- Better-than-expected results for the week once again lift S&P 500 EPS growth for Q1 2023, now set to come in at -2.2%

- Potential earnings surprises this week: PerkinElmer (PKI), Air Canada (CA:AC)

- Names to watch during the third peak week: DIS, TWLO, UAA, DDS, ABNB

- Thursday, May 11 will mark the busiest day of the season with 991 companies scheduled

As the second peak week of earnings season kicked off last week it was obvious that investor attention was focused elsewhere, both on the mounting banking crisis as well as on the Federal Reserve’s Wednesday meeting. While the Fed’s 25 basis point interest rate hike and suggestion of a near-term pause was what the markets were expecting, stocks moved lower on Wednesday as investors digested comments by Chairman Powell. They continued their decline on Thursday after news from PacWest showed the California bank was assessing strategic options, which led to the sell-off of regional bank shares and briefly brought the DJIA negative for the year. That all turned around Thursday after the close as Apple delivered better-than-expected results for Q1 and regional banks climbed from their lows, helping the all major indexes close higher on Friday.

In addition to Apple, positive surprises were seen for other big names such as MGM Resorts (MGM), Starbucks (SBUX), Ford Motor (F), Pfizer (PFE) and more, driving the S&P 500 blended EPS growth rate to -2.2%, an improvement from -3.7% in the week prior. Revenue growth for the quarter is positive at 3.9%.

Potential Earnings Surprises this Week – PKI & CA:AC

PerkinElmer (PKI)

Company Confirmed Report Date: Thursday, May 11, BMO

Projected Report Date (based on historical data): Tuesday, May 2, BMO

DateBreaks Factor: -2*

PerkinElmer is set to report Q1 2023 results on Thursday, May 11, nine days later than anticipated. This will be the latest PKI has ever reported earnings for the first quarter.

Academic research shows when a corporation reports earnings later than they have historically, it typically signals bad news to come on the conference call. PKI has reported negative earnings growth for the last five consecutive quarters, and either negative or flat revenue growth over the same time period. The stock is down 8.25% YTD.

Air Canada (CA:AC)

Company Confirmed Report Date: Friday, May 12, BMO

Projected Report Date (based on historical data): Tuesday, April 25, BMO

DateBreaks Factor: -2*

Air Canada is set to report Q1 2023 results on Friday, May 12, over two weeks later than expected. Like PerkinElmer, this is potentially indicative that less than stellar news will be shared on the upcoming earnings call.

Poor earnings results or guidance from Air Canada would fly in the face of what we’ve seen with the large international carriers such as Delta, American Airlines and United which all reported better-than-expected results for Q1 and noted the strength in travel demand as well as record advanced bookings for this coming summer. After falling 23% from mid-February – mid-March, Air Canada’s stock improved on Thursday as they released updated 2023 guidance that pointed to a recovery ahead due to a “stronger-than-anticipated demand environment and lower-than expected fuel prices.” This suggests that any bad news reported in Friday’s Q1 report may just be backward-looking.

On Deck this Week:

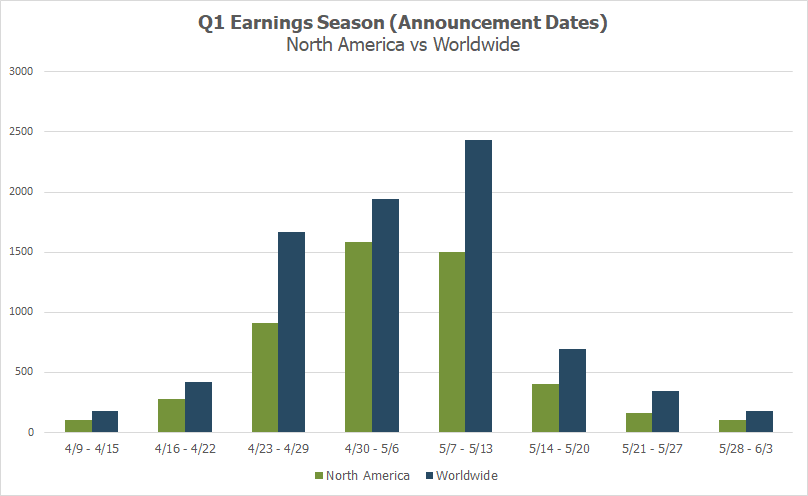

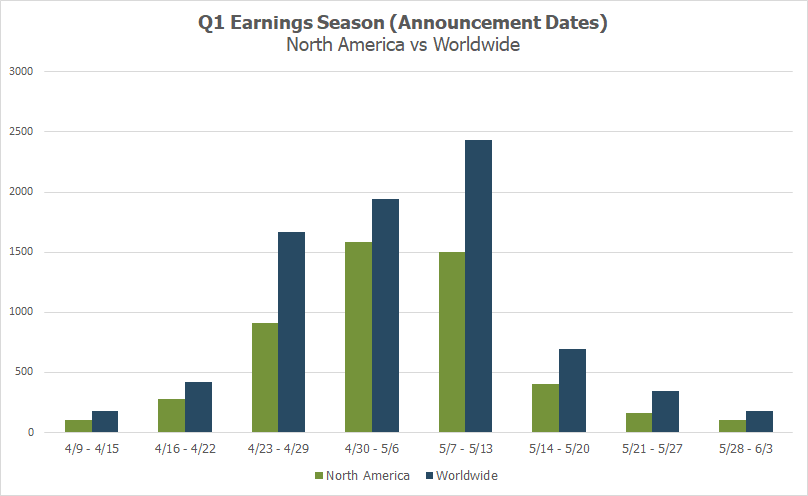

During this last peak week of earnings season we expect to see 3,236 companies in our universe of nearly 10,000 global equities release results for the first quarter. We’ll continue to hear from enterprise tech names such as Twilio (TWLO), get a read on the consumer when Airbnb (ABNB), Under Armour (UAA), Warby Parker (WRBY), Tapestry (TPR) and Dillard’s (DDS) all report, and of course hear about the state of streaming from Disney (DIS).

Source: Wall Street Horizon

Q1 Earnings Wave

Thursday, May 11 is predicted to be the most active day of this earnings season with 991 companies anticipated to report. Thus far 82% of companies have confirmed their earnings date and 48% have reported (out of our universe of 9,500+ global names). After this week the Q1 season will begin to wind down.

Source: Wall Street Horizon

—

Originally Posted May 8, 2023 – Can the Last Peak Week of Q1 Earnings Push Growth into Positive Territory?

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.