The long struggling company is in dire straits, add to concerns of a commercial real-estate crisis

The well-documented rise and tumultuous fall of WeWork (WE) could be reaching a conclusion. The co-working company, a beacon of the 2010s gig-economy, released an August 15 statement that warned investors that it had “substantial doubt” about its ability to remain solvent among the precarious commercial real-estate environment and mounting losses.

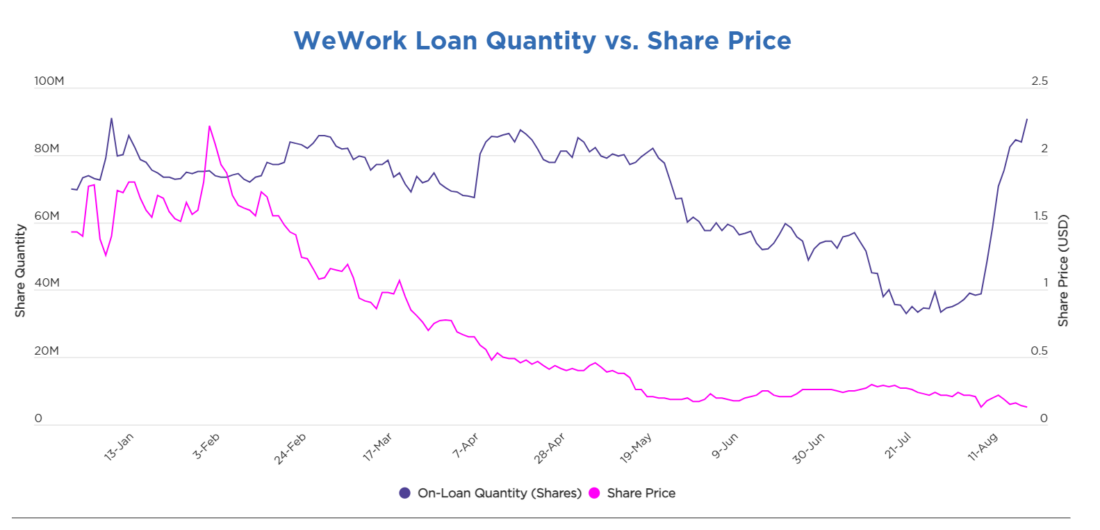

Analyzing Orbisa data, WeWork stock has seen substantially increased loan activity in recent weeks. In the period of August 9 – 21, the total number of shares on loan increased from 38.9 million to 91.0 million. The spike in loans observed by Orbisa preceded a similar increase in semimonthly exchange-reported short interest, a metric that has tracked closely with on-loan shares over the previous year.

Though its business faced serious challenges prior to the global pandemic, WeWork continues to flounder as America’s downtown landlords struggle to fill vacant offices. With its share price hovering around $0.13, WeWork made a subsequent announcement on August 18, declaring a planned 1-for-40 reverse stock split in an effort to remain compliant with the New York Stock Exchange’s listing requirements.

The potential demise of WeWork would add another fissure to a complex and changing commercial real-estate landscape. The shift to hybrid working arrangements ushered in by COVID-19 led to a substantial increase in office space supply and rapidly shifted the needs of tenants.

In a market that is heavily financed by debt, the steep increase of interest rates has regulators and investors alike concerned that just one major domino toppling could cause systematic shock. Those fears have been stoked by international harbingers with China enduring a property crisis of its own. Country Garden Holdings (2007 HK), one of China’s largest developers facing default, was the issuer to generate the most APAC corporate debt lending revenue in the first half of 2023. Shares in Country Garden Holdings remain 94% utilized.

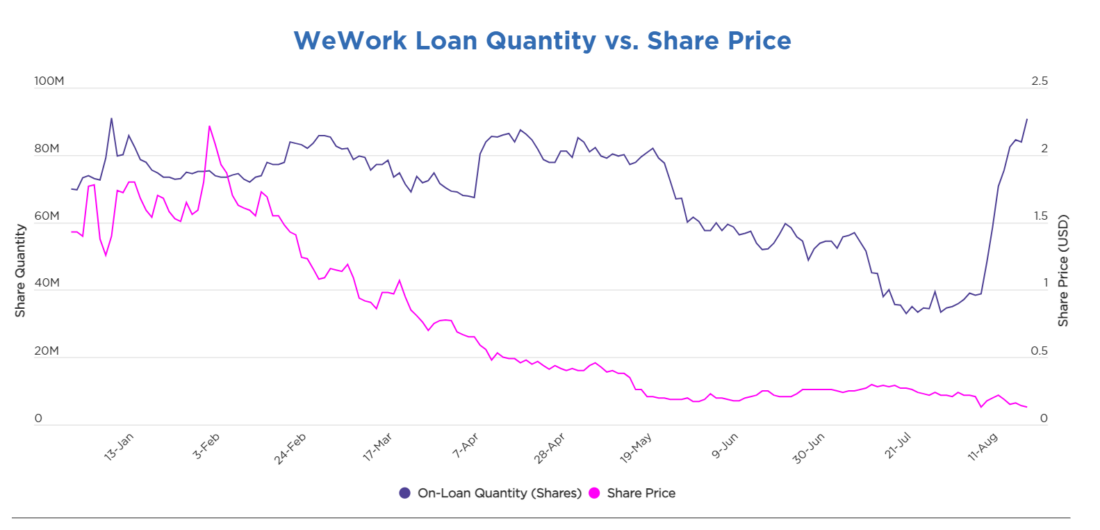

Despite substantial reasons for concern, many commercial developers have managed to stay on course thus far. In WeWork’s home base of New York, Orbisa data suggests moderate lending activity for comparable firms. The following chart compares WeWork to four of the largest publicly traded commercial landlords in New York as of August 21. SL Green has the highest Short Interest Indicator, the percentage of on-loan shares relative to the total public float, but has also experienced the greatest cooling in terms of the cost to borrow shares over the previous month.

Orbisa continues to monitor the macro and security-level trends driving the securities lending market.

To get started with Orbisa, contact our team at discovermore@orbisa.com

—

Originally Posted September 5, 2023 – WeWork’s Warning Turns Short-Sellers’ Attention to Commerical Real Estate Sector

Disclosure: Orbisa

ORBISA (the “Firm”) is not registered as an investment advisor or otherwise in any capacity with any securities regulatory authority. The information contained, referenced or linked to herein is proprietary and exclusive to the Firm, does not constitute investment or trading advice, is provided for general information and discussion purposes only and may not be copied or redistributed without the Firm’s prior written consent. The Firm assumes no responsibility or liability for the unauthorized use of any information contained, referenced or linked to herein. © 2023 EquiLend Holdings LLC. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Orbisa and is being posted with its permission. The views expressed in this material are solely those of the author and/or Orbisa and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.