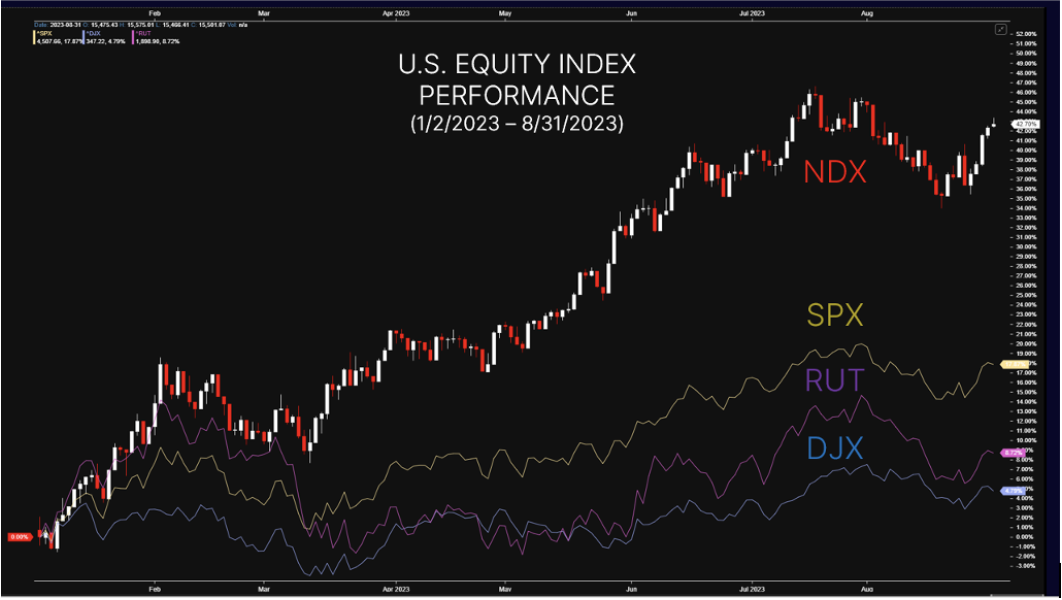

U.S. equity indexes have performed quite well through August. The Nasdaq-100 Index (NDX) is higher by nearly 43% year-to-date (YTD) while the S&P 500 has gained about 18% and the Russell 2000 and Dow Jones Industrial Average have added 8.72% and 4.79% respectively.

Source: LIVE VOL PRO

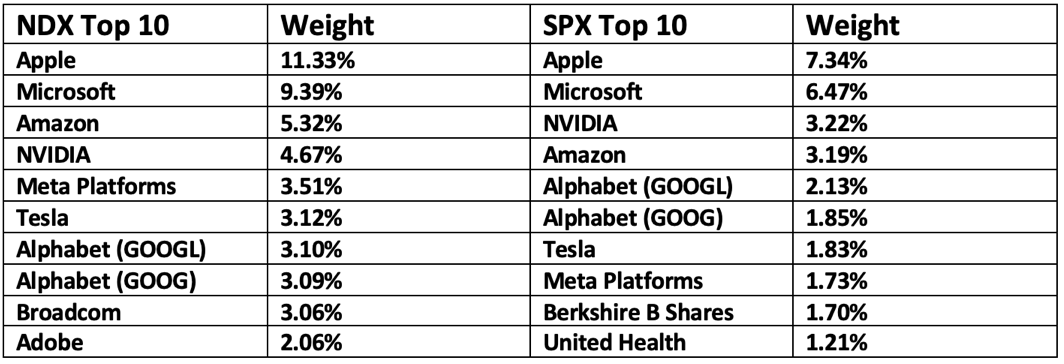

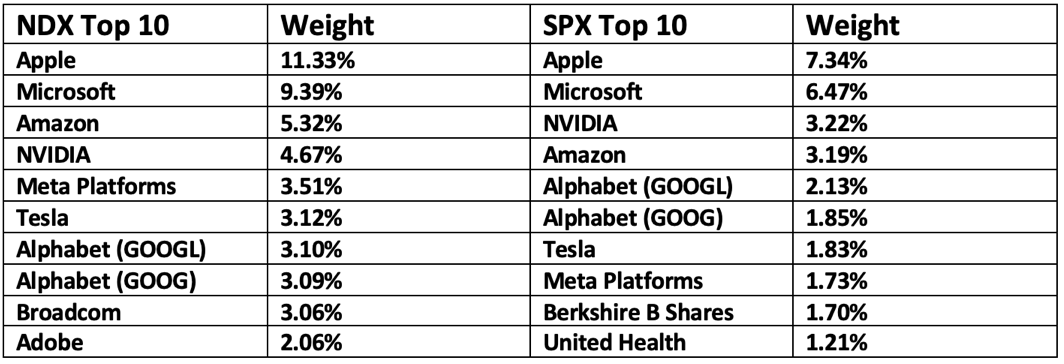

The broad-based advances have been primarily led by a handful of constituent names, specifically Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), NVIDIA (NVDA), Tesla (TSLA) and Meta Platforms (META). Collectively, they have been referred to as the “Magnificent Seven” and the overarching theme is predicated on the future impact of artificial intelligence (AI).

Here’s a side-by-side comparison of the top 10 holdings in the NDX and SPX, including the relative weights in each index. The “primary ingredients” in the indexes have significant overlap and include this year’s top performers. The performance difference is largely explained by the higher weighting of those names in the NDX, as well as the drag of financials and energies on the SPX.

I was curious if the year ended in August, how the relative performance would stack up to previous full calendar years. The results were somewhat surprising. For example, this would be the ninth time since 1985 that the NDX gained 40% or more in a year. By contrast, the SPX has never advanced that much over the same period.

That reality reminded me of a prescient comment Kris Sidial made during a February (2023) interview on TradeTalks. In short, he explained the potential for asymmetric right tail (10 delta long-dated NDX call options) payoffs if market sentiment about a tech recovery took root. Sentiment certainly shifted.

In fairness, the SPX added between 20% and 39.99% more often than the NDX over the past 38 years. In total, SPX annual performance fell between those parameters thirteen times, whereas the NDX distribution is only six times.

This would be a typical year for the S&P 500. A 10% – 19.99% gain happened ten times previously and 2023 could be the eleventh. As a reminder, the SPX is plus ~18% through August.

Let’s also address the left tail, or significant downside occurrences. The NDX fell 30% or more five times. The worst annual performance happened in 2008 when it fell by 41.89%. That same year, the SPX declined 37%.

So, the year-to-date performance for the two major equity indexes are impressive, but not outliers. A 40% plus advance for the NDX would fall on the right side of the distribution, but there were similar years in the mid-90s. There were also 85.3% and 101.95% annual gains in the late 90s.

If you’re concerned about a potential drawdown during the final four months of the year, there are a variety of Nasdaq-100 Index options (NDX, NQX, XND) that could be used to potentially manage your exposure. To learn more, email us at IndexOptions@nasdaq.com.

—

Originally Posted September 11, 2023 – 2023: Impressive or an Outlier?

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

This interview originally appeared in our Smart Investing newsletter. Sign up here to access your weekly digest of the latest investing news, personal finance tips and educational must-knows – all in one place.

Disclosure: Nasdaq

Index

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

Options

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and education purposes and are not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

© 2023. Nasdaq, Inc. All Rights Reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Nasdaq and is being posted with its permission. The views expressed in this material are solely those of the author and/or Nasdaq and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.