Use the Securities Lending Dashboard to analyze short sale metrics for these and other stocks.

Recent shifting sands in Silicon Valley have had global impact. Data from Orbisa, securities lending data curated for the buy-side, shows how the story unfolded.

THE SVB SELL OFF

The collapse of Silicon Valley Bank (SVB) triggered a series of events in the financial markets that impacted regional banks on a national level. Trading of shares in a number of banks was halted due to volatility that saw the price of many of these banks drop by 60% or more. Naturally, these events have had a direct impact on the securities lending marketplace which we have seen reflected in Orbisa data.

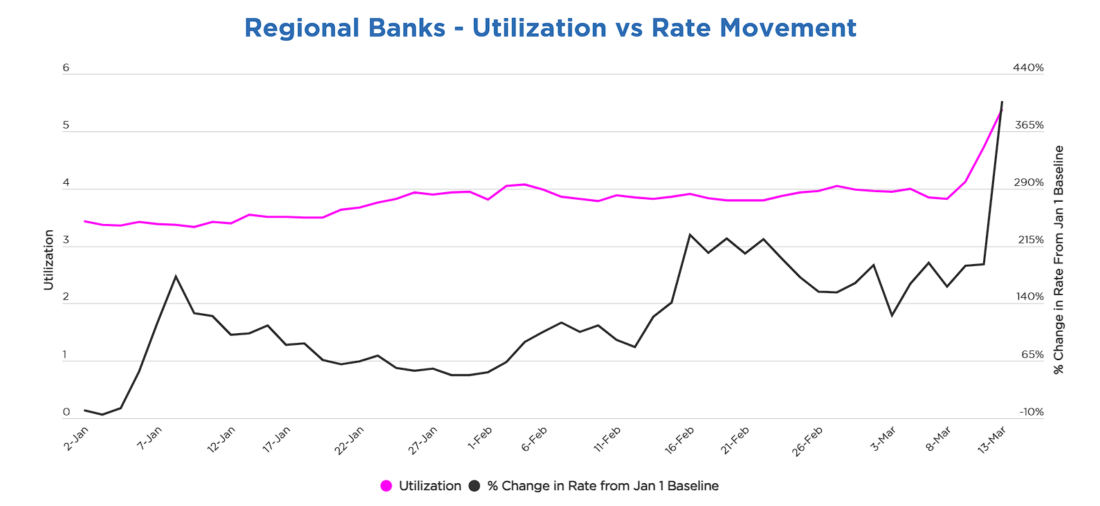

Looking at a composite list of regional bank stocks derived from the SPDR® S&P® Regional Banking ETF (KRE), the group’s utilization jumped from below 4% to almost 5.5% as of March 13. The cost of borrow also increased as it became evident that some of these banks were perhaps on investors’ radar in early January. Using January 2 as a baseline, when these securities were largely trading GC (non-special), Orbisa is able to track the change in borrow rates. By mid-January the average borrowing rate across these regional banks had risen by 175%. In mid-February the average cost to borrow increased by more than 200% relative to the January 1 baseline. Now borrowing demand is at an all-time high for the year.

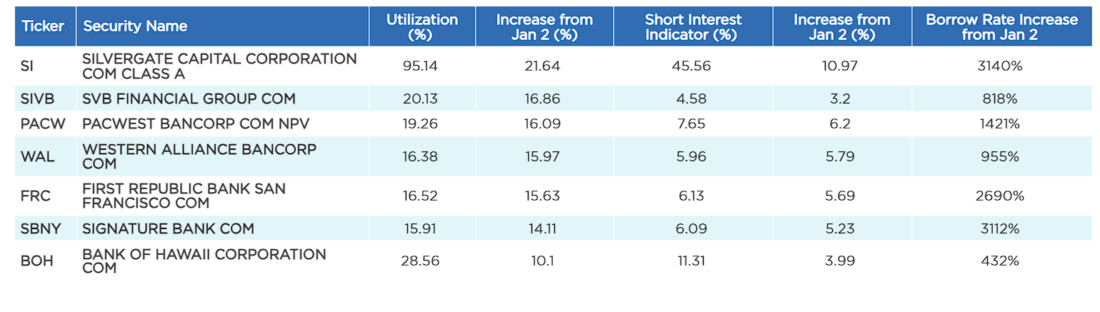

Looking into the KRE ETF, below are the banks that experienced the biggest increases in utilization year-to-date. These banks also experienced increases in Short Interest Indicators and borrowing rates.

As the ripple effects of Silicon Valley continue, stay tuned to Orbisa for additional insights and analysis of related securities lending data.

—

Originally Published March 16, 2023 – SVB FINANCIAL (SIVB) AND THE IMPACT ON SECURITIES LENDING

Disclosure: Orbisa

ORBISA (the “Firm”) is not registered as an investment advisor or otherwise in any capacity with any securities regulatory authority. The information contained, referenced or linked to herein is proprietary and exclusive to the Firm, does not constitute investment or trading advice, is provided for general information and discussion purposes only and may not be copied or redistributed without the Firm’s prior written consent. The Firm assumes no responsibility or liability for the unauthorized use of any information contained, referenced or linked to herein. © 2023 EquiLend Holdings LLC. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Orbisa and is being posted with its permission. The views expressed in this material are solely those of the author and/or Orbisa and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.