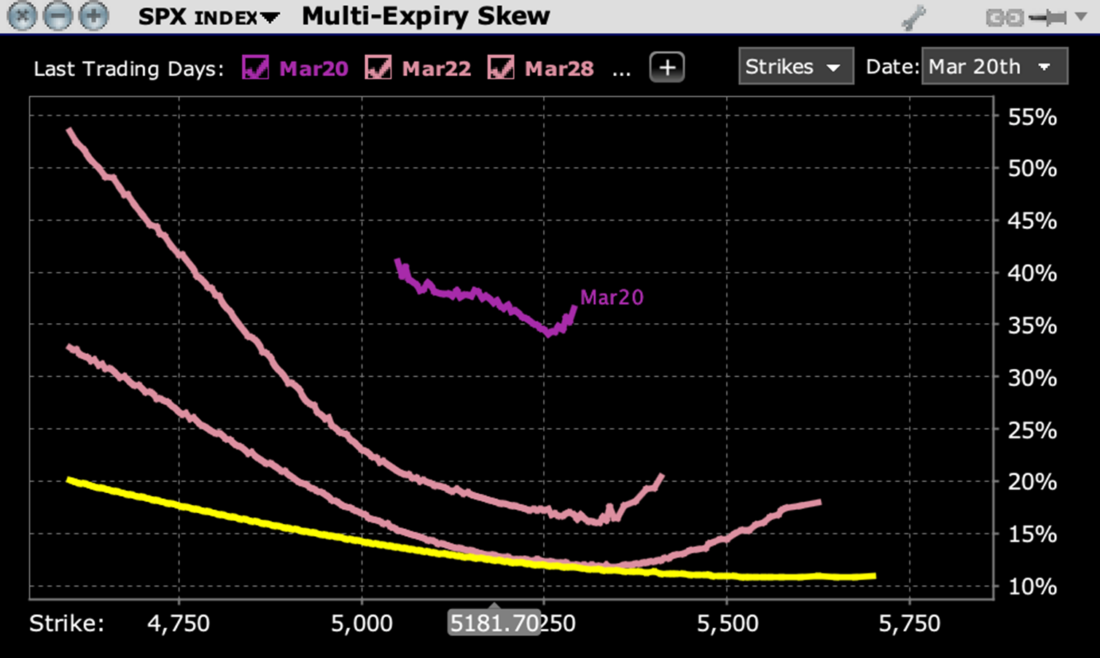

Option skews do reflect some degree of risk aversion. Options expiring today, this Friday, next Thursday (markets are closed Friday for the Good Friday holiday) and at the next monthly expiration all show an asymmetric skew, with downside options sporting higher volatilities than their upside counterparts, and with shorter-term options showing steeper skews:

SPX Skews for Options Expiring March 20 (top), March 22nd (2nd from top), March 28th (3rd from top), April 19th (bottom)

Source: Interactive Brokers

Bottom line, options markets are not ignoring the risks of a significant move after today’s meeting. While there is a respect for the possibility that Chair Powell could upset the market’s mojo, the prevailing sentiment is that he will once again outline the economy’s pros and cons in such a way that traders can seize upon the parts of his comments that fit or amplify the current sanguine

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.