Use the Securities Lending Dashboard to analyze short sale metrics for these and other stocks.

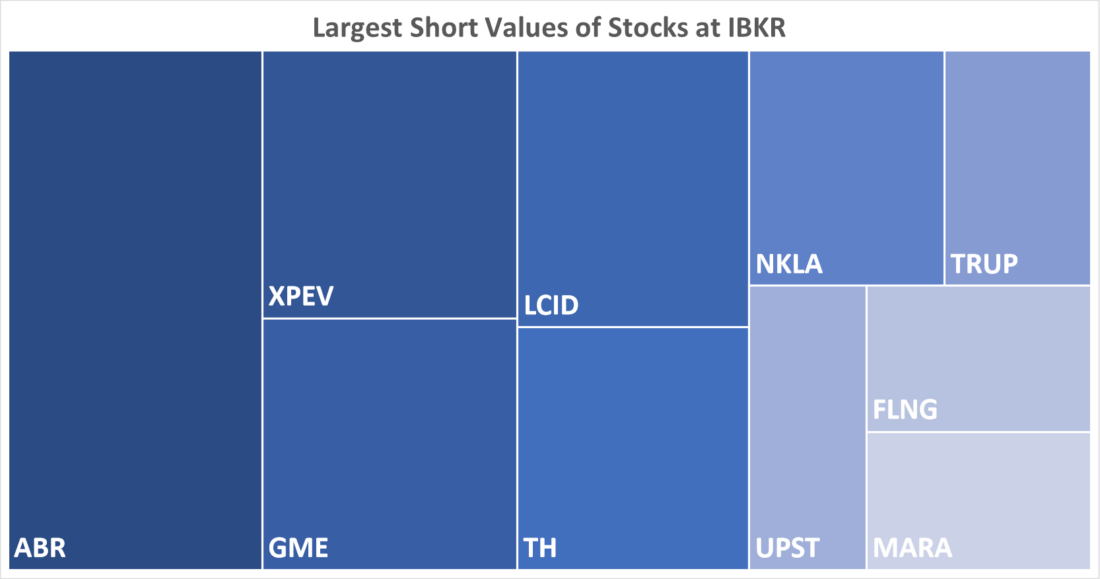

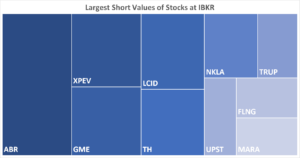

Largest Short Values of Stocks at IBKR

| Rank | Stock | Description |

| 1 | ABR | ARBOR REALTY TRUST INC |

| 2 | XPEV | XPENG INC – ADR |

| 3 | GME | GAMESTOP CORP-CLASS A |

| 4 | LCID | LUCID GROUP INC |

| 5 | TH | TARGET HOSPITALITY CORP |

| 6 | NKLA | NIKOLA CORP |

| 7 | TRUP | TRUPANION INC |

| 8 | UPST | UPSTART HOLDINGS INC |

| 9 | FLNG | FLEX LNG LTD |

| 10 | MARA | MARATHON DIGITAL HOLDINGS IN |

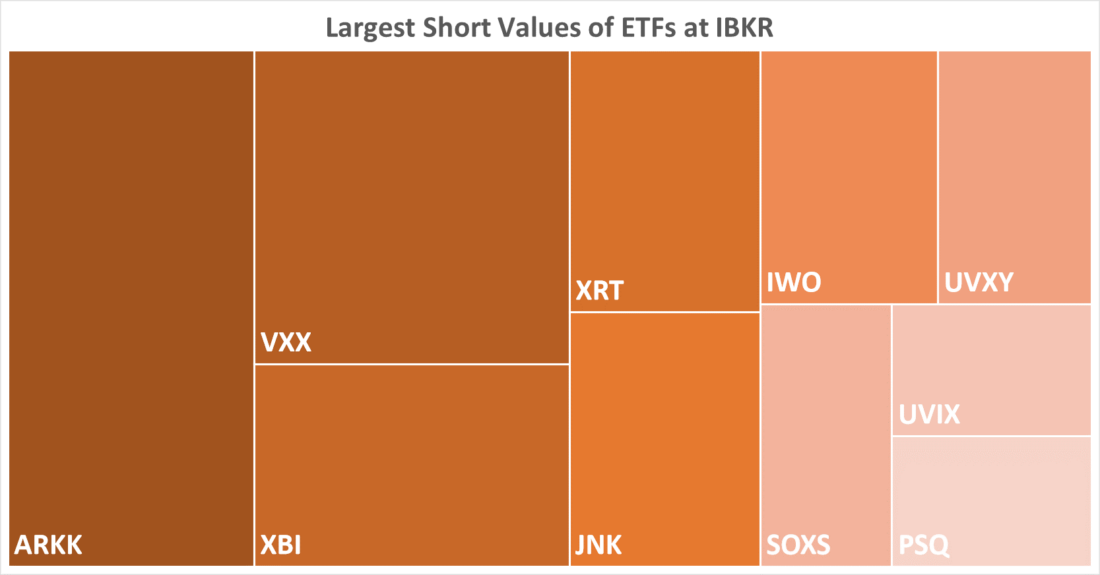

Largest Short Values of ETFs at IBKR

| Rank | ETF | Description |

| 1 | ARKK | ARK INNOVATION ETF |

| 2 | VXX | IPATH SERIES B S&P 500 VIX |

| 3 | XBI | SPDR S&P BIOTECH ETF |

| 4 | XRT | SPDR S&P RETAIL ETF |

| 5 | JNK | SPDR BLOOMBERG HIGH YIELD BO |

| 6 | IWO | ISHARES RUSSELL 2000 GROWTH |

| 7 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| 8 | SOXS | DIREXION DAILY SEMI BEAR 3X |

| 9 | UVIX | 2X LONG VIX FUTURES ETF |

| 10 | PSQ | PROSHARES SHORT QQQ |

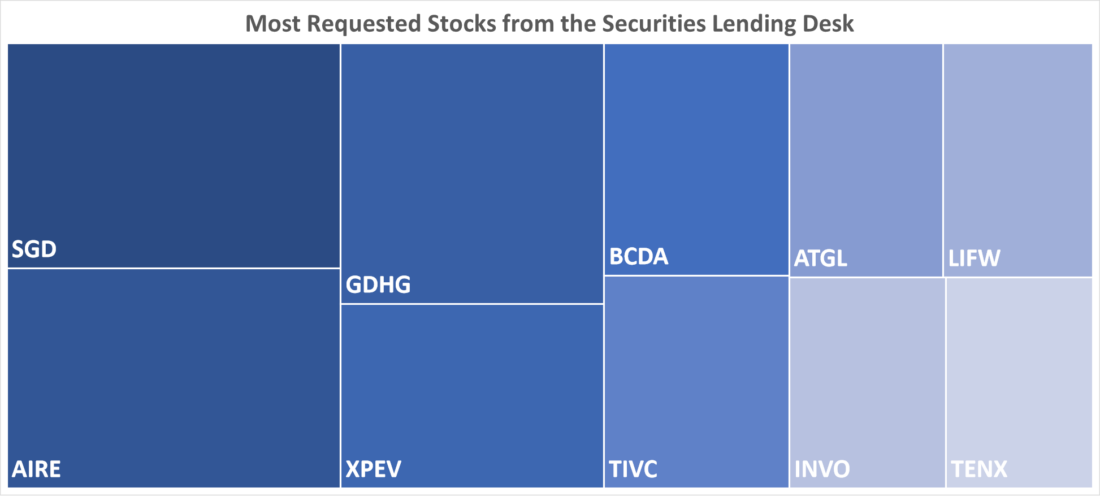

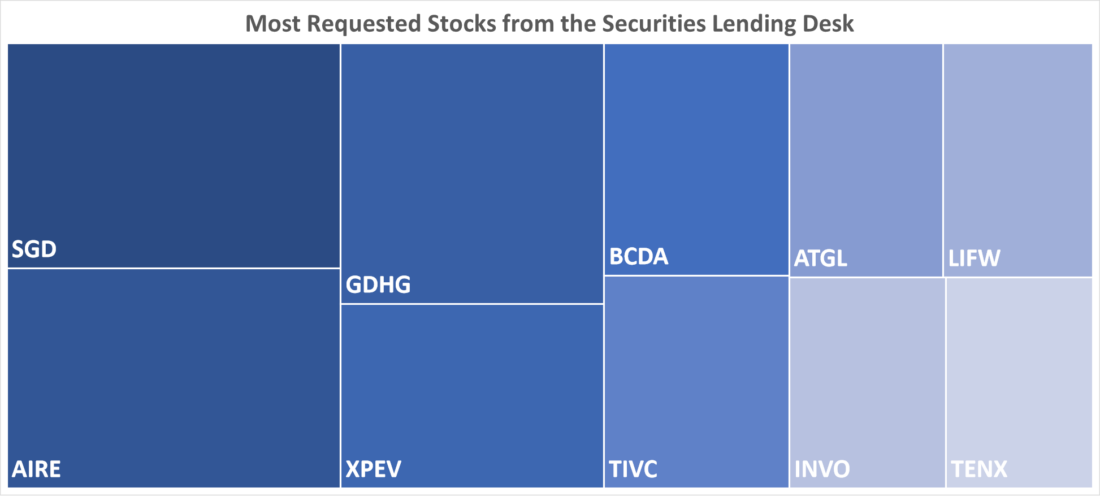

Most Requested Stocks from the Securities Lending Desk

| Rank | ETF | Description |

| 1 | SGO | SAFE & GREEN DEVELOPMENT COR |

| 2 | AIRE | REALPHA TECH CORP |

| 3 | GDHG | GOLDEN HEAVEN GROUP HOLDINGS |

| 4 | XPEV | XPENG INC – ADR |

| 5 | BCDA | BIOCARDIA INC |

| 6 | TIVC | TIVIC HEALTH SYSTEMS INC |

| 7 | ATGL | ALPHA TECHNOLOGY GROUP LTD |

| 8 | LIFW | MSP RECOVERY INC |

| 9 | INVO | INVO BIOSCIENCE INC |

| 10 | TENX | TENAX THERAPEUTICS INC |

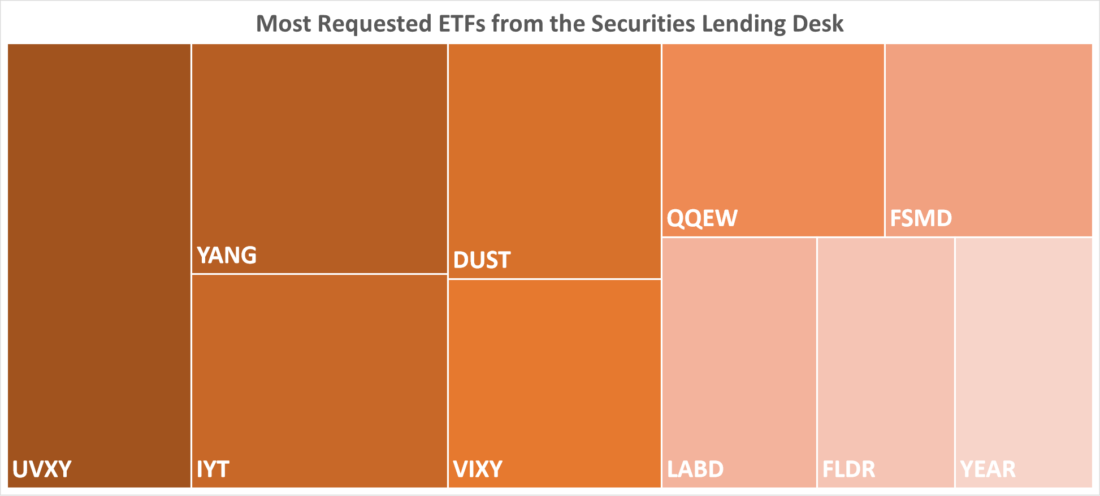

Most Requested ETFs from the Securities Lending Desk

| Rank | ETF | Description |

| 1 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| 2 | YANG | DRX DLY FTSE CHINA BEAR 3X |

| 3 | IYT | ISHARES US TRANSPORTATION ET |

| 4 | DUST | DIREXION DAILY GOLD MINERS I |

| 5 | VIXY | PROSHARES VIX SHORT-TERM FUT |

| 6 | QQEW | FIRST TRUST NASDQ 100 EQ WEI |

| 7 | FSMD | FIDELITY SMALL-MID MULTIFACT |

| 8 | LABD | DRX DLY S&P BIOTECH BEAR 3X |

| 9 | FLDR | FIDELITY LOW DURATION ETF |

| 10 | YEAR | AB ULTRA SHORT INCOME ETF |

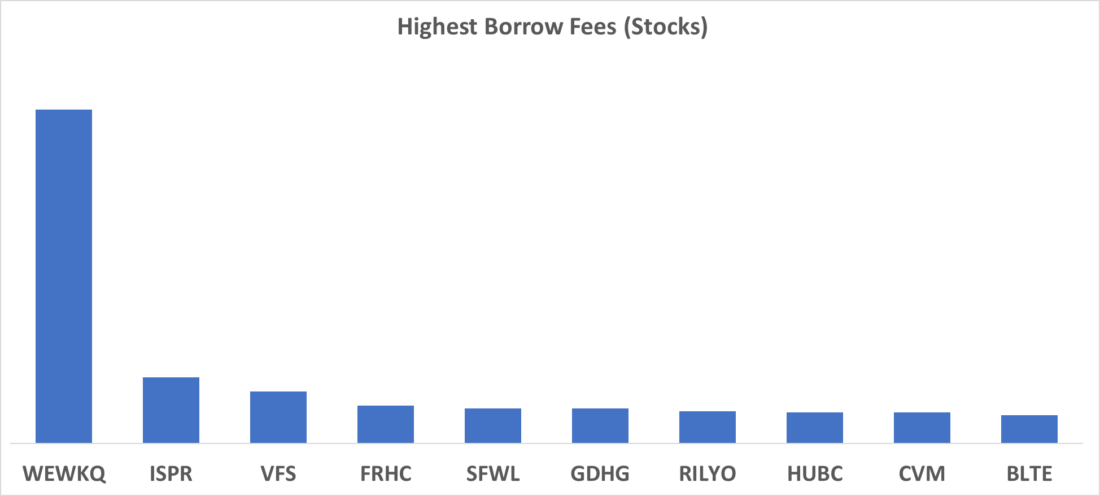

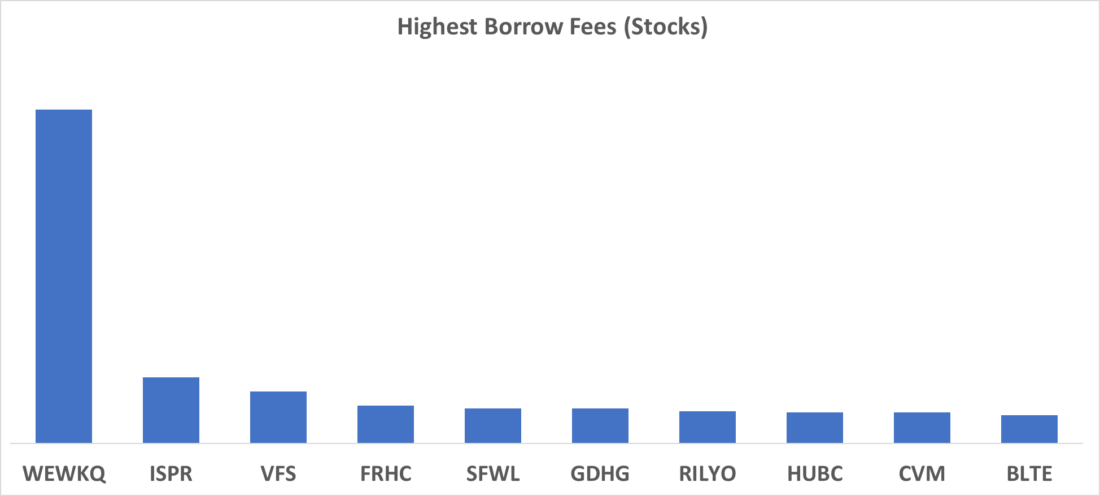

Highest Borrows Fees (Stocks)

| Rank | Stock | Description |

| 1 | WEWKQ | WEWORK INC-CL A |

| 2 | ISPR | ISPIRE TECHNOLOGY INC |

| 3 | VFS | VINFAST AUTO LTD |

| 4 | FRHC | FREEDOM HOLDING CORP/NV |

| 5 | SFWL | SHENGFENG DEVELOPMENT LTD-A |

| 6 | GDHG | GOLDEN HEAVEN GROUP HOLDINGS |

| 7 | RILYO | B. RILEY FINANCIAL INC |

| 8 | HUBC | HUB CYBER SECURITY LTD |

| 9 | CVM | CEL-SCI CORP |

| 10 | BLTE | BELITE BIO INC – ADR |

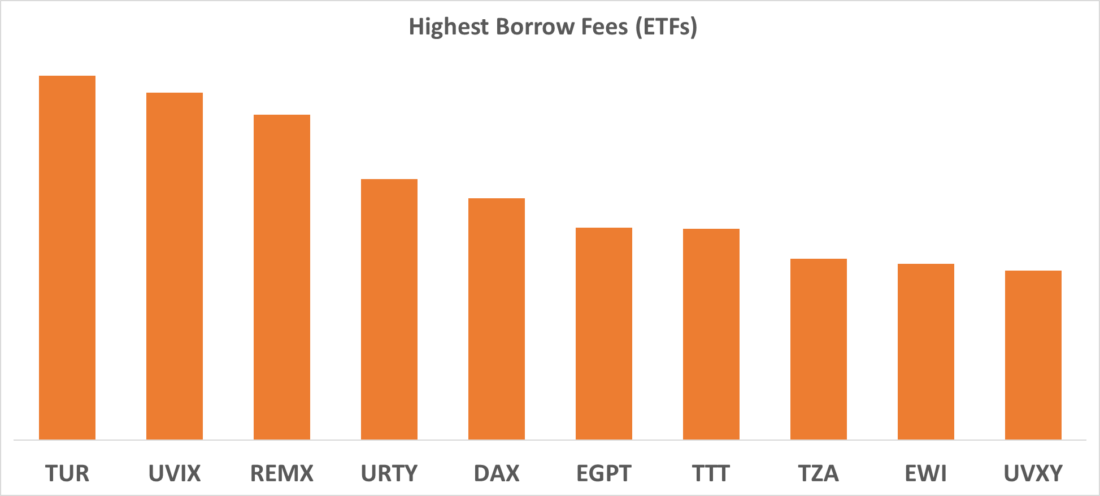

Highest Borrow Fees (ETFs)

| Rank | ETF | Description |

| 1 | TUR | ISHARES MSCI TURKEY ETF |

| 2 | UVIX | 2X LONG VIX FUTURES ETF |

| 3 | REMX | VANECK RARE EARTH/STRAT MET |

| 4 | URTY | PROSHARES ULTRAPRO RUSS2000 |

| 5 | DAX | GLOBAL X DAX GERMANY ETF |

| 6 | EGPT | VANECK EGYPT INDEX ETF |

| 7 | TTT | PROSHARES ULT -3X 20+ YR TSY |

| 8 | TZA | DIREXION DLY SM CAP BEAR 3X |

| 9 | EWI | ISHARES MSCI ITALY ETF |

| 10 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Day Trading

Day Trading can be extremely risky and may not be appropriate for individuals with limited resources, investment experience or low risk tolerance. Please review the Day Trading Risk Disclosure Statement before deciding whether Day Trading is appropriate for you.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

I am unclear about something here, and have been confused about this for some time…maybe someone could help me out. On the list of “Largest Short Values of ETFs at IBKR” it often shows inverse ETFs. For example, this week lists #8 as SOXS.

Why is there a large interest in borrowing an inverse ETF instead of owning the equivalent long version of the same (in this example SOXL) and avoid the borrow fees?

Is this due to day trading the ETF and day traders are simply going long and short on the same ETF instead of switching back and forth between the long and short version of the same ETF?

Or am I misunderstanding the list itself and IBKR is reporting the opened positions (largest value) of the inverse ETF?

Hello William, thank you for reaching out. Leveraged ETFs tend to have higher fees, which negatively affects NAV for the long holder. Shorting them allows the short seller to capture those fees as a reduction to NAV. Please view the linked resources below for more information on Leveraged ETFs.

https://www.ibkrguides.com/kb/article-2959.htm

https://www.ibkrguides.com/kb/article-2880.htm

Re: soxs. It’s easier than that. Traders long soxl, funded by soxs. Long one that compounds up, funded by one that compounds down.

Thanks for the reply, Mike. Sorry if I’m a little dense, I’m relatively new to trading. Is this a statistical arbitrage strategy? I get the concept of collecting dividends from both while insulating myself from any change in price action (market neutral as long as I rebalance frequently). If so, wouldn’t I be long on both since one is an inverse to the other?

If I’m short SOXS, then I benefit from the same price action as being long on SOXL, but I am incurring borrowing fees.

I guess I don’t understand “funded by soxs”

to William: My guess at arbitrage – If one owns (is long) soxs and puts it in the IB loan short program you get paid for that by IB. Then long soxl would offset the soxs (in the short term) and you receive the dividend?

(I would message IB to check if this is correct)

—————

Though Mike said traders – so I doubt he is talking of an arbitrage?