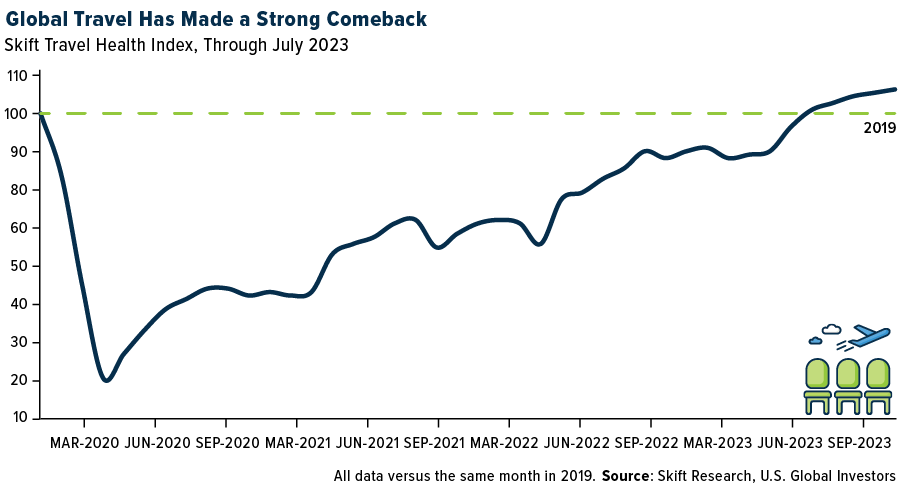

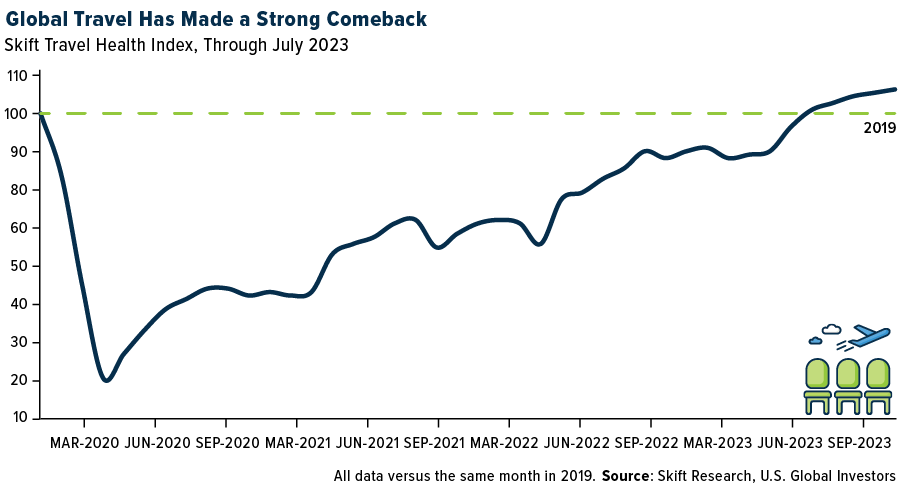

Last month, I shared with you that this summer is expected to mark a new historic high in commercial airline passenger volumes, breaking the previous record set in 2019. One of the unforeseen side effects of the current travel boom has been flight delays, mostly because of staff shortages, and this has raised the issue of pilot retirements.

Not too many people are aware that pilots in the U.S. must retire at age 65, due to federal regulations. That may be set to change, however, if a just-passed bill succeeds in becoming law.

Last Thursday, in a bipartisan vote, the House of Representatives approved the Federal Aviation Administration (FAA) reauthorization bill, which, among other things, authorizes more than $100 billion for airline operations, equipment and airports over five years. It also (controversially) raises the pilot retirement age from 65 to 67.

The new legislation will now need to be negotiated between the House and the Senate to move forward. If it doesn’t pass by the end of the fiscal year on September 30, when the current FAA law expires, crucial aviation programs could be at risk of being shut down.

I’ve written before about the pilot shortage, arguing that a reasonable supply deficit could actually encourage airlines to demonstrate capacity growth discipline and focus on the most profitable routes. I still support this idea, but others see a potential crisis brewing.

A “Tsunami” Of Pilot Retirements?

Testifying before the House Transportation and Infrastructure Committee in April, Regional Airline Association (RAA) President and CEO Faye Malarkey Black warned of a “coming tsunami of pilot retirements.” The shortage has resulted in more than 500 regional aircraft being grounded, Black said, and a 25% reduction in flights at 308 airports, mostly smaller ones.

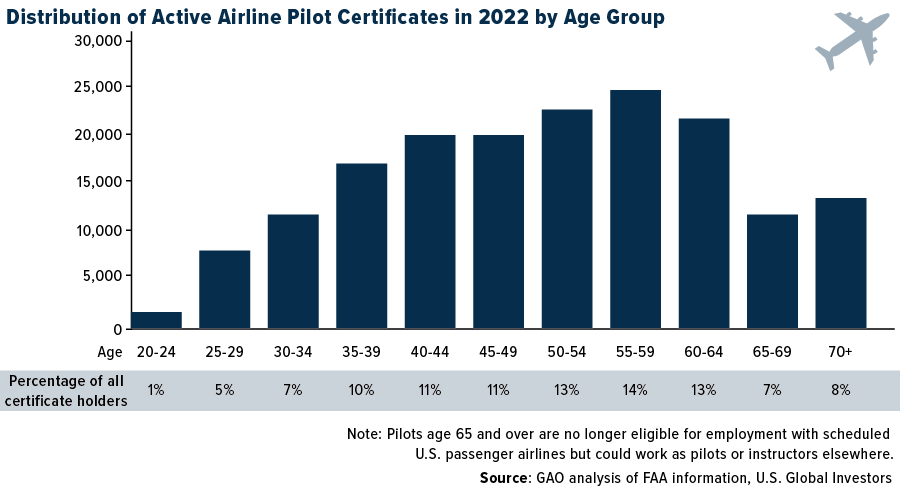

Further, the shortage of pilots, particularly captains, is forecast to be exacerbated as approximately 50% of the workforce will retire in the next 15 years.

These headwinds come despite increased enrollments in pilot training schools and rising numbers of pilots since 2017, according to a May report by the Government Accountability Office (GAO). In the same report, though, the GAO discloses that aviation businesses have reported difficulties in maintaining sufficient numbers of mechanics.

How are the airlines weathering these crosswinds? In response to workforce supply concerns, airlines are increasing pay for pilots and mechanics. Some regional airlines made significant pay hikes in 2022. Airlines are creating flight schools, and the FAA is supporting industry workforce development initiatives, including grants to attract young people to aviation careers.

To be fair, not everyone agrees that there’s a pilot shortage. The Air Line Pilots Association (ALPA) suggests that the idea of a pilot shortage isn’t factual and is an attempt to detract from airlines’ mismanagement, particularly in the wake of the pandemic.

The spread between views on the pilot shortage could suggest two different investment implications. If the shortage is real and worsening, it could represent a challenge that airlines must address to ensure operational stability. However, if it’s a narrative spun to distract from mismanagement, as the ALPA suggests, it could raise concerns about the governance and risk management of certain airlines, affecting their investment attractiveness.

American And United Airlines Surpass Expectations Amid The Travel Boom

Amid these swirling winds, we’ve seen some major updrafts. Last week, American Airlines increased its earnings forecast for 2023 in response to the travel boom.

In the June quarter, American outperformed consensus, reporting adjusted earnings per share of $1.92 and total revenue of $14.06 billion, against the anticipated $1.59 per share and expected $13.74 billion. Furthermore, the airline reported net income of $1.34 billion, up from $476 million in the same period a year earlier.

United Airlines also reported record quarterly earnings, surpassing estimates due to a surge in international travel demand. Despite disruptions, the airline managed a strong financial performance, with shares rising more than 8% last week. In the third quarter, United projects capacity growth of around 16% and an estimated revenue increase of up to 13% compared to the same period in 2022.

Both American Airlines and United Airlines show us that there are opportunities to be had even amid the challenges. They’re also leveraging the ongoing international travel boom, as evidenced by United’s plans to offer direct flights from the U.S. to Manila in the Philippines, starting in October. This expansion into Asia is part of a broader strategy that seeks to leverage the upsurge in international travel bookings after the pandemic slump.

A Clear-Sky Forecast For Airline Investors

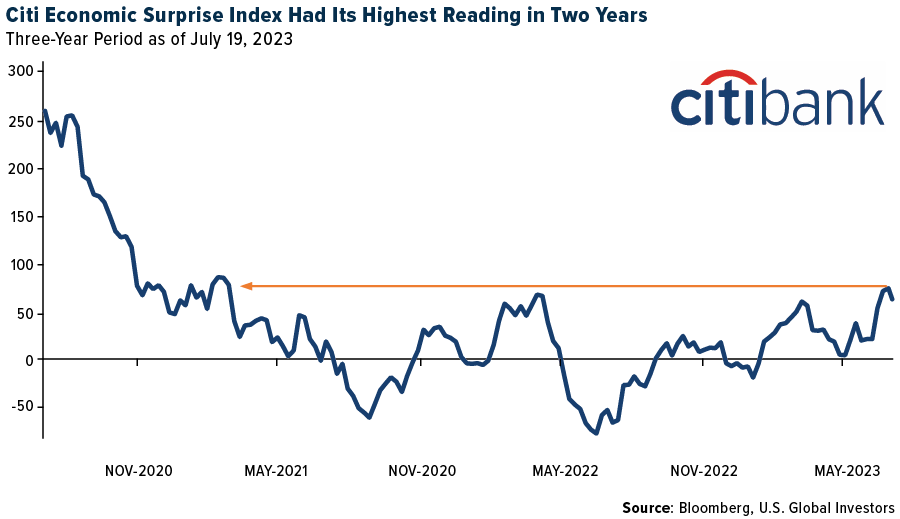

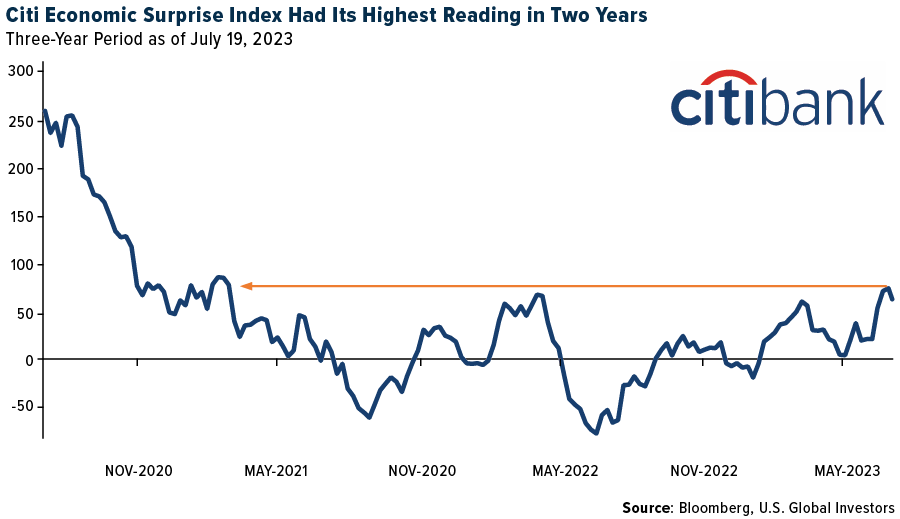

Indeed, recent economic news has been more positive than anticipated, as indicated by the Citi Economic Surprise Index reaching its highest point in the last two years. The index provides a snapshot of how the economy is performing against expectations, with higher numbers signifying better-than-expected results. This uplift has been attributed to favorable recent reports, including decreasing U.S. consumer price inflation, reduced wholesale price increases, lower import prices and fewer-than-expected jobless claims.

A year ago, the same index warned of a potential economic slowdown as the Federal Reserve increased interest rates significantly, while inflation remained persistently high. This led many economists to predict an upcoming recession.

However, many economists are now retracting those predictions as economic data continues to defy expectations.

For airline investors, I believe this is a landscape of opportunity. Amid the turbulence, there are pockets of clear air. There are legislative tailwinds, innovation in training and recruitment, international expansion strategies and an overall robust economy that favors travel. As always, remember to keep your portfolios diversified and your eyes on the long-term horizon.

—

Originally Posted July 24, 2023 –New Legislation Could Raise Pilot Retirement Age Amid A Record-Breaking Summer For Airlines

The Skift Travel Health Index is a real-time measure of the performance of the travel industry in 22 countries. The Index tracks 84 indicators to assess the health of the travel industry in each country. Citigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts. With a sum over 0, its economic performance generally beats market expectations. With a sum below 0, its economic conditions are generally worse than expected.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2023): American Airlines Group Inc., Delta Air Lines Inc., United Airlines Holdings Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Raising the retirement age is maybe okay, as long as the co-pilot is ten or more years younger.

My best friend was with UNITED for 32 years and I always remember his story of flying to Hawaii as co-pilot sitting next to a 64+ year old pilot who was days away from retiring and who upon approach to Maui’s airport was ignoring the Vasi-Lights and was way-way high and was set to over-shoot the runway. My friend reached over and touched the pilot’s elbow and asked if he could land the plane. The pilot was startled and upon seeing their altitude agreed. They landed safely and the pilot announced his retirement and returned home, here in California, as a passenger not as a pilot.

Thank you for sharing this anecdote with us, Jock. It was an interesting read.