The caps and gowns have been delivered. The assembly halls and football fields across the country have been readied for the big day. College graduation is a huge accomplishment and something to be celebrated.

According to recent statistics, more than two million Americans will complete their bachelor’s degree this year. Some will continue their education in a graduate program, while others will enter the workforce. At that point, they will likely have the opportunity to allocate some portion of their earnings to an investment account (401k, Roth IRA, etc.).

The potential benefits of setting aside money early and often is demonstrable. Admittedly, it’s very difficult to consider “retirement” when starting your first job. There are countless uncertainties, but that’s the way the world works. Uncertainty is endemic to the human condition.

One way to potentially minimize future concerns is to start saving and investing early. The concept of compounding returns can (and should) be understood whether you pursued finance courses or not. The combination of a significant time frame and indexed investing, while not bulletproof, will likely pay off down the road.

Average vs. Compound Rates of Return

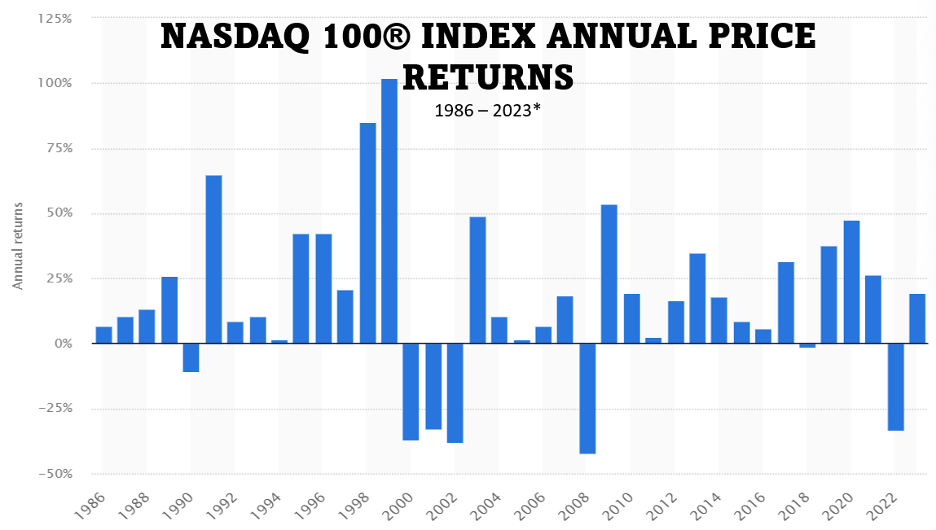

A “compounded return” is the rate earned over a longer time horizon. This approach incorporates volatility (or uncertainty) into the calculation. This contrasts with an “average annual rate of return,” which can be misleading. The chart below shows the annual price returns for the Nasdaq-100 Index (NDX), a basket of the 100 biggest stocks listed on the Nasdaq (think companies like Apple, Amazon, Tesla). Generally speaking, it measures the total gain/loss of those companies for the year:

NASDAQ/STATISTA

Rarely Average

Looking at the chart above, it might not be immediately obvious that the average annual total return for the Nasdaq-100 since inception is +17.10%. However, out of 37 years analyzed, there are only four calendar years that were close to average. Put another way, the NDX performance on a year-by-year is rarely in line with its long-term average.

For the sake of comparison, the S&P 500 Index (SPX) has an average annual total return of 9.55% since 1986, and like the NDX, has very few years that are close the average.

Since 1986, the NDX has outperformed the SPX on average; keep in mind it has done so with higher volatility. In most situations, the term volatility has a negative connotation and in capital markets, volatility is unavoidable. It is why people choose to invest. Absent a degree of change – there is no incentive to accept risk.

Congratulations on your accomplishment. Try to invest early and consistently. Always keep learning!

You can learn more about Nasdaq Index Options here.

—

Originally Posted June 12, 2023 – What Recent Graduates May Want to Know About Index Investing

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Disclosure: Nasdaq

Index

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

Options

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and education purposes and are not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

© 2023. Nasdaq, Inc. All Rights Reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Nasdaq and is being posted with its permission. The views expressed in this material are solely those of the author and/or Nasdaq and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.