This week marks the high point of earnings season. Most of the megacap tech stocks that make up the bulk of the weighting in the NASDAQ 100 (NDX) and a significant piece of the S&P 500 (SPX) report this week. Tesla (TSLA) kicked off this particular parade last week, and this afternoon brings us Microsoft (MSFT) and Alphabet (GOOG, GOOGL). MSFT is the second largest US stock by market cap, and the combined market caps of the two classes of Alphabet combine to put that company in third place.

So far, markets have tended to take earnings reports with a generally positive slant. Sure, there have been notable losers like SNAP, and TSLA’s report was not well received, but investors are willing to reward companies that meet expectations and keep forward guidance in place. Along with the markets’ recent bounces, this tells us that “good enough” earnings are indeed good news.

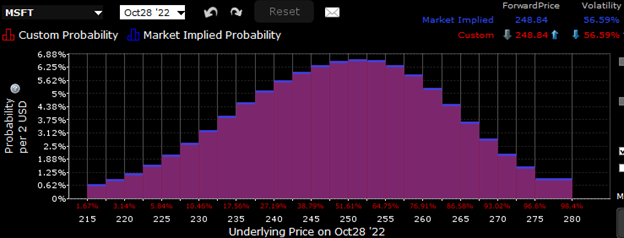

The options market reflects the positive frame of mind for MSFT. The IBKR Probability Lab shows a peak probability in the $252 range for options expiring on Friday. That is about 2% above current levels:

IBKR Probability Lab for MSFT Options Expiring October 28th, 2022

Source: Interactive Brokers

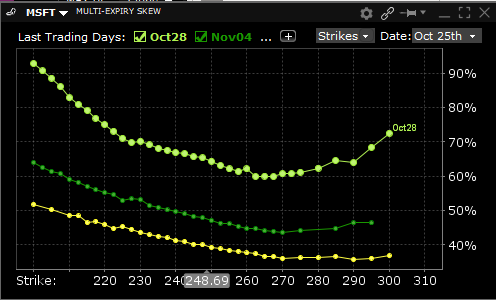

The multi-expiry skew graph shows the normal steepness in below-market weekly options, but it flattens to normal levels with options expiring next week. The at-money volatility of about 66 implies post-earnings move greater than 4%, which is not too far out of line with MSFT’s average 3.6% average post-earnings reaction. When we consider that the last four post-earnings moves for MSFT have all been to the upside (6.7%, 4.8%, 2.9% and 4.2%), the positive bias does not seem unreasonable.

Multi-Expiry Skew for MSFT, October 28th (top), November 4th (mid), November 18th (bottom)

Source: Interactive Brokers

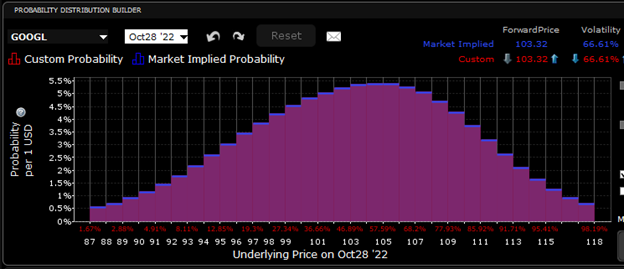

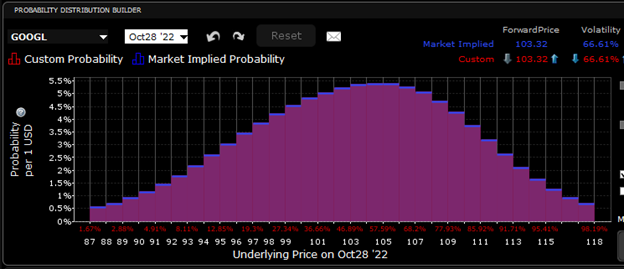

We see something similar for Alphabet. We will be using the GOOGL options for illustration because their volume tends to be somewhat higher than GOOG, though the metrics are all quite close. The probability peaks at the $105 range, above the current stock price.

IBKR Probability Lab for GOOGL Options Expiring October 28th, 2022

Source: Interactive Brokers

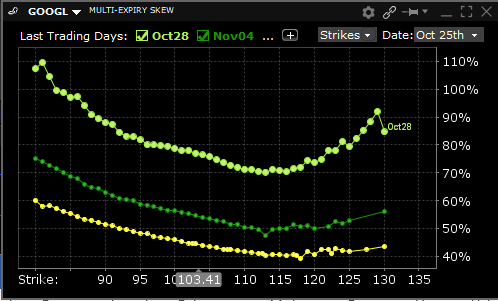

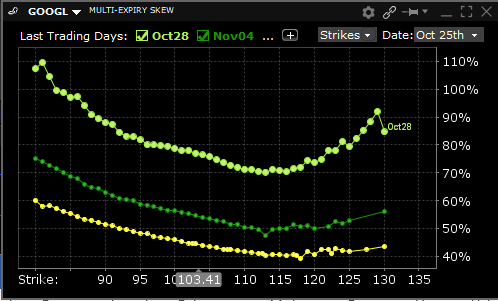

The multi-expiry skew graph shows a fairly typical downward bias, but can hardly be considered to be especially pronounced, particularly once we get past this week. The at-money volatility for this week is 77, which implies a post-earnings move slightly above the average 4.7%. GOOGL’s most recent moves have been large, with 3 of 4 being higher (7.7% -3.7%, 7.5%, 5%).

Multi-Expiry Skew for GOOGL, October 28th (top), November 4th (mid), November 18th (bottom)

Source: Interactive Brokers

One thing that both companies share is a propensity to reward holders after their earnings releases, even in this year’s turbulent markets. That goes some way to explaining their high valuations. Options traders appear to be expecting the solid run of results to continue for MSFT and GOOGL.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ